Vietnam Agricultural Tractor Market Size, Share, By Engine Power (Less Than 15 HP, 15-30 HP, 31-45 HP, And 46-75 HP), By Drive Type (Two-Wheel Drive And Four-Wheel Drive), By Propulsion Technology (Diesel, Hybrid, And Fully Electric), And Vietnam Agricultural Tractor Market Insights, Industry Trend, Forecasts to 2035

Industry: AgricultureVietnam Agricultural Tractor Market Insights Forecasts to 2035

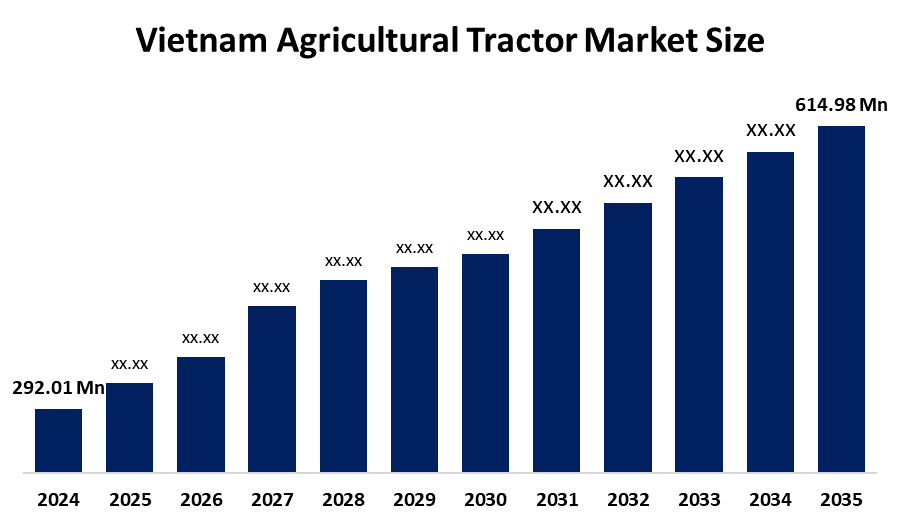

- Vietnam Agricultural Tractor Market Size 2024: USD 292.01 Mn

- Vietnam Agricultural Tractor Market Size 2035: USD 614.98 Mn

- Vietnam Agricultural Tractor Market CAGR 2024: 7.01%

- Vietnam Agricultural Tractor Market Segments: Engine Power, Drive Type, and Propulsion Technology

Get more details on this report -

Vietnam agricultural tractor market related to the manufacture, import, sale and utilization of tractors used primarily for agricultural applications including land preparation, ploughing, harrowing, planting, transporting and post-harvesting activities. Agricultural tractors are the backbone of agricultural mechanization in Vietnam, with a significant portion of the use of tractors in rice production, cash crop and horticulture. The market consists largely of small and medium horsepower tractors, which corresponds to Vietnam's fragmented and small-sized agricultural holdings. The growth of the Vietnam agricultural tractor market is closely associated with modernisation of farming methods and increased demand for higher productivity.

The agricultural tractors in Vietnam are backed by government support, including the Vietnam's agricultural mechanization improvements subsidies, low-interest loans and other support programs that reduce the cost of owning a tractor or farm equipment for the farmer using it. This heavy investment in agriculture has allowed more than 70% of Vietnam's cultivated land to be mechanized due to increased usage of machinery in the agricultural production process.

As technology advances, Vietnam agricultural tractor providers are now using adoption of precision agriculture features GPS-enabled tractors incorporate many aspects to increase operational efficiency and decrease fuel consumption. As manufacturers bring an increasing number of tractors designed with more modern electronics, automation tools, and bluetooth technology, farmers will be able to grab the benefits of increasing operational accuracy.

Vietnam Agricultural Tractor Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 292.01 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 7.01% |

| 2035 Value Projection: | USD 614.98 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 222 |

| Tables, Charts & Figures: | 125 |

| Segments covered: | By Engine Power, By Propulsion Technology |

| Companies covered:: | Kubota Corporation, Yanmar Holdings Co., Ltd., Deere & Company, Mahindra & Mahindra Ltd., CNH Industrial, AGCO Corporation, Iseki & Co., Ltd., LS Group, CLAAS KGaA mbH, Zetor Tractors, Zoomlion Heavy Industry Science and Technology Co., Ltd., Vietnam Engine & Agricultural Machinery Corp, Truong Hai Group Corporation, Tong Yang Moolsan Co. Ltd., Vietnam Agrotech Co., Ltd., and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the Vietnam Agricultural Tractor Market:

The Vietnam agricultural tractor market is driven by the increase in mechanization, increase in demand for food and exports, need for increased productivity and efficiency in farming operations, rise in the use of tractors and other mechanized equipment farmers are experiencing the impact of increased labour costs and an influx of migrant workers into urban areas with strong government support.

The Vietnam agricultural tractor market is restrained by the high upfront costs of tractors, especially for smallholder farmers, fragmented landholdings that limit mechanization efficiency, and a shortage of skilled operators for more advanced machinery.

The future of Vietnam agricultural tractor market is bright and promising, with versatile opportunities emerging from the rise in smaller-scale farms, the number of compact tractors is growing, shared machinery services and rental services give farmers more access to farming equipment by providing an additional source of machinery services and giving them access to it for rent. Expansion of electric and sustainable tractor models leads to increased potential for precision farming solutions with increasing opportunities for agricultural tractor providers in Vietnam.

Market Segmentation

The Vietnam Agricultural Tractor Market share is classified into engine power, drive type, and propulsion technology.

By Engine Power:

The Vietnam agricultural tractor market is divided by engine power into less than 15 HP, 15-30 HP, 31-45 HP, and 46-75 HP. Among these, the 46-75 HP segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Versatility for diverse tasks, balanced power and maneuverability, adaptability to farm sizes, technological integration, and government support all contribute to the 46-75 HP segment's largest share and higher spending on agricultural tractor when compared to other engine power.

By Drive Type:

The Vietnam agricultural tractor market is divided by drive type into two-wheel drive and four wheel drive. Among these, the four-wheel drive segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The four-wheel drive segment dominates because of challenging local terrain and soil conditions, government support for modern farming, and the superior performance and versatility offered by 4WD tractors that enhanced performance and efficiency.

By Propulsion Technology:

The Vietnam agricultural tractor market is divided by propulsion technology into diesel, hybrid, and fully electric. Among these, the fully electric segment held the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Strong growth for electric and small HP tractors, rising fuel costs, labour shortage, suitability for small farms, and government support with incentives all contribute to the fully electric segment's largest share and higher spending on agricultural tractor when compared to other propulsion technology.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Vietnam agricultural tractor market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Vietnam Agricultural Tractor Market:

- Kubota Corporation

- Yanmar Holdings Co., Ltd.

- Deere & Company

- Mahindra & Mahindra Ltd.

- CNH Industrial

- AGCO Corporation

- Iseki & Co., Ltd.

- LS Group

- CLAAS KGaA mbH

- Zetor Tractors

- Zoomlion Heavy Industry Science and Technology Co., Ltd.

- Vietnam Engine & Agricultural Machinery Corp

- Truong Hai Group Corporation

- Tong Yang Moolsan Co. Ltd.

- Vietnam Agrotech Co., Ltd.

- Others

Recent Developments in Vietnam Agricultural Tractor Market:

In December 2025, Dongfeng Motor Company launched the new X9 fuel tractor specifically developed for Vietnamese operating conditions at a major conference in Ho Chi Minh City.

In February 2025, Truong Hai Group Corporation invested over USD 1billion to establish a large 786-hectare industrial park in Binh Duong, which focused on mechanical manufacturing, including agricultural tractors, to reduce import dependence.

In February 2025, AGCO Corporation and CLAAS KGaA mbH ,both companies announced their participation in the AGRITECHNICA ASIA Vietnam 2025 exhibition to showcase new and advanced agricultural technologies, including precision farming and harvesting solutions.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Vietnam, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Vietnam agricultural tractor market based on the below-mentioned segments:

Vietnam Agricultural Tractor Market, By Engine Power

- Less Than 15 HP

- 15-30 HP

- 31-45 HP

- 46-75 HP

Vietnam Agricultural Tractor Market, By Drive Type

- Two-Wheel Drive

- Four-Wheel Drive

Vietnam Agricultural Tractor Market, By Propulsion Technology

- Diesel

- Hybrid

- Fully Electric

Frequently Asked Questions (FAQ)

-

Q: What is the Vietnam agricultural tractor market size?A: Vietnam agricultural tractor market is expected to grow from USD 292.01 million in 2024 to USD 614.98 million by 2035, growing at a CAGR of 7.01% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the rising mechanization of agriculture due to rural labour shortages, growing food and export demand, need to boost efficiency and productivity in farming operations, increasing mechanization helps address higher labour costs and labour migration to urban areas, pushing farmers to adopt tractors and mechanized tools.

-

Q: What factors restrain the Vietnam agricultural tractor market?A: Constraints include the high upfront costs of tractors, especially for smallholder farmers, fragmented landholdings that limit mechanization efficiency, and a shortage of skilled operators for more advanced machinery.

-

Q: How is the market segmented by engine power?A: The market is segmented into less than 15 HP, 15-30 HP, 31-45 HP, and 46-75 HP.

-

Q: Who are the key players in the Vietnam agricultural tractor market?A: Key companies include Kubota Corporation, Yanmar Holdings Co., Ltd., Deere & Company, Mahindra & Mahindra Ltd., CNH Industrial, AGCO Corporation, Iseki & Co., Ltd., LS Group, CLAAS KGaA mbH, Zetor Tractors, Zoomlion Heavy Industry Science and Technology Co., Ltd., Vietnam Engine & Agricultural Machinery Corp, Truong Hai Group Corporation, Tong Yang Moolsan Co. Ltd., Vietnam Agrotech Co., Ltd., and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?