Global Veterinary Hematology Analyzers Market Size, Share, and COVID-19 Impact Analysis, By Product (Table-Top Analyzers, Fully Automatic Analyzers, Semi-Automatic Analyzers, Point-of-Care Analyzers, Cartridge Based Analyzers, and Direct Sample-Based Analyzers), By End User (Veterinary Hospitals & Clinics, Veterinary Reference Laboratories, Point-of-Care Testing, and Veterinary Research & Academic Institutes), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: HealthcareGlobal Veterinary Hematology Analyzers Market Insights Forecasts to 2033

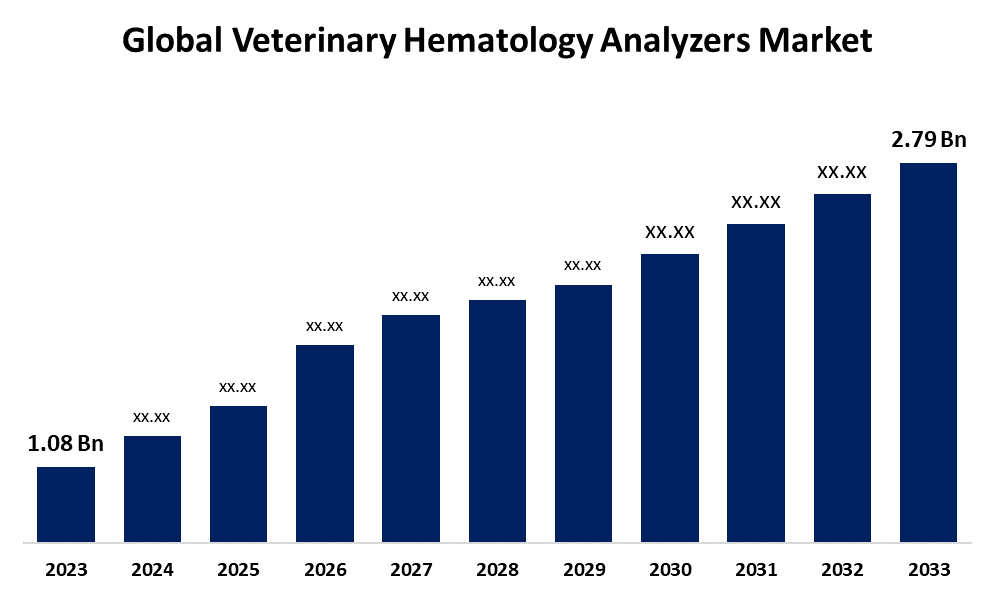

- The Global Veterinary Hematology Analyzers Market Size was Estimated at USD 1.08 Billion in 2023

- The Global Veterinary Hematology Analyzers Market Size is Expected to Grow at a CAGR of around 9.96% from 2023 to 2033

- The Worldwide Veterinary Hematology Analyzers Market Size is Expected to Reach USD 2.79 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Veterinary Hematology Analyzers Market Size is Expected to cross USD 2.79 Billion by 2033, Growing at a CAGR of 9.96% from 2023 to 2033. AI-powered diagnostics, the expansion of point-of-care testing, growing pet adoption, technological improvements, and rising veterinary healthcare spending are some of the prospects driving innovation and market growth in the veterinary hematology analyzers market.

Market Overview

The industry that focuses on automated blood analysis for animals to help with illness diagnosis and health monitoring is known as the veterinary hematology analyzers market. Red blood cells (RBCs), white blood cells (WBCs), platelets, and hemoglobin levels are among the blood components that these analyzers measure both quantitatively and qualitatively. Growing pet adoption, growing veterinary healthcare costs, and improvements in diagnostic technology are the main factors propelling the market. These analyzers are used in research labs, hospitals, and veterinary clinics for effective, real-time blood testing that supports early illness identification and treatment planning. For instance, in September 2024, Zoetis Inc. launched the Vetscan OptiCell, a revolutionary cartridge-based hematology analyzer that uses artificial intelligence (AI) to provide accurate Complete Blood Count (CBC) analysis at the point of care, giving veterinary clinics lab-quality results while saving time, money, and space.

The strong prevalence of animal diseases, rising clinical visits involving bloodwork, rising adoption of companion animals, rising costs for animal healthcare, and technological developments in hematology analyzers are all driving this market's explosive expansion. Primary factors driving the veterinary hematology analyzers market growth include the rising number of companion animals, the high incidence of zoonotic illnesses, rising animal health costs, and rising pet insurance usage in industrialized nations.

Report Coverage

This research report categorizes the veterinary hematology analyzers market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the veterinary hematology analyzers market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the veterinary hematology analyzers market.

Veterinary Hematology Analyzers Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 1.08 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 9.96% |

| 2033 Value Projection: | USD 2.79 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 267 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By End User and COVID-19 Impact Analysis |

| Companies covered:: | Siemens Healthineers, Heska Corporation, IDEXX Laboratories, Inc., Urit Medical, Abaxis, Inc., Qreserve, Inc., Drew Scientific, Inc., Clindiag Systems Co., Ltd., Boule Medical AB, Sysmex Corporation, Diatron MI PLC, HORIBA Medical, HemoCue AB, Woodley Equipment Company Ltd., and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

Increased need for accurate diagnosis and treatment of animal illnesses, rising healthcare costs, and an expanding pet population all contribute to the veterinary hematology analyzers market. The market for veterinary hematology analyzers is driven by the growth in the number of pets and the frequency of zoonotic illnesses. The market for veterinary hematology analyzers is being driven by an increase in the number of pets. Growing pet ownership, an increase in livestock, and the growing importance of preventative animal care have all contributed to a need for rapid and accurate diagnostic testing in veterinary clinics, which is the main driver veterinary hematology analyzers market.

Restraining Factors

High prices, intricate legal requirements, a lack of knowledge in developing nations, issues with data accuracy, and technology constraints are some of the restrictions facing the veterinary hematology analyzers market.

Market Segmentation

The veterinary hematology analyzers market share is classified into product and end user.

- The table-top analyzers segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the product, the veterinary hematology analyzers market is divided into table-top analyzers, fully automatic analyzers, semi-automatic analyzers, point-of-care analyzers, cartridge-based analyzers, and direct sample-based analyzers. Among these, the table-top analyzers segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. The fully automated and semiautomatic analyzers are the two categories of table-top analyzers. The expansion of this market is driven by elements including the devices' low cost, convenience of use, and low maintenance requirements. Hospitals and veterinary clinics make extensive use of tabletop analyzers.

- The veterinary hospitals & clinics segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the end user, the veterinary hematology analyzers market is divided into veterinary hospitals & clinics, veterinary reference laboratories, point-of-care testing, and veterinary research & academic institutes. Among these, the veterinary hospitals & clinics segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. Increased use of hematology analyzers for the diagnosis and treatment of various animal illnesses, as well as an increase in clinical visits including bloodwork, would support the expansion of veterinary hospitals and the veterinary care market.

Regional Segment Analysis of the Veterinary Hematology Analyzers Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the veterinary hematology analyzers market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the veterinary hematology analyzers market over the predicted timeframe. The rapidly rising number of companion animals, the expanding emphasis on animal health, the availability of technologically improved healthcare structures, and the growing use of pet insurance are the reasons for the North America region. The growing popularity of pets and pet insurance, the incidence of animal ailments, and the rate of animal medicalization have all contributed to the U.S. sector dominating the North America veterinary hematology analyzers market.

Asia Pacific is expected to grow at the fastest CAGR growth of the veterinary hematology analyzers market during the forecast period. The statistics of the Asia Pacific area are anticipated to be driven by variables including the rising number of pets, the prevalence of animal illnesses, and the expanding awareness of animal health. The use of veterinary hematology analyzers in rural agricultural operations and urban hospitals is very promising in China, which is part of the Asia-Pacific area.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the veterinary hematology analyzers market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Siemens Healthineers

- Heska Corporation

- IDEXX Laboratories, Inc.

- Urit Medical

- Abaxis, Inc.

- Qreserve, Inc.

- Drew Scientific, Inc.

- Clindiag Systems Co., Ltd.

- Boule Medical AB

- Sysmex Corporation

- Diatron MI PLC

- HORIBA Medical

- HemoCue AB

- Woodley Equipment Company Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In December 2024, the foremost animal health firm in the world, Zoetis Inc., launched Vetscan OptiCellTM, a revolutionary screenless point-of-care hematological analyzer, to the world at the Veterinary Meeting & Expo (VMX) in Orlando, Florida, in January. It is the first veterinary hematology diagnostic instrument that uses a cartridge and artificial intelligence (AI) to provide accurate insights in minutes through full blood count (CBC) analysis.

- In August 2024, Chengdu Seamaty Technology Co., Ltd. launched four new veterinary analyzers for quick and accurate CBC evaluations, including the VBC30 Vet 3-part and VBC50 5-part hematology analyzers.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the veterinary hematology analyzers market based on the below-mentioned segments:

Global Veterinary Hematology Analyzers Market, By Product

- Table-Top Analyzers

- Fully Automatic Analyzers

- Semi-Automatic Analyzers

- Point-of-Care Analyzers

- Cartridge Based Analyzers

- Direct Sample-Based Analyzers

Global Veterinary Hematology Analyzers Market, By End User

- Veterinary Hospitals & Clinics

- Veterinary Reference Laboratories

- Point-of-Care Testing

- Veterinary Research & Academic Institutes

Global Veterinary Hematology Analyzers Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the veterinary hematology analyzers market over the forecast period?The veterinary hematology analyzers market is projected to expand at a CAGR of 9.96% during the forecast period.

-

2. What is the market size of the veterinary hematology analyzers market?The Global Veterinary Hematology Analyzers Market Size is Expected to Grow from USD 1.08 Billion in 2023 to USD 2.79 Billion by 2033, at a CAGR of 9.96% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the veterinary hematology analyzers market?North America is anticipated to hold the largest share of the veterinary hematology analyzers market over the predicted timeframe.

Need help to buy this report?