Global Vendor Neutral Archives Market Size, Share, and COVID-19 Impact Analysis, By Imaging Modalites (Radiology, Cardiology, Pathology, Endoscopy, Mammography, and Others), By End Use (Hospitals, Diagnostic Imaging Centers, and Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Vendor Neutral Archive Market Insights Forecasts to 2035

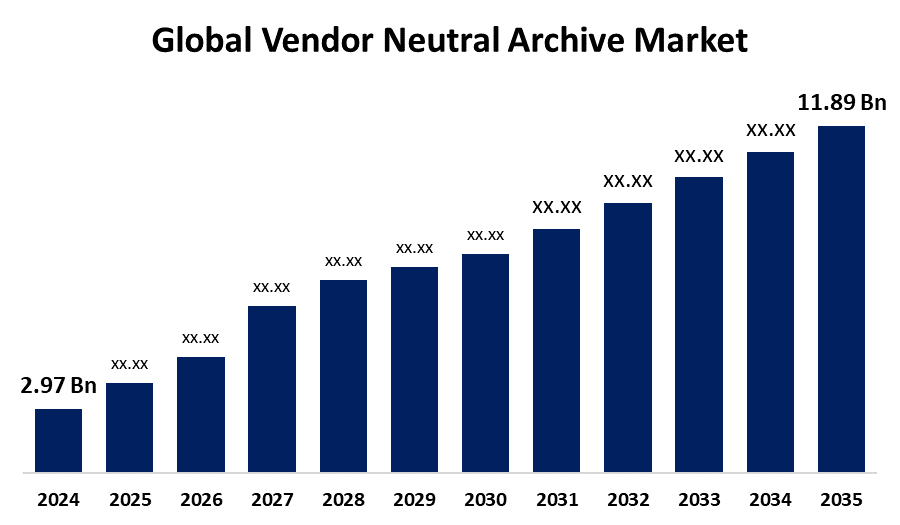

- The Global Vendor Neutral Archive Market Size Was Estimated at USD 2.97 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 13.44% from 2025 to 2035

- The Worldwide Vendor Neutral Archive Market Size is Expected to Reach USD 11.89 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Vendor Neutral Archive Market Size was worth around USD 2.97 Billion in 2024 and is predicted to grow to around USD 11.89 Billion by 2035 with a compound annual growth rate (CAGR) of 13.44% from 2025 to 2035. Increased imaging volumes in radiology, cardiology, pathology and ophthalmology, and post-M&A consolidation needs from pre-existing PACS are contributing to the trend. The increased utilization of complex medical imaging for diagnostic evaluation and therapy is also creating digital healthcare solutions, such as Vendor Neutral Archives (VNA), to ease and standardize the administration of healthcare data.

Global Vendor Neutral Archive Market Forecast and Revenue Outlook

- 2024 Market Size: USD 2.97 Billion

- 2035 Projected Market Size: USD 11.89 Billion

- CAGR (2025-2035): 13.44%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Market Overview

The vendor neutral archives market is a digital medical records solution that can store medical images and documents in an interoperable or open-standard format so they can be accessed quickly and shared seamlessly across systems, allowing for improved clinical workflows and enterprise-level data management. Rising cloud integration influences the vendor neutral archive (VNA) market, enabling improvements in scalability, security, and real-time access to data. A focus on interoperability promotes the exchange of imaging data to improve collaborative health care team workflow effectiveness. VNAs are critical to both clinical decision-making and precision medicine. VNAs are increasingly integrating artificial intelligence (AI) to enhance image analysis, data classification, and real-time decision-making. By providing predictive analytics, anomaly detection, and pre-emptive diagnosis, AI is transforming VNAs into smart platforms that uplift patient outcomes and advance healthcare performance across a varied range of clinical environments. The progress of VNAs is additionally augmented by recent activity and strategic partnerships with leading healthcare IT firms. For instance, in February 2024, Fujifilm's Synapse VNA was named best in KLAS for the fifth time in a row for outstanding customer satisfaction and interoperability. Similarly, GE HealthCare and Tribun Health announced in March 2024 that they would be collaborating on a Vendor Neutral Archive that would include Vendor Neutral Archive data in GE's Edison VNA platform with the intent of improving interoperability and offering physicians a deeper understanding of patients' information.

Key Market Insights

- North America is expected to account for the largest share in the Vendor Neutral Archive Market during the forecast period.

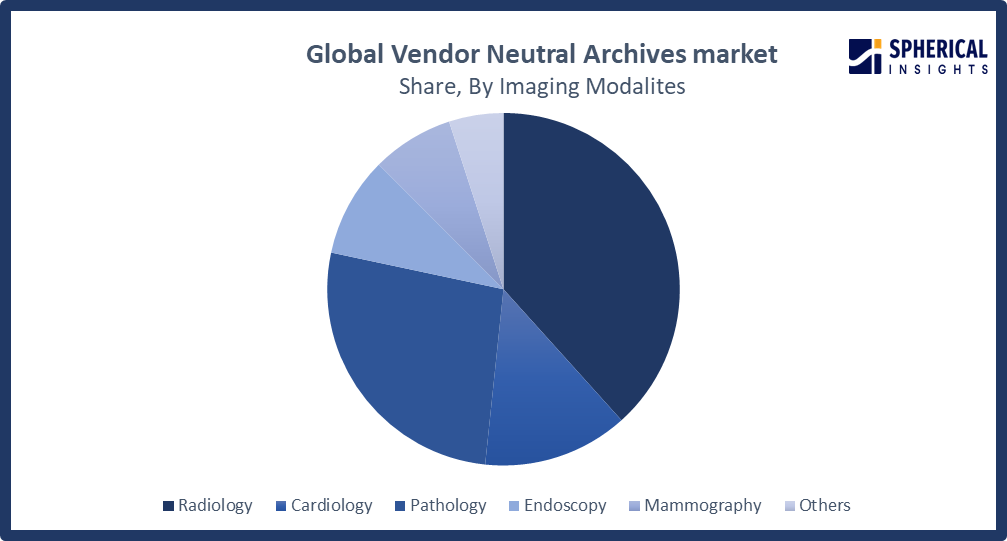

- In terms of imaging modalites, the radiology segment is projected to lead the Vendor Neutral Archive Market throughout the forecast period

- In terms of end-user, the hospitals segment captured the largest portion of the market

Vendor Neutral Archive Market Trends

- Scalability and resilience are improved by hybrid storage solutions and growing cloud utilization.

- Interoperability (DICOM, HL7/FHIR, IHE-XDS) is emphasised for smooth data integration.

- Clinical decision-making, data management, and imaging analysis are all enhanced by AI integration.

- Stricter data governance increases the need for centralised, compliant archivses.

- Leading vendors' innovations and strategic alliances drive market expansion.

Report Coverage

This research report categorizes the vendor neutral archives market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the vendor neutral archives market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the vendor neutral archives market.

Global Vendor Neutral Archive Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.97 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 13.44% |

| 2035 Value Projection: | USD 11.89 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Imaging Modalites, By End Use, By Region |

| Companies covered:: | GE HealthCare, Siemens Healthineers International AG, Carestream Health, BridgeHead Software, Canon Medical Systems, Novarad, Dell Technologies, Change Healthcare, Dicom Systems, Inc., Intelerad, RamSoft, FUJIFILM Corporation, Koninklijke Philips N.V.,, IBM Watson Health (Merative), Hyland Healthcare, Sectra AB, Agfa HealthCare, Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving factors

Market growth for vendor neutral archive (VNA) solutions is being driven by the escalating imaging data volume, interoperability requirements, regulatory compliance, AI utilization, and shift to cloud-based solutions. VNAs are known as digital health records due to their properties of portability, access management, and long-term storage. VNAs provide centralized, standardized storage for data from Home Health care and medical imaging. Cloud integration, supported by AI analytics and advanced imaging technologies, enhances data availability, workflow automation, and accuracy of diagnosis, leading to further innovation and better, more timely clinical decisions.

Restraining Factor

Data security and privacy issues, high implementation costs, and integration challenges with existing systems are the main issues surrounding VNA and PACS. Medical data is diverse among departments, facilities, and vendors, which causes inefficiencies. Because of this, it is difficult for medical professionals to get instant access to comprehensive patient records. VNAs solve the problems related to uniform data storage and standardization. Natural disasters, power outages, or cyberattacks can cause systems to malfunction or erase important data.

Market Segmentation

The global vendor neutral archives market is divided into imaging modalites and end-use.

Global Vendor Neutral Archives Market, By Imaging Modalities:

- The radiology segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on imaging modalities, the global vendor neutral archives market is segmented into radiology, cardiology, pathology, endoscopy, mammography, and others. Among these, the radiology segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The largest volume of imaging data, including CT, MRI, X-ray, and ultrasound images, is produced by radiology departments. This data has to be easily accessible and stored across numerous systems and locations. In order to facilitate interoperability, long-term storage, and efficient workflows, VNAs were first used to organise and consolidate radiological pictures from various PACS suppliers. This helped to explain the segment's high market share.

Get more details on this report -

The pathology segment in the vendor neutral archives market is expected to grow at the fastest CAGR over the forecast period.

Global Vendor Neutral Archives Market, By End-use:

- The hospitals segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on end use, the global vendor neutral archives market is segmented into hospitals, diagnostic imaging centers, and others. Among these, the hospitals segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The vast quantities of imaging data created across multiple specialities and departments require rapid access, interoperability, and centralized storage for clinical workflows and patient care. Large hospitals can also use VNA solutions that integrate data from multiple PACS and support enterprise imaging programs, as they have the financial and IT capacity to do so. For instance, in April 2025, a private hospital in Australia selected Sectra's enterprise imaging solution to optimize patient outcomes and organizational efficiencies through improved workflows in cardiology, radiology, and breast imaging. This highlights the fact that hospitals are focusing more and more on integrated imaging platforms.

The diagnostic imaging centres segment in the vendor neutral archives market is expected to grow at the fastest CAGR over the forecast period.

Regional Segment Analysis of the Global Vendor Neutral Archive Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America Vendor Neutral Archives Market Trends

Get more details on this report -

North America is expected to hold the largest share of the global vendor neutral archives market over the forecast period.

The North America vendor neutral archive market led the global market due to robust governmental support for data exchange and interoperability, high imaging volumes, and sophisticated healthcare infrastructure. The need for vendor-neutral, centralised solutions that simplify access across many specialities and facilities is being driven by the growing use of enterprise imaging strategies and electronic health records (EHRs). Additionally, the region's VNA industry is expanding due to the presence of major firms like Philips, GE Healthcare, and Hyland.

U.S. Vendor Neutral Archives Market Trends

This volume emphasises how important it is to store, organise, and retrieve imaging data in an efficient manner. The market for VNAs is expanding as a result of the enormous volumes of data generated by so many imaging procedures, which healthcare practitioners need to safely store and make available across various care settings.

Asia Pacific Vendor Neutral Archives Market Trends

Asia Pacific is expected to grow at the fastest CAGR in the vendor neutral archives market during the forecast period. Large-scale healthcare digitisation and infrastructure improvements in key nations including China, India, Japan, South Korea, and Australia are driving the region's strong traction. Cloud-based and hybrid VNA solutions are being aggressively implemented by healthcare providers to facilitate scalable image storage, disaster recovery, and telehealth. Adoption is being further fuelled by the increasing prevalence of integration with PACS, EHR systems, and developing AI-driven imaging analytics.

Europe Vendor Neutral Archives Market Trends

The growing demand for interoperable systems across national health services, increased imaging volumes, and the growing use of digital health solutions are all contributing to the steady expansion of the VNA market in Europe. The strong legislative focus on patient privacy and data protection, as demonstrated by the General Data Protection Regulation (GDPR), which requires the safe management, preservation, and access of medical data, is one of the major factors driving market expansion. Because they provide secure access management, data governance tools, and audit trails, VNAs are viewed as compliance enablers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global vendor neutral archives market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Worldwide Top Key Players in the vendor neutral archives market include:

- GE HealthCare

- Siemens Healthineers International AG

- Carestream Health

- BridgeHead Software

- Canon Medical Systems

- Novarad

- Dell Technologies

- Change Healthcare

- Dicom Systems, Inc.

- Intelerad

- RamSoft

- FUJIFILM Corporation

- Koninklijke Philips N.V.,

- IBM Watson Health (Merative)

- Hyland Healthcare

- Sectra AB

- Agfa HealthCare

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent development

- In December 2024, Peter Arduini, CEO of GE Healthcare, proclaimed that radiologists face challenges in healthcare imaging and diagnosis. He also said that GE Healthcare has set the goal of delivering technologies that address radiologists. The company is focusing on innovations and new solutions, including AI and digital technologies, that will help clinicians deliver more personal and precise care through diagnosis, treatment, and recovery.

- In June 2024, Philips announced the expansion of cloud-based imaging with IntelSpace radiology on Amazon Web Services that includes high-speed remote reading access and AI capabilities to enhance patient care.

- In February 2024, Fujifilm Healthcare Americas Corporation announced that the Synapse VNA and Synapse Radiology PACS of the company were recognized with the Best in KLAS awards: software and services by KLAS Research.

- In November 2023, InsiteOne acquired BRIT Systems, integrating its RIS/PACS/VNA platform into its portfolio. This move enhances InsiteOne’s multi-tenant enterprise imaging capabilities.

- In October 2022, RamSoft launched OmegaAI, a cloud-native Imaging EMR that consolidates VNA, PACS, RIS, zero-footprint viewing, patient portals, BI tools, and FHIR-based interoperability into a single SaaS platform.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the vendor neutral archives market based on the following segments:

Global Vendor Neutral Archives Market, By Imaging Modalites

- Radiology

- Cardiology

- Pathology

- Endoscopy

- Mammography

- Others

Global Vendor Neutral Archives Market, By End Use

- Hospitals

- Diagnostic Imaging Centers

- Others

Global Vendor Neutral Archives Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the Vendor Neutral Archives market over the forecast period?The global Vendor Neutral Archives market is projected to expand at a CAGR of 13.44% during the forecast period.

-

2. What is the market size of the Vendor Neutral Archives market?The global Vendor Neutral Archives market size is expected to grow from USD 2.97 billion in 2024 to USD 11.89 billion by 2035, at a CAGR 13.44% of during the forecast period 2025-2035.

-

3. Which region holds the largest share of the Vendor Neutral Archive market?North America is anticipated to hold the largest share of the Vendor Neutral Archives market over the predicted timeframe.

-

4. Who are the top 10 companies operating in the global Vendor Neutral Archive market?GE HealthCare, Siemens Healthineers, International AG., Carestream Health, BridgeHead Software, Canon Medical Systems, Novarad, Dell Technologies, Change Healthcare, Dicom Systems.

-

5. What factors are driving the growth of the Vendor Neutral Archive market?The VNA market is driven by growing imaging data, demand for interoperability, regulatory compliance, and adoption of cloud and AI technologies. VNAs enable centralized, standardized storage with enhanced data access, workflow automation, and diagnostic accuracy, supporting timely, data-driven clinical decisions.

Need help to buy this report?