Global Vanilla Market Size, Share, and COVID-19 Impact Analysis, By Type (Indian Vanilla, Tahitian Vanilla, Mexican Vanilla, Madagascar Vanilla), By Form (Liquid, Powder, Whole), By Application (Pharmaceuticals, Food & Beverages, Cosmetics & Personal Care, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033

Industry: Food & BeveragesGlobal Vanilla Market Insights Forecasts to 2033

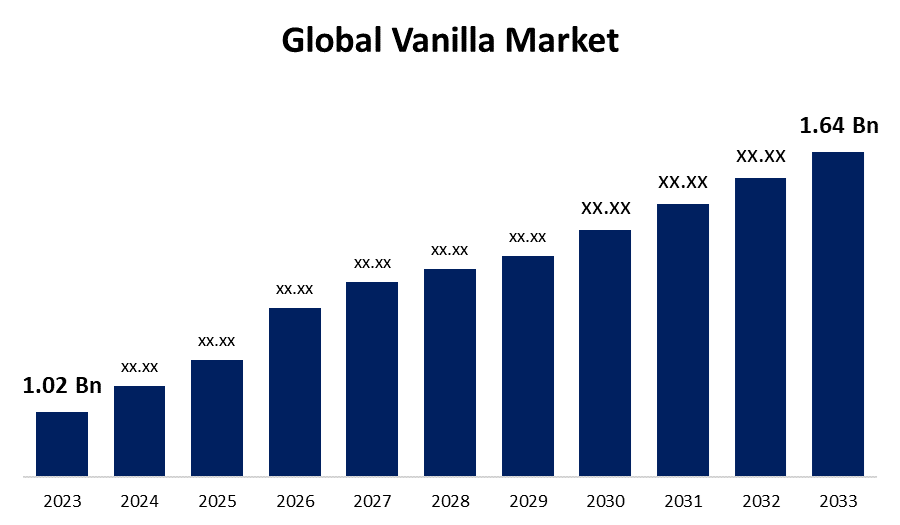

- The Global Vanilla Market Size was Valued at USD 1.02 Billion in 2023.

- The Market Size is Growing at a CAGR of 4.86% from 2023 to 2033.

- The Worldwide Vanilla Market Size is Expected to Reach USD 1.64 Billion by 2033.

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Vanilla Market Size is Anticipated to Exceed USD 1.64 Billion by 2033, Growing at a CAGR of 4.86% from 2023 to 2033.

Market Overview

Vanilla is a flavoring substance obtained from orchids of vanilla plants. Vanilla is prepared by macerating and filtering vanilla pods in a mixture of water and ethanol. It has a sweet, aromatic taste that's widely popular in desserts and beverages. Vanilla is noted for its refreshing, exotic flavor and mellow, pleasant smell. Vanilla also has therapeutic effects, including antioxidant, anti-inflammatory, and depression medicine characteristics. Vanilla contains several health-promoting ingredients, such as nutrients, vitamins, minerals, and phenols, which have resulted in a rise in consumer interest. An outcome, it is widely used in the bakery food products, cosmetics and personal care, and healthcare sectors, propelling its market expansion. The global vanilla market is expanding rapidly due to increased consumer demand for plant-based goods. The perfect warm and humid temperature, vanilla is primarily grown in tropical regions such as Mexico, Madagascar, and Indonesia. Elsevier reports that the total yearly vanillin output is 20,000 tons, with lignin, petroleum-based substance guaiacol, and vanilla beans accounting for 15%, 85%, and 1%, respectively. Cakes, ice creams, brownies, cupcakes, chocolates, vanilla custard, puddings, and yogurt are among the many bakery products that use the extract.

Report Coverage

This research report categorizes the market for the global vanilla market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global vanilla market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global vanilla market.

Global Vanilla Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.02 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 4.86% |

| 2033 Value Projection: | USD 1.64 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Form, By Application, By Region |

| Companies covered:: | McCormick & Company Sensient Technologies Corporation Prova SAS International Flavors & Fragrances Inc. Virginia Dare Extract Co. Eurovanille Givaudan SA Aurochemicals Dolan Flavoring Co. Firmenich SA Flavor Producers, LLC Flavorchem Corporation H&H Product Company Heilala Vanilla Limited Lochhead Manufacturing Company McCormick & Company, Inc. Penta Manufacturing Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing consumer belief that organic components, such as vanilla, make food healthy is a major driver of global demand for organic flavors. As a consequence, consumers are using both terms interchangeably and products with artificial components are commonly avoided, which benefits the industry. With evolving consumer tastes and the food flavoring market dynamics, food manufacturers are under pressure to discontinue developing synthetic ingredients for use in food products. The increasing rise of the cake industry is a significant contribution to the vanilla market's expansion. Vanilla's widespread use as a flavoring agent in the manufacturing of cupcakes, cakes, brownies, puddings, and other sweets has resulted in increased demand. Consumers choose plant-based flavoring agents over artificial flavoring agents because of their realistic taste and ability to improve product texture. Furthermore, the excellent supply network allows for the simple availability of vanilla convenience and specialized stores, which has helped global vanilla market growth.

Restraining Factors

With the high pricing and unavailability of the ingredients, manufacturers are driven to hunt for substitutes for the crucial vanilla taste. These solutions included using vanillin substitutes and mixing extracts with tastes to create a less expensive choice with little to no change in the flavor profile. Natural vanilla production in the world is minimal and has recently declined, with vanilla orchids accounting for less than 1% of the taste. With demand increasing, sales of the coveted taste are out of balance. The global supply of vanilla beans is insufficient to meet demand from a variety of end-user sectors.

Market Segmentation

The global vanilla market share is classified into type, form, and application.

- The Madagascar vanilla segment is expected to grow at the fastest pace in the global vanilla market during the forecast period.

Based on type, the global vanilla market is divided into Indian vanilla, Tahitian vanilla, Mexican vanilla, and Madagascar vanilla. Among these, the Madagascar vanilla segment is expected to grow at the fastest pace in the global vanilla market during the forecast period. Madagascar or bourbon vanilla accounts for the majority of the market share due to its widespread availability in supermarkets. Along with its sweet, creamy flavor, which is unmatched by other beans cultivated in other countries.

- The powder segment is expected to grow at the fastest pace in the global vanilla market during the forecast period.

Based on the form, the global vanilla market is divided into liquid, powder, and whole. Among these, the powder segment is expected to grow at the fastest pace in the global vanilla market during the forecast period. Vanilla powder is easier to use and preserve than traditional vanilla extract or vanilla beans. Powdered vanilla is also convenient to include in a variety of food preparations. High-quality vanilla powder is frequently regarded as an organic and genuine product, free of chemicals and artificial ingredients. Organic vanilla sales are increasing as consumer demand for clean and pure components grows.

- The food & beverages segment is expected to hold the largest share of the global vanilla market during the forecast period.

Based on application, the global vanilla market is divided into pharmaceuticals, food & beverages, cosmetics & personal care, and others. Among these, the food & beverages segment is expected to hold the largest share of the global vanilla market during the forecast period. Baked items and beverages are popular foods, and their rising consumption is driving up vanilla sales. The rise of food tourism is also exposing East Asian customers to a wide variety of flavors from throughout the world, especially vanilla. Curiosity and the desire to combine global tastes into regional dishes are driving rising vanilla use. It can be found in frozen desserts, ice cream, smoothies, frostings, whipped cream, and other things. In recent years, vanilla extract has been added to lattes, hot chocolates, creamy shakes, cocktails, and cold drinks.

Regional Segment Analysis of the Global Vanilla Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global vanilla market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global vanilla market over the predicted timeframe. The food and beverage business is a vital component of the US business. According to the US Committee for economic development study, the food and beverage industry supports almost 1.5 Billion people. The growing consumption of bakery and sweets products in several nations, including the United States and Canada, is expected to drive demand for vanilla across North America in a few years. Buns, bread, cakes, croissants, doughnuts, and pastries are just a few of the bakery products available. The increased need for flavored bread items in the region is driving up the demand for vanilla, which is benefiting the industry. Its antioxidant and antibacterial properties, vanilla is an excellent choice for cleansing and repairing damaged skin. It is also known to help people with anxiety and depression. When evaluating the precise quantity of ethyl vanillin in products containing vanilla extract, pharmaceutical and biotechnology businesses in the United States utilize vanilla extract, or vanillin, as a standard of measure.

Asia Pacific is expected to grow at the fastest pace in the global vanilla market during the forecast period. Caused by rising demand for vanilla essence in the region's dairy product manufacturing and an increasing consumer base for vanilla-extracted products in emerging nations such as China and India. The region's wealth of raw materials for the manufacture of several vanilla-derived products is a key driver of its business. Adequate climatic conditions are also an important factor that has led to many food companies establishing manufacturing sites in the region, leading to increased vanilla sales performance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global vanilla along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- McCormick & Company

- Sensient Technologies Corporation

- Prova SAS

- International Flavors & Fragrances Inc.

- Virginia Dare Extract Co.

- Eurovanille

- Givaudan SA

- Aurochemicals

- Dolan Flavoring Co.

- Firmenich SA

- Flavor Producers, LLC

- Flavorchem Corporation

- H&H Product Company

- Heilala Vanilla Limited

- Lochhead Manufacturing Company

- McCormick & Company, Inc.

- Penta Manufacturing

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In November 2023, Aurochemicals manufactures 603 top-quality flavor and fragrance ingredients. In 2022, the top product Vanillin Natural broke a revenue record with its sales. Vanillin Natural, a widely used ingredient with great potential, captures the intricate flavor profiles of vanilla.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global vanilla market based on the below-mentioned segments:

Global Vanilla Market, By Type

- Indian Vanilla

- Tahitian Vanilla

- Mexican Vanilla

- Madagascar Vanilla

Global Vanilla Market, By Form

- Liquid

- Powder

- Whole

Global Vanilla Market, By Application

- Pharmaceuticals

- Food & Beverages

- Cosmetics & Personal Care

- Others

Global Vanilla Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which region holds the largest share of the global vanilla market?North America is anticipated to hold the largest share of the global vanilla market over the predicted timeframe.

-

2. What is the projected market size & growth rate of the global vanilla market?The global vanilla market was valued at USD 1.02 Billion in 2023 and is projected to reach USD 1.64 Billion by 2033, growing at a CAGR of 4.86% from 2023 to 2033.

-

3. Which are the key companies that are currently operating within the global vanilla market?McCormick & Company, Sensient Technologies Corporation, Prova SAS, International Flavors & Fragrances Inc., Virginia Dare Extract Co., Eurovanille, Givaudan SA, Aurochemicals, Dolan Flavoring Co., Firmenich SA, Flavor Producers LLC, Flavorchem Corporation, H&H Product Company, Heilala Vanilla Limited, Lochhead Manufacturing Company, McCormick & Company Inc., Penta Manufacturing, and Others.

Need help to buy this report?