Global Valve Positioner Market Size, Share, and COVID-19 Impact Analysis, By Type (Pneumatic Valve Positioner, Electro-Pneumatic Valve Positioner, Digital Valve Positioner), By Actuation (Single-Acting, Double-Acting), By Verticals (Energy & Power, Chemical, Oil & Gas, Pharmaceutical, Metal & Mining, Food & Beverage, Water & Wastewater Treatment, Paper & Pulp, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Industry: Semiconductors & ElectronicsGlobal Valve Positioner Market Insights Forecasts to 2032

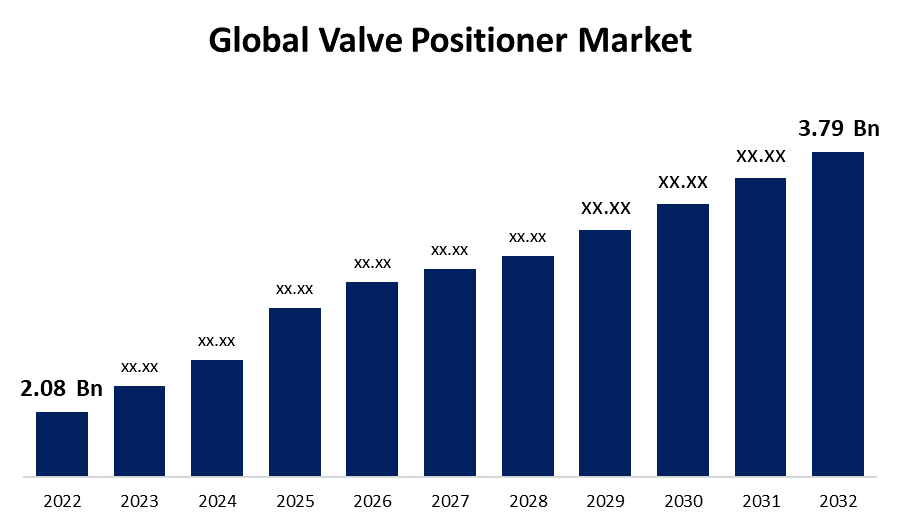

- The Global Valve Positioner Market Size was valued at USD 2.08 Billion in 2022.

- The Market Size is Growing at a CAGR of 6.2% from 2022 to 2032

- The Worldwide Valve Positioner Market is expected to reach USD 3.79 Billion by 2032

- North America is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Valve Positioner Market Size is expected to reach USD 3.79 Billion by 2032, at a CAGR of 6.2% during the forecast period 2022 to 2032.

Valve Positioners are a highly utilized type of control valve component employed across a wide range of industrial applications. A positioner is a type of motion-control mechanism that actively compares valve stem position feedback to the control signal, changing pressure to the actuator diaphragm or piston until the correct stem position is achieved. Because the main objective of a valve positioner is to make certain that the mechanical valve's position always matches the command signal. A feedback linkage is integrated back into the valve positioner to accomplish this. The valve positioner's action is determined by how position feedback triggers control of the pneumatic signal to the actuator. Valve positioners are classified into three primary categories: pneumatic, electro-pneumatic, and digital. A valve positioner helps to improve the accuracy of the valve action. A valve positioner aids in improving valve action accuracy. These are used in a variety of industries, including oil and gas, wastewater treatment, food and beverage, and many more.

Global Valve Positioner Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 2.08 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 6.2% |

| 2032 Value Projection: | USD 3.79 Billion |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | COVID-19 Impact Analysis, By Type, By Actuation, By Verticals, and By Region |

| Companies covered:: | GEMU Group, SMC, ABB, Siemens AG, Schneider Electric, Azbil Corporation, Emerson Electric Co., Flowserve Corporation, Dwyer Instruments Ltd., Valve Related Controls, Inc., Power-Genex Ltd., Val Controls, Bray International, Nihon KOSO Co., Ltd., Spirax-Sarco Limited, Samson AG, VRG Controls, Festo Inc., Badger Meter, Inc., ControlAir, Crane Co., and Other key venders |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rising number of urban residents along with the number of industries in developing markets, as well as a growing acceptance of smart valve positioners in various plant operations, contribute to the valve positioner market expansion. As well, the introduction of IIoT and increased digitalization awareness are likely to offer development possibilities for the valve positioner market during the estimated time frame. When compared to pneumatic and electro-pneumatic valve positioners, the adoption of smart or digital valve positioners has risen in the past few years. This is due to the fact that the digital valve positioner offers an intelligent, flexible, and dependable valve solution for valve control. The digital valve positioner is responsible for controlling the valve position but also performs other activities such as data collection, remote monitoring, assessment, and maintenance.

The overall valve positioners market is expanding due to the rising significance of process monitoring and control. Valve positioners allow precise control over the flow or pressure of an operation, which aids in process efficiency, cost reduction, and efficiency. They offer numerous advantages such as enhanced process administration, real-time monitoring, predictive maintenance, telemetry, and energy saving. Additionally, as urbanization and industry have increased, so has the demand for wastewater treatment, which in turn has increased the valve positioner market. The substantial investments in the energy and power industries have the potential to be one of the driving reasons for the global valve positioner market's growth.

Market Segmentation

By Technology Insights

The digital valve positioner segment is dominating the market with the largest revenue share over the forecast period.

On the basis of type, the global valve positioner market is segmented into the pneumatic valve positioner, electro-pneumatic valve positioner, and digital valve positioner. Among these, the digital valve positioner segment is dominating the market with the largest revenue share of 48.6% over the forecast period. The installation and operation of digital valve positioners, also known as smart valve positioners, has increased lately as the process industry has increased its use of automated technologies. To position the actuator accurately, these smart valve positioners leverage microprocessors to transform electrical data into air pressure indications. With the addition of online valve diagnostics, the adoption of digital valve positioners is expected to increase plant efficiency and process uptime. As a result of the introduction of digitalization, the need for digital valve positioners in the process industry is expanding.

By Actuation Insights

The single-acting segment is witnessing significant CAGR growth over the forecast period.

On the basis of actuation, the global valve positioner market is segmented into single-acting and double-acting. Among these, the single-acting segment is witnessing significant CAGR growth over the forecast period. The actuator is primarily responsible for the functioning of the valve's opening and closing mechanisms. A valve positioner, on the other hand, primarily aids in altering the position of an actuator in response to the input signals for its action. Single acting positioners rely on spring force to control the actuator, which supplies air pressure to open the valve and a mechanical spring to close it. The single-acting positioner is compatible with both linear and rotary actuators.

By Verticals Insights

The oil & gas segment accounted for the largest revenue share of more than 34.7% over the forecast period.

On the basis of verticals, the global valve positioner market is segmented into energy & power, chemical, oil & gas, pharmaceutical, metal & mining, food & beverage, water & wastewater treatment, paper & pulp, and others. Among these, the oil & gas segment is dominating the market with the largest revenue share of 34.7% over the forecast period. The oil and gas industry necessitates precise control over fluid flow, which demands the use of valve positioners. The rise in exploration and production operations in the oil and gas industry continues to drive up the need for valve positioners. Valve positioners are excellent for the oil and gas industry since they are built to handle extreme circumstances such as high pressure and temperature. Furthermore, the oil and gas end-use industry dominates the global valve positioners market as a result of the high need for flow monitoring and control during exploration and production operations, safety and security, high durability, and rising industry investments.

Regional Insights

North America dominates the market with the largest market share over the forecast period.

Get more details on this report -

North America is dominating the market with more than 38.7% market share over the forecast period. This is due to the region's abundance of high-end industries and significant industry participants. Because of the country's rising population, the presence of diverse businesses and key organizations, along with rapid technical improvements, the United States has a larger market for valve positioners in North America. The oil and gas industry in North America has a large need for valve positioners, which contributes significantly to the market's dominance. Furthermore, the region has a large industrial base, which drives the region's demand for valve positioners.

Asia Pacific, on the contrary, is expected to grow the fastest during the forecast period. This is attributable to the improving number of process sectors demanding sophisticated process control and monitoring, as well as an increasing need for energy and fuel. Rapid population expansion and urbanization in rising economies such as China, Japan, and India have resulted in increased demand for energy and power, water and wastewater treatment, chemicals, pharmaceuticals, and oil and gas. As a result, demand for industrial valves and related accessories, such as valve positioners, has skyrocketed.

List of Key Market Players

- GEMU Group

- SMC

- ABB

- Siemens AG

- Schneider Electric

- Azbil Corporation

- Emerson Electric Co.

- Flowserve Corporation

- Dwyer Instruments Ltd.

- Valve Related Controls, Inc.

- Power-Genex Ltd.

- Val Controls

- Bray International

- Nihon KOSO Co., Ltd.

- Spirax-Sarco Limited

- Samson AG

- VRG Controls

- Festo Inc.

- Badger Meter, Inc.

- ControlAir

- Crane Co.

Key Market Developments

- On April 2023, Valworx has introduced a new series of low-emission, firesafe flange valves. Valworx stainless steel flange valves are pipeline approved, with low fugitive emissions and a firesafe design. They are ideal for lowering greenhouse gas emissions in oil and gas applications. Braided graphite stem seals, an investment cast 2-piece full port 316 stainless steel body/ball, and reinforced Teflon (RTFE) ball seats are among the features of the valves.

- On April 2022, The TopWorxTM PD Series Smart Valve Positioner has been released by Emerson. The PD Series adds intelligence, reliability, and versatility to valve control to Emerson's current line of TopWorx sensing and control devices. The PD Series expands TopWorx's current discrete valve controller range by giving 100% control over valve position and combining communication via a 4-20 mA loop signal and HART protocols. The PD Series is appropriate for applications such as oil and gas, chemical, industrial energy, on-site utilities, power generation, pulp and paper, waste and wastewater, and food and beverage.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Valve Positioner Market based on the below-mentioned segments:

Valve Positioner Market, Type Analysis

- Pneumatic

- Electro-Pneumatic

- Digital

Valve Positioner Market, Actuation Analysis

- Single-Acting

- Double-Acting

Valve Positioner Market, Verticals Analysis

- Energy & Power

- Chemical

- Oil & Gas

- Pharmaceutical

- Metal & Mining

- Food & Beverage

- Water & Wastewater Treatment

- Paper & Pulp

- Others

Valve Positioner Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Valve Positioner market?The Global Valve Positioner Market is expected to grow from USD 2.08 billion in 2022 to USD 3.79 billion by 2032, at a CAGR of 6.2% during the forecast period 2022-2032.

-

2. Which are the key companies in the market?GEMU Group, SMC, ABB, Siemens AG, Schneider Electric, Azbil Corporation, Emerson Electric Co., Flowserve Corporation, Dwyer Instruments Ltd., Valve Related Controls, Inc., Power-Genex Ltd., Val Controls, Bray International, Nihon KOSO Co., Ltd., Spirax-Sarco Limited, Samson AG, VRG Controls, Festo Inc., Badger Meter, Inc., ControlAir, Crane Co.

-

3. Which segment dominated the Valve Positioner market share?The oil & gas segment in verticals type dominated the Valve Positioner market in 2022 and accounted for a revenue share of over 34.7%.

-

4. What are the elements driving the growth of the Valve Positioner market?The upsurge in industrial development and population size in urban regions, the raising use of valve positioners for various plant operations, innovations in technology, boosting the adoption of IoT for industrial applications, and automated technology in manufacturing and other associated processes are among the primary trends of the valve positioner market.

-

5. Which region is dominating the Valve Positioner market?North America is dominating the Valve Positioner market with more than 38.7% market share.

-

6. Which segment holds the largest market share of the Valve Positioner market?The digital valve positioner segment based on type holds the maximum market share of the Valve Positioner market.

Need help to buy this report?