Global Vaccine Transport Carrier Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Passive Vaccine Carriers and Active Vaccine Carriers), By Material (Plastic, Metal, and Others), By End-User (Hospitals, Clinics, Research Institutes, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Vaccine Transport Carrier Market Insights Forecasts to 2035

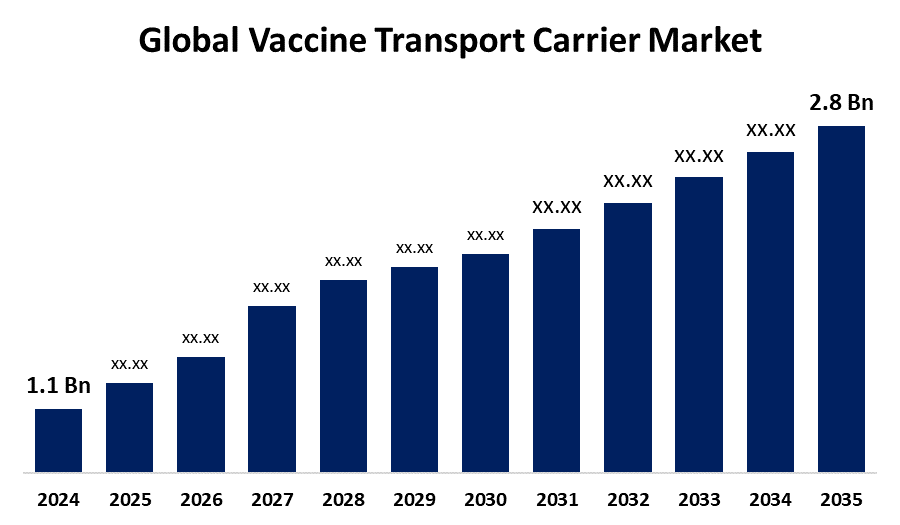

- The Global Vaccine Transport Carrier Market Size Was Estimated at USD 1.1 Billion in 2024

- The Market Size is Expected to Grow at a CAGR od around 8.86% from 2025 to 2035

- The Worldwide Vaccine Transport Carrier Market Size is Expected to Reach USD 2.8 Billion by 2035

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Vaccine Transport Carrier Market Size Was Worth around USD 1.1 Billion in 2024 and is Predicted to Grow to around USD 2.8 Billion by 2035 with a Compound Annual Growth Rate (CAGR) of 8.86% from 2025 and 2035. The market for vaccine transport carrier is expanding due to growing vaccination drives, surging demand for temperature-sensitive biologics, advancements in technology, global healthcare programs, and increased healthcare outreach to developing and remote areas.

Market Overview

The market for vaccine transport carrier refers to the manufacturing and distribution of refrigerated containers used for safely storing and transporting vaccines at regulated temperatures. These carriers are crucial to immunization campaigns, particularly in outlying or underserved areas, for maintaining vaccine viability and adherence to cold chain guidelines. Strong points of portability, ruggedness, and consistent temperature control are dominant. Increasing immunization campaigns, pandemic readiness, and international health programs fuel market demand. Opportunities are presented by innovation in solar-powered or smart carriers with concurrent monitoring.

Government programs such as the WHO Expanded Programme on Immunization (EPI), GAVI support, and health policies at the national level are also driving infrastructure and investment considerably. The Impelling drivers include worldwide health crises, advancements in technology, improved access to healthcare, and global solidarity regarding vaccination in low and middle-income nations.

Report Coverage

This research report categorizes the vaccine transport carrier market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the vaccine transport carrier market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the vaccine transport carrier market.

Global Vaccine Transport Carrier Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.1 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 8.86% |

| 2035 Value Projection: | USD 2.8 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product Type, By Material |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for vaccine transport carriers is driven by rising global immunization programs, growing demand for temperature-sensitive vaccines, and the necessity to preserve cold chain integrity. Rising pandemics and outbreaks have increased the need for effective vaccine logistics. Advances in technology, including GPS tracking and temperature monitoring, also drive adoption. Supportive government policies, international health efforts (e.g., WHO, GAVI), and increasing healthcare infrastructure within developing countries also play a critical role. Also, increased awareness regarding vaccine effectiveness and safety propels the demand for efficient transport solutions to enable effective delivery of vaccines to remote and underserved communities.

Restraining Factors

Expensive prices of advanced carriers, inferior infrastructure in remote communities, no technical skills, and the difficulty in handling the cold chain during long-distance transport hinder the vaccine transport carrier market.

Market Segmentation

The vaccine transport carrier market share is classified into product type, material, and end user.

- The passive vaccine carriers segment accounted for a significant market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the vaccine transport carrier market is divided into passive vaccine carriers and active vaccine carriers. Among these, the passive vaccine carriers segment accounted for a significant market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Passive vaccine carriers, generally dependent on insulation and ice packs to preserve temperatures, are the preferred choice for short-distance transport and are common in areas with poor access to sophisticated infrastructure. They are both efficient and convenient to use, making them a preferred option in rural and underdeveloped regions.

- The plastic segment dominated the market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the material, the vaccine transport carrier market is divided into plastic, metal, and others. Among these, the plastic segment dominated the market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Plastic carriers are used extensively for transporting vaccines due to they are light, robust, and inexpensive. They are simple to manipulate, can be shaped and sized as per requirements, and can have insulation and protective covers added, further increasing their utility in medical environments

- The hospitals segment accounted for a significant market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end-user, the vaccine transport carrier market is divided into hospitals, clinics, research institutes, and others. Among these, the hospitals segment accounted for a significant market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Hospitals are the major end-users of vaccine transport carriers, using different sizes to address routine and urgent requirements. The assurance of vaccine effectiveness and reduction in wastage necessitate demand for efficient, high-technology transport services within hospitals.

Regional Segment Analysis of the Vaccine Transport Carrier Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the vaccine transport carrier market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the vaccine transport carrier market over the predicted timeframe. North America is expected to maintain its leading position in the vaccine transport carrier market, bolstered by a developed healthcare infrastructure, increased healthcare spending, and the wide presence of key market leaders. The regions focus on mass immunization programs and developed logistics and transportation networks fuel demand for effective vaccine transport solutions. In addition, ongoing efforts to boost supply chain resilience and anticipate upcoming pandemics go a long way towards driving market growth to make North America a dominant player in the global vaccine transport carrier market.

Asia Pacific is expected to grow at a rapid CAGR in the vaccine transport carrier market during the forecast period. The increased investments in healthcare, growing immunization awareness, and high populations in need of widespread vaccine coverage are the main drivers of the vaccine transport carriers market in the Asia Pacific. China, India, and Japan are leading the way in improving healthcare infrastructure and increasing immunization programs, fueling demand. The region also has high growth and expansion potential driven by rapid economic growth and improved logistics capabilities.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the vaccine transport carrier market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Thermo Fisher Scientific Inc.

- Sofrigam SA

- Sonoco ThermoSafe

- Cryopak Industries Inc.

- B Medical Syatems

- CSafe Global

- Cold Chain Technologies, Inc.

- Inmark Packaginf

- DGP Intelsius Ltd.

- Qingdao Leff

- Sintex Plastic Technology

- Pelican BioThermal LLC

- Softbox Systems Ltd.

- Cyro Scietific Syates Pvt Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In June 2021, B Medical Systems partnered with Dr. Reddy’s to supply cold chain solutions for the nationwide rollout of Sputnik V in India. Hundreds of vaccine freezers will be installed, ensuring storage at -18 degrees C or below, as required for Sputnik V, the first foreign-made COVID-19 vaccine approved in India.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the vaccine transport carrier market based on the below-mentioned segments:

Global Vaccine Transport Carrier Market, By Product Type

- Passive Vaccine Carriers

- Active Vaccine Carriers

Global Vaccine Transport Carrier Market, By Material

- Plastic

- Metal

- Others

Global Vaccine Transport Carrier Market, By End-User

- Hospitals

- Clinics

- Research Institutes

- Others

Global Vaccine Transport Carrier Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the vaccine transport carrier market over the forecast period?The global vaccine transport carrier market is projected to expand at a CAGR of 8.86% during the forecast period.

-

2. What is the market size of the vaccine transport carrier market?The global vaccine transport carrier market size is expected to grow from USD 1.1 Billion in 2024 to USD 2.8 Billion by 2035, at a CAGR of 8.86% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the vaccine transport carrier market?North America is anticipated to hold the largest share of the vaccine transport carrier market over the predicted timeframe.

Need help to buy this report?