Global Usage-based Insurance Market Size, Share, and COVID-19 Impact Analysis, By Package (PAYD, PHYD, MHYD), By Technology (OBD-II, Black Box, Smartphone, Embedded), by Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

Industry: Banking & FinancialGlobal Usage-based Insurance Market Size Insights Forecasts to 2032

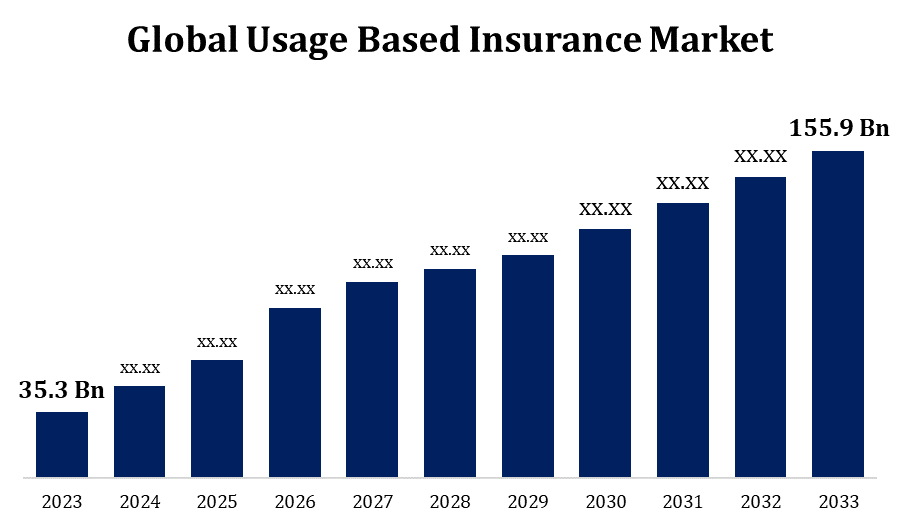

- The Global Usage-based Insurance Market Size was valued at USD 20.1 Billion in 2022.

- The Market Size is Growing at a CAGR of 29.2% from 2022 to 2032.

- The Worldwide Usage-based Insurance Market Size is expected to reach USD 67.8 Billion by 2032.

- Asia Pacific is expected To Grow the fastest during the forecast period

Get more details on this report -

The Global Usage-based Insurance Market Size is expected to reach USD 67.8 Billion by 2032, at a CAGR of 29.2% during the forecast period 2022 to 2032.

Unlike traditional auto insurance, usage-based insurance bases the calculation of your insurance price on the quantity of driving you do. Your driving habits and distance driven both play a significant role in determining your vehicle insurance cost. The insurer determines your insurance price using information like your driving speed, acceleration rate, braking pattern, and if you use a phone while driving. Such insurance encourages safe driving and enables you to lower your premiums if you don't use your car frequently. The insurer determines insurance prices based on information including driving speed, acceleration rate, if a person uses a phone while driving, and other factors. Usage-based insurance encourages safe driving and lowers costs for drivers who don't use their cars frequently. A telematics device is used by usage-based insurance to monitor how the car is driven. Under usage-based insurance programmes, "telematics" data about vehicles is gathered through cellular, GPS, or other technologies.

Impact of COVID 19 On Global Usage-based Insurance Market

The market for usage-based insurance has grown significantly over the past few years, but it is expected to somewhat decline in 2020 as a result of the COVID-19 pandemic. This is linked to the majority of governments putting their citizens on lockdown and stopping all international travel to stop the spread of the virus. Thus, despite the global health crisis, insurers have implemented new developments in current policies like pay-as-you-drive, usage-based insurance, as well as telematics insurance and adopted technologies for improving the claim processes and provide a better user experience.

Global Usage-based Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 20.1 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 29.2% |

| 2032 Value Projection: | USD 67.8 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Package, By Technology, by Region |

| Companies covered:: | Mechatronic Systems Inc., TrueMotion, Cambridge Mobile Telematics, Insure The Box Limited, Progressive Casualty Insurance Company, Modus Group, LLC, Inseego Corp, Metromile Inc., The Floow Limited, Vodafone, Allstate Insurance Company, Octo Group, TomTom International, Allianz, AXA Equitable Life Insurance Company, Liberty Mutual Insurance, Verizon, Sierra Wireless, Mapfre, Movitrack Viasat, Inc., ASSICURAZIONI GENERALI S.P.A., UNIPOLSAI ASSICURAZIONI S.P.A |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Key Market Drivers

The increasing adoption of usage based insurance owing the rise in the demand for remote diagnostics in order to monitor consumer driving behaviour represents one of the primary factors which are supporting the market growth. Apart from this, the increasing demand for usage based insurance because insurers can improve customer relationship management with regular reports and tailored monthly bills is providing a positive image to the market. In addition, the increasing demand to reduce road accident and promote driver safety among the people across the world. The rise in the demand for usage based insurance owing to the decrease in the insurance premiums and risk based costs are boosting the growth of the market. Moreover, the increase in the need for usage based insurance because it offer accurate and timely date collection methods and flexible insurance premiums is providing lucrative growth opportunities to the industry investors. The rising adoption of advanced technologies like hybrid based insurance and smartphone based usage based insurance is propelling the market in a positive way. Furthermore, different benefits provided by usage based insurance like reverse gear indication, usage based insurance, harsh braking, seat belt use, acceleration control are strengthening the growth of the market.

Key Market Challenges

The demand for telematics devices is likely to rise as the market for passenger vehicles, the most common form of electric mobility, expands. A considerable change in the sale and manufacture of passenger vehicles will be what will fuel the demand for UBI solutions in passenger vehicles. However, high telematics installation costs and other data security concerns are anticipated to impede the growth of the market.

Market Segmentation

Technology Insights

Black Box segment holds the largest market share over the forecast period

On the basis of technology, the global usage based insurance market is segmented into OBD-II, black box, smartphone, embedded. Among these, black box segment holds the largest market share over the forecast period. Telematics insurance, commonly referred to as black box usage based insurance, is a kind of auto insurance that employs technology to monitor and record a policyholder's driving behaviour. The idea is to determine a driver's insurance costs based on how frequently they drive and how hazardous (or safe) they are behind the wheel. The increasing use of telematics insurance in usage based insurance for heavy duty vehicles will boost the demand for black box. Presently, the penetration is extremely highest in European region specifically in Italy. Not only this but also the UBI market is witnessing a shift from black box to an embedded system.

Package Insights

MHYD dominates the market with the largest market share over the forecast period

Based on the package, the global usage based insurance market is segmented into PAYD, PHYD, and MHYD. Among these, MHYD is dominating the market with the largest market share over the forecast period. It is an extended version of PHYD which gives feedback to the drivers on the improvement areas. The MHYD systems works like PHYD by collecting different driving behaviour information like sharp cornering, harsh braking, and overspeeding in order to rate the driver. It also suggests improvement in certain areas like speed and braking. On the other hand, the increasing adoption rate of this model of usage based insurance is anticipated to be less in developing nations, it is ideal for mature markets. Apart from this, the evolution of data analytics is anticipated to gain the momentum of MHYD over the forecast period.

Regional Insights

North America is dominating the market with the largest market share over the forecast period

Get more details on this report -

North America is dominating the global Usage-based Insurance market over the forecast period. The market in North America is anticipated to rise as a result of the rising acceptance of Mobility as a Service and more partnerships between telematics and insurance firms. To lower the frequency of accidents, government officials are encouraging the adoption of telematics-enabled auto insurance. As a result, there is a fierce competition between IT companies and automakers to enhance technology.

Due to growing consumer awareness, the expansion of the auto industry, a shift in emphasis towards remote diagnostic technologies, and an increase in the number of connected automobiles, Asia-Pacific currently is witnessing the fastest market growth in the usage-based insurance market.

Recent Market Developments

- In February 2021, the Progressive Corporation and Protective Insurance Corporation has made an announcement that they have entered into a definitive agreement under which progressive has agreed to acquire all the Class A and Class B common shares of protective insurance corporation.

List of Key Companies

- Mechatronic Systems Inc.

- TrueMotion

- Cambridge Mobile Telematics

- Insure The Box Limited

- Progressive Casualty Insurance Company

- Modus Group, LLC

- Inseego Corp

- Metromile Inc.

- The Floow Limited

- Vodafone

- Allstate Insurance Company

- Octo Group

- TomTom International

- Allianz

- AXA Equitable Life Insurance Company

- Liberty Mutual Insurance

- Verizon

- Sierra Wireless

- Mapfre

- Movitrack Viasat, Inc.

- ASSICURAZIONI GENERALI S.P.A.

- UNIPOLSAI ASSICURAZIONI S.P.A

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global Usage-based Insurance Market based on the below-mentioned segments:

Usage-based Insurance Market, Packge Analysis

- PAYD

- PHYD

- MHYD

Usage-based Insurance Market, Technology Analysis

- OBD-II

- Black Box

- Smartphone

- Embedded

Usage-based Insurance Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of Usage-based Insurance Market?The Global Usage-based Insurance Market Size is expected To Grow from USD 20.1 Billion in 2022 to USD 67.8 Billion by 2032, at a CAGR of 29.2% during the forecast period 2022-2032.

-

2. Who are the key Market players of Usage-based Insurance Market?Some of the key Market players of Mechatronic Systems Inc., TrueMotion, Cambridge Mobile Telematics, Insure The Box Limited, Progressive Casualty Insurance Company, Modus Group, LLC, Inseego Corp, Metromile Inc., The Floow Limited, Vodafone, Allstate Insurance Company, Octo Group, , TomTom International, Allianz, AXA Equitable Life Insurance Company, , Liberty Mutual Insurance, Verizon, Sierra Wireless, , Mapfre, Movitrack Viasat, Inc., ASSICURAZIONI GENERALI S.P.A., and UNIPOLSAI ASSICURAZIONI S.P.A

-

3. Which segment hold the largest Market share?Black box segment hold the largest Market share is going to continue its dominance.

-

4. Which region is dominating the Usage-based Insurance Market?Asia Pacific is dominating the Usage-based Insurance Market with the highest market share.

Need help to buy this report?