Global Urea Ammonium Nitrate (UAN) Market Size, Share, and COVID-19 Impact Analysis, By Type (UAN 28, UAN 30, and UAN 32), By Application (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Urea Ammonium Nitrate (UAN) Market Size Insights Forecasts to 2035

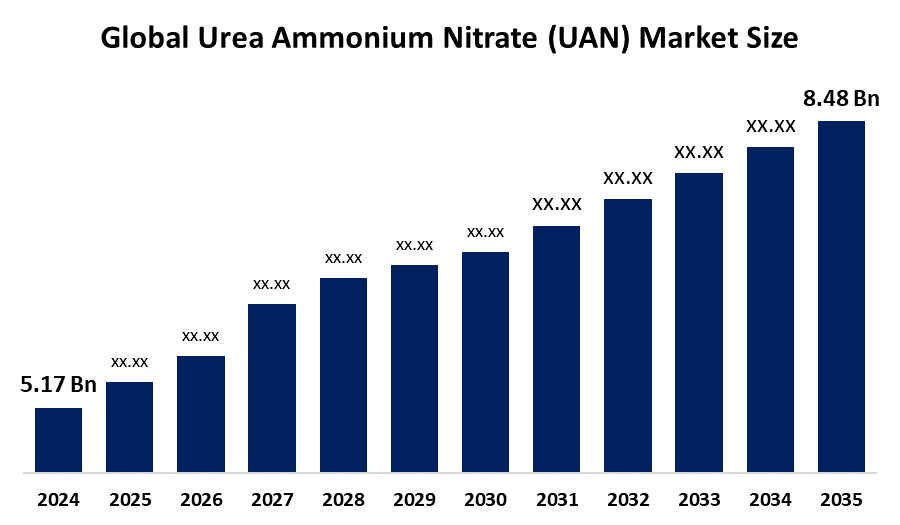

- The Global Urea Ammonium Nitrate (UAN) Market Size Was Estimated at USD 5.17 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.6% from 2025 to 2035

- The Worldwide Urea Ammonium Nitrate (UAN) Market Size is Expected to Reach USD 8.48 Billion by 2035

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Urea Ammonium Nitrate (UAN) Market Size was worth around USD 5.17 Billion in 2024 and is predicted to Grow to around USD 8.48 Billion by 2035 with a compound annual growth rate (CAGR) of 4.6% from 2025 to 2035. The global UAN market is growing due to rising food demand from an increasing population, high-efficiency fertilisers that increase crop yields, and the widespread use of precision agriculture technology. The two main reasons for this development are the ability to use the product in various applications and its enhanced environmental performance.

Market Overview

Urea ammonium nitrate (UAN) is a high-efficiency liquid fertiliser solution that contains a combination of urea, ammonium nitrate, and water and delivers nitrogen at 28%-32%. UAN provides agricultural professionals with multiple advantages because it enables them to distribute fertiliser seamlessly throughout their fields while also blending materials with pesticides and delivering fast plant nutrients, which benefit cereals, oilseeds and vegetables. The global market is driven by rising food demand from a growing population, the need for enhanced agricultural productivity, and the adoption of precision farming, with 2024 consumption exceeding 25 million metric tons.

In February 2026, India dedicated Rs.1.71 lakh crore to fertiliser subsidies in the 2026-27 budget, which the country will use to provide affordable urea and nitrogen fertilizers. The program uses the NBS scheme and the Direct Benefit Transfer system for nutrient distribution, which maintains UAN demand at stable levels while improving soil health and supporting farmers' needs for crop planning. Major growth opportunities require companies to develop sustainable products that release nutrients slowly and expand their presence in emerging markets, and use digital solutions for better product delivery. Major market players, including CF Industries, Nutrien, EuroChem, Yara International and OCI, are boosting their production capacities while they spend money on environmentally friendly manufacturing methods to maintain their market position.

Report Coverage

This research report categorizes the urea ammonium nitrate (UAN) market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the urea ammonium nitrate (UAN) market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the urea ammonium nitrate (UAN) market.

Global Urea Ammonium Nitrate (UAN) Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 5.17 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.6% |

| 2035 Value Projection: | USD 8.48 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 164 |

| Tables, Charts & Figures: | 91 |

| Segments covered: | By Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | CF Industries Holdings, Inc., EuroChem Group AG, Nutrien Ltd., Koch Fertilizer, LLC, Acron Group, Yara International ASA, SABIC, OCI N.V., Uralchem JSC, LSB Industries, Qatar Fertiliser Company, Indian Farmers Fertiliser Cooperative Limited, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The worldwide market for urea ammonium nitrate (UAN) fertilizer experiences primary market expansion because agricultural productivity requires efficient fertilisers to meet rising food production needs, which result from global population growth. The agricultural sector experiences growth because farmers widely implement precision agriculture technologies that use UAN as their preferred fertilizer because it provides multiple application methods and delivers accurate results, which enhance nutrient absorption while diminishing operational losses. The demand for UAN fertiliser is increasing because people understand environmental sustainability better, and UAN provides less nitrogen volatility, together with reduced nitrogen leaching, compared to standard urea. The market experiences substantial growth because emerging economies expand their agricultural land area while they invest in modern fertilizer manufacturing technologies.

In April 2024, Chemicals and Fertilisers Minister Mansukh Mandaviya announced India aims to end urea imports by 2025, boosting domestic production from 225 to over 310 lakh tonnes. The government revived four closed urea plants, promotes alternative fertilizers like nano urea and DAP, enhancing soil health and crop yields.

Restraining Factors

The urea ammonium nitrate (UAN) market faces multiple restrictions, which arise from environmental rules that limit nitrogen runoff, together with natural gas price variations, which increase production expenses and the rising need for safety standards that govern transportation and storage operations. The market experiences growth restrictions because farmers prefer speciality fertilisers, inventory levels remain high, and anti-dumping duties particularly affect European Union countries.

Market Segmentation

The urea ammonium nitrate (UAN) market share is classified into type and application.

- The UAN 32 segment dominated the market in 2024, approximately 55% and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the urea ammonium nitrate (UAN) market is divided into UAN 28, UAN 30, and UAN 32. Among these, the UAN 32 segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The UAN 32 segment led market expansion because its 32% nitrogen content provided better efficiency for increasing corn and wheat crop yields. The product achieved market leadership because it allowed farmers to apply it easily while maintaining cost savings and effective weed control through its one-pass operation, which reduced nitrogen loss during large-scale agricultural use.

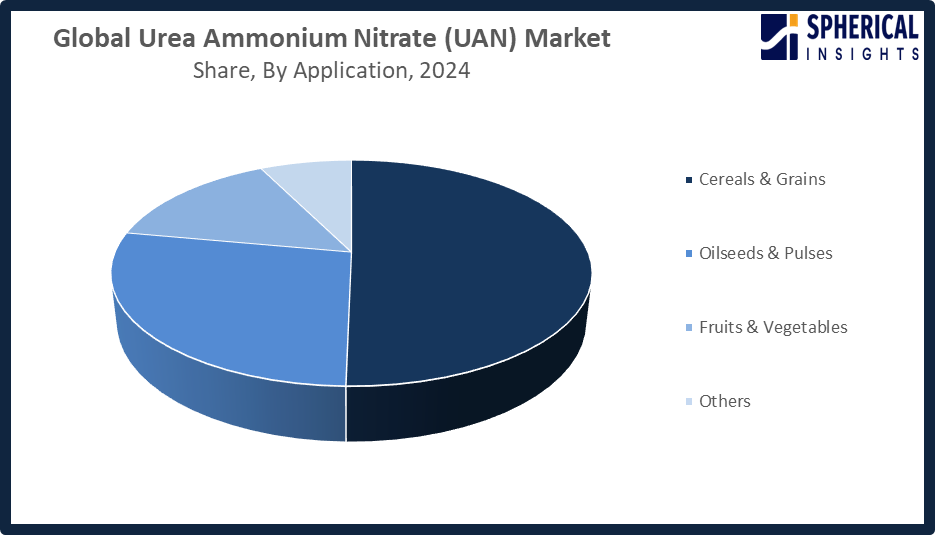

- The cereals & grains segment accounted for the highest market revenue in 2024, approximately 50% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the urea ammonium nitrate (UAN) market is divided into cereals & grains, oilseeds & pulses, fruits & vegetables, and others. Among these, the cereals & grains segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The cereals & grains segment led UAN market growth because staple crops such as maize, wheat, and rice require high nitrogen levels to grow. The agricultural industry used UAN extensively because farmers needed to produce more food to meet growing demand while trying to achieve maximum crop production. The product became a market leader because it enabled efficient nutrient absorption while matching current agricultural methods.

Get more details on this report -

Regional Segment Analysis of the Urea Ammonium Nitrate (UAN) Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the urea ammonium nitrate (UAN) market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the urea ammonium nitrate (UAN) market over the predicted timeframe. North America will secure a 35% portion of the urea ammonium nitrate (UAN) market because its agricultural practices use advanced machinery and its farmers use modern agricultural methods to grow corn, wheat and soybean crops, which need effective nitrogen fertiliser application. The United States leads market expansion because of its vast cereal output and precision farming practices, and extensive use of UAN liquid fertilisers for nutrient management control proceed to match market needs. The Canadian market drives growth because demand for oilseeds and pulse crops continues to increase. The US government abolished import tariffs on essential fertilizers which included UAN and urea, and ammonium nitrate, in November 2025, thus reducing input expenses for farmers before the 2026 season while undoing price hikes that occurred because of the previous tariffs.

Asia Pacific is expected to grow at a rapid CAGR in the urea ammonium nitrate (UAN) market during the forecast period. The UAN market in the Asia Pacific will experience a 20% share of rapid expansion through increasing food requirements and population growth, and the development of large-scale cereal and grain farming operations. The Indian and Chinese markets drive growth because their governments support balanced fertiliser application, modern farming methods and yield improvement initiatives. India’s Nutrient-Based Subsidy (NBS) Scheme in January 2026 supported balanced nutrient use of nitrogen, phosphorus, potassium, and sulphur, which provided farmers with accessible and timely fertilizers while enhancing soil health and productivity and market competition and innovation through subsidy alignment with international price variations for farmer and fiscal support.

The UAN market in Europe grows due to strict environmental regulations, sustainable farming practices and the need to increase nitrogen use efficiency. The three countries of Germany, France and the UK lead with their precision agriculture techniques and their advanced liquid fertiliser technologies, which produce higher crop yields while decreasing environmental runoff. The EU established anti-dumping duties in October 2019 against UAN products from Russia, Trinidad and Tobago, and the US, which resulted in decreased Russian and American imports while Trinidad and Tobago increased its exports, showing changes in trade patterns and possible domestic production adjustments.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the urea ammonium nitrate (UAN) market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- CF Industries Holdings, Inc.

- EuroChem Group AG

- Nutrien Ltd.

- Koch Fertilizer, LLC

- Acron Group

- Yara International ASA

- SABIC

- OCI N.V.

- Uralchem JSC

- LSB Industries

- Qatar Fertiliser Company

- Indian Farmers Fertiliser Cooperative Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In December 2025, the Indian government reinforced the PM-PRANAM scheme, encouraging states and Union Territories to reduce chemical fertilizer use, including urea and UAN. Under the initiative, around 50% of subsidy savings are returned to states, promoting sustainable, balanced fertilization and stronger environmental stewardship.

- In September 2025, Canadian fertilizer producer Nutrien agreed to sell its 50% stake in Profertil, Argentina's largest urea producer, to Adecoagro and Asociacion de Cooperativas Argentinas for $600 million. The transaction, subject to customary conditions, is expected to close by year-end, with YPF holding a right of first refusal.

- In July 2025, Acron Group reported a 12% rise in goods production to 4.6 million tonnes in H1 2025. Mineral fertilizer output increased 9% to 3.7 million tonnes, while industrial production, driven by higher ammonium nitrate output, surged 24% to 743,000 tonnes, the company stated.

- In April 2025, QatarEnergy announced plans to expand low-carbon ammonia and urea production with a new Mesaieed Industrial City Facility. The two-phase project will have a total capacity of 6.4 million tonnes per year. Contractors met in March to discuss development plans for the upcoming QatarEnergy production complex.

- In October 2024, Yara International inaugurated its ammonia import terminal in Brunsbuttel Germany, strategically located on the North Sea and Kiel Canal. The facility can import up to three million tonnes of low-emission ammonia annually, supporting Germany's hydrogen economy and strengthening Europe's sustainable fertilizer and energy supply.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the urea ammonium nitrate (UAN) market based on the below-mentioned segments:

Global Urea Ammonium Nitrate (UAN) Market, By Type

- UAN 28

- UAN 30

- UAN 32

Global Urea Ammonium Nitrate (UAN) Market, By Application

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Others

Global Urea Ammonium Nitrate (UAN) Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the urea ammonium nitrate (UAN) market over the forecast period?The global urea ammonium nitrate (UAN) market is projected to expand at a CAGR of 4.6% during the forecast period.

-

2. What is the global urea ammonium nitrate (UAN) market?The global UAN market involves production, trade, and use of urea ammonium nitrate, a liquid nitrogen fertilizer for crops worldwide.

-

3. What is the market size of the urea ammonium nitrate (UAN) market?The global urea ammonium nitrate (UAN) market size is expected to grow from USD 5.17 billion in 2024 to USD 8.48 billion by 2035, at a CAGR of 4.6% during the forecast period 2025-2035.

-

4. Which region holds the largest share of the urea ammonium nitrate (UAN) market?North America is anticipated to hold the largest share of the urea ammonium nitrate (UAN) market over the predicted timeframe.

-

5. Who are the top 10 companies operating in the global urea ammonium nitrate (UAN) market?CF Industries Holdings, Inc., EuroChem Group AG, Nutrien Ltd., Koch Fertilizer, LLC, Acron Group, Yara International ASA, SABIC, OCI N.V., Uralchem JSC, LSB Industries, and Others.

-

6. What factors are driving the growth of the urea ammonium nitrate (UAN) market?UAN market growth is driven by rising demand for high-efficiency fertilizers to boost crop yields, increasing global food needs, shifting towards precision farming, and its versatility as a liquid nutrient source.

-

7. What are the market trends in the urea ammonium nitrate (UAN) market?UAN market trends include increasing adoption of precision agriculture, rising demand in developing nations, focus on sustainability, and integration of digital tools.

-

8. What are the main challenges restricting wider adoption of the urea ammonium nitrate (UAN) market?The wider adoption of the Urea Ammonium Nitrate (UAN) market is primarily restricted by significant logistical requirements, raw material price volatility, and environmental concerns regarding nitrogen runoff.

Need help to buy this report?