United States Women’s Grooming Market Size, Share, and COVID-19 Impact Analysis, By Product (Skin Care, Hair Care, Oral Care, Color Cosmetics, Shower & Bath, Perfume/Fragrances), By Distribution Channel (Hypermarkets & Supermarkets, Specialty Beauty Stores, Pharmacies & Drugstores, Online/E-Commerce, and Others), and United States Women’s Grooming Market Insights, Industry Trend, Forecasts To 2035

Industry: Consumer GoodsUnited States Women’s Grooming Market Insights Forecasts to 2035

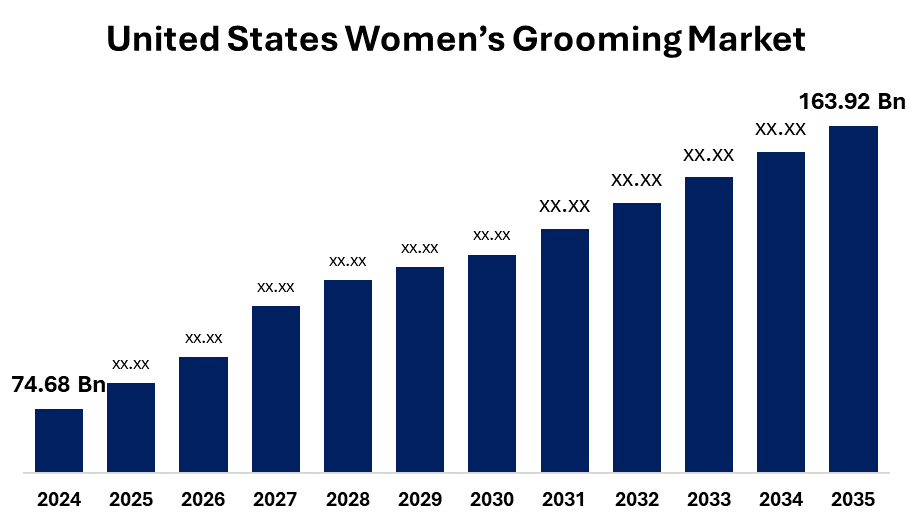

- The United States Women’s Grooming Market Size Was Estimated at USD 74.68 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.41% from 2025 to 2035

- The United States Women’s Grooming Market Size is Expected to Reach USD 163.92 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United States Women Grooming Market Size is anticipated to reach USD 163.92 Billion by 2035, Growing at a CAGR of 7.41% from 2025 to 2035.

Market Overview

The women's grooming means to maintain personal hygiene, presence, and overall aesthetics through various types of products and services. This includes skincare, haircare, body care, makeup, nail care, fryer, and wellness solutions that enhance beauty, confidence, and self-interviews. Women’s grooming market has developed with a basic hygiene requirement for the fashion, welfare, and self-impressed industries affected by the trends of self-care. Traditionally limited to skincare and haircare, this section now includes a wide spectrum, including cosmetics, personal hygiene products, salon services, and premium beauty equipment. Increasing awareness about personal presence, an increase in disposable income, and the increasing influence of social media and celebrity culture have increased market growth. Modern women are more conscious of using products that align with their values, leading to high demand for organic, natural, cruelty-free, and durable-dominated solutions. The emergence of digital platforms and e-commerce has expanded further access, allowing women to detect and purchase various types of grooming products.

Report Coverage:

This research report categorizes the United States women’s grooming market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States women’s grooming market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States women’s grooming market.

Driving Factor

The women's grooming products market is driven by changing beauty standards and increasing awareness about personal care in women. The region includes a wide range of products associated with skincare, haircare, cosmetics, and individual hygiene items, especially for women. In addition, the growing trend of self-care has changed the beauty and welfare industry, rapidly looking for products that align with their values and overall welfare.

Restraining Factor

The U.S. women’s grooming market faces restraints such as high product costs, intense competition, and availability of counterfeit products, along with challenges in supply chain management and shifting consumer preferences, which may slow down consistent growth across certain segments.

Market Segmentation

The United States women’s grooming market share is classified into product and distribution channel.

- The skincare products held the largest market share in 2024 and are anticipated to grow substantial CAGR during the forecast period

The United States women’s grooming market is segmented by product into skin care, hair care, oral care, color cosmetics, shower & bath, perfume/fragrances. Among these, the skincare products held the largest market share in 2024 and are anticipated to grow substantial CAGR during the forecast period. The growing importance of skincare has clearly changed the consumer approach, which demands to raise awareness about widespread skincare regimen. As consumers prioritize effective skincare solutions, manufacturers are responding by developing a diverse array of innovative products to suit current trends.

- Supermarkets/hypermarkets accounted for a significant share in 2024 and are anticipated to grow at a substantial CAGR during the forecast period.

The United States women’s grooming market is segmented by distribution channel into hypermarkets & supermarkets, specialty beauty stores, pharmacies & drugstores, online/e-commerce, and others. Among these, Supermarkets/hypermarkets accounted for a significant share in 2024 and are anticipated to grow at a substantial CAGR during the forecast period. Retail giants have successfully established a comprehensive shopping environment that enables consumers to conveniently access a diverse array of grooming products under one roof. This convenience is a key driver of consumer behavior, as shoppers value the ability to effortlessly locate their preferred brands and discover new offerings without the necessity of visiting multiple retail locations.

List of Key Companies

- Procter & Gamble Co.

- Unilever PLC

- Estée Lauder Companies Inc.

- L'Oréal S.A.

- Revlon Inc.

- Coty Inc.

- Johnson & Johnson

- Colgate-Palmolive Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States women’s grooming market based on the below-mentioned segments:

United States Women’s Grooming Market, By Product

- Skin Care

- Hair Care

- Oral Care

- Color Cosmetics

- Shower & Bath

- Perfume/Fragrances

United States Women’s Grooming Market, By Distribution Channel

- Hypermarkets & Supermarkets

- Specialty Beauty Stores

- Pharmacies & Drugstores

- Online E-commerce

- Others

Frequently Asked Questions (FAQ)

-

1. What was the market size of the U.S. women’s grooming market in 2024?The market size was valued at USD 74.68 billion in 2024.

-

2. What is the expected CAGR of the U.S. women’s grooming market from 2025 to 2035?The market is projected to grow at a CAGR of 7.41% during the forecast period.

-

3. What will be the market size of the U.S. women’s grooming market by 2035?The market is expected to reach USD 163.92 billion by 2035.

-

4. Which product segment held the largest share in 2024?Skincare products held the largest market share in 2024.

-

5. Which distribution channel dominated the market in 2024?Supermarkets/Hypermarkets accounted for a significant market share in 2024.

-

6. What are the key driving factors of the U.S. women’s grooming market?Key drivers include changing beauty standards, rising self-care trends, increased disposable income, social media influence, and demand for natural and cruelty-free products.

-

7. Who are the major players in the U.S. women’s grooming market?Key players include Procter & Gamble, Unilever, Estée Lauder, L'Oréal, Revlon, Coty, Johnson & Johnson, and Colgate-Palmolive.

-

8. What recent developments have impacted the United States women’s grooming?In August 2024, Johnson & Johnson launched the Collagen Bank line with patented micro-peptide technology, targeting Gen Z consumers concerned with early aging.

-

9. Which consumer trends are shaping the future of the women’s grooming market?Trends include a shift toward organic and sustainable products, digital/e-commerce adoption, premium skincare, wellness-oriented grooming, and personalized beauty solutions.

Need help to buy this report?