United States Ultra-Thin Solar Cells Market Size, Share, and COVID-19 Impact Analysis, By Material (Cadmium Telluride, Copper Indium Gallium Selenide, Perovskite Solar Cell, Organic Photovoltaic, and Others), By End-Use (Residential and Commercial), And United States Ultra-Thin Solar Cells Market Insights, Industry Trend, Forecasts To 2035

Industry: Energy & PowerUnited States Ultra-Thin Solar Cells Market Insights Forecasts to 2035

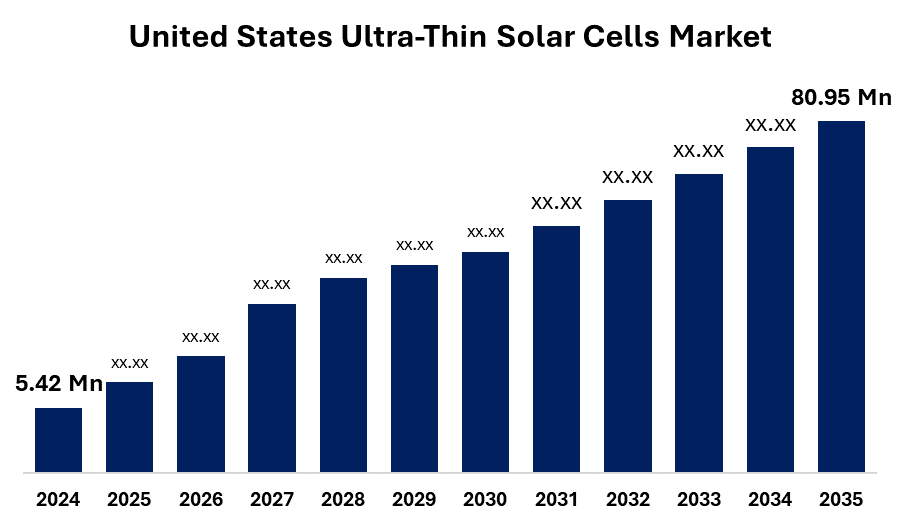

- The United States Ultra-Thin Solar Cells Market Size Was Estimated at USD 5.42 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 27.86% from 2025 to 2035

- The United States Ultra-Thin Solar Cells Market Size is Expected to Reach USD 80.95 Million by 2035

Get more details on this report -

The United States Ultra-thin Solar Cells Market Size is anticipated to reach USD 80.95 Million by 2035, Growing at a CAGR of 27.86% from 2025 to 2035

Market Overview

Ultra-thin solar cells are photovoltaic devices designed with a thickness of an important semiconductor layer compared to traditional solar panels, usually ranging from a few micrometers to nanometers. These cells maintain high energy conversion efficiency using fewer materials, making them mild, flexible, and suitable for a wide range of applications. Unlike traditional silicone-based solar modules, ultra-skinned solar cells can be manufactured using advanced technologies such as thin-film statements, organic photovoltaic, or perovskite-based materials, which enable the use of portable devices, construction materials, and other incompatible surfaces. The market of ultra-split solar cells is receiving traction due to increasing demand for renewable energy, government encouragement to adopt clean energy, and technological progress in energy-skilled materials. These cells provide benefits such as low production costs, flexibility for integration in curved or light surfaces, and low carbon footprints during manufacturing. They are rapidly deployed in residential, commercial, and industrial applications, including roofs, aspects, and wearable electronics. The market of ultra-split solar cells is increasing due to increased interest in renewable energy, government incentives to adopt solar, and technological innovations that improve efficiency and are expanding due to reducing material costs.

Report Coverage

This research report categorizes the United States ultra-thin solar cells market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States ultra-thin solar cells market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States ultra-thin solar cells market.

United States Ultra-Thin Solar Cells Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 5.42 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 27.86% |

| 2035 Value Projection: | USD 80.95 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 111 |

| Segments covered: | By Material, By End-Use |

| Companies covered:: | First Solar, Inc., Ascent Solar Technologies, Inc., PowerFilm, Inc., Solar Frontier K.K., Kaneka Corporation, Canadian Solar Inc., Mitsubishi Electric Corporation, Hanwha Qcells. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factor

The United States ultra-thin solar cells market is driven by increasing demand for encouragement to adopt mild, flexible, and energy-efficient renewable solutions, assisted by government policies and clean energy. Energy freedom and carbon decrease targets also encourage innovation in urban infrastructure and thin-film and ultra-thin PV applications for smart mobility solutions.

Restraining Factor

The United States ultra-thin solar cells market faces restraints due to high manufacturing costs, lower durability than traditional silicone panels, limited mass production infrastructure, and technical challenges in efficiency and stability, which obstruct widespread adoption in residential and industrial applications.

The United States ultra-thin solar cells market share is classified into material and end-use.

- The perovskite segment accounted for the largest market share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The United States ultra-thin solar cells market is segmented by material into cadmium telluride, copper indium gallium selenide, perovskite solar cell, organic photovoltaic, and others. Among these, the perovskite segment accounted for the largest market share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. This is due to rapid growth in efficiency and cost competition compared to traditional materials. This section has attracted attention to its light properties and ease of production, which allows integration into flexible surfaces and portable power systems

- The commercial segment accounted for the largest revenue share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The United States ultra-thin solar cells market is segmented by end-use into residential and commercial. Among these, the commercial segment accounted for the largest revenue share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. This is due to light, space-skilled solar solutions for retrofitting and new construction projects. Ultra-split solar cells are rapidly integrated into the construction of roofs of commercial installations such as office complexes, retail centers, educational complexes, and hospitality locations through the building-integrated photovoltaic (BIPV).

Competitive Analysis

The report offers the appropriate analysis of the key organizations companies involved within the United States ultra-thin solar cells market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- First Solar, Inc.

- Ascent Solar Technologies, Inc.

- PowerFilm, Inc.

- Solar Frontier K.K.

- Kaneka Corporation

- Canadian Solar Inc.

- Mitsubishi Electric Corporation

- Hanwha Qcells

- Others

Recent Development

- In March 2025, Ascent Solar Technologies, Inc. announced the expansion of its Thornton, Colorado, facility to increase manufacturing of flexible CIGS-based ultra-thin solar modules. The improvement aims to fulfill the growing demand for lightweight, high-performance solar solutions in aerospace, defense, and off-grid residential applications. This initiative is consistent with the United States' expanding transition toward advanced solar technologies that enable portable power, building integration, and energy resilience in remote and mobile areas.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States ultra-thin solar cells market based on the following segments:

United States Ultra-Thin Solar Cells Market, By Material

- Cadmium

- Telluride

- Copper Indium Gallium Selenide

- Perovskite Solar Cell

- Organic Photovoltaic

- Others

United States Ultra-Thin Solar Cells Market, By End-Use

- Residential

- Commercial

Frequently Asked Questions (FAQ)

-

1. What is the base year considered for the United States Ultra-Thin Solar Cells Market report?The base year considered for this report is 2024.

-

2. What is the historical period covered in this U.S. ultra-thin solar market analysis?The historical data spans from 2020 to 2023.

-

3. What is the forecast period for the United States Ultra-Thin Solar Cells Market?The market is forecasted from 2025 to 2035.

-

4. What was the estimated U.S. ultra-thin solar market size in 2024?The United States Ultra-Thin Solar Cells Market was estimated at USD 5.42 million in 2024.

-

5. What is the projected U.S. ultra-thin solar market size by 2035?The market is expected to reach USD 80.95 million by 2035.

-

6. What is the expected CAGR during the forecast period?The market is projected to grow at a CAGR of 27.86% from 2025 to 2035.

-

7. What are the key drivers of the U.S. ultra-thin solar market growth?The market is driven by increasing demand for lightweight, flexible, and energy-efficient renewable solutions, supportive government policies, and growing adoption of advanced solar technologies in commercial and residential sectors.

-

8. What factors are restraining U.S. ultra-thin solar market growth?High manufacturing costs, lower durability compared to conventional silicon panels, limited large-scale production infrastructure, and technical challenges in efficiency and stability hinder widespread adoption.

-

9. Who are the key companies in the United States Ultra-Thin Solar Cells Market?Major players include First Solar, Inc., Ascent Solar Technologies, PowerFilm, Inc., Solar Frontier K.K., Kaneka Corporation, Canadian Solar Inc., Mitsubishi Electric Corporation, and Hanwha Qcells.

-

10. Who are the target audiences for this report?Target audiences include market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?