United States Telehealth Services Market Size, Share, and COVID-19 Impact Analysis, By Type (Products and Services), By Application (Telemedicine, Patient Monitoring, Continuous Medical Education, and Others), and United States Telehealth Services Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited States Telehealth Services Market Insights Forecasts to 2035

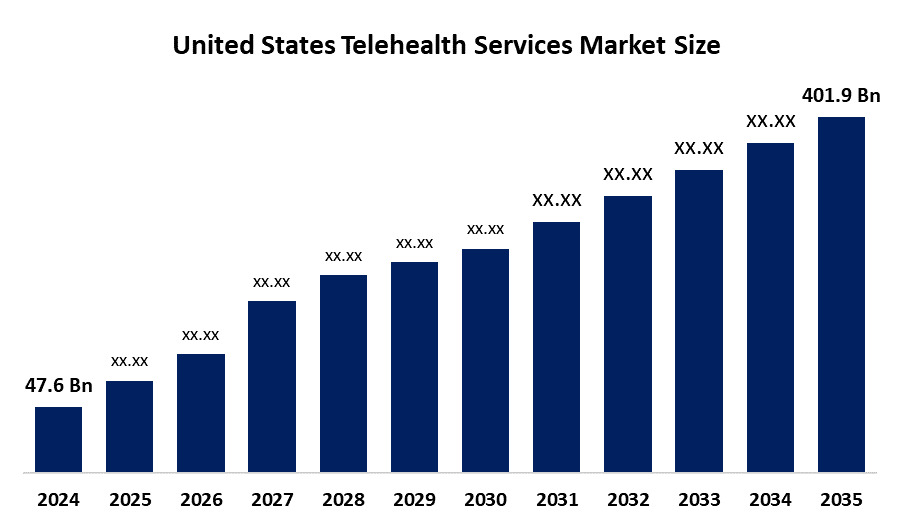

- The United States Telehealth Services Market Size Was Estimated at USD 47.6 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 21.4% from 2025 to 2035

- The United States Telehealth Services Market Size is Expected to Reach USD 401.9 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United States Telehealth Services Market Size is Anticipated to reach USD 401.9 Billion by 2035, Growing at a CAGR of 21.4% from 2025 to 2035. The United States Telehealth Services Market is driven by rising demand for convenient healthcare access, increasing chronic disease prevalence, growing geriatric population, and expanding insurance reimbursement coverage for virtual care. The rapid digitalization of healthcare infrastructure and patient acceptance of online consultations following the COVID-19 pandemic have significantly accelerated market expansion.

Market Overview

The United States telehealth services market refers to healthcare services offered via digital communication technology like video consultation services, mobile health applications, remote health monitoring devices, and cloud-based medical platforms. Telehealth services enable patients to remotely consult doctors, monitor their health conditions from home, access mental health counselling, and receive prescriptions without having to visit hospitals. The telehealth market has witnessed immense adoption after the COVID-19 pandemic due to government relaxation, support for reimbursement, and increasing awareness about telehealth solutions. Advances in digital connectivity and medical software integration are also aiding the adoption of telehealth solutions.

The United States telehealth services market is witnessing key trends shaping its future. The use of remote patient monitoring is growing at a rapid pace as healthcare providers are monitoring chronic conditions like diabetes and cardiovascular diseases using connected wearable devices. Tele-mental health solutions are also growing at a significant pace as accessibility has improved, and there is less stigma associated with tele-mental health solutions. Artificial intelligence-based triage solutions, chatbots, and predictive analytics are also improving the efficiency of diagnosis and reducing unnecessary hospital visits.

Government support is also fueling the growth of markets with expanded medicare and medicaid reimbursement, flexibility in interstate medical licensing, and investments in secure digital infrastructure. Regulatory authorities are also promoting HIPAA-compliant platforms to ensure safe and reliable virtual healthcare services.

Report Coverage

This research report categorizes the market for the United States telehealth services market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States telehealth services market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States telehealth services market.

United States Telehealth Services Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 47.6 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 21.4% |

| 2035 Value Projection: | USD 401.9 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Teladoc Health, Inc., Amwell (American Well), MDLIVE (Evernorth/Cigna, Doximity, Doctor On Demand, Hims & Hers Health, LifeStance Health Group, Others, and Key Players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The United States telehealth services market is mainly driven by the rising costs of healthcare and the need for an affordable way of delivering healthcare. The rising number of geriatric patients and the prevalence of chronic diseases are increasing the demand for continuous patient monitoring and follow-up consultations. The shortage of doctors, particularly in rural areas, is forcing healthcare providers to resort to telehealth services. Additionally, the popularity of smartphones and internet access, as well as the favourable insurance reimbursement policies, are propelling the telehealth services market.

Restraining Factors

The market is challenged by restraints such as data privacy and cybersecurity issues related to digital healthcare platforms. State licensing requirements and uncertainties related to future reimbursement policies are also limiting factors. In addition, a lack of digital literacy among older patients and inadequate internet connectivity in some rural areas hinder the large-scale implementation of telehealth services.

Market Segmentation

The United States telehealth services market share is classified into type and application.

- The services segment accounted for the largest revenue market in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States telehealth services market is segmented by type into products and services. Among these, the services segment accounted for the largest revenue market in 2024 and is expected to grow at a significant CAGR during the forecast period. It is primarily based on a recurring usage pattern and not on a one-time purchase pattern. Patients keep making appointments for virtual consultations, therapy sessions, follow-ups, and management of chronic conditions, which keeps generating billing transactions. Moreover, insurance companies pay for teleconsultations, just like in-person consultations, which motivates hospitals and doctors to make frequent teleconsultations. Remote patient monitoring services are also offered on a monthly subscription model, which generates continuous revenue streams, but products like equipment and software are sold only once.

- The telemedicine segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States telehealth services market is segmented by application into telemedicine, patient monitoring, continuous medical education, and others. Among these, the telemedicine segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. It is the first and most common point of contact between patients and healthcare professionals. Most primary care consultations, pediatric consultations for minor illnesses, prescription refills, and follow-ups with specialists are done through virtual doctor consultations, hence the high number of consultations compared to other apps. Telemedicine is fully covered by insurance and is well accepted by both patients and healthcare providers, hence the high patient traffic and daily usage, while patient monitoring and medical education are only used for specific purposes.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States telehealth services market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Teladoc Health, Inc.

- Amwell (American Well)

- MDLIVE (Evernorth/Cigna

- Doximity

- Doctor On Demand

- Hims & Hers Health

- LifeStance Health Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

In April 2025, Teladoc Health introduced an AI-powered virtual assistant for patient triaging.

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States telehealth services market based on the below-mentioned segments:

United States Telehealth Services Market, By Type

- Products

- Services

United States Telehealth Services Market, By Application

- Telemedicine

- Patient Monitoring

- Continuous Medical Education

- Others

Frequently Asked Questions (FAQ)

-

1. What is the United States telehealth services market?The United States telehealth services market refers to the healthcare industry that provides medical care remotely using video consultations, mobile apps, and remote monitoring technologies.

-

2. What is the United States telehealth services market size?United States Telehealth Services market size is expected to grow from USD 47.6 billion in 2024 to USD 401.9 billion by 2035, growing at a CAGR of 21.4% during the forecast period 2025-2035.

-

3. What are the key drivers of the United States telehealth services market?The market is driven by chronic diseases, rising healthcare costs, physician shortages, insurance reimbursement support, and increasing demand for convenient care.

-

4. Which types dominate the United States telehealth services market?The services segment dominates due to frequent virtual consultations and recurring patient monitoring subscriptions.

-

5. What are the major trends in the United States telehealth services market?Key trends include remote patient monitoring, tele-mental health, AI-based diagnosis, and home healthcare adoption.

-

6. Who are the key companies operating in the United States telehealth services market?Major players include Teladoc Health, Inc., Amwell (American Well), MDLIVE (Evernorth/Cigna, Doximity, Doctor on Demand, Hims & Hers Health, LifeStance Health Group.

Need help to buy this report?