United States Telecom services Market Size, Share, and COVID-19 Impact Analysis, By Service Type (Fixed Voice Services, Fixed Internet Access Services, Mobile Voice Services, Mobile Data Services, Pay TV Services, and Machine-to-Machine Services), By Transmission (Wireline, Wireless), By End-Use (Consumer and Business), and United States Telecom services Market Insights, Industry Trend, Forecasts To 2035

Industry: Information & TechnologyUnited States Telecom Services Market Insights Forecasts to 2035

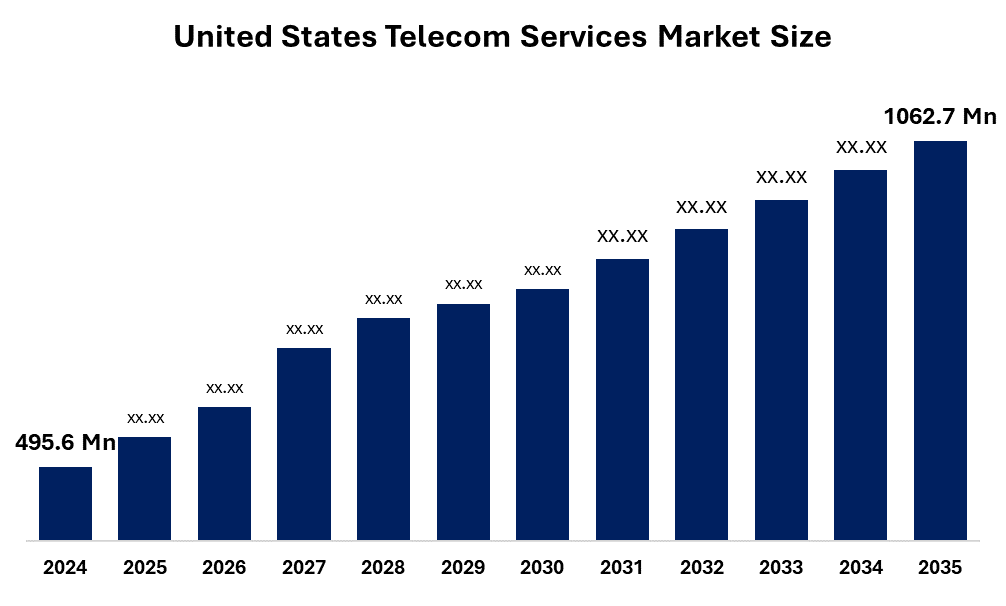

- The USA Telecom Services Market Size Was Estimated at USD 495.6 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.18% from 2025 to 2035

- The USA Telecom Services Market Size is Expected to Reach USD 1062.7 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights Consulting, the United States Telecom Services Market Size is Anticipated to reach USD 1,062.7 Million by 2035, Growing at a CAGR of 7.18% from 2025 to 2035. Market growth is being driven by the future potential of 5G, rapid advancements in AI and ML, the adoption of edge computing, and the rising demand for cybersecurity solutions, all of which are expected to spur innovation among U.S. telecom service providers.

Market Overview

The telecom services consist of the transfer of voice, data, lessons, videos, and internet communications on wired, wireless, satellite, and broadband networks. Telecom firms offer these services, which are important for the facility of connectivity, communication, and information sharing between people, organizations, and governments. One of the most important corners of contemporary civilization is the telecom service sector, which facilitates both international commercial operations and private communication. Entrepreneurial solutions, including fixed-line telephone, mobile phones, broadband internet, wireless data, television broadcasting, cloud communication, managed services, and integrated communication, include several services. The emergence of Internet of Things (IOT), Artificial Intelligence (AI), and cloud computing requires strong telecommunications services to handle data flow and connectivity between devices that have produced all new revenue streams. Telecom services are also being used by businesses for consumer interaction platforms, safe communication, and digital change projects.

Report Coverage

This research report categorizes the USA telecom services market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the U.S. telecom services market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States telecom services market

United States Telecom Services Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 495.6 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 7.18% |

| 2035 Value Projection: | USD 1062.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 140 |

| Segments covered: | By End-Use, By Service Type. |

| Companies covered:: | AT&T Inc., Comcast Corporation, Verizon Communications Inc., T-Mobile US Inc., Charter Communications, Inc., United States Cellular Corporation, Lumen Technologies Inc and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factor

The U.S. telecom services market is driven by the expansion of 5G networks, the rapid uptake of smartphones, and the increasing demand for high-speed internet. Growth is promoted by the rising dependence on cloud services, IoT devices, and remote work solutions. Government initiatives for digital infrastructure, as well as overall industry growth, further intensify consumer demand for e-commerce and video streaming.

Restraining Factor

The U.S. telecom services market faces restrictions due to significant capital expenditure on network infrastructure, complex regulations, and fierce pricing rivalry among operators. Additionally, there are challenges related to disruptive growth, cybersecurity risks, spectrum licensing fees, and limited rural access for small and medium-sized telecom companies.

The United States telecom services market share is classified into service type, transmission, and end-use.

- The mobile data services segment accounted for the largest revenue share in 2024 and is expected to grow at a substantial CAGR during the projected timeframe.

The United States telecom services market is segmented by service type into fixed voice services, fixed internet access services, mobile voice services, mobile data services, pay TV services, and machine-to-machine services. Among these, the mobile data services segment accounted for the largest revenue share in 2024 and is expected to grow at a substantial CAGR during the projected timeframe. This is due to rapidly growing consumer use of smartphones. Additionally, US professionals have demonstrated the growing desire to adopt a 5G smartphone due to the facility of innocent performance, resulting in significant demand for telecommunications services.

- The wireless segment held the largest market share in 2024 and is projected to grow at a significant CAGR during the forecast period.

The United States telecom services market is segmented by transmission into wireline and wireless. Among these, the wireless segment held the largest market share in 2024 and is projected to grow at a significant CAGR during the forecast period. A sharp increase in the use of wireless local area network (WLAN), especially in public sectors such as office buildings, cafeterias, and airports. Additionally, there has been significant progress in the United States wireless infrastructure.

- The business segment is anticipated to grow at the fastest CAGR during the projected timeframe.

The United States telecom services market is segmented by end-use into consumer and business. Among these, the business segment is anticipated to grow at the fastest CAGR during the projected timeframe. The need to maintain technological development and customer satisfaction in commercial settings. In addition to providing businesses with the resources that they need to operate efficiently in many places, a strong telecom network facilitates efficient customer communication.

Competitive Analysis

The report provides a detailed analysis of the key organizations and companies operating in the United States telecom services market, along with a comparative evaluation based on their offerings, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. It also includes an in-depth review of recent news and developments related to these companies, such as product developments, innovations, joint ventures, partnerships, mergers and acquisitions, strategic alliances, and more. This enables a comprehensive assessment of the overall competitive landscape in the market.

List of Key Companies

- AT&T Inc.

- Comcast Corporation

- Verizon Communications Inc.

- T-Mobile US, Inc.

- Charter Communications, Inc.

- United States Cellular Corporation

- Lumen Technologies, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End Users

- Government Authorities

- Consulting and Research Firms

- Venture Capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the U.S. telecom services market based on the below-mentioned segments:

United States Telecom Services Market, By Service Type

- Fixed Voice Services

- Fixed Internet Access Services

- Mobile Voice Services

- Mobile Data Services

- Pay TV Services

- Machine-to-Machine Services

United States Telecom Services Market, By Transmission

- Wireline

- Wireless

United States Telecom Services Market, By End-Use

- Consumer

- Business

Frequently Asked Questions (FAQ)

-

Q: What is the forecast period covered in this report?A: The report covers historical data from 2020 to 2023, with forecasts from 2025 to 2035.

-

Q: What was the market size of the U.S. Telecom services Market in 2024?A: The market size was valued at USD 495.6 million in 2024.

-

Q: What is the projected market size by 2035?A: It is expected to reach USD 1062.7 million by 2035.

-

Q: What is the forecasted CAGR during 2025–2035?A: The market is anticipated to grow at a CAGR of 7.18% during the forecast period.

-

Q: What factors are driving the growth of the U.S. Telecom services Market?A: Key drivers include the growth of the U.S. telecom services market is driven by 5G expansion, rising data consumption, IoT adoption, and digital transformation.

-

Q: What are the main restraints in the market?A: The U.S. telecom services market faces restraints from high infrastructure costs, regulatory complexities, spectrum limitations, intense competition, and cybersecurity risks, which collectively hinder profitability, slow network expansion, and affect service quality.

-

Q6. Which service type segment dominated the market in 2024?A: The mobile data services held the largest revenue share, driven by repeated demand for assay kits, allergen extracts, and reagents.

-

Q: Which transmission is growing fastest in the market?A: the wireless transmission segment held the largest market share in 2024 and is projected to grow at a significant CAGR during the forecast period.

-

Q: Which end-use segment accounted for the largest market share in 2024?A: business dominated the market due to integrated diagnosis, management, and treatment services.

-

Q: Which companies are key players in this market?A: Major players include AT&T Inc., Comcast Corporation, Verizon Communications Inc., T-Mobile US Inc., Charter Communications, Inc., United States Cellular Corporation, Lumen Technologies Inc., and Others.

Need help to buy this report?