United States Sulfuric Acid Market Size, Share, and COVID-19 Impact Analysis, By Raw Material (Elemental Sulfur, Base Metal Smelters, Pyrite Ore, and Other), By Application (Fertilizers, Chemical Manufacturing, Metal Processing, Petroleum Refining, Textile Industry, Automotive, Pulp & Paper, and other), and United States Sulfuric Acid Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited States Sulfuric Acid Market Insights Forecasts to 2035

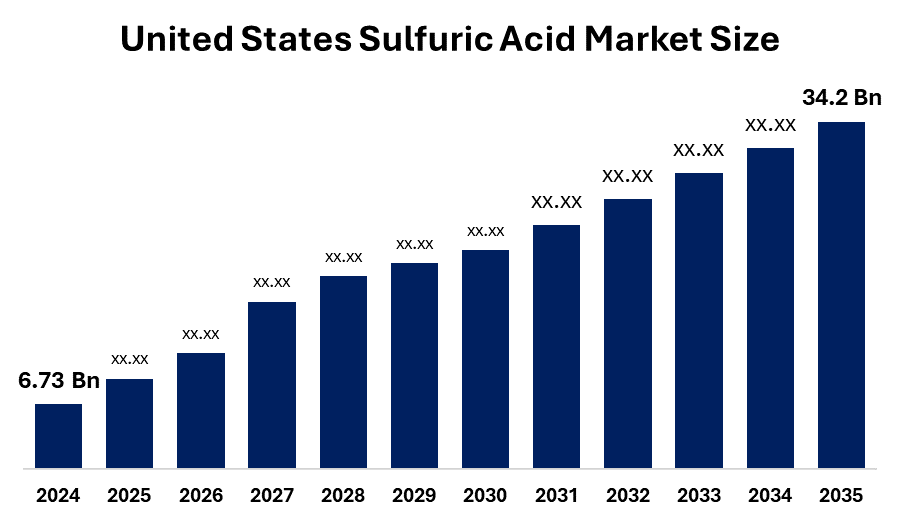

- The United States Sulfuric Acid Market Size Was Estimated at USD 6.73 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 15.93% from 2025 to 2035

- The United States Sulfuric Acid Market Size is Expected to Reach USD 34.2 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Sulfuric Acid Market is anticipated to reach USD 34.2 billion by 2035, growing at a CAGR of 15.93% from 2025 to 2035. The United States sulfuric acid market is driven by a growing demand for sulfuric acid (H2SO4) from the metal processing industry in the removal of rust and other contaminants from different metal surfaces, including iron, steel, copper, and aluminium.

Market Overview

Sulfuric acid is one of the most widely used industrial chemicals in the United States, which is valuable for its strong acidic properties, dehydration ability, and role as a versatile chemical intermediate. When too much heat is released, a little yellow sticky liquid dissolves in water. The contact process is the main industrial method for the production of sulfuric acid. This takes the catalyst oxidation of sulfur dioxide (Sulfur Dioxide) to sulfur trioxide, which is then absorbed into water. The contact process, in which sulfur dioxide, which arises from burning sulfur or burning of metal ores, is absorbed into oxidation and water, is the main method used in the industrial construction of sulfuric acid in the United States. This is suitable for many applications, as this technique guarantees excellent purity and efficiency. The US also emphasizes the recovery of petroleum refining and the melting of gases to mitigate their negative effects on the environment. There are many uses for sulfuric acid. Furthermore, in the fertilizer business, it is especially required for the synthesis of phosphoric acid, which is then used to create phosphate fertilizers such as ammonium phosphate and superphosphate. It is used to make explosives, detergents, dyes, and other acids, such as nitric and hydrochloric acid in the chemical industry. To increase the quality of gasoline, sulfuric acid is also used by the petroleum industry in purification processes such as alkaliization.

Report Coverage

This research report categorizes the market for United States sulfuric acid market based on various segments and regions, forecasts revenue growth, and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States sulfuric acid market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment United States sulfuric acid market.

United States Sulfuric Acid Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 6.73 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 15.93% |

| 2035 Value Projection: | USD 34.2 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 170 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Application, By Raw Material. |

| Companies covered:: | Cargill, Inc., MGP Ingredients Inc., Grain Millers Inc., Cristalco SAS, Green Plains Inc., Greenfield Global, The Andersons Inc., Grain Processing Corporation, Birla Sugar Ltd., Chippewa Valley Ethanol Co.LLP, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The United States sulfuric acid market is driven by increasing requirements for fertilizers to promote agricultural production, especially based on phosphate. Development is also supported by high consumption in chemical manufacturing, metal processing, and petroleum purification. The condition of sulfuric acid in industrial and environmental applications is further strengthened by its increasing use in lead-acid battery manufacturing and wastewater treatment.

Restraining Factors

The United States industrial alcohol market faces challenges with strict rules on sulfur dioxide emissions and high handling risk due to expensive security compliance requirements. Alternative energy provides additional challenges for long-term demand for alternative energy storage technologies and the availability of raw materials.

Market Segmentation

The United States sulfuric acid market share is classified into raw material and application.

- The elemental sulfur dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States sulfuric acid market is segmented by raw material into elemental sulfur, base metal smelters, pyrite ore, and others. Among these, the elemental sulfur dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period. This dominance is due to the cheap, easily available, and emission of low emissions compared to base metal smelters and pyrite ore. In addition, using solid sulfur enables more accurate control over the response process, which can increase productivity and cut waste.

- The fertilizers segment dominated the market in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The United States sulfuric acid market is segmented by application into fertilizers, chemical manufacturing, metal processing, petroleum refining, textile industry, automotive, pulp & paper, and other. Among these, the fertilizers segment dominated the market in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. powerful acidic properties and ability to decompose raw materials and provide nutrients required for plant growth, ethanol is often employed in the manufacture of fertilizers. Ammonium sulfate and other forms of nitrogen and phosphate-based fertilizers are produced by combining H2SO4 with other materials such as ammonia.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the United States sulfuric acid market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cargill, Inc.

- MGP Ingredients Inc.

- Grain Millers Inc.

- Cristalco SAS

- Green Plains Inc.

- Greenfield Global

- The Andersons Inc.

- Grain Processing Corporation

- Birla Sugar Ltd.

- Chippewa Valley Ethanol Co.LLP

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States sulfuric acid market based on the below-mentioned segments

United States Sulfuric Acid Market, By Raw Material

- Elemental Sulfur

- Base Metal Smelters

- Pyrite Ore

- Other

United States Sulfuric Acid Market, By Application

- Fertilizers

- Chemical Manufacturing

- Metal Processing

- Petroleum Refining

- Textile Industry

- Automotive

- Pulp & Paper

- Other

Frequently Asked Questions (FAQ)

-

Q: What is the United States Sulfuric Acid Market size in 2024?A: The United States sulfuric acid market size was estimated at USD 6.73 billion in 2024.

-

Q: What is the projected market size of the United States Sulfuric Acid Market by 2035?A: The market is expected to reach USD 34.2 billion by 2035.

-

Q: What is the growth rate (CAGR) of the United States Sulfuric Acid Market?A: The market is projected to grow at a CAGR of 15.93% from 2025 to 2035.

-

Q: What are the key factors driving the growth of the U.S. Sulfuric Acid Market?A: Rising demand for fertilizer production, high consumption in chemical manufacturing, metal processing, and petroleum refining, and growing use in lead-acid batteries and wastewater treatment are driving market growth.

-

Q: Which segment dominated the U.S. Sulfuric Acid Market by raw material in 2024?A: The elemental sulfur segment dominated in 2024, due to cost-effectiveness, wide availability, and lower emissions compared to other sources.

-

Q: Which application segment held the largest U.S. Sulfuric Acid market share in 2024?A: The fertilizers segment accounted for the largest share in 2024 and is expected to grow significantly during the forecast period.

-

Q: What challenges are restraining the U.S. Sulfuric Acid Market?A: Strict environmental regulations on sulfur dioxide emissions, high handling risks, costly safety compliance, and competition from alternative energy storage technologies restrain market growth.

-

Q: What industrial processes use sulfuric acid in the U.S.?A: Sulfuric acid is widely used in fertilizers, chemical manufacturing, petroleum refining, textile processing, pulp & paper, automotive, and metal processing.

-

Q: Which companies are key players in the U.S. Sulfuric Acid Market?A: Major players include Cargill, Green Plains Inc., Greenfield Global, The Andersons Inc., Cristalco SAS, Grain Processing Corporation, and others.

-

Q: What is the forecast period considered for the U.S. Sulfuric Acid Market report?A: The report covers historical data from 2020–2023, uses 2024 as the base year, and provides forecasts for 2025–2035.

Need help to buy this report?