United States Sugar Market Size, Share, And COVID-19 Impact Analysis, By Product Type (White Sugar, Brown Sugar), By Form (Granulated Sugar, Powdered Sugar, and Syrup Sugar), By End-Use (Food & Beverages, Pharmaceuticals, Personal Care, Household, and Others), and United States Sugar Market Insights, Industry Trend, Forecasts To 2035

Industry: Food & BeveragesUnited States Sugar Market Insights Forecasts to 2035

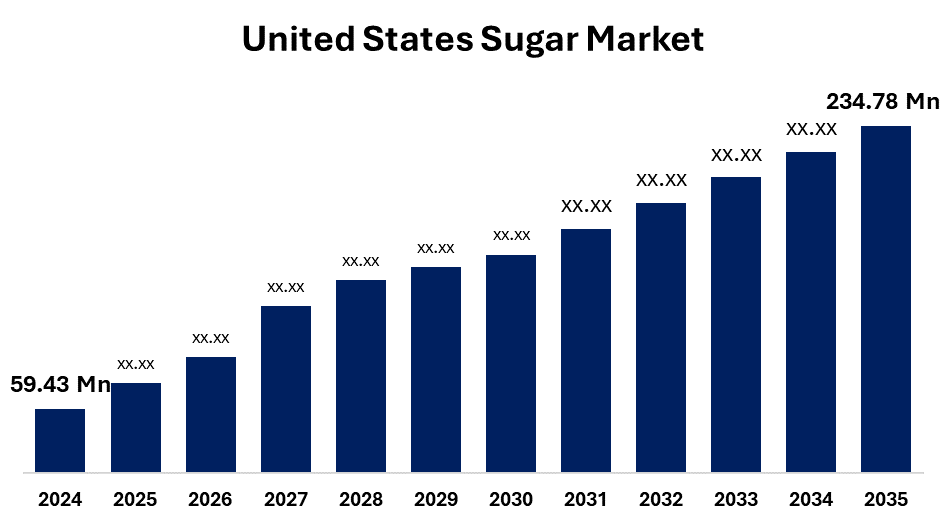

- The United States Sugar Market Size Was Estimated at USD 59.43 Million Tons in 2024

- The Market Size is Expected to Grow at a CAGR of around 13.3% from 2025 to 2035

- The United States Sugar Market Size is Expected to Reach USD 234.78 Million Tons by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United states sugar Market Size is anticipated to reach USD 234.78 Million tons by 2035, Growing at a CAGR of 13.3% from 2025 to 2035

Market Overview

Sugar is a naturally occurring, clear, soluble chemical that has a sweet flavor from sugar cane or sugar beet in the form of glucose and fructose. Sugar is classified into two types, white sugar and brown sugar, while sugar may also be found in honey and is naturally created from fruits, vegetables, and milk. Sugar is composed of high calories and carbohydrates, providing the body with fast energy. Sugar can also aid in normalizing excessive blood pressure and hypoglycemia, and is good for the intestines. Sugar is nutritionally useful and a source of flavor and thickness in food products, and a food preservative due to hindering the growth of mold. The US has legislation and government programs, which include cane sugar, that support the domestic sugar industry. The US has a tariff-rate quota that limits the sugar imported at a minimally lower tariff, which protects the US sugar market to provide a constant market for domestic sugar producers that includes cane sugar.

Report Coverage:

This research report categorizes the United States sugar market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States sugar market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States sugar market.

United States Sugar Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 13.3% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 122 |

| Segments covered: | By Product Type, By Form, By End-Use |

| Companies covered:: | US Sugar Corp., Western Sugar Cooperative, American Crystal Sugar Company, C&H Sugar Company, Inc., Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factor

The U.S. sugar market is driven by robust demand from the food and beverage sector, where sugar is still a major participant in confectionery, bakery, dairy, and soft beverages. With the number of people and urban lifestyles, the demand for sugar and syrup is continuing to grow. The government has also aided stability in the sugar market as it provides programs and tariff protection, which stabilize domestic prices and encourage local production.

Restraining Factor

Many people are consuming less sugar mainly because of the increase in fatal health issues (obesity and diabetes), and consumers have turned to low-calorie diets. More consumers have also switched to and adopted natural and artificial sweeteners like stevia and aspartame which diminishes the demand for traditional sugar.

Market Segmentation

The United States sugar market share is classified into product type, form, and end-use.

- The white sugar segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States sugar market is segmented by product type into by product type into white sugar and brown sugar. Among these, the white sugar segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The versatility of white sugar makes it an ideal ingredient across a multitude of sectors, including baking, confectionery, beverages, and food processing. It has a neutral flavor profile and easily dissolves, able to appeal to a host of sensory perceptions and is therefore blended seamlessly into an enormous array of food and beverage forms for both consumers and manufacturers across sectors.

- The granulated sugar segment held the largest market share in 2024 and is expected to grow at a substantial CAGR during the forecast period.

The United States sugar market is segmented by form into granulated sugar, powdered sugar, and syrup sugar. Among these, the granulated sugar segment held the largest market share in 2024 and is expected to grow at a substantial CAGR during the forecast period. Granulated sugar is useful in that it blends easily with a host of different mixtures and dissolves evenly rather than in chunks, an important point in both home kitchens and an industrial food production environment. Granulated sugar also has a long shelf-life and will not clump, making it convenient to store both logistically and physically for a consumer or manufacturer.

- The food & beverages segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The United States sugar market is segmented by end-use into food & beverages, pharmaceuticals, personal care, household, and others. Among these, the food & beverages segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Sugar is an important ingredient in a broad spectrum of food and beverage products and provides sweetness while clarifying texture for several food and beverage applications. Whether sweetening beverages or adding flavor to consumer favorites like bakery products, confectionery, and dairy products, sugar is an essential ingredient we all think of when formulating food products.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the United States sugar market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes Protein development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List Of Companies

- US Sugar Corp.

- Western Sugar Cooperative

- American Crystal Sugar Company

- C&H Sugar Company, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States sugar market based on the below-mentioned segments:

United States Sugar Market, By Product Type

- White Sugar

- Brown Sugar

United States Sugar Market, By Form

- Granulated Sugar

- Powdered Sugar

- Syrup Sugar

United States Sugar Market, By End-Use

- Food & Beverages

- Pharmaceuticals

- Personal Care

- Household

- Others

Frequently Asked Questions (FAQ)

-

What is the size of the U.S. sugar market in 2024?The U.S. sugar market size was estimated at USD 59.43 million tons in 2024.

-

What is the forecasted market size of the U.S. sugar market by 2035?The market is expected to reach USD 234.78 million tons by 2035, growing at a CAGR of 13.3%.

-

Which product type segment dominates the U.S. sugar market?The white sugar segment held the largest share in 2024 due to its versatility in food and beverages.

-

Which form of sugar is most widely used in the U.S. market?The granulated sugar segment dominated in 2024, owing to its wide usability, long shelf life, and convenience.

-

Which end-use industry is the largest consumer of sugar in the U.S.?Major drivers include rising demand from food & beverages, population growth, urbanization, and government support programs.

-

What are the restraining factors of the U.S. sugar market?Restraints include health concerns (obesity, diabetes), sugar taxes, and the growing popularity of sweetener alternatives like stevia.

-

Who are the key players in the U.S. sugar market?Major companies include U.S. Sugar Corp., Western Sugar Cooperative, American Crystal Sugar Company, C&H Sugar Company, Inc., and others.

-

What are the latest trends in the U.S. sugar market?Key trends include factory shutdowns, introduction of cane sugar sodas, FDA’s proposed reduction in juice sugar standards, and increasing consumer demand for low- and no-sugar alternatives.

-

What is the forecast period for the U.S. sugar market analysis?The report forecasts market trends and growth from 2025 to 2035, using 2024 as the base year and considering historical data from 2020 to 2023.

Need help to buy this report?