United States Styrene Butadiene Rubber SBR Market Size, Share, and COVID-19 Impact Analysis, By Type (Emulsion Styrene Butadiene Rubber, and Solution Styrene Butadiene Rubber), By End Use (Tyres, Conveyor Belt, Shoe Sole, and Others), and United States Styrene Butadiene Rubber SBR Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited States Styrene Butadiene Rubber SBR Market Insights Forecasts to 2035

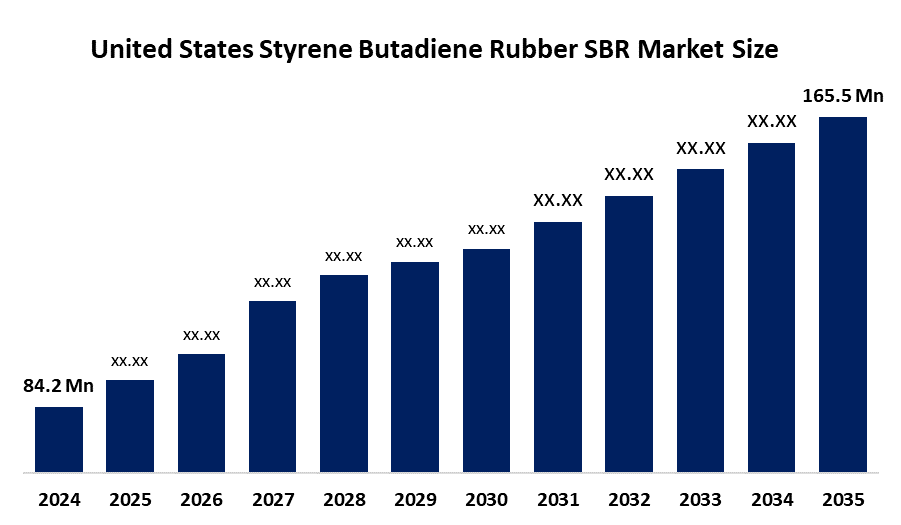

- The United States Styrene Butadiene Rubber SBR Market Size Was Estimated at USD 84.2 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.34% from 2025 to 2035

- The United States Styrene Butadiene Rubber SBR Market Size is Expected to Reach USD 165.5 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States styrene butadiene rubber SBR market size is anticipated to reach USD 165.5 million by 2035, growing at a CAGR of 6.34% from 2025 to 2035. The styrene butadiene rubber SBR market in United States is driven by strong tire manufacturing demand, increased automobile production, rising sales of replacement tires, infrastructure development, the affordability of SBR, and growing industrial and footwear applications.

Market Overview

The United States styrene butadiene rubber (SBR) market extends to both SBR production and SBR consumption because SBR functions as a synthetic elastomer that provides high abrasion resistance and economical performance. The material serves multiple purposes, including its use in tire treads and sidewalls, footwear soles, conveyor belts, hoses, gaskets, adhesives and sealants, and flooring and industrial rubber goods, which support automotive and construction and manufacturing operations that need durable and high-performance materials.

Government policies, which include the Infrastructure Investment and Jobs Act and fuel-efficiency tire standards, create a foundation for the United States SBR market, which drives demand in both the automotive and construction sectors. The Green Chemistry Program of the EPA, together with the Inflation Reduction Act, establishes sustainable SBR production methods and environmentally friendly technologies, while environmental regulations push the synthetic rubber industry towards cleaner production methods and new technological developments.

The United States has made progress through its bio-based and recycled SBR projects, which receive funding from businesses that develop sustainable materials and performance products for electric vehicle tires and high-performance applications. The development of sustainable practices benefits from increased research and development activities in recycling processes and advanced material compounding methods, while future opportunities emerge from environmentally friendly SBR materials, circular economy solutions, and the expansion of electric vehicle tire markets.

Report Coverage

This research report categorizes the market for the United States styrene butadiene rubber SBR market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States styrene butadiene rubber SBR market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States styrene butadiene rubber SBR market.

United States Styrene Butadiene Rubber SBR Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 84.2 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 6.34% |

| 2035 Value Projection: | USD 165.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Application |

| Companies covered:: | LION ELASTOMERS LLC, Firestone Polymers LLC, Fleur de Lis Worldwide LLC, Goodyear Chemical, Trinseo S.A., Kraton Polymers / Kraton Corporation, Goodyear Rubber Products, Inc., Colorado Molded Products Co., Others, and Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The styrene butadiene rubber SBR market in United States is driven by the tire and automotive industry demand, which increases with rising vehicle production and replacement tire sales. Market growth across all end-use sectors receives support from infrastructure development and construction, and industrial application expansion, as SBR materials provide cost advantages over natural rubber, and high-performance sustainable SBR grades continue to develop.

Restraining Factors

The styrene butadiene rubber SBR market in United States is mostly constrained by the fluctuating prices of styrene and butadiene, environmental regulations, competition from natural rubber and alternative elastomers, energy-intensive production methods, and rising costs of sustainability and recycling compliance.

Market Segmentation

The United States styrene butadiene rubber SBR market share is classified into type and end use.

- The emulsion styrene butadiene rubber segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States styrene butadiene rubber SBR market is segmented by type into emulsion styrene butadiene rubber, and solution styrene butadiene rubber. Among these, the emulsion styrene butadiene rubber segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of its extensive use in tire manufacturing, affordability, well-established production infrastructure, and robust demand from general rubber goods and replacement tire applications.

- The tyres segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The United States styrene butadiene rubber SBR market is segmented by end use into tyres, conveyor belt, shoe sole, and others. Among these, the tyres segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. High SBR use in tire treads and sidewalls, high demand for replacement tires, growing car ownership, and the necessity for affordable, abrasion-resistant rubber materials are the main factors driving this dominance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States styrene butadiene rubber SBR market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- LION ELASTOMERS LLC

- Firestone Polymers LLC

- Fleur de Lis Worldwide LLC

- Goodyear Chemical

- Trinseo S.A.

- Kraton Polymers / Kraton Corporation

- Goodyear Rubber Products, Inc.

- Colorado Molded Products Co.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In June 2025, due to overstock and rising imports in the face of declining tire demand, U.S. SBR prices fell in December 2025, impacting the dynamics of the domestic market.

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States styrene butadiene rubber SBR market based on the below-mentioned segments:

United States Styrene Butadiene Rubber SBR Market, By Type

- Emulsion Styrene Butadiene Rubber

- Solution Styrene Butadiene Rubber

United States Styrene Butadiene Rubber SBR Market, By End Use

- Tyres

- Conveyor Belt

- Shoe Sole

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the United States styrene butadiene rubber SBR market size?A: United States styrene butadiene rubber SBR market size is expected to grow from USD 84.2 million in 2024 to USD 165.5 million by 2035, growing at a CAGR of 6.34% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by tire and automotive industry demand, which increases with rising vehicle production and replacement tire sales.

-

Q: What factors restrain the United States styrene butadiene rubber SBR market?A: Constraints include the fluctuating prices of styrene and butadiene, as well as environmental regulations.

-

Q: How is the market segmented by type?A: The market is segmented into emulsion styrene butadiene rubber, and solution styrene butadiene rubber.

-

Q: Who are the key players in the United States styrene butadiene rubber SBR market?A: Key companies include LION ELASTOMERS LLC, Firestone Polymers LLC, Fleur de Lis Worldwide LLC, Goodyear Chemical, Trinseo S.A., Kraton Polymers / Kraton Corporation, Goodyear Rubber Products, Inc., Colorado Molded Products Co., and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?