United States Stain Remover Products Market Size, Share, and COVID-19 Impact Analysis, By Product (Liquid, Powder, Spray, Bar, and Others), By Application (Household and Commercial), and United States Stain Remover Products Market Insights, Industry Trend, Forecasts To 2035

Industry: Consumer GoodsUnited States Stain Remover Products Market Insights Forecasts to 2035

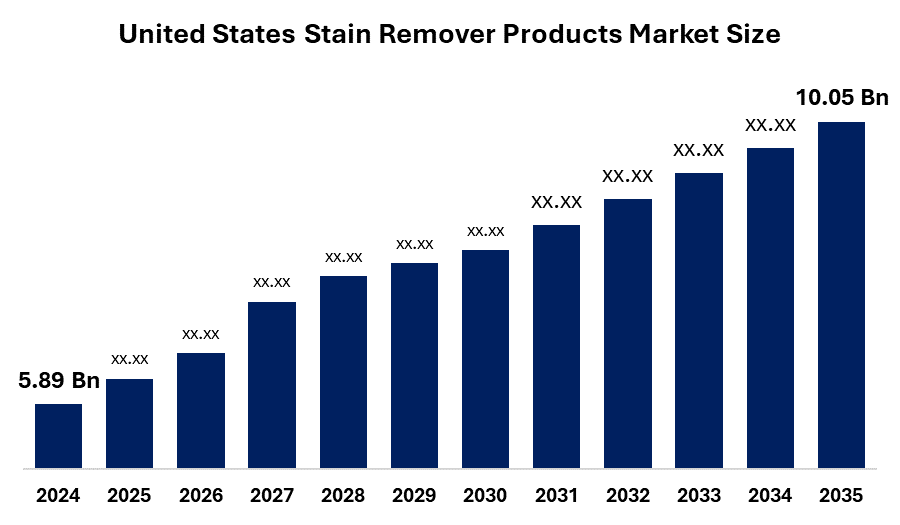

- The United States Stain Remover Products Market Size Was Estimated at USD 5.89 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.98% from 2025 to 2035

- The United States Stain Remover Products Market Size is Expected to Reach USD 10.05 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United States Stain Remover Products Market Size is Anticipated to Reach USD 10.05 Billion by 2035, Growing at a CAGR of 4.98% from 2025 to 2035. The market growth is driven by changing consumer habits and preferences, influenced by a combination of economic, cultural, and technological factors.

Market Overview

Stain remover products are specially designed socks made from materials that effectively manage and transport moisture away from the skin. Their primary function is to keep feet dry by drawing sweat away from the foot and allowing it to evaporate, which helps to enhance comfort and reduce the risk of foot-related issues. Moisture-wicking socks have emerged as a pivotal innovation in textile performance, merging comfort with advanced moisture management. These specialized hosiery solutions draw perspiration away from the skin, ensuring a drier environment that mitigates irritation and blister formation. Electronic cigarettes, an alternative to tobacco products, have been gaining popularity. These sophisticated mechanical devices are designed to deliver the same addictive nicotine in tobacco cigarettes without the harmful effects of tobacco smoke. Health concerns related to smoking have considerably increased in the past few years as individual organizations and governments treat this issue with high priority.

Report Coverage:

This research report categorizes the United States stain remover products market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States stain remover Products market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States stain remover products market.

United States Stain Remover Products Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 5.89 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 4.98% |

| 2035 Value Projection: | USD 10.05 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 150 |

| Segments covered: | By Product, By Application. |

| Companies covered:: | Procter & Gamble, The Clorox Company, S.C. Johnson & Son, Inc., Church & Dwight Co., Inc., Henkel AG & Co. KGaA, Unilever PLC, Seventh Generation Inc., and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factor

The stain remover products market in the United States is witnessing significant growth due to the rising consumer awareness toward personal hygiene worldwide is growing significantly, resulting in an increase in product demand. The increased awareness is due to government support, NGO campaigns, and social media advertisements by various companies. In addition, the increase in awareness toward good hygiene practices that promote overall health and well-being drives the global market growth.

Restraining Factor

The increase in the use of harmful chemicals such as sodium pyrithione, linear alkylbenzene sulfonates, and dilute hydrofluoric acid in producing stain removers can cause various health risks, such as irritation to the skin, eyes, lungs, and digestive tract; dizziness; headache; and memory issues.

Market Segmentation

The United States stain remover products market share is classified into product and Application.

- The powder stain remover segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States stain remover products market is segmented by product into liquid, powder, spray, bar, and others. Among these, the powder stain remover segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by widespread availability, consumer familiarity, and cost-effectiveness. Powders are highly versatile, suitable for a broad range of stains and fabrics, and are especially effective on heavy and set-in stains.

- The household segment dominated the market in 2024 and accounted for a significant CAGR during the forecast period.

The United States stain remover products market is segmented by application into household and commercial. Among these, the household segment dominated the market in 2024 and accounted for a significant CAGR during the forecast period. The segment is driven by rising consumer awareness of hygiene, the need for frequent laundering, and a surge in dual-income households that prioritize time-saving and efficient cleaning solutions. The growing trend of home-based laundry, coupled with busy urban lifestyles, has led consumers to seek products that are easy to use, effective, and compatible with modern appliances.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States stain remover products market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Procter & Gamble

- The Clorox Company

- S.C. Johnson & Son, Inc.

- Church & Dwight Co., Inc.

- Henkel AG & Co. KGaA

- Unilever PLC

- Seventh Generation Inc.

- Others

Recent Development

- In February 2024, Under the Tide brand, Procter & Gamble added a new plant-based stain removal formula to its lineup, emphasizing the need to use fewer chemicals while yet achieving high cleaning effectiveness. Alongside a significant marketing push featuring Marvel Studios, Tide also introduced Ultra Oxi Boost Power PODS in January 2025, promoting them as their most potent, clean, and greatest stain removal pods to date.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2025 to 2035. Spherical Insights has segmented the United States stain remover products market based on the below-mentioned segments:

United States Stain Remover Products Market, By Product

- Liquid

- Powder

- Spray

- Bar

- Others

United States Stain Remover Products Market, By Application

- Household

- Commercial

Frequently Asked Questions (FAQ)

-

Q: What is the market size of the U.S. Stain Remover Products Market in 2024?A: The U.S. stain remover products Market size was estimated at USD 5.89 billion in 2024.

-

Q: What is the forecasted CAGR of the U.S. Stain Remover Products Market from 2024 to 2035?A: The market is expected to grow at a CAGR of around 4.98% during the period 2024–2030.

-

Q: Which product Application held the largest market share in 2024?A: The powder stain remover segment held the largest market share in 2024 due to its cost-effectiveness, wide availability, and strong performance on heavy stains.

-

Q: Who are the top companies operating in the U.S. Stain Remover Products Market?A: Key players include Procter & Gamble, The Clorox Company, S.C. Johnson & Son, Inc., Church & Dwight Co., Inc., Henkel AG & Co. KGaA, Unilever PLC, Seventh Generation Inc., and Others.

-

Q: Can you provide company profiles for the leading Stain Remover Products?A: Yes. For example, Procter & Gamble (P&G) offers a consumer goods powerhouse with diverse segments: beauty, grooming, healthcare, baby and family care, and fabric & home care.

-

Q: What are the main drivers of growth in the stain remover products market?A: The rising consumer awareness toward personal hygiene worldwide is growing significantly, increasing product demand.

-

Q: What are the major challenges or restraints facing the market?A: The use of harmful chemicals in stain removers poses health risks such as skin and eye irritation, dizziness, and respiratory issues, which could limit market growth.

-

Q: Which regulations are affecting this market?A: Regulations issued by the U.S. Environmental Protection Agency (EPA), which regulates the introduction and use of chemicals in commercial products, including stain removers.

-

Q: Which application segment is expected to grow the largest over the next 10 years?A: Over the next 10 years, the household segment is expected to remain the largest growing segment in the United States Stain Remover Products Market.

-

Q: What are the latest trends in the Stain Remover Products market?A: A major shift toward plant-based, biodegradable, and chemical-free stain removers is underway, driven by consumer and regulatory pressures.

-

Q: What is the forecast period for this market analysis?A: The report forecasts market trends and growth from 2025 to 2035, using 2024 as the base year and considering historical data from 2020 to 2023.

Need help to buy this report?