United States Sports Drink Market Size, Share, By Ingredient (Citric Acid, Flavours and Preservatives, Salts and Electronics, Carbohydrates, Vitamins, Others), By Product Type (Hypotonic, Isotonic, and Hypertonic), and By End User (Athletes, Casual Consumers, Lifestyle User), and United States Sports Drink Market Insights, Industry Trend, Forecasts to 2035.

Industry: Consumer GoodsUnited States Sports Drink Market Insights Forecasts to 2035

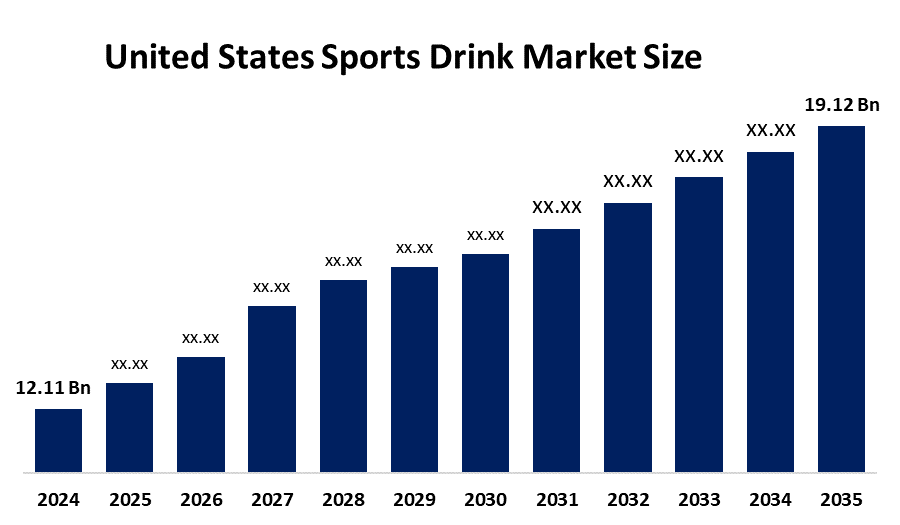

- United States Sports Drink Market Size 2024: USD 12.11 Billion

- United States Sports Drink Market Size 2035: USD 19.12 Billion

- United States Sports Drink Market CAGR: 4.24%

- United States Sports Drink Market Segments: Ingredient, Product Type, and End User

Get more details on this report -

The United States sports drinks market is witnessing steady growth as consumers increasingly prioritize health, wellness, and functional hydration in their daily routines. Demand is being driven by an increase in organized sports, endurance competitions, and fitness activities as well as a greater awareness of active lives. Clean-label, low-sugar sports drinks made with natural components that improve performance and hydration are replacing traditional sugary drinks as the preferred choice for consumers. Product accessibility and brand reach nationwide are being further improved by the growth of e-commerce and direct-to-consumer sales channels.

The U.S. market is also being impacted by regulatory scrutiny and public health measures. Although there isn't a federal sugar tax, several states and localities have imposed fees on sugar-sweetened beverages, and USDA dietary guidelines and FDA counsel encourage people to consume less sugar. Manufacturers are reformulating products with useful additives and less sugar as a result of these initiatives.

Innovations in technology, such as blockchain-enabled traceability, smart manufacturing, and AI-driven analytics, are increasing customer transparency and production efficiency. Additionally, in order to comply with environmental standards and changing consumer expectations, firms are progressively implementing sustainable packaging options.

Market Dynamics of the United States Sports Drink Market:

The market for sports drinks in the US is expanding steadily due to rising health consciousness and a robust exercise culture nationwide. Rising participation in sports, gym activities, outdoor recreation, and endurance events has increased demand for functional beverages that support hydration, energy replenishment, and performance enhancement. Clean-label sports beverages with minimal or no added sugar and natural components like electrolytes, vitamins, amino acids, and plant-based adaptogens are becoming more and more popular. By increasing product accessibility and allowing brands to interact directly with consumers, the growth of e-commerce and direct-to-consumer channels is also propelling market expansion.

The market is subject to a number of limitations in spite of these favourable factors. Health-conscious customers are paying more attention to traditional sports drinks due to growing worries about their high sugar content and artificial chemicals. Manufacturers are further challenged by state and municipal regulatory pressure, such as tariffs on sugar-sweetened beverages in some areas. Rapid expansion is also restricted by market saturation and fierce rivalry from other hydration options including flavored water, coconut water, and functional energy beverages.

However, the market presents significant growth opportunities. A wider range of consumers is anticipated as a result of innovative product composition, such as customized hydration solutions, plant-based and organic sports drinks, and improved functional advantages. The U.S. sports drink market is positioned for long-term growth thanks to developments in digital marketing, smart production technology, and sustainable packaging solutions.

United States Sports Drink Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 12.11 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 4.24% |

| 2035 Value Projection: | USD 19.12 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Ingredient, By End User |

| Companies covered:: | PepsiCo, Inc., The Coca-Cola Company, Monster Hydro, Electrolit, Lifeaid Beverage Co., BioSteel Sports Nutrition Inc, Hoist, Applied Nutrition Ltd, Others, and Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The United States sports drink market share is classified into ingredient, product type, and end user.

By Ingredient:

On the basis of ingredients, the United States sports drink market is categorized into citric acid, flavours and preservatives, salts and electronics, carbohydrates, vitamins, and others. Among these, the carbohydrates segment held the largest market share in 2024 and is expected to grow at a remarkable rate over the forecast period. This growth is driven by the critical role carbohydrates play in delivering quick energy, enhancing endurance, and supporting post-exercise recovery. Athletes, fitness enthusiasts, and anyone participating in high-intensity or endurance exercises frequently drink sports drinks enhanced with carbs.

By Product Type:

Based on product type United States sports drink market is divided into hypotonic, isotonic, and hypertonic. Among these, the isotonic segment accounted for the largest market share in 2024 and is expected to grow at a significant rate of CAGR during the projected period. The primary reason for this dominance is isotonic liquids have a balanced concentration of electrolytes and carbohydrates, which closely resembles the fluid composition of the body. As a result, they enable rapid hydration and efficient energy replenishment during moderate to high-intensity physical activities. Athletes and fitness aficionados generally favour isotonic sports beverages for usage during training, competition, and workouts.

By End User:

The United States sports drink market is classified by end user into athletes, casual consumers, and lifestyle users. Among these, the athletes segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. Professional and semi-professional athletes' high need for performance-enhancing hydration products that promote electrolyte balance, endurance, and recovery is what is driving this increase. Athletes continue to be the main end-user group in the market due to their regular intake during training and competitive sports.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the United States sports drink market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in the United States Sports Drink Market:

- PepsiCo, Inc.

- The Coca-Cola Company

- Monster Hydro

- Electrolit

- Lifeaid Beverage Co.

- BioSteel Sports Nutrition Inc

- Hoist

- Applied Nutrition Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States sports drink market based on the following segments:

United States Sports Drink Market, By Ingredient

- Citric Acid

- Flavours and Preservatives

- Salts and Electronics

- Carbohydrates

- Vitamins

- Others

United States Sports Drink Market, By Product Type

- Hypotonic

- Isotonic

- Hypertonic

United States Sports Drink Market, By End User

- Athletes

- Casual Consumers

- Lifestyle User

Frequently Asked Questions (FAQ)

-

1.What is the expected growth outlook of the United States sports drink market?The United States sports drink market is expected to grow from USD 12.11 billion in 2024 to USD 19.12 billion by 2035, registering a CAGR of 4.24% during the forecast period 2025–2035.

-

2.What factors are driving the growth of the U.S. sports drink market?Key growth drivers include rising health and fitness awareness, increasing participation in organized sports and endurance activities, growing demand for functional hydration products, and the shift toward clean-label, low-sugar, and natural ingredient formulations.

-

3.How do government regulations impact the U.S. sports drink market?While there is no federal sugar tax, state and local sugar-sweetened beverage taxes, along with FDA guidance and USDA dietary recommendations, are encouraging manufacturers to reduce sugar content and develop healthier product formulations.

-

4.Who are the key players in the United States sports drink market?Major players include PepsiCo, Inc., The Coca-Cola Company, Monster Hydro, Electrolit, Lifeaid Beverage Co., BioSteel Sports Nutrition Inc., Hoist, and Applied Nutrition Ltd, among others.

Need help to buy this report?