United States Sovereign Cloud Market Size, Share, and COVID-19 Impact Analysis, By Functionality (Data Sovereignty, Technical Sovereignty, and Operational Sovereignty), By Deployment (Cloud and On-Premise), By End-use (Government & Defense, Healthcare, BFSI, Telecommunications, Energy & Utilities, Manufacturing, and Others), and United States Sovereign Cloud Market Insights, Industry Trend, Forecasts To 2035.

Industry: Information & TechnologyUnited States Sovereign Cloud Market Insights Forecasts To 2035

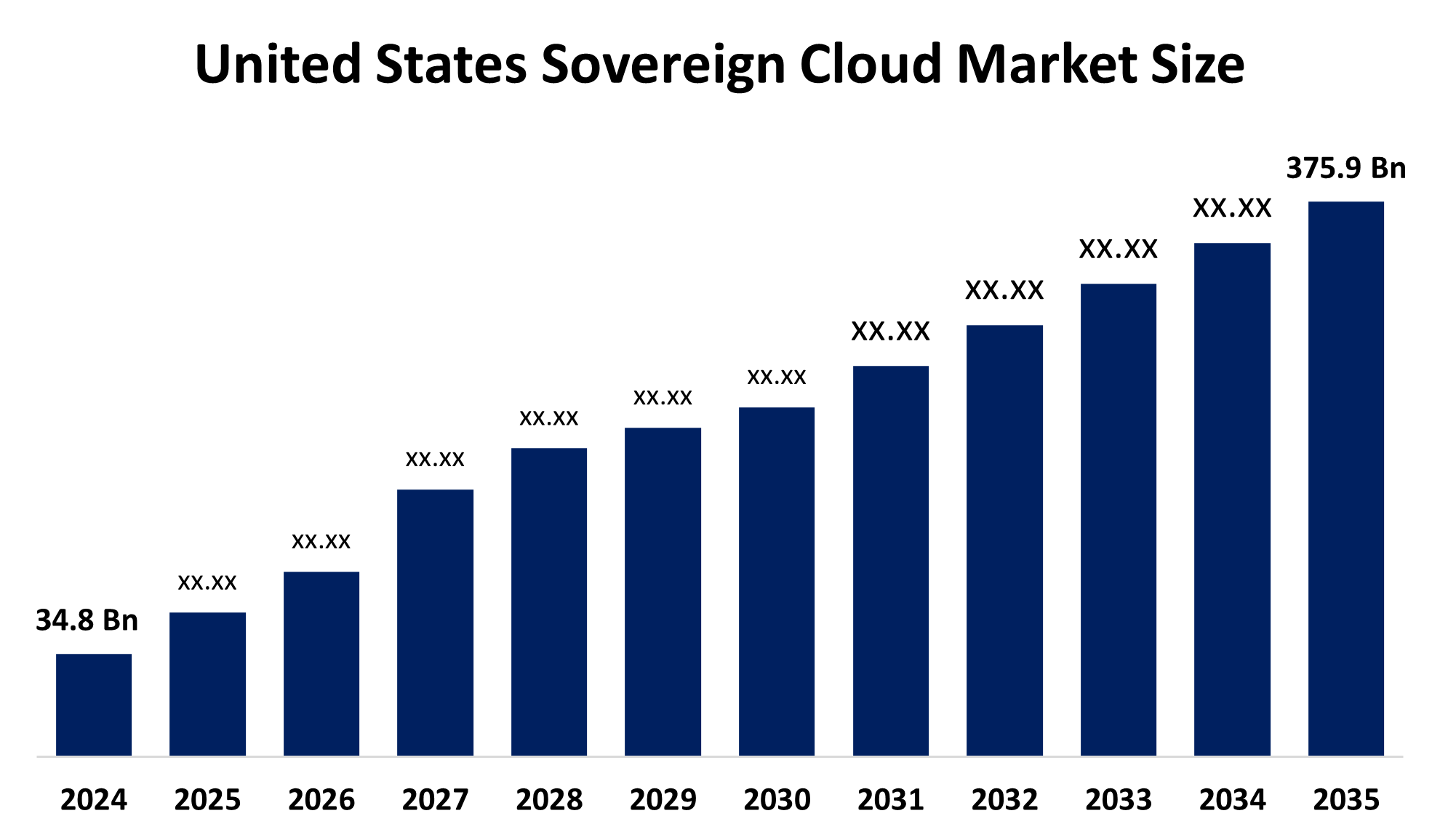

- The United States Sovereign Cloud Market Size Was Estimated at USD 34.8 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 24.15% from 2025 to 2035

- The United States Sovereign Cloud Market Size is Expected to Reach USD 375.9 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United States Sovereign Cloud Market Size is Expected To Grow From USD 34.8 Billion in 2024 to USD 375.9 Billion by 2035, growing at a CAGR of 24.15% during the Forecast Period 2025-2035. The U.S. sovereign cloud market is being driven by growing worries about cybersecurity, data sovereignty, and regulatory compliance. Sovereign cloud solutions are being adopted by businesses and government organizations to guarantee that data stays inside national boundaries and conforms with local laws.

Market Overview

Sovereign cloud refers to an infrastructure and service paradigm for cloud computing that guarantees that data, apps, and workloads continue to be fully continuous under the jurisdiction, governance, and control of a particular country. A sovereign cloud acts according to the standards related to the data residence, data secrecy, and digital sovereignty according to regional laws, rules, and standards, contrary to traditional public cloud services that can store or process data in international data centers. This guarantees governments, important companies, and highly regulated sectors that foreign institutions will access or handle sensitive data. The sovereign clouds are usually run directly or with the help of local suppliers approved by the government approved by the government. They can include both the oversight operating oversight by institutions with local jurisdiction and infrastructure that is physically located within national boundaries. They promote digital independence in addition to security, ensuring that the nations are not dependent on foreign cloud providers for important digital infrastructure. Provide equal cost-effectiveness, scalability, and flexibility as traditional cloud systems, but with additional safety measures against cross-border transfer, illegal data access, and foreign government intervention. These platforms also make it possible for governments and businesses to use cloud services without renouncing security, privacy, or integrity of sensitive data.

Report Coverage

This research report categorizes the USA sovereign cloud market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the USA sovereign cloud market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.S. sovereign cloud market.

Driving Factor

The United States sovereign cloud market is driven by the demand for increasing sovereignty, more stringent regulatory structures, and increasing concerns about data sovereignty. Demand is further intensified for data localization, an increase in government mandates, digital change projects, and the need for safe AI and IOT adoption. Strategic alliances between regional operators and international cloud providers help to improve confidence and market entry.

Restraining Factor

The United States sovereign cloud market has to face restrictions due to competition from high implementation costs, restricted scalability, and compatibility issues compared to global public clouds. In addition, development can be constrained by regional providers dependence on regional providers and dependence on low innovation cycles than hyperscale cloud vendors, especially for businesses that require advanced abilities and global integration.

The United States sovereign cloud market share is classified into functionality, deployment, and end-use.

- The data sovereignty dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The United States sovereign cloud market is segmented by functionality into data sovereignty, technical sovereignty, and operational sovereignty. Among these, data sovereignty dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. This is due to the businesses holding a high priority on strict adherence to national data rules, that data is handled, processed, and maintained at a domestic level. In addition, data sovereignty is becoming an important requirement for both public and private sector organizations due to tight privacy laws and increasing concerns about illegal data access and foreign monitoring.

- The cloud segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the projected timeframe.

The United States sovereign cloud market is segmented by deployment into cloud and on-premise. Among these, the cloud segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the projected timeframe. This is due to the scalable, increasing demand for safe infrastructure, which corresponds to strict national privacy and data sovereignty laws. In addition, large cloud providers such as AWS, Microsoft, and Oracle have installed U.S.-based data centers and special sovereign cloud solutions to clearly address these needs.

- The healthcare segment is expected to grow fastest during the forecast period.

The United States sovereign cloud market is segmented by end-use into government & defense, healthcare, BFSI, telecommunications, energy & utilities, manufacturing, and others. Among these, the healthcare segment is expected to grow fastest during the forecast period. This is due to increasing concern about data privacy and the quick digitization of medical services. In addition, the increasing use of AI-competent diagnostics, electronic health records (EHRS), and telemedicine has produced large-scale, significant health data that needs to be safely processed and stored.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the United States sovereign cloud market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List Of Companies

- Amazon Web Services, Inc.

- Microsoft Corporation

- Google LLC

- Oracle Corporation

- IBM Corporation

- Hewlett-Packard Enterprise Company

- Rackspace Technology, Inc

- Other

Key Target Audience

- Market Players

- Investors

- End users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value Added Resellers (VARs)

Market Segments

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States sovereign cloud market based on the below-mentioned segments:

United States Sovereign Cloud Market, By Functionality

- Data Sovereignty

- Technical Sovereignty

- Operational Sovereignty

United States Sovereign Cloud Market, By Deployment

- Cloud

- On-Premise

United States Sovereign Cloud Market, By End-Use

- Government & Defense

- Healthcare

- BFSI

- Telecommunications

- Energy & Utilities

- Manufacturing

- Others

Frequently Asked Questions (FAQ)

-

1. What is the market size of the United States sovereign cloud market in 2024?The United States sovereign cloud market size was estimated at USD 34.8 billion in 2024.

-

2. What is the forecasted market size of the United States sovereign cloud market by 2035?The market is expected to reach USD 375.9 billion by 2035.

-

3. What is the growth rate (CAGR) of the United States sovereign cloud market during 2025–2035?The market is projected to grow at a CAGR of 24.15% from 2025 to 2035.

-

4. What factors are driving the growth of the U.S. sovereign cloud market?Growth is driven by cybersecurity concerns, strict data sovereignty regulations, government mandates for data localization, rising adoption of AI and IoT, and partnerships between local operators and global cloud providers.

-

5. What are the restraining factors in the United States sovereign cloud market?High implementation costs, limited scalability, compatibility issues with global cloud services, and slower innovation cycles compared to hyperscale providers restrain market growth.

-

6. Which functionality segment dominated the market in 2024?The data sovereignty segment dominated in 2024 and is expected to maintain strong growth due to strict privacy laws and compliance requirements.

-

7. Which deployment model held the largest market share in 2024?The cloud deployment model held the largest share in 2024, driven by scalable, secure infrastructure that complies with U.S. data sovereignty laws.

-

8. Who are the key players in the United States sovereign cloud market?Major players include Amazon Web Services, Microsoft, Google, Oracle, IBM, Hewlett-Packard Enterprise, Rackspace Technology, and others.

-

9. Who are the key target audiences for this market?Key audiences include market players, investors, government authorities, consulting and research firms, venture capitalists, end-users, and value-added resellers (VARs).

-

10. What is the forecast period covered in this report?The report covers historical data from 2020–2023, with forecasts from 2025 to 2035.

Need help to buy this report?