United States Solar Encapsulation Market Size, Share, And COVID-19 Impact Analysis, By Material (Ethylene Vinyl Acetate, Polyvinyl Butyral, Polyolefin, Ionomer, and Others), By Application (Ground-mounted, Building-integrated photovoltaic, Floating photovoltaic, and Others), By Technology (Crystalline Silicon Solar and Thin-Film Solar) and United States Solar Encapsulation Market Insights, Industry Trend, Forecasts To 2035

Industry: Energy & PowerUnited States Solar Encapsulation Market Size Insights Forecasts to 2035

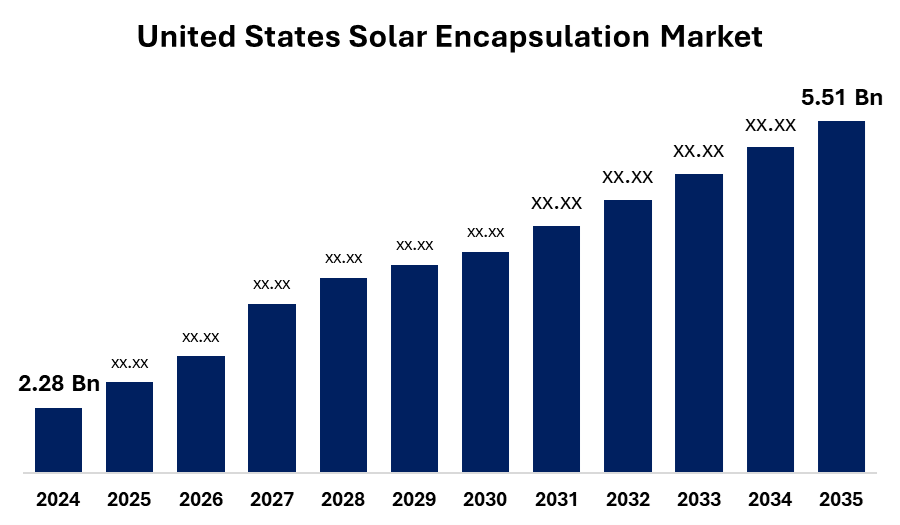

- The United States Solar Encapsulation Market Size Was Estimated at USD 2.28 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.35% from 2025 to 2035

- The United States Solar Encapsulation Market Size is Expected to Reach USD 5.51 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United States Solar Encapsulation Market Size is anticipated to reach USD 5.51 Billion by 2035, growing at a CAGR of 8.35% from 2025 to 2035.The United States solar encapsulation market is being driven by demand for advanced encapsulants that improve solar panel performance, longevity, and sustainability is primarily driven by increased adoption of solar energy, significant technological advancements in solar module manufacturing for higher efficiency and durability, and strict government regulations promoting clean energy.

Market Overview

Solar encapsulation is the process of attaching photovoltaic cells within a solar module, which emphasizes the use of encapsulating materials to provide longevity, mechanical support and protection against environmental factors. Encapsulating materials such as solar cells such as dust, moisture, UV radiation, and mechanical stress are used. It ensures the durability, reliability, and efficiency of solar panels throughout their operational life. Typically, encapsulants are made of advanced polymers like EVA (ethylene-vinyl acetate), polyolefins, or thermoplastic materials that provide excellent adhesion, optical transparency, and thermal stability materials ensure electrical insulation and optical transparency by increasing the performance, efficiency, and lifetime of the solar panel. Innovation modules, such as innovation and UV-resistant encapsulants, are improving performance and helping to reduce the cost of maintenance. the existence of characteristics such as strong light communication, mechanical resistance, insulation, and mechanical resistance, along with increasing awareness about renewable energy benefits, is expected an increase in expansion in the solar encapsulation market.

Report Coverage

This research report categorizes the United States solar encapsulation market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States solar encapsulation market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States solar encapsulation market.

United States Solar Encapsulation Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.28 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 8.35% |

| 2035 Value Projection: | USD 5.51 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 147 |

| Tables, Charts & Figures: | 128 |

| Segments covered: | By Material, By Application, By Technology And COVID-19 Impact Analysis |

| Companies covered:: | First Solar, DuPont, 3M, SKC Co., Ltd., Mitsui Chemicals, Inc., HANGZHOU FIRST APPLIED MATERIAL CO., LTD., STR Holdings, Inc., Solutia Inc., Advanced Polymer Technology Corp., TPI Polene Power Public Co. Ltd, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factor

The United States solar encapsulation market is expanding due to the increasing requirement of long-lasting and effective PV modules in residential, commercial and utility-manual projects. Technological progress in UV-resistant and moisture-proof solutions such as encapsulant materials, further enhances the performance of solar panels, expands lifetime and improves energy production, which promotes adoption.

Restraining Factor

The prices of raw materials, which affect encapsulants, affect the production costs, and withstand technical challenges such as encapsulant malanusiran or reducing efficiency over time. Additionally, limited recycling infrastructure for encapsulation materials enhances environmental concerns and may disrupt the profit margin and slow down overall market expansion.

Market Segmentation

The United States solar encapsulation market share is classified into material type, application, and technology.

- The ethylene vinyl acetate segment dominated the market in 2024 and is anticipated to grow substantial CAGR during the forecast period.

The United States solar encapsulation market is segmented by material type into ethylene vinyl acetate, polyvinyl butyral, polyolefin, ionomer, and others. Among these, the ethylene vinyl acetate segment dominated the market in 2024 and is anticipated to grow substantial CAGR during the forecast period. Ethylene vinyl acetate prominence is largely attributed to its proven performance, high optical transparency, and strong adhesion properties. It is an encapsulator of choice for crystalline silicone-based solar modules that are widely used in establishments in U.S. residential, commercial and utility.

- The ground-mounted segment dominated the market in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The United States solar encapsulation market is segmented by application into ground-mounted, building-integrated photovoltaic, floating photovoltaic, and others. Among these, the ground-mounted segment dominated the market in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Ground-mounted systems provide better energy production due to customized orientation and minimal shading, making them ideal for large projects benefiting from federal tax credits and utility purchase programs. As American clean energy moves forward for freedom and its purpose is to decrease its power grid.

- The crystalline silicon solar segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States solar encapsulation market is segmented by technology into crystalline silicon solar and thin-film solar. Among these, the crystalline silicon solar segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. Crystalline silicone modules having high conversion efficiency, long lifespan, and strong performance in diverse climatic regions remain the technique of choice in the US due to their strong performance. With the emphasis on the decarbonization of their power grid with the country, utility-scale and commercial establishments remain in favor of C-C module, which continuously increases demand for encasing materials.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the United States solar encapsulation market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- First Solar

- DuPont

- 3M

- SKC Co., Ltd.

- Mitsui Chemicals, Inc.

- HANGZHOU FIRST APPLIED MATERIAL CO., LTD.

- STR Holdings, Inc.

- Solutia Inc.

- Advanced Polymer Technology Corp.

- TPI Polene Power Public Co. Ltd

- Other

Recent Development

- In February 2025, Advanced Polymer Technology Corp. announced the expansion of its solar encapsulation manufacturing operations in Houston, Texas. The new facility aims to enhance the production of advanced, high-performance encapsulant materials designed for next-generation photovoltaic modules, including bifacial and high-efficiency solar cells. This strategic move supports the rising demand for durable, UV-resistant, and thermally stable encapsulations as utility-scale solar projects gain momentum across the U.S.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States Solar Encapsulation market based on the below-mentioned segments:

United States Solar Encapsulation Market, By Material Type

- Ethylene Vinyl Acetate

- Polyvinyl Butyral

- Polyolefin

- Ionomer

- Others

United States Solar Encapsulation Market, By Application

- Ground-Mounted

- Building-Integrated Photovoltaic

- Floating Photovoltaic

- Others.

United States Solar Encapsulation Market, By Technology

- Crystalline Silicon Solar

- Thin-Film Solar

Frequently Asked Questions (FAQ)

-

Q:1 What was the market size of the U.S. solar encapsulation market in 2024?The U.S. solar encapsulation market size was valued at USD 2.28 billion in 2024.

-

Q:2 What is the expected market size of the U.S. solar encapsulation market by 2035?The market is projected to reach USD 5.51 billion by 2035.

-

Q:3 At what CAGR is the U.S. solar encapsulation market expected to grow from 2025 to 2035?The market is expected to expand at a CAGR of 8.35% during the forecast period.

-

Q:4 What are the key factors driving the growth of the U.S. solar encapsulation market?Key drivers include the increasing adoption of solar energy, advancements in encapsulant technologies, government incentives for clean energy, and the demand for long-lasting, efficient PV modules.

-

Q:5 Which material segment dominated the U.S. solar encapsulation market in 2024?The Ethylene Vinyl Acetate (EVA) segment dominated in 2024 due to its high transparency, adhesion, and reliability in crystalline silicon modules.

-

Q:6 Which application segment held the largest share of the U.S. solar encapsulation market in 2024?The ground-mounted segment dominated in 2024, supported by large-scale solar projects and federal tax credits.

-

Q:7 Which technology segment accounted for the largest share in 2024?The Crystalline Silicon Solar technology segment held the largest share in 2024 because of its high efficiency and durability.

-

Q:8 What are the major restraining factors of the U.S. solar encapsulation market?Restraints include volatile raw material costs, technical challenges with encapsulant degradation, and limited recycling infrastructure, which may affect profit margins.

-

Q:9 Who are some of the key players operating in the U.S. solar encapsulation market?Major players include First Solar, DuPont, 3M, SKC Co. Ltd., Mitsui Chemicals, STR Holdings, and Advanced Polymer Technology Corp.

-

Q:10 What is the forecast period covered in this report?The report covers the U.S. solar encapsulation market forecast from 2025 to 2035, with historical data from 2020–2023 and a base year of 2024.

Need help to buy this report?