United States Small Molecule Drug Discovery Outsourcing Market Size, Share, and COVID-19 Impact Analysis, By Service (Chemistry Services and Biology Services), By End-Use (Pharmaceutical & Biotechnology Companies and Academic Institutes), and United States Small Molecule Drug Discovery Outsourcing Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited States Small Molecule Drug Discovery Outsourcing Market Size Insights Forecasts to 2035

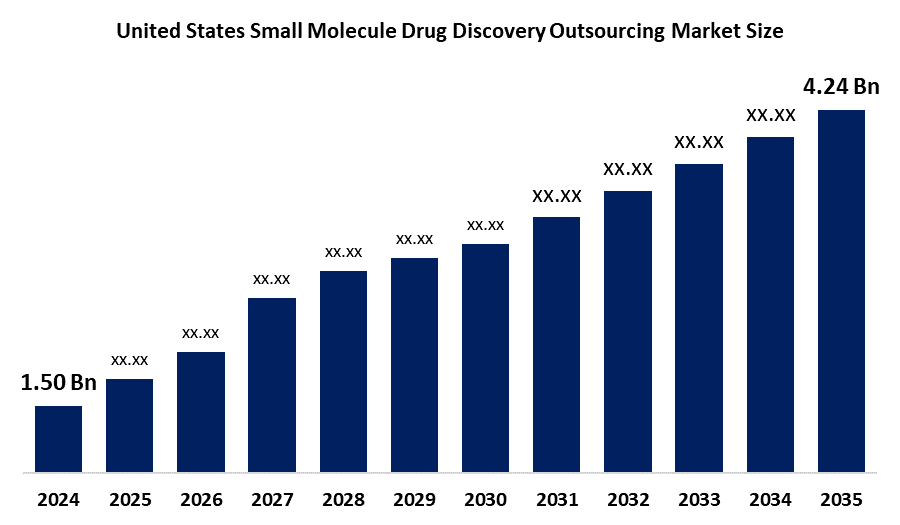

- The United States Small Molecule Drug Discovery Outsourcing Market Size Was Estimated at USD 1.50 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 9.91% from 2025 to 2035

- The United States Small Molecule Drug Discovery Outsourcing Market Size is Expected to Reach USD 4.24 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The United States Small Molecule Drug Discovery Outsourcing Market Size is anticipated to Reach USD 4.24 Billion by 2035, Growing at a CAGR of 9.91% from 2025 to 2035. The United States small molecule drug discovery outsourcing market is growing due to the growing prevalence of chronic disease, an aging population, innovations in AI, high-throughput screening, and computational chemistry, combined with a robust United States pharmaceutical and biotech ecosystem backed by strong funding and regulatory support, which are boosting efficiency and fostering advancements in small-molecule drug discovery.

Market Overview

The United States small molecule drug discovery outsourcing market refers to the segment of the pharmaceutical and biotechnology industry in the United States focused on the research, identification, and development of low-molecular-weight chemical compounds that can be developed into therapeutic drugs. The market is mainly used for developing treatments in oncology, cardiovascular diseases, CNS disorders, infectious diseases, metabolic conditions like diabetes, and autoimmune diseases. In the United States, the growing prevalence of chronic diseases and an aging population are driving demand for small-molecule drug discovery outsourcing, as pharma companies seek faster development of therapies for conditions like cancer, diabetes, and cardiovascular diseases.

The United States small molecule drug discovery outsourcing market offers strong opportunities for CROs, enabling pharma companies to access expertise, advanced technologies, and cost-efficient solutions, shorten development timelines, and focus on core activities while meeting the growing demand for chronic and age-related disease treatments. In November 2024, AstraZeneca will invest $50 billion in U.S. R&D and manufacturing, including a Virginia facility for small molecules, peptides, oligonucleotides, and expansions in Maryland, Massachusetts, Indiana, Texas, and California.

Report Coverage

This research report categorizes the market for the United States small molecule drug discovery outsourcing market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States small molecule drug discovery outsourcing market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States small molecule drug discovery outsourcing market.

United States Small Molecule Drug Discovery Outsourcing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.50 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 9.91% |

| 2035 Value Projection: | USD 4.24 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 177 |

| Tables, Charts & Figures: | 99 |

| Segments covered: | By Service, By End-Use and COVID-19 Impact Analysis |

| Companies covered:: | Charles River Laboratories, Curia Global, Inc., Eurofins Scientific, Labcorp, Merck & Co., Inc., Oncodesign, Evotec, GenScript Biotech, Pharmaron, Syngene International, BridGene Biosciences, and Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The United States small molecule drug discovery outsourcing market is driven by the increasing incidence of chronic diseases such as cancer, diabetes, and cardiovascular disorders, which is driving a strong demand for new therapies, while the expanding elderly population, who are more prone to complex health conditions, heightens the need for targeted treatments. To manage costs and accelerate development, pharmaceutical companies are increasingly turning to contract research organizations (CROs) for specialized expertise and research support. Furthermore, innovations in AI, high-throughput screening, and computational chemistry, combined with a robust United States pharmaceutical and biotech ecosystem backed by strong funding and regulatory support, are boosting efficiency and fostering advancements in small-molecule drug discovery.

Restraining Factors

The small molecule drug discovery outsourcing market in the United States is mostly constrained by the high R&D costs, regulatory challenges, intense competition, technical and scientific risks, complexity, targeting certain diseases, limited access to advanced technologies, pricing pressure and reimbursement challenges, supply chain constraints, and evolving market dynamics.

Market Segmentation

The United States small molecule drug discovery outsourcing market share is classified into service and end-use.

- The chemistry services segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States small molecule drug discovery outsourcing market is segmented by service into chemistry services and biology services. Among these, the chemistry services segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the growing demand for early-stage medicinal and synthetic chemistry, which is prompting pharmaceutical and biotech companies to increasingly engage contract research organizations (CROs) for access to advanced synthesis capabilities, scalable compound libraries, SAR expertise, and specialized chemical optimization, particularly for complex and covalent small-molecule development.

- The pharmaceutical & biotechnology companies segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The United States small molecule drug discovery outsourcing market is segmented by end-use into pharmaceutical & biotechnology companies and academic institutes. Among these, the pharmaceutical & biotechnology companies segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This is due to the fact that pharmaceutical and biotechnology companies are increasingly relying on contract research organizations (CROs) to optimize discovery pipelines and alleviate operational challenges. Rising R&D costs, regulatory complexities, and the need for faster delivery of innovative therapies have driven outsourcing. Strategic partnerships and licensing agreements further support portfolio diversification and exploration of novel small-molecule targets, particularly in oncology and CNS disorders.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States small molecule drug discovery outsourcing market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Charles River Laboratories

- Curia Global, Inc.

- Eurofins Scientific

- Labcorp

- Merck & Co., Inc.

- Oncodesign

- Evotec

- GenScript Biotech

- Pharmaron

- Syngene International

- BridGene Biosciences

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In October 2025, Charles River Laboratories announced a strategic collaboration with X-Chem to accelerate DNA-encoded library hit identification in early discovery.

- In April 2025, Charles River Laboratories expanded its collaboration with CAS (American Chemical Society division) to enhance scientific innovation in drug discovery workflows.

- In February 2025, BridGene Biosciences announced a strategic collaboration and licensing agreement with Takeda. Using its IMTAC chemoproteomics platform, BridGene will identify novel small-molecule candidates for challenging immunology and neurology targets.

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States small molecule drug discovery outsourcing market based on the below-mentioned segments:

United States Small Molecule Drug Discovery Outsourcing Market, By Service

- Chemistry Services

- Biology Services

United States Small Molecule Drug Discovery Outsourcing Market, By End-Use

- Pharmaceutical and Biotechnology Companies

- Academic Institutes

Frequently Asked Questions (FAQ)

-

Q. What is the projected market size of the United States small molecule drug discovery outsourcing market by 2035?A: The United States small molecule drug discovery outsourcing market is expected to grow from USD 1.50 billion in 2024 to USD 4.24 billion by 2035, expanding at a CAGR of approximately 9.91% during the forecast period 2025–2035.

-

Q. What are the main drivers of the United States small molecule drug discovery outsourcing market?A: The market is driven by the rising prevalence of chronic diseases such as cancer, diabetes, and cardiovascular disorders, an aging population, innovations in AI, high-throughput screening, computational chemistry, and a robust pharmaceutical and biotech ecosystem with strong funding and regulatory support.

-

Q. What are the major restraining factors for the United States small molecule drug discovery outsourcing market?A: The United States small molecule drug discovery outsourcing market is constrained by high R&D costs, stringent regulatory requirements, intense competition, scientific and technical risks, supply chain constraints, limited access to advanced technologies, pricing pressures, and challenges in targeting complex or rare diseases.

-

Q. Who are the key players in the United States small molecule drug discovery outsourcing market?A: Key players include Charles River Laboratories, Curia Global, Eurofins Scientific, Labcorp, Merck & Co., Oncodesign, Evotec, GenScript Biotech, Pharmaron, Syngene International, and BridGene Biosciences, providing CRO services, medicinal chemistry, biology, and early-stage small-molecule discovery support.

Need help to buy this report?