United States Sealing Membrane Market Size, Share, and COVID-19 Impact Analysis, By Product (Sheet Membranes and Liquid-Applied Membranes), By End Use (Residential, Commercial, and Industrial), and United States Sealing Membrane Market Insights, Industry Trend, Forecasts To 2035

Industry: Advanced MaterialsUnited States Sealing Membrane Market Insights Forecasts To 2035

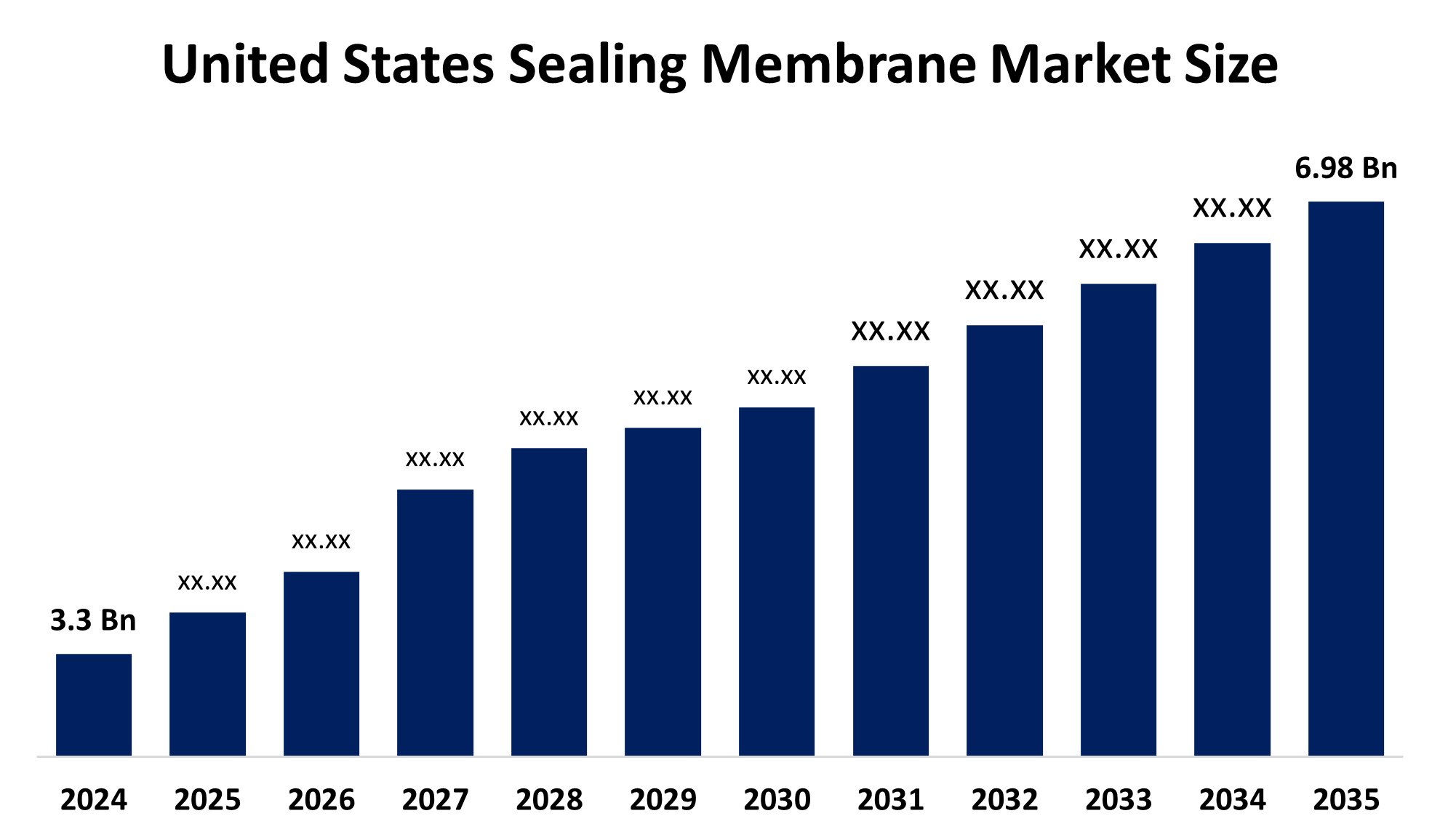

- The U.S. Sealing Membrane Market Size Was Estimated at USD 3.3 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.05% from 2025 to 2035

- The U.S. Sealing Membrane Market Size is Expected to Reach USD 6.98 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The United States Sealing Membrane Market is Anticipated To Reach USD 6.98 Billion by 2035, Growing at a CAGR of 7.05% from 2025 to 2035. The United States sealing membrane market is being driven by rising construction activity, investments in affordable housing, and a renewed emphasis on building durability and sustainability.

Market Overview

A sealing membrane is a protective barrier material that prevents water, moisture, and other fluids from passing through surfaces such as concrete, masonry, metal, or wood. It is important in protecting structures from damage due to seepage, leakage, and environmental risk. Ceiling membranes are available in different types of forms, including liquid-applied coatings, sheet membranes, and spray-applied systems, each of which is designed to meet specific construction and industrial requirements. The sealing membrane is recognized for its ability to provide long-term moisture protection by increasing the longevity and stability of buildings and infrastructure. They are usually used in roof systems, cellars, tunnels, water reservoirs, bridges, and wastewater treatment plants. In residential conditions, they prevent water damage to bathrooms, kitchens, and balconies. Beyond the resistance to water, the new sealing membrane is designed for flexible, UV-stable, chemically resistant, and crack-resistant, which suits them for both rigid outdoor climates and high-stress applications. The extension of environmentally friendly, solvent-free, and recycled sealing membranes places more emphasis on permanent construction materials.

Report Coverage

This research report categorizes the United States sealing membrane market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States sealing membrane market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States sealing membrane market.

Driving Factor

The US sealing membrane market is driven by increasing infrastructure investment, more green building initiatives, and increasing demand for waterproofing in residential and commercial development. Strict construction quality and durability rules, as well as environmentally friendly and high-performance progress in membrane, are accelerating adoption in a wide range of industries, including roofs, tunnels, and water management.

Restraining Factor

The US sealing membrane market has to face restrictions due to High installation costs, slight awareness in small construction projects, and performance issues under adverse weather conditions, all obstruct market expansion. Additionally, competition from traditional waterproofing technologies, as well as variation in the price of raw materials, reduces obstacles for wider adoption.

The United States Sealing Membrane market share is classified into product and end-use.

- The liquid-applied membranes segment accounted for the highest revenue share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The U.S. sealing membrane market is segmented by product into sheet membranes and liquid-applied membranes. Among these, the liquid-applied membranes segment accounted for the highest revenue share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. Liquid-long membranes are gaining popularity due to their flexibility, easy applications, and adaptation to complex surfaces. Liquid yoga can easily suit unusual shapes, making them perfect for repair and renewal on any surface. The facility of deploying these membranes without considerable destruction contributes to their popularity.

- The residential segment dominated the market in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The U.S. sealing membrane market is segmented by end-use into residential, commercial, and industrial. Among these, the residential segment dominated the market in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Effective waterproofing for foundations, roofs, and cellars is preferred to protect structural integrity by homeowners and builders and extend the lives of their properties. Along with government incentives, knowledge of the long-term benefits of moisture conservation has increased, and a discretionary expenditure has removed waterproofing for an important investment.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the United States sealing membrane market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- GAF Materials LLC

- Carlisle SynTec Systems

- Johns Manville. A Berkshire Hathaway Company

- Sika Sarnafil

- Others

Key Target Audience

- Market Players

- Investors

- End users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States sealing membrane market based on the below-mentioned segments:

United States Sealing Membrane Market, By Product

- Sheet Membranes

- Liquid-Applied Membranes

United States Sealing Membrane Market, By End-Use

- Residential

- Commercial

- Industrial

Frequently Asked Questions (FAQ)

-

1. What is the United States sealing membrane market size in 2024?The U.S. sealing membrane market size was estimated at USD 3.3 billion in 2024.

-

2. What is the projected market size by 2035?The market is expected to reach USD 6.98 billion by 2035.

-

3. What is the expected growth rate (CAGR) of the market?The market is projected to grow at a CAGR of 7.05% from 2025 to 2035.

-

4. What are the main product types in the U.S. sealing membrane market?The market is segmented into sheet membranes and liquid-applied membranes.

-

5. Which product segment dominated the U.S. sealing membrane market in 2024?The liquid-applied membranes segment accounted for the highest revenue share due to flexibility, easy application, and suitability for complex surfaces.

-

6. Which end-use sector led the U.S. sealing membrane market in 2024?The residential sector is dominated, driven by rising demand for waterproofing in foundations, roofs, and basements.

-

7. What factors are driving the U.S. sealing membrane market?Key drivers include increasing infrastructure investment, green building initiatives, government support, and the growing need for durable waterproofing solutions.

-

8. What are the restraining factors in the U.S. sealing membrane market?Challenges include high installation costs, limited awareness in smaller projects, weather-related performance concerns, raw material price fluctuations, and competition from traditional waterproofing methods.

-

9. Who are the key players in the U.S. sealing membrane market?Major players include GAF Materials LLC, Carlisle SynTec Systems, Johns Manville (Berkshire Hathaway), and Sika Sarnafil.

Need help to buy this report?