United States Reverse Osmosis Membrane Market Size, Share, By Configuration (Spiral Wound, Hollow-Fiber, Tubular, And Plate & Frame), By Application (Industrial Water Treatment, Desalination, Residential Water Purification, And Others), And United States Reverse Osmosis Membrane Market Insights, Industry Trend, Forecasts to 2035.

Industry: Chemicals & MaterialsUnited States Reverse Osmosis Membrane Market Insights Forecasts to 2035

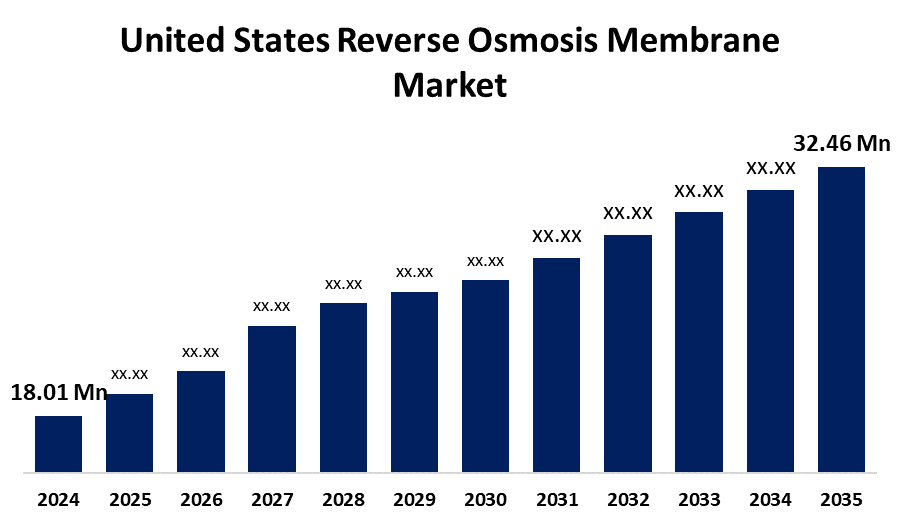

- United States Reverse Osmosis Membrane Market Size 2024: 18.01 Million Units

- United States Reverse Osmosis Membrane Market Size 2035: 32.46 Million Units

- United States Reverse Osmosis Membrane Market CAGR 2024: 5.5%

- United States Reverse Osmosis Membrane Market Segments: Configuration and Application

Get more details on this report -

The United States reverse osmosis (RO) membrane market encompasses the production and supply of RO membrane In the United States. The demand for reverse osmosis membranes has been rapidly increasing because of the growing adoption of advanced water treatment and purification technologies in municipalities, utilities and industries throughout the nation. This increase has been primarily driven by the rising concerns surrounding water scarcity, increasing numbers of aging infrastructures and stricter environmental regulations. As a result of these factors, the U.S. reverse osmosis membrane marketplace accounts for a large share of North America’s reverse osmosis membrane sales volume.

The reverse osmosis membrane in United States are backed by government support, including the Bipartisan Infrastructure Law, which allocates tens of billions of dollars to the Environmental Protection Agency (EPA) and other agencies to upgrade municipal drinking water, wastewater, and stormwater systems. According to the EPA, over 80% of water bodies in the United States are affected by some form of pollution, underscoring the scale of the water quality challenge and the consequent requirement for advanced purification technologies like RO membranes in both municipal and industrial applications to ensure regulatory compliance and protect ecosystems.

As technology advances, United States reverse osmosis membrane providers are now creating membranes that are more crowded-resistant and higher than previous generations. These new membranes are being designed to work better and for longer periods without reducing the amount of energy they require by operating at lower operating pressures. New technologies allow for the use of real-time monitoring sensors and ultra-thin films that are low energy which not only prolong the life of the membrane, but they also help to reduce the lifetime cost of the membrane. These new technologies have greatly increased the viability of RO systems in many applications such as desalination, urban water reuse, and industrial water treatment.

Market Dynamics of the United States Reverse Osmosis Membrane Market:

The United States reverse osmosis membrane market is driven by the increasing water scarcity and deteriorating groundwater quality, demand for reliable water purification solutions, rapid urbanization and industrial expansion, demand for treated water for processes and sanitation, rising health and environmental awareness among consumers and policymakers, continued expansion of municipal water infrastructure, and regulatory frameworks aimed at improving water quality further stimulate adoption of RO systems across sectors.

The United States reverse osmosis membrane market is restrained by the high capital and operational costs, more energy consumption for high-pressure operations, membrane fouling and maintenance issues, the need for extensive pretreatment infrastructure, and economic and technical barriers.

The future of United States reverse osmosis membrane market is bright and promising, with versatile opportunities emerging from the increasing water shortages being experienced particularly in some areas. There has been an uptick in demand for municipal desalination and water reuse projects. Demand is also being driven by the various improvements made to existing infrastructure such as industrial wastewater recycling and the introduction of more stringent water quality regulations. In addition to this, technological developments in energy-efficient and anti-fouling membranes are opening up new opportunities for growth within the municipal, household, and decentralized treatment markets as the use of reverse osmosis systems becomes more prevalent.

United States Reverse Osmosis Membrane Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 18.01 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.5% |

| 2035 Value Projection: | 32.46 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 89 |

| Segments covered: | By Configuration, By Application |

| Companies covered:: | DuPont Water Solutions, Toray Industries, LG Chem, Hydranautics, Pentair X-Flow, Aquatech International, Applied Membranes, Inc., Axeon Water Technologies, Kovalus Separation Solutions, Veolia Water Technologies & Solutions, Pall Corporation, Solenis, Synder Filtration, Samco Technologies, Inc., 3M, and Others. |

| Pitfalls & Challenges: | COVID-19 Impact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The United States REVERSE OSMOSIS MEMBRANE MARKET share is classified into configuration and application.

By Configuration:

The United States reverse osmosis membrane market is divided by configuration into spiral wound, hollow fiber, tubular, and plate & frame. Among these, the spiral wound segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Superior performance, high durability in saline water conditions, cost-effectiveness, high packing density, compact design, and favoured for large scale municipal, industrial, and desalination application all contribute to the spiral wound segment's largest share and higher spending on reverse osmosis membrane when compared to other configuration.

By Application:

The United States reverse osmosis membrane market is divided by application into industrial water treatment, desalination, residential water purification, and others. Among these, the industrial water treatment segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The industrial water treatment segment dominates because of strict environmental regulations on wastewater discharge, high demand for high-purity water in manufacturing, and the necessity for industrial water recycling amid acute water scarcity in United States.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the United States reverse osmosis membrane market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in United States Reverse Osmosis Membrane Market:

- DuPont Water Solutions

- Toray Industries

- LG Chem

- Hydranautics

- Pentair X-Flow

- Aquatech International

- Applied Membranes, Inc.

- Axeon Water Technologies

- Kovalus Separation Solutions

- Veolia Water Technologies & Solutions

- Pall Corporation

- Solenis

- Synder Filtration

- Samco Technologies, Inc.

- 3M

- Others

Recent Developments in United States Reverse Osmosis Membrane Market:

In December 2025, DuPont announced the launch of the FilmTec SW30XLE-400/34 reverse osmosis element, a low energy, fouling-resistant membrane designed specifically for seawater desalination offering upto 25% lower initial pressure drop compared to previous generations, enhancing efficiency and reducing cleaning frequency.

In November 2025, Watts launched a new series of Commercial Reverse Osmosis systems designed for industrial applications. These systems use ultra-low-energy membranes to increase water production while minimizing energy consumption.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the United States reverse osmosis membrane market based on the below-mentioned segments:

United States Reverse Osmosis Membrane Market, By Configuration

- Spiral Wound

- Hollow Fiber

- Tubular

- Plate & Frame

United States Reverse Osmosis Membrane Market, By Application

- Industrial Water Treatment

- Desalination

- Residential Water Purification

- Others

Frequently Asked Questions (FAQ)

-

What is the United States reverse osmosis membrane market size?United States reverse osmosis membrane market is expected to grow from 18.01 million units in 2024 to 32.46 million units by 2035, growing at a CAGR of 5.5% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by the increasing water scarcity and deteriorating groundwater quality, demand for reliable water purification solutions, rapid urbanization and industrial expansion, demand for treated water for processes and sanitation, rising health and environmental awareness among consumers and policymakers, continued expansion of municipal water infrastructure, and regulatory frameworks aimed at improving water quality further stimulate adoption of RO systems across sectors.

-

What factors restrain the United States reverse osmosis membrane market?Constraints include the high capital and operational costs, more energy consumption for high-pressure operations, membrane fouling and maintenance issues, the need for extensive pretreatment infrastructure, and economic and technical barriers.

-

How is the market segmented by configuration?The market is segmented into spiral wound, hollow fiber, tubular, and plate & frame.

-

Who are the key players in the United States reverse osmosis membrane market?Key companies include DuPont Water Solutions, Toray Industries, LG Chem, Hydranautics, Pentair X-Flow, Aquatech International, Applied Membranes, Inc., Axeon Water Technologies, Kovalus Separation Solutions, Veolia Water Technologies & Solutions, Pall Corporation, Solenis, Synder Filtration, Samco Technologies, Inc., 3M, and Others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?