United States Refrigerator Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Single Door, Top Freezer, French Door, Bottom Freezer, Side-By-Side, and Others), By Distribution Channel (Supermarkets and Hypermarkets, Exclusive Stores, Multi-Branded Stores, Online, and Others), and United States Refrigerator Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsUnited States Refrigerator Market Insights Forecasts to 2035

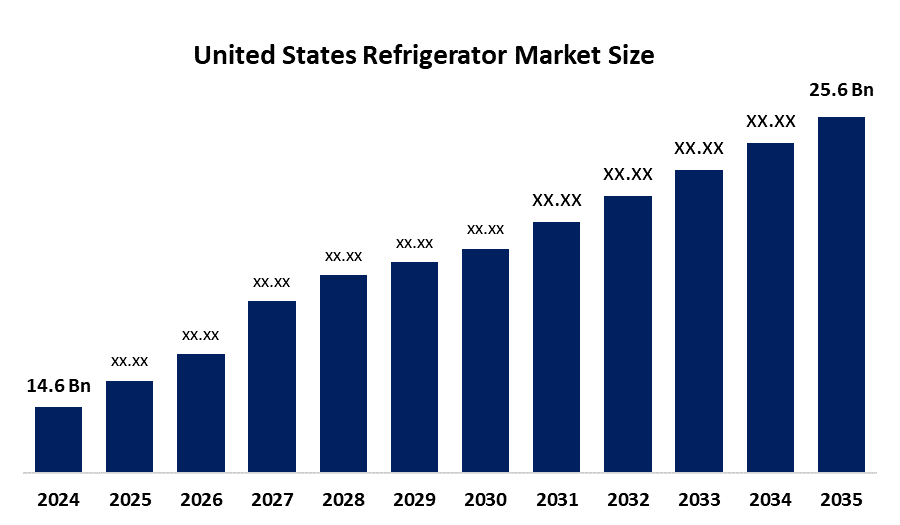

- The United States Refrigerator Market Size Was Estimated at USD 14.6 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.2% from 2025 to 2035

- The United States Refrigerator Market Size is Expected to Reach USD 25.6 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States refrigerator market size is anticipated to reach USD 25.6 billion by 2035, growing at a CAGR of 5.2% from 2025 to 2035. The United States Refrigerator market is driven by rising smart home adoption, replacement demand for old appliances, increasing urban households, kitchen remodelling activities, and growing preference for energy-efficient appliances.

Market Overview

The United States refrigerator market is defined as the sector or industry related to the manufacturing, supply, and trade of home refrigeration equipment for food preservation at home or in residential kitchens. It encompasses various refrigerators, including single-door, top-freezer, bottom-freezer, side-by-side, and French-door configurations, fitted with sophisticated refrigeration equipment, inverter technology, and connected-device features. Additionally, the market is affected by changing consumer lifestyles, energy rating regulations, and the evolution of enhanced refrigeration performance and storage optimization capabilities. Moreover, the United States market is boosted by the rise in household formation, rising discretionary income, high-end home appliance demand, and the need for protective regulations of the environment through the use of environmentally friendly refrigerants in the home appliance market.

Major trends are now emerging to define the future course of action in the United States refrigerator market. There is a strong trend toward smart refrigerators with Wi-Fi, touchscreens, and voice assistant integration. Energy-efficient and inverter compressor refrigerators are increasingly adopted as electricity cost savings and sustainability goals are achieved. Online retail expansion and digital product customization have transformed purchasing behavior through convenient delivery, price comparison, and wider product choice availability.

The United States government helps the market of refrigerators through the regulation of energy efficiency standards to minimize the amount of energy used in the cooling systems. Policies that are consistent with energy star standards promote the use of environmentally friendly coolants in refrigeration. Technology also contributes to the sustainability of the market by utilizing intelligent devices such as temperature controllers and artificial intelligence in cooling systems. All these contribute to the development of the market.

Report Coverage

This research report categorizes the market for the United States refrigerator market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States refrigerator market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States refrigerator market.

United States Refrigerator Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 14.6 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 5.2% |

| 2035 Value Projection: | USD 25.6 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Whirlpool Corporation, LG Electronics, Samsung Electronics, GE Appliances (Haier), Electrolux AB (Frigidaire), Bosch Home Appliances, Maytag, KitchenAid, Others, and Key Players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The major driver of the United States refrigerator market is the rise in the number of newly constructed kitchens, coupled with renovation activities, which boost the demand for refrigerators. The increase in the standard of living of consumers in the United States is another driver for the market, as it boosts the demand for high-end refrigerators. Growing awareness about the need to save energy among consumers in the US makes it a favorable region from the perspective of government regulatory policies, encouraging manufacturers to offer efficient refrigerator models such as inverters. The rising health awareness of consumers about the need for proper refrigerator hygiene is boosting the demand for advanced refrigerator cooling systems. The fast-paced lifestyle of the people in the United States has led them to consume an increased number of frozen, processed, and ready-to-eat foods, thus creating a demand for large refrigerators.

Restraining Factors

The United States market for refrigerators faces challenges related to the high costs of technologically advanced smart refrigerators, which are impeding consumer demand. Fluctuating raw material costs cause upward pressure on the production as well as end-product costs of home appliances. The high repair costs of technologically advanced appliances and issues related to the supply of raw materials for electronics are restraining factors.

Market Segmentation

The United States Refrigerator market share is classified into product type and distribution channel.

- The French door segment accounted for the largest revenue market in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States refrigerator market is segmented by product type into single door, top freezer, French door, bottom freezer, side-by-side, and others. Among these, the French door segment accounted for the largest revenue market in 2024 and is expected to grow at a significant CAGR during the forecast period. These refrigerators have more storage capacity, wide shelves, better organizing systems, and modern looks fitting well into contemporary modular kitchen styles. Furthermore, modern refrigerators have inimitable features like connectivity systems, temperature control systems, ice and water dispensers, and inverter compressors. Consumers in the United States increasingly prefer to opt for high-end products while renovating their homes or replacing appliances, thus increasing the overall market revenue for French door models, even if their sales remain low compared to simple refrigerators.

- The multi-branded stores segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the United States refrigerator market is bifurcated into supermarkets and hypermarkets, exclusive stores, multi-branded stores, online, and others. Among these, the multi-branded stores segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. Refrigerators are considered to be long-term investment products. So, the customers need demonstrations, confirmation of product size, and consultation services while making a purchase decision. Also, better financing options are available in these stores, which enhances customer trust. Furthermore, high-end refrigerators are generally sold through these kinds of stores. This results in a higher average transaction amount. So, multi-brand stores are considered to be the biggest generators of revenue.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States refrigerator market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Whirlpool Corporation

- LG Electronics

- Samsung Electronics

- GE Appliances (Haier)

- Electrolux AB (Frigidaire)

- Bosch Home Appliances

- Maytag

- KitchenAid

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

In March 2025, Samsung launched a new lineup featuring 4-Door French door and side-by-side models with AI Vision Inside, capable of recognizing 37 food types, 9-inch AI Home displays, and AI Hybrid Cooling for enhanced freshness.

In Jan 2024, LG Electronics unveiled new InstaView Door-in-Door refrigerators with enhanced Knock-on Glass technology to reduce cold air loss.

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States Refrigerator market based on the below-mentioned segments:

United States Refrigerator Market, By Product Type

- Single Door

- Top Freezer

- French Door

- Bottom Freezer

- Side-By-Side

- Others

United States Refrigerator Market, By Distributive Channel

- Supermarkets and Hypermarkets

- Exclusive Stores

- Multi-Branded Stores

- Online

- Others

Frequently Asked Questions (FAQ)

-

1. What is the United States Refrigerator market?The United States Refrigerator market refers to the industry involved in the manufacturing, supply, and sale of household refrigeration appliances used for food preservation.

-

2. What is the United States Refrigerator market size?The United States Refrigerator market size is expected to grow from USD 14.6 billion in 2024 to USD 25.6 billion by 2035, growing at a CAGR of 5.2% during the forecast period 2025-2035.

-

3. What are the key drivers of the United States Refrigerator market?The market is driven by smart appliance adoption, replacement demand, urban households, and energy-efficient appliance regulations.

-

4. Which product types dominate the United States Refrigerator market?French-door refrigerators currently dominate due to premium features and larger storage capacity.

-

5. What are the major trends in the United States Refrigerator market?Key trends include smart refrigerators, energy efficiency, and premium large-capacity models.

-

6. Who are the key companies operating in the United States Refrigerator market?Major players include Whirlpool Corporation, LG Electronics, Samsung Electronics, GE Appliances (Haier), Electrolux AB (Frigidaire), Bosch Home Appliances, Maytag, and KitchenAid

-

7. What are the restraints affecting the United States Refrigerator market?High product cost, maintenance expenses, and raw material price fluctuations restrain growth.

-

8. What is the future outlook for the United States Refrigerator market?The market is expected to grow steadily due to smart home adoption and appliance replacement demand.

Need help to buy this report?