United States Power Tools Batteries Market Size, Share, And COVID-19 Impact Analysis, By Type (Lithium-ion, Nickel-Cadmium, Nickel-Metal Hydride, Others), By Application (Residential, Commercial, Industrial), and United States Power Tools Batteries Market Insights, Industry Trend, Forecasts To 2035

Industry: Information & TechnologyUnited States Power Tools Batteries Market Size Insights Forecasts to 2035

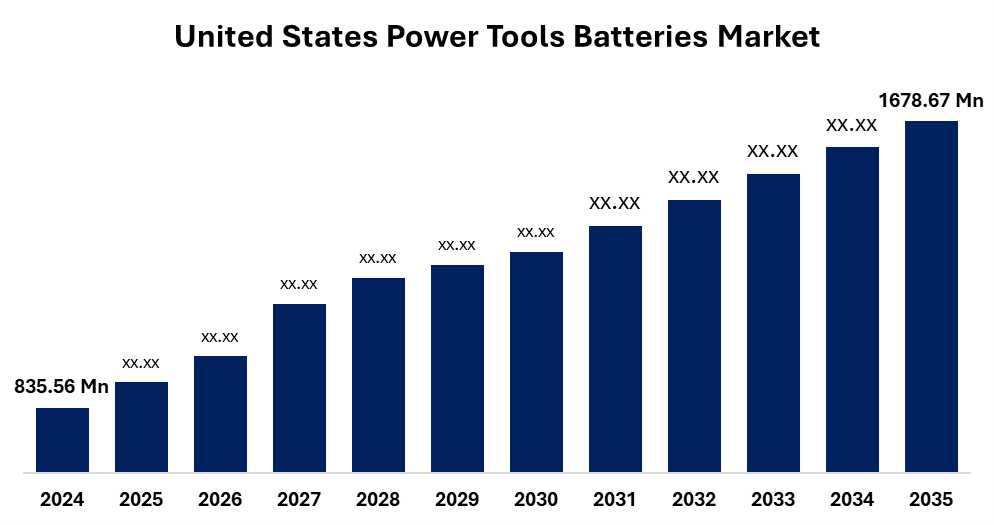

- The United States Power Tools Batteries Market Size Was Estimated at USD 835.56 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.55% from 2025 to 2035

- The United States Power Tools Batteries Market Size is Expected to Reach USD 1678.67 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United States Power Tools Batteries Market Size is anticipated to reach USD 1678.67 Million by 2035, growing at a CAGR of 6.55% from 2025 to 2035. The United States Power Tools Batteries market is driven by rising residential and infrastructure construction, increased DIY activity, the widespread adoption of cordless and smart tools, and advancements in Lithium-ion battery technology.

Market Overview

The power tools battery is a portable energy source, especially in the manufacturing, sales, and distribution of batteries, containing a wide array of electrical equipment for professional trades and diy projects. Market opportunities include capitalization on the increasing demand for lithium-ion (LI-ion) batteries, which is inspired by their long life and high energy density compared to chronic NICD technologies. Increasing interest in smart and connected tools, especially in fastening and drilling applications within industrial and consumer markets, presents an Avenue for innovation. Additionally, opportunities support infrastructure projects that create demands for construction equipment, promoting the development of wireless options in flexible DIY culture, and developing permanent solutions to meet environmental concerns and long-term life battery packs. The US government's schemes for the battery market, including the power tool batteries, focus on creating a domestic supply chain through laws such as the US government schemes, Infrastructure Investment and Jobs Act, the Investment Act, like Inflation Reduction Act. The Advanced Battery (FCAB) and Federal Consortium initiative for battery policies and incentive database provides a coordinated approach to the formation of battery technologies and a safe, circular economy for battery technologies.

Report Coverage:

This research report categorizes the United States power tools batteries market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States power tools batteries market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States power tools batteries market.

Driving Factor

The primary driving factors for the power tool battery market in lithium-ion battery technology, offering better performance, and increasing demand for cordless and smart power tools, for changes towards durable and electric technologies. Other factors include an increase in the motor vehicle and energy sectors, government support and convenience, and consumer focus on remote monitoring.

Restraining Factor

The factors that restrain the US power tools battery market include upgraded cordless tools and high initial costs of batteries, supply chain weaknesses, and limited availability of significant raw materials, ongoing concerns about battery recycling and environmental disposal, and potential competition from alternative technologies or technical disruption. The need to balance high production costs and performance, cost, and consumer demand also offers challenges.

Market Segmentation

The United States power tools battery market share is classified into type and application.

- The lithium-ion segment dominated the market and is anticipated to grow at a significant CAGR during the forecast period.

The United States power tools batteries market is segmented by type into lithium-ion, nickel-cadmium, nickel-metal hydride, and others. Among these, the lithium-ion segment dominated the market and is anticipated to grow at a significant CAGR during the forecast period. The lithium-ion battery is dominating the American power tool market due to its superior energy density, mild design, prolonged lifetime, and the ability to provide rapid charging and coherent power generation as compared to NI-CD and NI-MH batteries. These advantages give rise to long-lasting and better performance, making them preferred options for both professional and DIY users.

- The industrial segment accounted for the largest market revenue share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The United States power tools battery market is segmented by application into residential, commercial, and industrial. Among these, the industrial segment accounted for the largest market revenue share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. This dominance is inspired by heavy-duty, reliable equipment in construction, motor vehicles, and the high demand for manufacturing. Industries require strong power equipment for complex, ongoing tasks, and benefit from high-performance, fast-charged batteries that promote productivity and reduce downtime in a rigid work environment.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the United States power tools batteries market, along with a comparative evaluation primarily based on their type offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes Protein development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- DeWalt (Stanley Black & Decker)

- Milwaukee Tool (Techtronic Industries)

- Bosch

- Ryobi

- Makita

- Samsung SDI

- LG Chem

- Panasonic

- BYD

- East Penn Manufacturing

- A123 Systems.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States power tools batteries market based on the below-mentioned segments:

United States Power Tools Batteries Market, By Type

- Lithium-ion

- Nickel-Cadmium

- Nickel-Metal Hydride

- Others

United States Power Tools Batteries Market, By Application

- Residential

- Commercial

- Industrial

Frequently Asked Questions (FAQ)

-

Q:1 What was the market size of the U.S. Power Tools Batteries Market in 2024?The market size was estimated at USD 835.56 million in 2024.

-

Q:2 What is the projected size of the U.S. Power Tools Batteries Market by 2035?It is expected to reach USD 1678.67 million by 2035.

-

Q:3 What is the forecasted growth rate (CAGR) for this market?The market is expected to grow at a CAGR of 6.55% from 2025 to 2035.

-

Q:4 What are the main factors driving market growth?Growth is driven by rising construction activity, increasing DIY projects, adoption of cordless tools, and advancements in lithium-ion battery technology.Growth is driven by rising construction activity, increasing DIY projects, adoption of cordless tools, and advancements in lithium-ion battery technology.

-

Q:5 Which battery type dominated the market in 2024?The lithium-ion battery segment dominated due to its high energy density, long life, lightweight design, and rapid charging features.

-

Q:6 Which application segment accounted for the largest market share in 2024?The industrial segment led the market in 2024, driven by high demand for durable and reliable tools in construction and manufacturing.

-

Q:7 What are the key restraining factors for this market?Challenges include high initial costs, raw material supply issues, battery recycling concerns, and competition from alternative technologies.

-

Q:8 How is the U.S. government supporting the power tools batteries market?Through initiatives like the Infrastructure Investment and Jobs Act and the Inflation Reduction Act, which promote domestic supply chains and battery innovation.

-

Q:9 Which consumer trends are influencing market demand?Trends include the rise of DIY culture, preference for eco-friendly cordless tools, and growing demand for smart, connected power tools.

-

Q:10 Who are the leading companies in the U.S. Power Tools Batteries Market?Key players include DeWalt, Milwaukee Tool, Bosch, Ryobi, Makita, Samsung SDI, LG Chem, Panasonic, BYD, East Penn Manufacturing, and A123 Systems.

Need help to buy this report?