United States Polyvinyl Butyral Market Size, Share, and COVID-19 Impact Analysis, By Type (Films & Sheets, Resins, Solutions, and Others), By Application (Laminated Safety Glass, Paints & Coatings, Adhesive, and Others), By End Use (Automotive, Building & Construction, Photovoltaics, and Others), and United States Polyvinyl Butyral Market Insights, Industry Trend, Forecasts to 2035.

Industry: Chemicals & MaterialsUnited States Polyvinyl Butyral Market Insights Forecasts To 2035

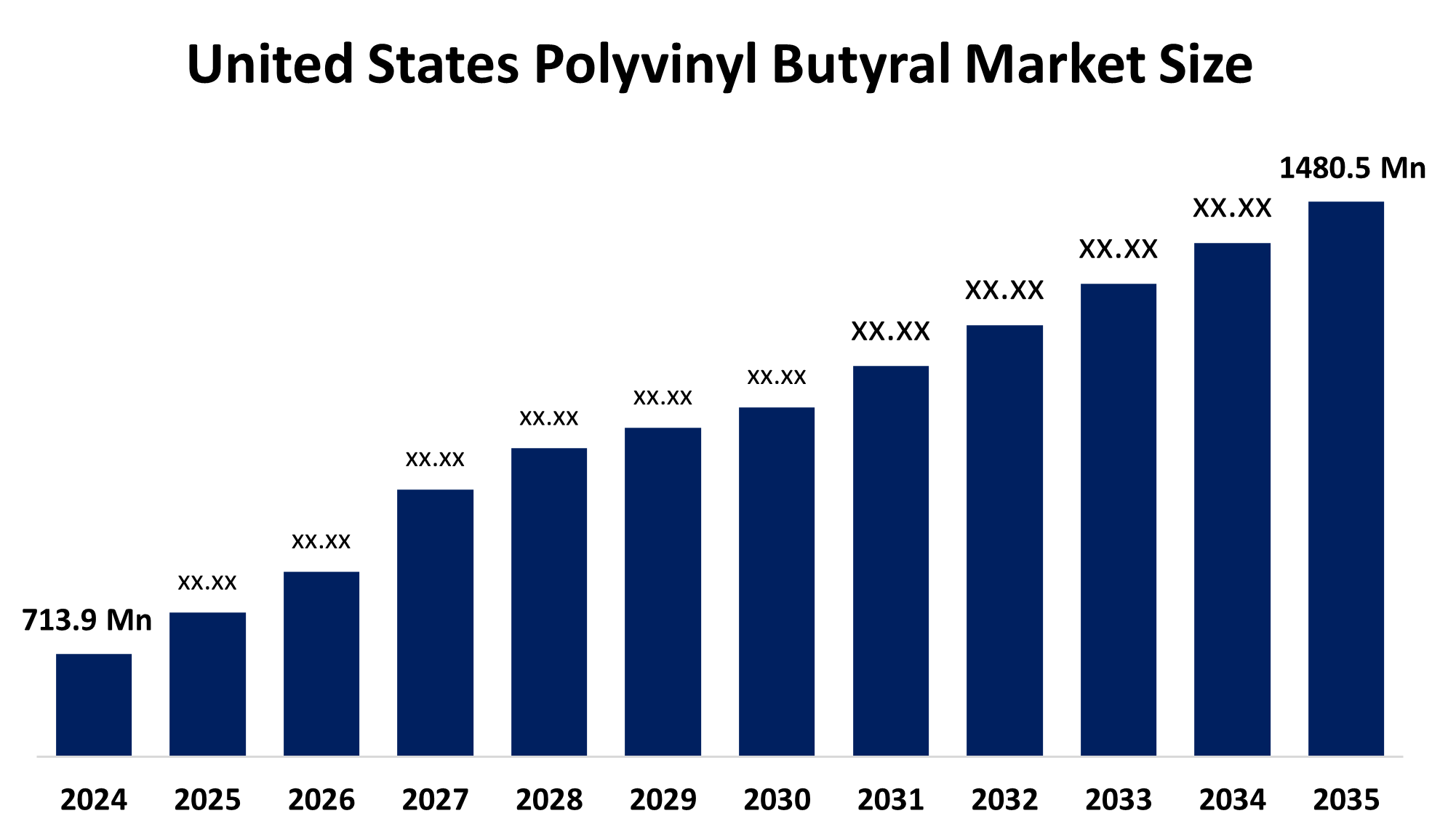

- The United States Polyvinyl Butyral Market Size Was Estimated at USD 713.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.86% from 2025 to 2035

- The United States Polyvinyl Butyral Market Size is Expected to Reach USD 1480.5 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United States Polyvinyl Butyral Market Size is Anticipated To Reach USD 1480.5 Million by 2035, Growing at a CAGR of 6.86% from 2025 to 2035. The United States polyvinyl butyral market is driven by the expansion of solar energy installations is boosting polyvinyl butyral (PVB) demand as the resin serves as a critical interlayer in laminated photovoltaic modules, enhancing durability against weather and mechanical stress.

Market Overview

Polyvinyl alcohol (PVA) reacts with butyraldehyde to be known as polyvinyl butyral (PVB). It is a thermoplastic, transparent, flexible, and rigid polymer that is highly prized for its better adhesion, cruelty, and impact resistance. PVB is extremely versatile for a wide range of industrial applications due to its solubility in many solvents. PVB, one of its most famous applications, serves as an interlayer among glass sheets in the construction of laminated security glass. This application is particularly prevalent in architectural glazing, car windshields, and aerospace windows as it enhances safety, improves impact resistance, and stops scattering. PVB interlayers also provide benefits in energy efficiency, UV protection, and sound insulation. Because PVB follows a variety of surfaces well, including glass, metal, and plastic, it is used in coatings, adhesives, inks, and films besides glass tearing. Due to its optical clarity and flexibility, it can be used in photovoltaic applications, such as solar modules, where it serves as an encapsulant to mold solar cells while preserving their efficiency. PVB is used in printed circuit boards and special films in electronics.

Report Coverage

This research report categorizes the market for United States polyvinyl butyral market based on various segments and regions, forecasts revenue growth, and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States polyvinyl butyral market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment United States polyvinyl butyral market.

United States Polyvinyl Butyral Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024 : | USD 713.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.86% |

| 2035 Value Projection: | USD 1480.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, By End-Use |

| Companies covered:: | Eastman Chemical Company, Kuraray America, Inc., Sekisui Specialty Chemicals America, LLC, Everlam USA, Huakai Plastic Co., Ltd., Chang Chun Plastic, Inc., Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The United States polyvinyl butyral market is driven by increasing demand for laminated security glass in the building and motor vehicle industries due to its advantages in UV security, demolition, and security. The requirement of PVB as an encapsulant in photovoltaic modules increases with the increasing use of solar energy. Rules that prefer durable, light, and energy-efficient materials also encourage innovation, which expands applications in electronics, aircraft, and renewable energy fields.

Restraining Factors

The United States polyvinyl butyral market faces challenges with the cost of production and the price of raw materials, especially polyvinyl alcohol. The development of substitute interlayer materials and stringent environmental restrictions on chemical manufacture present additional obstacles for long-term expansion and comprehensive use of PVBs in many fields.

Market Segmentation

The United States polyvinyl butyral market share is classified into type, application, and end-use.

- The films & sheets held the largest market share in 2024 and are expected to grow at a significant CAGR during the forecast period.

The United States polyvinyl butyral market is segmented by type into films & sheets, resins, solutions, and others. Among these, the films & sheets held the largest market share in 2024 and are expected to grow at a significant CAGR during the forecast period. Manufacturers are reacting to the growing requirement of sound-scoring interiors in high-end houses and office buildings, where residents seek acoustic comfort and safety. At the same time, glass processors watching to save interior upholstery are rapidly improving UV-blocking compositions.

- The laminated safety glass segment dominated the market in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The United States polyvinyl butyral market is segmented by application into laminated safety glass, paints & coatings, adhesive, and others. Among these, the laminated safety glass segment dominated the market in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Strict construction and vehicle codes are related to possession protection. Glass assembler blasts are facing increasing pressure to follow the state-level frontal rules for prevention and federal accident testing requirements. Architects are specifying laminated modules for rapid storm-prone areas, emphasizing the energy-abuses of PVB in addition to impact resistance.

- The automotive segment held the largest market revenue share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The United States polyvinyl butyral market is segmented by end-use into automotive, building & construction, photovoltaics, and others. Among these, the automotive segment held the largest market revenue share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. By incorporating state-of-the-art glazing technologies at the beginning of the new model, the automakers stimulate the demand for PVB. The broad use of frameless door design and spacious glass roofs, which depend on PVB for both structural relations and noise, has increased as a result of steps towards electric vehicles.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the United States polyvinyl butyral market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Eastman Chemical Company

- Kuraray America, Inc.

- Sekisui Specialty Chemicals America, LLC

- Everlam USA

- Huakai Plastic Co., Ltd.

- Chang Chun Plastic, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States polyvinyl butyral market based on the below-mentioned segments

United States Polyvinyl Butyral Market, By Type

- Films & Sheets

- Resins

- Solutions

- Others

United States Polyvinyl Butyral Market, By Application

- Laminated Safety Glass

- Paints & Coatings

- Adhesive

- Others

United States Polyvinyl Butyral Market, By End-Use

- Automotive

- Building & Construction

- Photovoltaics

- Others

Frequently Asked Questions (FAQ)

-

1. What is the United States Polyvinyl Butyral Market size in 2024?The United States Polyvinyl Butyral market size was estimated at USD 713.9 million in 2024.

-

2. What is the projected market size of the United States Polyvinyl Butyral Market by 2035?The market is expected to reach USD 1480.5 million by 2035.

-

3. What is the growth rate (CAGR) of the United States Polyvinyl Butyral Market?The market is projected to grow at a CAGR of 6.86% from 2025 to 2035.

-

4. What are the key factors driving the growth of the U.S. Polyvinyl Butyral Market?Rising demand for fertilizer production, high consumption in chemical manufacturing, metal processing, and petroleum refining, and growing use in lead-acid batteries and wastewater treatment are driving market growth.

-

5. Which segment dominated the U.S. Polyvinyl Butyral Market by raw material in 2024?The elemental sulfur segment dominated in 2024, due to cost-effectiveness, wide availability, and lower emissions compared to other sources.

-

6. Which application segment held the largest U.S. Polyvinyl Butyral market share in 2024?The fertilizers segment accounted for the largest share in 2024 and is expected to grow significantly during the forecast period.

-

7. What challenges are restraining the U.S. Polyvinyl Butyral Market?Strict environmental regulations on sulfur dioxide emissions, high handling risks, costly safety compliance, and competition from alternative energy storage technologies restrain market growth.

-

8. What industrial processes use Polyvinyl Butyral in the U.S.?Polyvinyl Butyral is widely used in fertilizers, chemical manufacturing, petroleum refining, textile processing, pulp & paper, automotive, and metal processing.

-

10. Which companies are key players in the U.S. Polyvinyl Butyral Market?A: Major players include Cargill, Green Plains Inc., Greenfield Global, The Andersons Inc., Cristalco SAS, Grain Processing Corporation, and others.

-

11. What is the forecast period considered for the U.S. Polyvinyl Butyral Market report?The report covers historical data from 2020–2023, uses 2024 as the base year, and provides forecasts for 2025–2035.

Need help to buy this report?