United States Plasmid DNA Manufacturing Market Size, Share, By Disease (Cancer, Infectious Diseases, Genetic Disorder, and Others), By Application (DNA Vaccines, Cell & Gene Therapy, Immunotherapy, and Others), United States Plasmid DNA Manufacturing Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited States Plasmid DNA Manufacturing Market Insights Forecasts to 2035

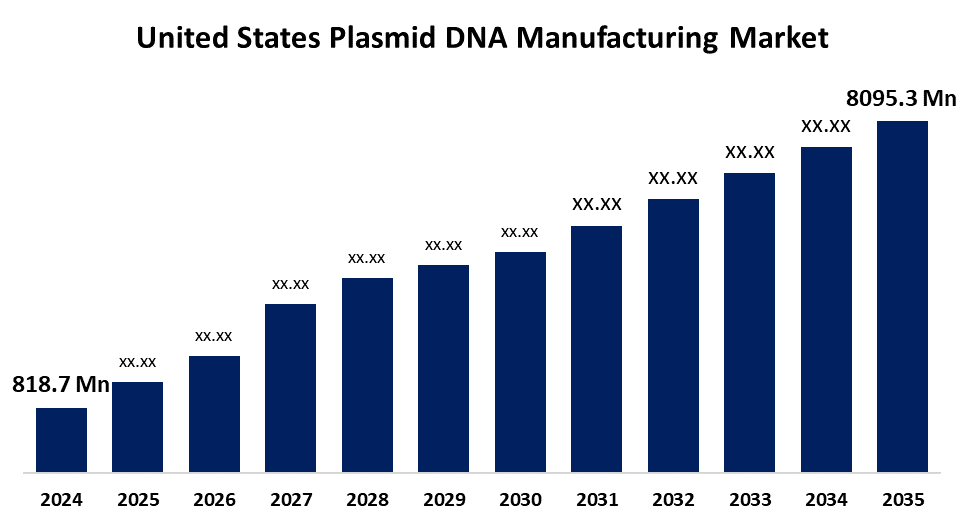

- United States Plasmid DNA Manufacturing Market Size 2024: USD 818.7 Million

- United States Plasmid DNA Manufacturing Market Size 2035: USD 8095.3 Million

- United States Plasmid DNA Manufacturing Market CAGR 2024: 23.16%

- United States Plasmid DNA Manufacturing Market Segments: Disease and Application.

Get more details on this report -

The United States plasmid DNA manufacturing market refers to the specialized production of circular, double-stranded DNA molecules used as critical starting materials for cell and gene therapies, mRNA vaccines, and viral vector production. These plasmids serve as the genetic "blueprint" or vehicle for delivering therapeutic genes into target cells, making them indispensable in the modern biopharmaceutical supply chain. Current trends include a significant shift toward outsourcing production to contract development and manufacturing organizations (CDMOs) to mitigate the high capital costs associated with in-house facility maintenance and regulatory compliance.

The market's growth is heavily influenced by a combination of government support and robust private sector investment. Federal agencies, including the National Institutes of Health (NIH) and BARDA, have launched initiatives to strengthen domestic biomanufacturing capacity to secure supply chains for vaccines and emergency medical countermeasures. Simultaneously, private equity and venture capital firms are pouring billions into specialized Contract Development and Manufacturing Organizations (CDMOs).

Technological advancements in plasmid DNA manufacturing are centered on improving yield, purity, and scalability. Innovations such as the development of antibiotic-free selection marker systems and automated, single-use bioreactors are streamlining the upstream fermentation process. In United States, there is also a growing interest in cell-free enzymatic synthesis, such as rolling circle amplification (RCA), which promises to eliminate the need for traditional bacterial fermentation altogether, significantly shortening lead times.

United States Plasmid DNA Manufacturing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 818.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 23.16% |

| 2035 Value Projection: | USD 8095.3 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Disease, By Application |

| Companies covered:: | Thermo Fisher Scientific Inc., Aldevron, Charles River Laboratories, Catalent, Inc., AGC Biologics, VGXI, Inc., GenScript ProBio, WuXi Advanced Therapies, Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the United States Plasmid DNA Manufacturing Market:

The United States plasmid DNA manufacturing market is driven by country’s well-established pharmaceutical infrastructure and increasing R&D investment in oncology and rare genetic disorders create a robust demand for high-purity GMP-grade plasmids. Additionally, the rise of personalized medicine and the growing number of regenerative medicine approvals by the PMDA are compelling domestic biopharmaceutical companies to secure reliable, local DNA manufacturing sources to ensure supply chain resilience.

The plasmid DNA manufacturing market in United States restrained by high technical complexity and substantial capital investment required for GMP-certified cleanrooms and specialized fermentation equipment. Furthermore, capacity bottlenecks at established CDMOs and the shortage of highly skilled bioprocessing engineers in United States can lead to long lead times, delaying critical clinical trials and commercial launches.

The emergence of cell-free DNA synthesis technologies presents a significant opportunity to bypass traditional bacterial fermentation, offering faster and more scalable production. Additionally, the expanding "Bio-Foundry" initiatives and potential for United States to become a regional CDMO hub for the broader Asia-Pacific market provide lucrative growth pathways for domestic manufacturers.

Market Segmentation

The United States plasmid DNA manufacturing market share is classified into disease and application.

By Disease:

The United States plasmid DNA manufacturing market is divided by disease into cancer, infectious diseases, genetic disorders, and others. Among these, the cancer segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This is due to increased demand from the manufacturing of vaccines, growing usage of plasmid DNA in cancer treatments, and developing technology.

By Application:

The United States plasmid DNA manufacturing market is divided by application into DNA vaccines, cell & gene therapy, immunotherapy, and others. Among these, the cell & gene therapy segment held the largest share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This is due to the broad application of gene therapy for hereditary and genetic disorders, as well as by continuous technological developments that improve the safety and dependability of treatment.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the United States plasmid DNA manufacturing market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in United States Plasmid DNA Manufacturing Market:

- Thermo Fisher Scientific Inc.

- Aldevron

- Charles River Laboratories

- Catalent, Inc.

- AGC Biologics

- VGXI, Inc.

- GenScript ProBio

- WuXi Advanced Therapies

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States plasmid DNA manufacturing market based on the below-mentioned segments:

United States Plasmid DNA Manufacturing Market, By Disease

- Cancer

- Infectious Diseases

- Genetic Disorder

- Others

United States Plasmid DNA Manufacturing Market, By Application

- DNA Vaccines

- Cell & Gene Therapy

- Immunotherapy

- Others

Frequently Asked Questions (FAQ)

-

Q: What is plasmid DNA and why is it important in healthcare?A: Plasmid DNA is a circular, double-stranded DNA molecule used as a key raw material in cell and gene therapies, DNA vaccines, and immunotherapies, enabling the delivery of therapeutic genes into target cells.

-

Q: What is driving the growth of the United States plasmid DNA manufacturing market?A: Market growth is driven by rising investments in cell and gene therapy, increasing oncology and rare disease R&D, strong government support for domestic biomanufacturing, and expanding outsourcing to CDMOs.

-

Q: Which disease segment dominates the United States plasmid DNA manufacturing market?A: The cancer segment dominates the market due to extensive use of plasmid DNA in cancer vaccines, immunotherapies, and gene-based treatment approaches.

-

Q: Which application segment holds the largest market share?A: Cell & gene therapy holds the largest share, supported by the growing number of gene therapy clinical trials and approvals targeting genetic and hereditary disorders.

-

Q: What are the key challenges faced by the United States plasmid DNA manufacturing market?A: Major challenges include high capital investment requirements, technical complexity of GMP-grade manufacturing, capacity constraints at CDMOs, and shortages of skilled bioprocessing professionals.

-

Q: What technological trends are shaping the United States plasmid DNA manufacturing market?A: Key trends include antibiotic-free plasmid systems, single-use bioreactors, automation, and emerging cell-free DNA synthesis technologies such as rolling circle amplification (RCA).

-

Q: Who are the major players in the United States plasmid DNA manufacturing market?A: Leading companies include Thermo Fisher Scientific, Aldevron, Charles River Laboratories, Catalent, AGC Biologics, VGXI, GenScript ProBio, and WuXi Advanced Therapies.

Need help to buy this report?