United States Personal Care Product Market Size, Share, And COVID-19 Impact Analysis, By Product (Skincare, Hair Care, Shower and Bath, Perfume/Fragrances, and Color Cosmetics), By Gender (Men and Women), By Distribution Channel (Hypermarkets & Supermarkets, Specialty Beauty Stores, Pharmacies & Drug stores, Online/E-Commerce, and Others), and United States Personal Care Product Market Insights, Industry Trend, Forecasts To 2035

Industry: Consumer GoodsUnited States Personal Care Product Market Insights Forecasts to 2035

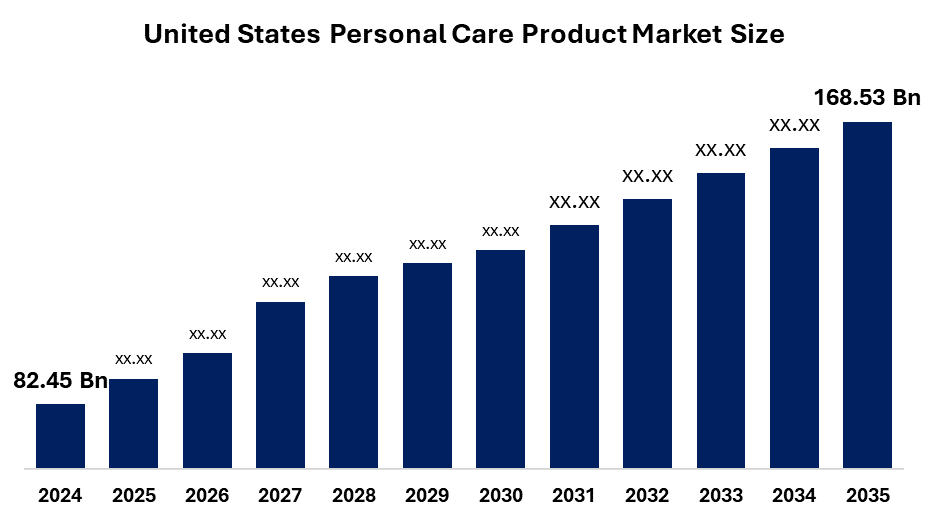

- The United States Personal Care Product Market Size Was Estimated at USD 82.45 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.72% from 2025 to 2035

- The United States Personal Care Product Market Size is Expected to Reach USD 168.53 Billion by 2035

Get more details on this report -

According to a Research Report published by Spherical Insights & Consulting, the United States Personal Care Product Market Size is Anticipated to Reach USD 168.53 Billion by 2035, Growing at a CAGR of 6.72% from 2025 to 2035.The US personal care product market is being driven by rising personal care influencers on social media, beauty specialist businesses, and dermatologists who are introducing individuals to new skincare products, which is a major driver of demand.

Market Overview

Personal care products are a broader category of consumer goods designed to support hygiene, grooming, beauty, and overall well-being. They include everyday imperatives such as skincare, haircare, oral care, cosmetics, foul smell, aroma, and hygiene objects, all aim to improve personal hygiene, presence, and confidence. These products play an important role in daily routine with both functional and attractive purposes. These products are integral parts of daily routine, meeting both functional needs, which fulfill ambitious needs such as cleanliness and beauty, confidence, and self-attainment. The Personal Care Products Market has become one of the most dynamic consumer goods industries, inspired by increasing disposable income, developing lifestyle, and increasing awareness about health and self-care. Consumers are rapidly preferring natural, organic, cruelty-free, and durable yogurt, reflecting a change in moral consumption and environmentally friendly options. Social media, impressive marketing, and celebrity endorsements significantly affect consumer behavior, which increases the demand for innovative and personal solutions.

Report Coverage

This research report categorizes the United States personal care product market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States personal care product market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States personal care product market.

United States Personal Care Product Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 82.45 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 6.72% |

| 2035 Value Projection: | USD 168.53 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 160 |

| Tables, Charts & Figures: | 150 |

| Segments covered: | By Gender, By Distribution Channel. |

| Companies covered:: | Revlon Consumer Products LLC, LOreal Group, Avon Products, Inc., Coty Inc., Estee Lauder Companies, Inc., Unilever plc, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factor

The U.S. personal care products market is driven by growing consumer on health, hygiene, and self-care, premium, natural, and durable yogas, and the increasing consumer on the strong impact of social media and digital platforms. Disposable income is increasing, developing beauty standards, and expanding e-commerce access to fuel innovation and adoption in various product categories.

Restraining Factor

The U.S. personal care products market faces restraints such as intensive competition, high product costs, and strict regulatory compliance. Additionally, the presence of fake products, ups and downs in raw material prices.

Market Segmentation

The United States Personal Care Product market share is classified into product, gender, and distribution channel.

- The skin care segment dominated the market in 2024 and is anticipated to grow substantial CAGR during the forecast period

The United States personal care product market is segmented by product into skincare, hair care, shower and bath, perfume/fragrances, and color cosmetics. Among these, the skin care segment dominated the market in 2024 and is anticipated to grow substantial CAGR during the forecast period. The focus on wellness, grooming, and self-care has increased significantly after the pandemic. People are prioritizing self-care routines and investing in skincare products. There is a growing demand for multifunctional products such as moisturizers with SPF to protect against UV rays or creams, and cosmetic products are built with the benefits of moisturizer and makeup finish.

- The women’s personal care products accounted for the largest revenue share in 2024 and are anticipated to grow at a substantial CAGR during the forecast period.

The United States personal care product market is segmented by gender into men and women. Among these, the women’s personal care products accounted for the largest revenue share in 2024 and are anticipated to grow at a substantial CAGR during the forecast period. The social norms and beauty standards have emphasized women’s appearance, driving the demand for personal care products such as makeup, haircare, skincare, body care, and more among women. Beauty marketing and advertising often target women and influence their purchase decisions.

- The hypermarkets & supermarkets segment dominated the market in 2024 and is expected to grow at a substantial CAGR during the forecast period.

The United States personal care product market is segmented by distribution channel into hypermarkets & supermarkets, specialty beauty stores, pharmacies & drugstores, online/e-commerce, and others. Among these, the hypermarkets & supermarkets segment dominated the market in 2024 and expected to grow at a substantial CAGR during the forecast period.

Hypermarkets & supermarkets provide a wide variety of products under one roof, therefore, it is convenient and time-saving for people to purchase products from such places. They give customers the advantage of competitive pricing, as such stores provide discounts to customers, as they can leverage their bulk buying power to negotiate lower prices with suppliers.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the United States personal care product market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Revlon Consumer Products LLC

- L’Oréal Group

- Avon Products, Inc.

- Coty Inc.

- Estee Lauder Companies, Inc.

- Unilever plc

- Others

Recent Development

- In March 2024, L'Oréal launched a new ingredient called Melasyl, designed to address localized pigmentation issues like age spots and post-acne marks across all skin tones. Melasyl was developed over 18 years of research and clinical testing and will be incorporated into products from L'Oréal's brands like La Roche Posay, L'Oréal Paris, and Vichy to provide more accessible solutions for people dealing with uneven skin tone and pigmentation.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States personal care product market based on the below-mentioned segments:

United States Personal Care Product Market, By Product

- Skincare

- Hair Care

- Shower and Bath

- Perfume/Fragrances

- Color Cosmetics

United States Personal Care Product Market, By Gender

- Men

- Women

United States Personal Care Product Market, By Distribution Channel

- Hypermarkets & Supermarkets

- Specialty Beauty Stores

- Pharmacies & Drugstores

- Online/E-commerce

- Others

Frequently Asked Questions (FAQ)

-

Q: What was the market size of the U.S. Personal Care Product market in 2024?A: The market size was valued at USD 74.68 billion in 2024.

-

Q: What is the expected CAGR of the U.S. Personal Care Product market from 2025 to 2035?A: The market is projected to grow at a CAGR of 7.41% during the forecast period.

-

Q: What will be the market size of the U.S. Personal Care Product market by 2035?A: The market is expected to reach USD 163.92 billion by 2035.

-

Q: Which product segment held the largest share in 2024?A: Skincare products held the largest market share in 2024.

-

Q: Which distribution channel dominated the market in 2024?A: Supermarkets/Hypermarkets accounted for a significant market share in 2024.

-

Q: What are the key driving factors of the U.S. Personal Care Product market?A: Key drivers include changing beauty standards, rising self-care trends, increased disposable income, social media influence, and demand for natural and cruelty-free products.

-

Q: Who are the major players in the U.S. Personal Care Product market?A: Key players include Procter & Gamble, Unilever, Estée Lauder, L'Oréal, Revlon, Coty, Johnson & Johnson, and Colgate-Palmolive.

-

Q: What recent developments have impacted the United States Personal Care Product?A: In August 2024, Johnson & Johnson launched the Collagen Bank line with patented micro-peptide technology, targeting Gen Z consumers concerned with early aging.

-

Q: Which consumer trends are shaping the future of the Personal Care Product market?A: Trends include a shift toward organic and sustainable products, digital/e-commerce adoption, premium skincare, wellness-oriented grooming, and personalized beauty solutions.

Need help to buy this report?