United States of America Isopropyl Alcohol (IPA) Market Size, Share, By Application (Process Solvent, Cleaning Agent, Coating Solvent, Intermediate, and Others), By Industry (Cosmetic and Personal Care, Pharmaceutical, Food and Beverage, Paints and Coatings, Chemical, and Others), United States of America Isopropyl Alcohol (IPA) Market Insights, Industry Trend, Forecasts to 2035.

Industry: Chemicals & MaterialsUnited States of America Isopropyl Alcohol (IPA) Market Insights Forecasts to 2035

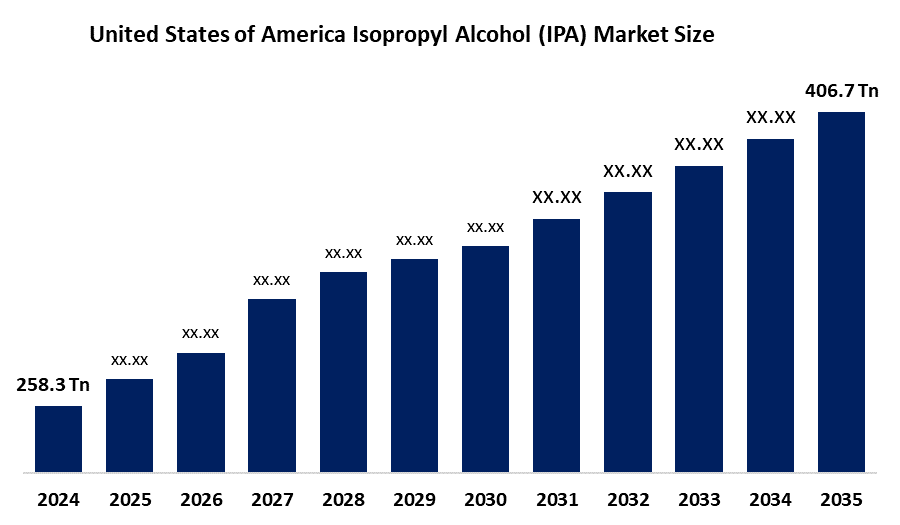

- United States of America Isopropyl Alcohol (IPA) Market Size 2024: USD 258.3Thousand tonnes

- United States of America Isopropyl Alcohol (IPA) Market Size 2035: USD 406.7Thousand tonnes

- United States of America Isopropyl Alcohol (IPA) Market CAGR 2024: 4.21%

- United States of America Isopropyl Alcohol (IPA) Market Segments: Application and Industry

Get more details on this report -

The United States isopropyl alcohol (IPA) market refers to the production, distribution, and consumption of IPA across pharmaceutical, healthcare, electronics, industrial, and personal care applications.

Eastman Chemical Company introduced its new electronic-grade IPA product line under the EastaPure brand in the final quarter of 2024. This high-purity solvent enables U.S. chip manufacturers to produce wafers through a domestically sourced solution that meets their needs for reliable manufacturing materials.

The FDA regulates hand sanitizers containing IPA as over-the-counter (OTC) drugs, which require both safety standards, labelling requirements and manufacturing procedures to be followed. The FDA established temporary policies during public health emergencies such as COVID-19 to facilitate domestic sanitizer production while maintaining product safety standards.

The United States of America isopropyl alcohol market presents strong upcoming growth possibilities because pharmaceutical needs and electronics production, healthcare sanitation requirements and speciality chemical and cleanroom usage are expected to rise.

Market Dynamics of the United States of America Isopropyl Alcohol (IPA) Market:

The United States of America isopropyl alcohol (IPA) market is driven by the disinfectant properties of IPA enable industrial growth in IPA-using industries, which include pharmaceuticals, healthcare and medical device manufacturing. Industrial manufacturing, automotive maintenance, and cosmetics production use IPA as an essential drug. The United States of America market maintains its upward trend because hygiene standards continue to rise, manufacturing processes advance, and domestic chemical production capacity expands.

The United States of America isopropyl alcohol (IPA) market is restrained by the raw material price fluctuations and strict environmental and safety rules, flammability risks and growing interest in alternative and bio-based solvents. The compliance costs increase because of these factors, which prevent industrial organizations from using the product.

The United States of America IPA market looks promising, with high-purity IPA serving as the main driver for advanced semiconductor fabrication and precision electronics cleaning and medical and disinfection purposes, which generate ongoing digital healthcare demands. The industry will develop innovative solutions through the establishment of bio-based, sustainable IPA production methods, the creation of energy-efficient manufacturing processes, and the development of new advanced purification methods.

United States of America Isopropyl Alcohol (IPA) Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 258.3 Thousand Tonnes |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 4.21% |

| 2035 Value Projection: | USD 406.7 Thousand Tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Dow Inc., Exxon Mobil Corporation, LyondellBasell Industries N.V., Shell USA, Inc., Eastman Chemical Company, Ecolab Inc., Avantor, Inc., INEOS Group Limited, Entegris, Inc., Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The United States of America isopropyl alcohol (IPA) market share is classified into application and industry.

By Application:

The United States of America isopropyl alcohol (IPA) market is divided by application into process solvent, cleaning agent, coating solvent, intermediate, and others. Among these, the process solvent segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is crucial for production operations because of its high solvency power, quick evaporation rate, and compatibility with delicate materials. Furthermore, United States of America's fast expansion of precision manufacturing and semiconductor fabrication continues to fuel a steady and robust demand for IPA as a process solvent, sustaining its market leadership and future expansion.

By Industry:

The United States of America isopropyl alcohol (IPA) market is divided by industry into cosmetic and personal care, pharmaceutical, food and beverage, paints and coatings, chemical, and others. Among these, the pharmaceutical segment accounted for the largest share in 2024 and is projected to grow at a significant CAGR during the forecast period. Because of its vital role as an antiseptic, disinfectant, and solvent in medication manufacture, medical device sterilisation, and healthcare hygiene goods, the pharmaceutical segment leads the United States of America's isopropyl alcohol (IPA) industry. Pharmaceutical-grade IPA is highly consumed in United States of America due to the country's ageing population, strict quality and safety regulations, and ongoing expansion of local pharmaceutical manufacture.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the United States of America isopropyl alcohol (IPA) market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in United States of America Isopropyl Alcohol (IPA) Market:

- Dow Inc.

- Exxon Mobil Corporation

- LyondellBasell Industries N.V.

- Shell USA, Inc.

- Eastman Chemical Company

- Ecolab Inc.

- Avantor, Inc.

- INEOS Group Limited

- Entegris, Inc.

- Others

Recent Developments in United States of America Isopropyl Alcohol (IPA) Market:

In March 2025, Expansion into Ultra-High Purity IPA, ExxonMobil announced a $100 thousand tonnes investment to upgrade its Baton Rouge chemical plant to produce 99.999% ultra-pure IPA. Scheduled for completion in 2027, this project aims to support the next generation of 2nm microchips, which require extreme purity to avoid damage during the drying and cleaning of wafer surfaces.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States of America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States of America isopropyl alcohol (IPA) market based on the below-mentioned segments:

United States of America Isopropyl Alcohol (IPA) Market, By Application

- Process Solvent

- Cleaning Agent

- Coating Solvent

- Intermediate

- Others

United States of America Isopropyl Alcohol (IPA) Market, By Industry

- Cosmetic and Personal Care

- Pharmaceutical

- Food and Beverage

- Paints and Coatings

- Chemical

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the United States of America isopropyl alcohol (IPA) market size?A: United States of America isopropyl alcohol (IPA) market is expected to grow from USD 258.3 thousand tonnes in 2024 to USD 406.7 thousand tonnes by 2035, growing at a CAGR of 4.21% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: the disinfectant properties of IPA enable industrial growth in IPA-using industries, which include pharmaceuticals, healthcare and medical device manufacturing. Industrial manufacturing, automotive maintenance, and cosmetics production use IPA as an essential drug. The United States of America market maintains its upward trend because hygiene standards continue to rise, manufacturing processes advance, and domestic chemical production capacity expands.

-

Q: What factors restrain the United States of America isopropyl alcohol (ipa) market?A: the raw material price fluctuations and strict environmental and safety rules, flammability risks and growing interest in alternative and bio-based solvents. The compliance costs increase because of these factors, which prevent industrial organizations from using the product.

-

Q: How is the market segmented by application?A: The market is segmented into process solvent, cleaning agent, coating solvent, intermediate, and others.

-

Q: Who are the key players in the United States of America isopropyl alcohol (ipa) market?A: Key companies include Dow Inc., Exxon Mobil Corporation, LyondellBasell Industries N.V., Shell USA, Inc., Eastman Chemical Company, Ecolab Inc., Avantor, Inc., INEOS Group Limited, Entegris, Inc. and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?