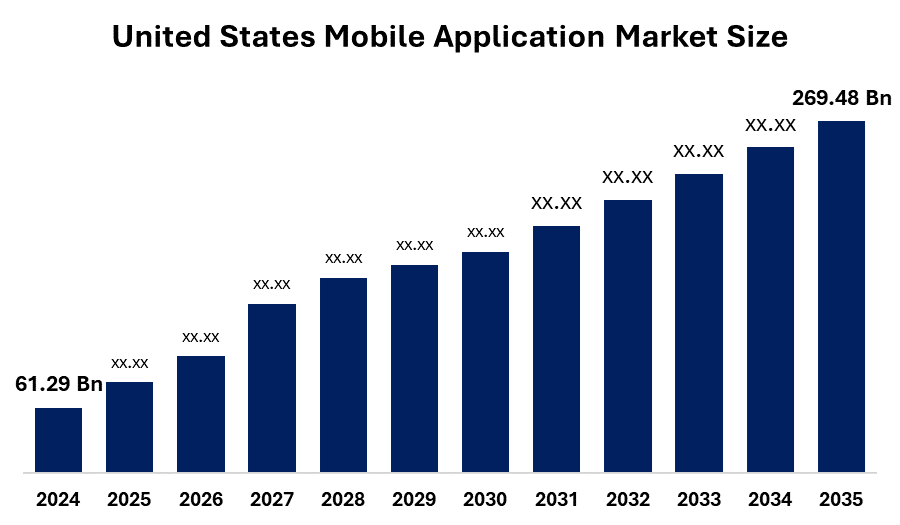

United States Mobile Application Market Size is Expected to Grow from USD 61.29 Billion in 2024 to USD 269.48 Billion by 2035, Growing at a CAGR of 14.41% during the forecast period 2025-2035.

Industry: Information & TechnologyUnited States Mobile Application Market Insights Forecasts to 2035

- The United States Mobile Application Market Size Was Estimated at USD 61.29 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 14.41% from 2025 to 2035

- The US Mobile Application Market Size is Expected to Reach USD 269.48 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United States Mobile Application Market Size is Anticipated to reach USD 269.48 Billion by 2035, Growing at a CAGR of 14.41% from 2025 to 2035.The US application market is being driven by importance of smartphone applications in performing daily tasks is increasing by the day, and almost every business is adopting digital technology and developing smartphone applications for their respective products or services, which is also contributing to the growth of the mobile application market.

Market Overview

A mobile application is a software application designed to run on mobile devices such as smartphones, tablets, and wearable devices. Unlike traditional desktop software, mobile apps, touch interfaces, small screens, and wireless connectivity are designed, allowing users to complete services and tasks from any time and any place. They can be pre-installed on equipment, downloaded from software distribution channels such as Google Play or Apple App Store, or accessed through workplace portals. The mobile application ecosystem has developed into an important component of the digital economy, which has changed the way businesses interact with customers and to streamlined operations. Apps are made for various types of uses, including communication, entertainment, e-commerce, banking, healthcare, education, navigation, and productivity. They can run as a native app for a certain operating system, such as Android or iOS, or a web app that can be accessed using mobile browsers. Mobile applications enable businesses to increase their digital presence, improve client interactions, and provide personal services. Mobile applications capabilities are being enhanced by adopting technology such as Artificial Intelligence (AI), Augmented Reality (AR), Virtual Reality (VR), and 5G Connection, which resulted in more impersonal and seamless user interactions.

Report Coverage

This research report categorizes the United States mobile application market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the U.S. mobile application market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA mobile application market.

United States Mobile Application Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 61.29 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 14.41% |

| 2035 Value Projection: | USD 269.48 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 187 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Store Type, By Application |

| Companies covered:: | Apple Inc., Google LLC, Microsoft Corporation, Amazon Inc., Electronic Arts, Netflix Inc., Cash App, Snap Inc., and others key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factor

The United States mobile application market is driven by the quick increase in smartphone penetration, access, and technological innovation in the United States. Increasing demand for digital payments, e-commerce, telemedicine, and entertainment.

Restraining Factor

The United States mobile application market has to face restrictions due to data privacy problems, stringent regulatory compliance, and increasing cybersecurity threats. In addition, intensive rivalry, APP saturation, and reliable network dependence on infrastructure can reduce profitability and limit long-term adoption in industries.

The United States mobile application market share is classified into store type, and application.

- The Apple store segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States mobile application market is segmented by store type into Google store, Apple store, and others. Among these, the Apple store segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the Apple store cosystem being a dynamic market that generates revenue through in-app sales, membership, and premium apps. The dedication of Apple to maintaining a safe and diverse app ecosystem has assisted this expansion. Apple's continuous support for developers has increased the amazing revenue growth of the Apple store through iOS apps.

- The gaming segment held the largest revenue share in the market in 2024 and is anticipated to grow at a significant CAGR during the projected timeframe.

The United States mobile application market is segmented by application into gaming, music & entertainment, health & fitness, social networking, retail & e-commerce, and others. Among these, the gaming segment held the largest revenue share in the market in 2024 and is anticipated to grow at a significant CAGR during the projected timeframe. Many major elements include strategic marketing, user engagement, and effective modification techniques. In addition, introducing social aspects in the gaming app increases the busyness of the user. Gaming firms are working on both installed and monetization strategies, which combine downloads with real revenue.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the United States mobile application market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Apple Inc.

- Google LLC

- Microsoft Corporation

- Amazon Inc.

- Electronic Arts

- Netflix Inc.

- Cash App

- Snap Inc.

Recent Development

- In March 2024, Snap Inc. announced sponsored AR Filters on Snapchat, a new augmented reality (AR) advertising platform that extends businesses' reach beyond the pre-capture Lens Carousel. This ad appears after Snapchatters have captured their material using the Snapchat Camera, which can be accessed by sliding to the post-capture Filter Carousel.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States mobile application market based on the below-mentioned segments:

United States Mobile Application Market, By Store Type

- Google Store

- Apple Store

- others

United States Mobile Application Market, By Application

- Gaming

- Music & Entertainment

- Health & Fitness

- Social Networking

- Retail & E-Commerce

- Others

Frequently Asked Questions (FAQ)

-

What is the base year and historical data period considered in this report?The base year is 2024, with historical data from 2020–2023.

-

What is the estimated market size of the U.S. mobile application market in 2024?The market size was estimated at USD 61.29 billion in 2024.

-

What is the expected market size by 2035?The market is projected to reach USD 269.48 billion by 2035.

-

What is the expected CAGR from 2025 to 2035?The market is expected to grow at a CAGR of 14.41% during the forecast period.

-

What are the key driving factors of the U.S. mobile application market?Growth is driven by high smartphone penetration, technological innovations, increasing demand for digital payments, e-commerce, telemedicine, and entertainment apps.

-

What are the main restraints in the U.S. mobile application market?Restraints include data privacy concerns, regulatory compliance, cybersecurity threats, intense competition, app saturation, and dependence on reliable network infrastructure.

-

Which store type held the largest U.S. mobile application market share in 2024?The Apple Store segment held the largest share in 2024 and is expected to maintain significant growth due to its ecosystem, in-app sales, and developer support.

-

Which application dominated the U.S. mobile application market in 2024?The gaming segment dominated in 2024 and is anticipated to continue strong growth due to user engagement, social features, and monetization strategies.

-

Who are the key players in the U.S. mobile application market?Major players include Apple Inc., Google LLC, Microsoft Corporation, Amazon Inc., Electronic Arts, Netflix Inc., Cash App, and Snap Inc. and others.

-

Who are the key target audiences for the U.S. mobile application market report?Target audiences include market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?