United States Mammography Market Size, Share, By Product Type (Digital Systems, 3-D Breast Tomosynthesis Systems, Analog Systems, And Others), By Technology (2-D Full-Field Digital And Others), And United States Mammography Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited States Mammography Market Insights Forecasts to 2035

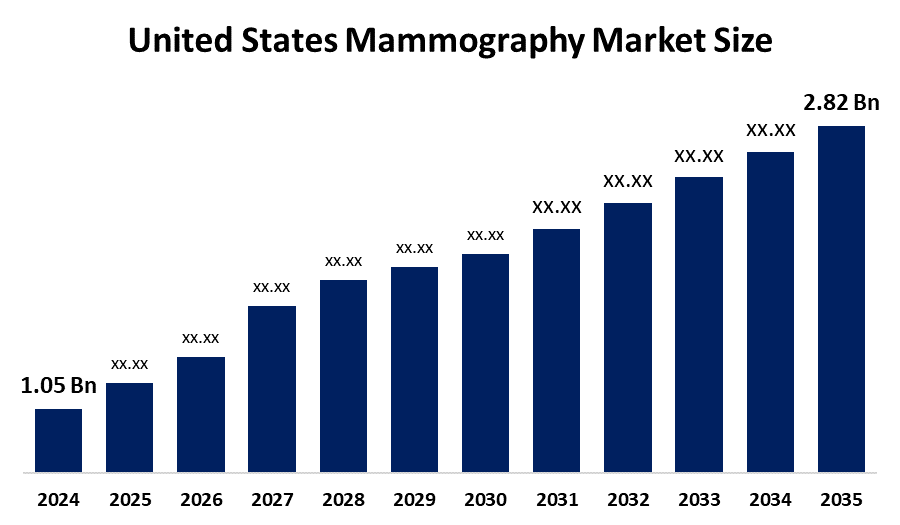

- United States Mammography Market Size 2024: USD 1.05 Billion

- United States Mammography Market Size 2035: USD 2.82 Billion

- United States Mammography Market CAGR 2024: 9.4%

- United States Mammography Market Segments: Product Type and Technology

Get more details on this report -

The US Mammography Market Includes All Economic Activity Related To Breast Cancer Screening And Diagnosis, Including The Purchase, Use And Maintenance Of 2D Digital Mammography Systems, 3D Breast Tomosynthesis, And Related Software And Services. The U.S. is one of the most developed markets for mammography worldwide due to the high level of adoption of digital mammography technologies, implementation of clinical guidelines to support routine screening practices, and significant investment into healthcare infrastructure which has led to a high level of demand for both mammography screening and diagnosis.

The mammography are in US are backed by government support, including the Mammography Quality Standards Act (MQSA) stands out as a pivotal government regulation that drives quality and standardization across the country’s mammography facilities. In 2023, approximately 79.8% of U.S. women aged 50–74 reported having undergone a mammogram within the past two years, a figure that reflects the widespread adoption of screening practices supported by public awareness campaigns, Medicare reimbursements, and coverage mandates under the Affordable Care Act that eliminate co-payments for preventive screenings.

As technology advances, US mammography providers are now using digital mammography and 3D breast tomosynthesis as the leading technologies for imaging and diagnosis. Digitally produced images allow radiologists to see breast tissue in smaller, thinner sections, which yields greater insight into potential cancers and read electronically with algorithms that incorporate artificial intelligence and machine learning, and the accuracy and speed of how images are interpreted is increased, providing an opportunity for improved utilization of resources and streamlining the work experience of radiology professionals, representing a key growth avenue as public health efforts continue to emphasize preventive care.

United States Mammography Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.05 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 9.4% |

| 2035 Value Projection: | USD 2.82 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 101 |

| Segments covered: | By Product Type, By Technology |

| Companies covered:: | Hologic, Inc, GE Healthcare, Siemens Healthineers, Koninklijke Philips N.N., FUJIFILM Holdings Corp., Canon Inc., Carestream Health, Planmed Oy, Konica Minolta, iCAD, Inc., Agfa-Gevaert, IMS Giotto, Metaltronica, Aurora Imaging Technology, Volpara Health, Others |

| Pitfalls & Challenges: | Covid 19 Impact Challenges, Future, Growth and Analysis |

Get more details on this report -

Market Dynamics of the United States Mammography Market:

The US mammography market is driven by the rising incidence of breast cancer and heightened awareness of early detection benefits, the urgency of early screening has translated into expanding mammography utilization, strong support by national campaigns, guideline endorsements that encourage regular screenings, especially for women over 40, and favourable reimbursement environments making mammography more accessible and financially sustainable for both providers and patients.

The US mammography market is restrained by the high cost of advanced mammography equipment, challenges for smaller clinics and rural healthcare providers with limited budgets, need for specialized staff training, and limit access in certain underserved areas.

The future of US mammography market is bright and promising, with versatile opportunities emerging from the expansion of AI assisted diagnosis systems, as well as mobile mammography units, is being implemented to enable access to underserved populations. These AI systems improve both the accuracy and speed of screening processes while minimizing differences in interpretation between radiologists, thus increasing the scalability of new screening technology across clinical settings. Additionally, mobile units and outreach initiatives are addressing the disparities between the geography and socio-economics of women who need access to breast cancer screenings. This presents a new opportunity for growth as more and more public health initiatives place a focus on prevention.

Market Segmentation

The United States Mammography Market share is classified into product type and technology.

By Product Type:

The US mammography market is divided by product type into digital systems, 3-D breast tomosynthesis systems, analog systems, and others. Among these, the digital systems segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Superior diagnostic accuracy, effective for dense breasts, favourable reimbursement policies, well developed marketing and healthcare infrastructure, and high demand for early-stage diagnosis all contribute to the digital systems segment's largest share and higher spending on mammography when compared to other product type.

By Technology:

The US mammography market is divided by technology into 2-D full-field digital, and others. Among these, the 2-D full-field digital segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The 2-D full-field digital segment dominates because of established role in routine screening, cost effectiveness, established insurance coverage, high image quality for early detection, and integration into digital health systems in US.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the US mammography market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in United States Mammography Market:

- Hologic, Inc

- GE Healthcare

- Siemens Healthineers

- Koninklijke Philips N.N.

- FUJIFILM Holdings Corp.

- Canon Inc.

- Carestream Health

- Planmed Oy

- Konica Minolta

- iCAD, Inc.

- Agfa-Gevaert

- IMS Giotto

- Metaltronica

- Aurora Imaging Technology

- Volpara Health

- Others

Recent Developments in United States Mammography Market:

In June 2025, the FDA granted De Novo authorization to Clarity Breast, marking the first AI tool designed to predict a woman’s five-year risk of developing breast cancer from a standard screening mammogram rather than just detecting current cancer.

In January 2025, Siemens Healthineers launched GRACE Breast Imaging in the US, installed this new 3D mammography system, featuring 50-degree wide-angle tomosynthesis to improve lesion visibility.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the US mammography market based on the below-mentioned segments:

United States Mammography Market, By Product Type

- Digital Systems

- 3-D Breast Tomosysthesis Systems

- Analog Systems

- Others

United States Mammography Market, By Technology

- 2-D Full-Field Digital

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the US mammography market size?A: US mammography market is expected to grow from USD 1.05 billion in 2024 to USD 2.82 billion by 2035, growing at a CAGR of 9.4% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the rising incidence of breast cancer and heightened awareness of early detection benefits, the urgency of early screening has translated into expanding mammography utilization, strong support by national campaigns, guideline endorsements that encourage regular screenings, especially for women over 40, and favourable reimbursement environments making mammography more accessible and financially sustainable for both providers and patients.

-

Q: What factors restrain the US mammography market?A: Constraints include the high cost of advanced mammography equipment, challenges for smaller clinics and rural healthcare providers with limited budgets, need for specialized staff training, and limit access in certain underserved areas.

-

Q: How is the market segmented by technology?A: The market is segmented into 2-D full-field digital, and others.

-

Q: Who are the key players in the US mammography market?A: Key companies include Hologic, Inc, GE Healthcare, Siemens Healthineers, Koninklijke Philips N.N., FUJIFILM Holdings Corp., Canon Inc., Carestream Health, Planmed Oy, Konica Minolta, iCAD, Inc., Agfa-Gevaert, IMS Giotto, Metaltronica, Aurora Imaging Technology, Volpara Health, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?