United States Livestock Monitoring Market Size, Share, By Animal (Bovine, Poultry, Swine, And Others), By Sector (Dairy, Meat, And Others), By Application (Milking Management, Breeding Management, Feeding Management, Health Monitoring, Behavioural Monitoring, And Others), And United States Livestock Monitoring Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited States Livestock Monitoring Market Insights Forecasts to 2035

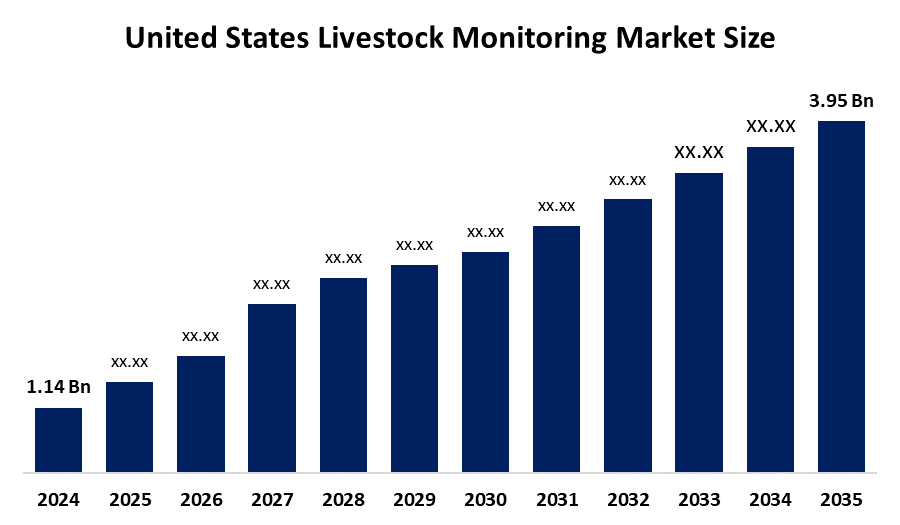

- United States Livestock Monitoring Market Size 2024: USD 1.14 Bn

- United States Livestock Monitoring Market Size 2035: USD 3.95 Bn

- United States Livestock Monitoring Market CAGR 2024: 11.96%

- United States Livestock Monitoring Market Segments: Animal, Sector, and Application

Get more details on this report -

The livestock monitoring industry of the U.S. is an ecosystem consisting of technologies, products, services, and practices that allow for the continuous oversight of the health, behaviour, productivity, and location of livestock including cattle, poultry, and pigs through digital technology. In practice, livestock monitoring includes multiple technology layers placed on farms so that they can continuously collect and send back data about the vital signs and behaviour of livestock. The main purpose of livestock monitoring is to provide a more data-driven approach than the traditional method of observing animals by providing greater opportunities for operational efficiency, welfare, food safety, traceability, and profitability for both small and large livestock producers.

The livestock monitoring in US are backed by government support, including the National Animal Health Monitoring System (NAHMS) administered by the U.S. Department of Agriculture’s Animal and Plant Health Inspection Service (APHIS), aimed broader surveillance efforts under USDA’s animal health surveillance programs work with state and industry partners to detect health threats early, protect public and animal health, and maintain market access for U.S. animal products. These government activities underpin the need for enhanced monitoring technologies and help drive demand for advanced digital livestock systems.

As technology advances, US livestock monitoring providers are now using technology with the introduction of IoT-enabled smart sensors, wearable collars and tags, advanced GPS & RFID systems, cloud computing, edge analytics, AI & machine learning. The use of these technologies allows farm operators to capture real-time information about animal behaviour, condition and health status. All of these technologies will integrate with conventional farm management systems, allowing farms to make better decisions more effectively in US livestock monitoring market.

United States Livestock Monitoring Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.14 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 11.96% |

| 2035 Value Projection: | USD 3.95 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 140 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Animal ,By Application |

| Companies covered:: | Merck & Co., Inc., Zoetis Inc., GEA Farm Technologies, DeLaval, Afimilk Ltd., BouMatic, Lely International NV, Dairymaster Ltd., Moocall, Fancom BV, IDEXX Laboratories, Cainthus, CowManager, Nedap Livestock Management, HID Global Corporation, and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the United States Livestock Monitoring Market:

The United States Livestock Monitoring Market Size is driven by the rising focus on animal health and welfare, increasing scale and consolidation of livestock operations, economic imperative to reduce losses due to disease or inefficiencies are strong motivations for producers to adopt monitoring systems, growth in consumer demand for transparency, traceability, and food safety, the emergence of predictive farming practices that leverage real-time data analytics, government support for digital agriculture and sustainability goals, enhance sustainability by reducing feed and water waste, and contribute to more efficient, welfare-oriented livestock production.

The United States Livestock Monitoring Market Size is restrained by the high upfront costs for advanced monitoring technologies, interoperability of different sensor systems, data integration issues, limited rural connectivity in some areas, and the need for training and skilled personnel to manage and interpret data.

The future of United States Livestock Monitoring Market Size is bright and promising, with versatile opportunities emerging from the demand for high-quality farmed animals will continue to grow and create more opportunities for livestock farmers. Cloud-based technology is evolving rapidly and becoming available to a much wider variety of businesses, including those traditionally not employing solution architectures and best-practices used by large-scale farms. Additionally, the evolving technologies of machine learning and analytics will provide new insights into livestock production and could enable real-time monitoring of the livestock supply chain, as well as create a foundation for the continued innovation and growth of the livestock monitoring industry in the United States.

Market Segmentation

The United States Livestock Monitoring Market share is classified into animal, sector, and application.

By Animal:

The United States Livestock Monitoring Market Size is divided by animal into bovine, poultry, swine, and others. Among these, the bovine segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Large scale beef and dairy operations, advanced technology for health, reproduction, and efficiency, intensive management, and compliance with traceability standards all contribute to the bovine segment's largest share and higher spending on livestock monitoring when compared to other animal.

By Sector:

The United States Livestock Monitoring Market Size is divided by sector into dairy, meat, and others. Among these, the dairy segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The dairy segment dominates because of high economic value, intense operational needs, rising dairy demand, early adoption of automation, and labour efficiency with significant investment in monitoring tech like sensors and software for optimization.

By Application:

The United States Livestock Monitoring Market Size is divided by application into milking management, breeding management, feeding management, health monitoring, behavioural monitoring, and others. Among these, the milking management segment held the largest market share in 2024 and is predicted to grow at a significant CAGR during the forecast period. Automated milking systems, robotic milkers, critical economic importance of dairy operations, and need for high efficiency, labour reducing, and data driven management tools all contribute to the milking management segment's largest share and higher spending on livestock monitoring when compared to other application.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the US livestock monitoring market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in United States Livestock Monitoring Market:

- Merck & Co., Inc.

- Zoetis Inc.

- GEA Farm Technologies

- DeLaval

- Afimilk Ltd.

- BouMatic

- Lely International NV

- Dairymaster Ltd.

- Moocall

- Fancom BV

- IDEXX Laboratories

- Cainthus

- CowManager

- Nedap Livestock Management

- HID Global Corporation

- Others

Recent Developments in United States Livestock Monitoring Market:

In August 2025, Nexa Labs launched the first implantable cattle monitoring system in the United States, providing more advanced, continuous tracking of cattle physiology and behaviour compared to traditional wearables.

In June 2025, Globalstar & CERAS TAG, in partnership launched the next-generation CERAS RANCHER device in the US for real-time tracking in remote, off-grid areas, specifically addressing security and biosecurity.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the United States Livestock Monitoring Market Size based on the below-mentioned segments:

United States Livestock Monitoring Market, By Animal

- Bovine

- Poultry

- Swine

- Others

United States Livestock Monitoring Market, By Sector

- Dairy

- Meat

- Others

United States Livestock Monitoring Market, By Application

- Milking Management

- Breeding Management

- Feeding Management

- Health Monitoring

- Behavioural Monitoring

- Others

Frequently Asked Questions (FAQ)

-

What is the US livestock monitoring market size?US livestock monitoring market is expected to grow from USD 1.14 billion in 2024 to USD 3.95 billion by 2035, growing at a CAGR of 11.96% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by the rising focus on animal health and welfare, increasing scale and consolidation of livestock operations, economic imperative to reduce losses due to disease or inefficiencies are strong motivations for producers to adopt monitoring systems, growth in consumer demand for transparency, traceability, and food safety, the emergence of predictive farming practices that leverage real-time data analytics, government support for digital agriculture and sustainability goals, enhance sustainability by reducing feed and water waste, and contribute to more efficient, welfare-oriented livestock production.

-

What factors restrain the US livestock monitoring market?Constraints include the high upfront costs for advanced monitoring technologies, interoperability of different sensor systems, data integration issues, limited rural connectivity in some areas, and the need for training and skilled personnel to manage and interpret data.

-

How is the market segmented by animal?The market is segmented into bovine, poultry, swine, and others.

-

Who are the key players in the US livestock monitoring market?Key companies include Merck & Co., Inc., Zoetis Inc., GEA Farm Technologies, DeLaval, Afimilk Ltd., BouMatic, Lely International NV, Dairymaster Ltd., Moocall, Fancom BV, IDEXX Laboratories, Cainthus, CowManager, Nedap Livestock Management, HID Global Corporation, and Others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?