United States Lithium Carbonate Market Size, Share, and COVID-19 Impact Analysis By Grade (Battery Grade, Technical Grade, Industrial Grade, and Others), By Application (Electric Vehicles, Cement, Pharmaceutical, Glass & Ceramics, and Others), and United States Lithium Carbonate Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited States Lithium Carbonate Market Insights Forecasts to 2035

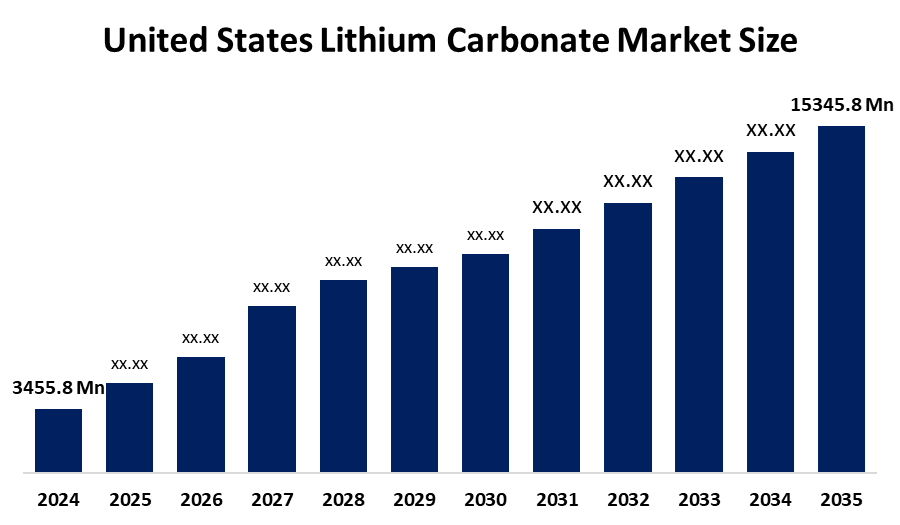

- The United States Lithium Carbonate Market Size Was Estimated at USD 3455.8 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 14.51% from 2025 to 2035

- The United States Lithium Carbonate Market Size is Expected to Reach USD 15345.8 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United States Lithium Carbonate Market Size is anticipated to reach USD 15345.8 Million by 2035, growing at a CAGR of 14.51% from 2025 to 2035. The United States lithium carbonate market is driven due to extensive use in a variety of industries, including metallurgy, glass and ceramics, aluminium, air conditioning, chemicals, lubricants, and the manufacturing of lithium-ion batteries. Lithium carbonate is now a crucial component in the development of technologies linked to energy storage, electric vehicles, and electronics due to the recent widespread adoption of lithium-ion batteries, which has greatly increased demand for the substance.

Market Overview

The United States lithium carbonate market is a critical and rapidly growing market in the overall US chemicals and raw materials industry, primarily defined by the supply and demand for lithium carbonate (Li2CO3) within the United States. The domestic production, import, and consumption of Li2CO3 for battery-grade, industrial, and pharmaceutical applications driven by EVs, storage, and chemical demand make up the U.S. lithium-carbonate market. Lithium carbonate has prospects for expansion in industrial applications and electrification initiatives, in addition to electric vehicles and energy storage. Lithium carbonate is in high demand as a result of industries like robotics, marine, and aerospace using lithium-ion batteries more and more for their power requirements. An emerging market that may help the lithium carbonate industry grow is the electrification of different industries, including public transportation, commercial vehicles, and construction equipment. The market-oriented through government incentives and corporate investment, the lithium carbonate market in the United States is characterised by high demand for renewable energy storage and electric vehicles (EVs). To reduce reliance on imported materials and create a secure supply chain for battery manufacturing, the US is pursuing domestic production and processing initiatives in response to this demand. Consumer electronics trends and the use of lithium carbonate by other industries also impact the market.

Government initiatives for the U.S. lithium carbonate market include funding from the Department of Energy, grants from the Tax Credit and Inflation Reduction Act, and a critical mineral designation that expedites permitting. These efforts aim to boost domestic production and processing to reduce reliance on imports, finance projects such as the Thacker Pass mine and the Albemarle Kings Mountain mine, and support a secure battery supply chain for electric vehicles and energy storage.

Report Coverage

This research report categorises the market for the United States lithium carbonate market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States lithium carbonate market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States lithium carbonate market.

United States Lithium Carbonate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3455.8 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 14.51% |

| 2035 Value Projection: | USD 15345.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Grade And By Application |

| Companies covered:: | Mitsubishi Corporation, Sumitomo Corporation, Albemarle Corporation, Rio Tinto Lithium, mu ionic solutions corporation, Piedmont Lithium., Arcadium lithium PLC, Standard lithium, Lithium americas, American Elements, and Others |

| Pitfalls & Challenges: | Covid 19 Impact Challenges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The rapid expansion of the electric vehicles is one of the primary drivers for the lithium carbonate market. As more automakers shift towards EV production amid a shift towards sustainability and tightening regulations, the need for lithium-ion batteries, which rely on lithium carbonate as a key component, will surge. With increasing EV adoption globally, lithium carbonate volumes over the forecast are poised to increase. The need for ever-smaller and more efficient battery designs is mirrored by the rise in wearable technology and portable electronics. Lithium-ion batteries, which have gradually become a part of battery systems, have a significant impact on consumer electronics and the demand for lithium carbonate.

Restraining Factors

The price of lithium carbonate is a major factor due to the significant and widespread disparity between supply and demand. This price decline was affected by increased production in regions such as China and South America, posing the challenges of maintaining a balanced market and pricing structure.

Market Segmentation

The United States lithium carbonate market share is classified into grade and application

- The battery grade segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States lithium carbonate market is segmented by grade into battery grade, technical grade, industrial grade, and others. Among these, the battery grade segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The battery-grade lithium market is driven due to rapid growth in demand from the renewable energy storage and electric vehicle (EV) sectors. The market share of technical-grade lithium carbonate for other industrial applications is likewise substantial. The production of cathode materials for consumer electronics, grid-scale energy storage, and lithium-ion batteries for electric vehicles depends on this substance

.

- The electric vehicles segment accounted for the largest revenue share in 2024 and is projected to grow at a significant CAGR during the forecast period.

The United States lithium carbonate market is segmented by application into electric vehicles, cement, pharmaceuticals, glass & ceramics, and others. Among these, the electric vehicles segment accounted for the largest revenue share in 2024 and is projected to grow at a significant CAGR during the forecast period. The United States lithium carbonate market is driven by higher demand for lithium-ion batteries in EV production. While the glass and ceramics, pharmaceutical and cement sectors also use lithium carbonate, their share is significantly lower than the automotive industry's consumption for batteries. An essential component of lithium-ion batteries, which are needed for all-electric and hybrid cars, is lithium carbonate.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the United States lithium carbonate market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of key companies

- Mitsubishi Corporation

- Sumitomo Corporation

- Albemarle Corporation

- Rio Tinto Lithium

- mu ionic solutions corporation

- Piedmont Lithium.

- Arcadium lithium PLC

- Standard lithium

- Lithium americas

- American Elements

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In October 2025, Lithium Americas launched the US Government took over 5% and entered into iv with General Motors. An agreement on a public loan is vital to finance the development of a maxi lithium deposit in Nevada with associated refining facilities

- In March 2025, the launch of Abaxx’s lithium carbonate futures introduces much-needed, physically deliverable benchmarks that reflect real market conditions, providing traders with a precise hedging instrument and greater optionality in managing supply chains, says Sacha Lifschitz, Abaxx’s director of metals markets.

- In March 2025, the Rio Tinto company cemented its position as one of the biggest lithium-producing companies in the world with the US USD 6.7 billion all-cash acquisition of Arcadium Lithium, the lithium giant formed after the US USD 10.6 billion merger of lithium majors Allkem and Livent.

- In February 2025, Ganfeng Lithium brought its USD 790 million Mariana project in Argentina into production. The Mariana mine is situated on the Llullaillaco salt flat and has the capacity to produce 20,000 MT of lithium chloride per year.

- In March 2025, Tianqi Lithium announced collaborations with a number of academic research institutions, including the Institute for Advanced Materials and Technology of the University of Science and Technology Beijing, on the research and development of next-generation solid-state battery materials and technology.

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States Lithium Carbonate market based on the following segments:

United States Lithium Carbonate Market, By Grade

- Battery Grade

- Technical Grade

- Industrial Grade

- Others

United States Lithium Carbonate Market, By Application

- Electric Vehicles

- Cement

- Pharmaceutical

- Glass & Ceramics

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the United States Lithium Carbonate market size?A: The United States lithium carbonate market was estimated at USD 3455.8 million in 2024 and is projected to reach USD 15345.8 million by 2035, growing at a CAGR of 14.51% during 2025–2035.

-

Q: What are the benefits of taking lithium carbonate?A: Lithium is used to treat certain mental health problems, such as mania (feeling highly excited and overactive), hypomania (like mania, but less severe) bipolar disorder, where your mood changes between feeling very high (mania) and very low (depression)

-

Q: Why is lithium carbonate so expensive?A: Battery-grade lithium carbonate consistently commands a premium over industrial-grade material due to Higher purity requirements for battery applications. More stringent specifications regarding impurity levels. Additional processing costs to achieve battery-grade quality.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the rise in electric vehicle adoption, expansion of energy storage systems, government subsidies for green transportation, advancements in battery technology, and increased use in electronics, medicine, and speciality glass

-

Q: How is the market segmented by battery type?A: The market is segmented into Lithium-ion Batteries and Lithium-metal Batteries

Need help to buy this report?