United States Liquid Packaging Cartons Market Size, Share, And COVID-19 Impact Analysis, By Carton Type (Brick Liquid Cartons and Shaped Liquid Cartons), By Shelf-Life (Long Shelf-Life and Short Shelf-Life), By End-Use (Liquid Dairy Products, Non-Carbonated Soft Drinks, Liquid Foods, and Alcoholic Drinks), and United States Liquid Packaging Cartons Market Insights, Industry Trend, Forecasts To 2035

Industry: Food & BeveragesUnited States Liquid Packaging Cartons Market Size Insights Forecasts to 2035

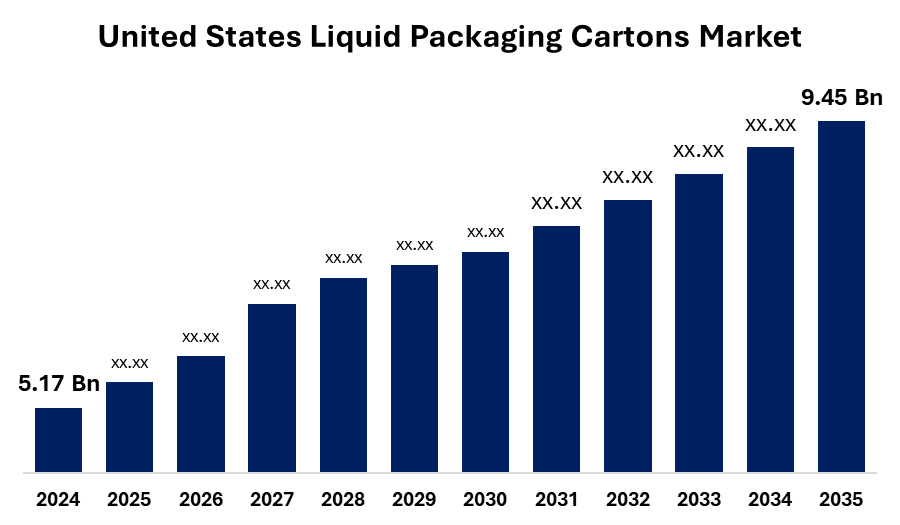

- The United States Liquid Packaging Cartons Market Size Was Estimated at USD 5.17 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.46% from 2025 to 2035

- The United States Liquid Packaging Cartons Market Size is Expected to Reach USD 9.45 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United State Liquid Packaging Cartons Market Size is anticipated to reach USD 9.45 Billion by 2035, growing at a CAGR of 5.64% from 2025 to 2035. The United States liquid packaging cartons market is driven by growing demand for sustainable and recyclable packaging solutions and the rising consumption of ready-to-drink beverages.

Market Overview

Liquid packaging cartons are specially designed, multi-level containers that are used for safe storage, transport, and distribution of liquid products. They are mainly made of paperboard, to provide thin layers of plastic, and sometimes combined with aluminum, for stability, barrier protection, and extended shelf life. These cartoons are used for the packaging of beverages such as milk, juice, water, plant-based drinks, liquid foods, and alcoholic beverages. The main purpose of liquid packaging coaches is to preserve the freshness of the product, prevent contamination, and ensure convenience for consumers. They are mildly recycled, and their carbon footprints are less than plastic bottles or glass containers, which gives them a durable option in the packaging industry. Based on use, they are available in different formats, such as brick boxes, gable-top cans, and size compartments, both single-service and family shapes. Liquid packaging compartments are popular in the food and beverage sector, especially for dairy products, fruit juices, plant-based beverages, soup, and sauce. Their mild structure reduces transportation costs, and their recycling is aligned with global stability goals.

Report Coverage

This research report categorizes the United States liquid packaging cartons market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States liquid packaging cartons market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the United States liquid packaging cartons market.

United States Liquid Packaging Cartons Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 5.17 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 5.64% |

| 2035 Value Projection: | USD 9.45 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 165 |

| Tables, Charts & Figures: | 128 |

| Segments covered: | By Carton Type, By Shelf-Life, By End-Use And COVID-19 Impact Analysis |

| Companies covered:: | Tetra Pak International S.A., Sig, Elopak, Mondi, Nippon Paper Industries Usa Co., Ltd., Uflex Limited, Greatview Aseptic Packaging Company Limited, Westrock Company, Stora Enso, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factor

The key driving factors for the United States liquid packaging cartons market include increasing consumer demand for durable and environmentally friendly packaging, extended shelf life, enhancing technology, and increasing consumption of dairy, juice, and plant-based beverages. Additionally, government rules are promoting market growth by reducing the use of plastic and focusing manufacturers on mild, recycled, and cost-effective solutions.

Restraining Factor

The major restraining factors for the United States liquid packaging cartons market include high recycling costs, limited recycling infrastructure in some regions, and competition from alternative packaging formats like plastic bottles and pouches, along with fluctuating raw material prices that increase production costs and hinder widespread adoption.

Market Segmentation

The United States liquid packaging cartons market share is classified into carton type, shelf-life, and end-use.

- The brick liquid cartons segment held the largest revenue share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The United States liquid packaging cartons market is segmented by carton type into brick liquid cartons and shaped liquid cartons. Among these, the brick liquid cartons segment held the largest revenue share of over in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Brick liquid cartons are rectangular or square-shaped cartons commonly used for long shelf-life products such as UHT milk, juices, and soups. Brick cartons are driven by the rising demand for aseptic packaging, particularly in developing countries where cold chain logistics are limited.

- The long shelf-life cartons segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The United States liquid packaging cartons market is segmented by shelf-life into long shelf-life, short shelf-life. Among these, the long shelf-life cartons segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Long shelf-life cartons are designed to preserve liquid products such as milk, juice, soups, and plant-based beverages for extended periods-typically 6 to 12 months-without refrigeration. This packaging is widely used for products that need to be stored and transported over long distances without relying on cold chain infrastructure.

- The liquid dairy products segment accounted for the largest revenue share of the United States liquid packaging cartons market in 2024.

The United States liquid packaging cartons market is segmented by end-use into liquid dairy products, non-carbonated soft drinks, liquid foods, and alcoholic drinks. Among these, the liquid dairy products segment accounted for the largest revenue share of the United States liquid packaging cartons market in 2024. Liquid dairy products such as milk, flavored milk, yogurt drinks, and cream are the dominant end-use category for liquid packaging cartons. These products are often packaged in aseptic or gable-top cartons, offering long shelf life without refrigeration and preserving nutritional content.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the United States liquid packaging cartons market, along with a comparative evaluation primarily based on their type offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes Protein development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Tetra Pak International S.A.

- Sig

- Elopak

- Mondi

- Nippon Paper Industries Usa Co., Ltd.

- Uflex Limited

- Greatview Aseptic Packaging Company Limited

- Westrock Company

- Stora Enso

- Others

Recent Development

- In July 2025, SIG launched the world’s first aseptic 1-liter carton pack that offers full barrier protection without an aluminum layer, reducing the carbon footprint by up to 61%. Made from over 80% paper and renewable materials, the sustainable packaging maintains up to 12 months of shelf life and works with existing filling lines.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States liquid packaging Cartons market based on the below-mentioned segments:

United States Liquid Packaging Cartons Market, By Carton Type

- Brick Liquid Cartons

- Shaped Liquid Cartons

United States Liquid Packaging Cartons Market, By Shelf-Life

- Long Shelf-Life

- Short Shelf-Life

United States Liquid Packaging Cartons Market, By End-Use

- Liquid Dairy Products

- Non-Carbonated Soft Drinks

- Liquid Foods

- Alcoholic Drinks

Frequently Asked Questions (FAQ)

-

Q:1 What is the market size of the United States Liquid Packaging Cartons Market in 2024?The United States liquid packaging cartons market size was estimated at USD 5.17 billion in 2024.

-

Q:2 What is the expected growth rate (CAGR) of the U.S. liquid packaging cartons market?The market is projected to grow at a CAGR of 5.64% from 2025 to 2035.

-

Q:3 What will be the market size of the United States liquid packaging cartons market by 2035?The market size is expected to reach USD 9.45 billion by 2035.

-

Q:4 What are liquid packaging cartons?Liquid packaging cartons are multi-layered containers made of paperboard, plastic, and sometimes aluminum, designed for the safe storage, transportation, and distribution of liquid products such as milk, juices, soups, and plant-based beverages.

-

Q:5 What are the key factors driving the growth of the U.S. liquid packaging cartons market?Key drivers include growing demand for sustainable packaging, rising consumption of dairy and plant-based beverages, technological advancements in aseptic packaging, and government regulations limiting plastic usage.

-

Q:6 What are the major restraining factors in the U.S. liquid packaging cartons market?Restraints include high recycling costs, limited recycling infrastructure, fluctuating raw material prices, and competition from plastic bottles and pouches.

-

Q:7 Which carton type held the largest market share in 2024?The brick liquid cartons segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

-

Q:8 Which shelf-life category dominates the U.S. liquid packaging cartons market?The long shelf-life cartons segment accounted for the largest share in 2024, driven by rising demand for aseptic packaging and extended product preservation without refrigeration.

-

Q:9 Which end-use segment led the U.S. liquid packaging cartons market in 2024?The liquid dairy products segment held the largest revenue share, supported by the strong demand for milk, flavored milk, yogurt drinks, and cream.

-

Q:10 Who are the key players in the U.S. liquid packaging cartons market?Major companies include Tetra Pak International S.A., SIG, Elopak, Mondi, Nippon Paper Industries USA, Uflex Limited, Greatview Aseptic Packaging, WestRock Company, and Stora Enso.

-

Q:11 What is the forecast period covered in the U.S. liquid packaging cartons market report?The report covers historical data from 2020–2023, base year 2024, and forecasts from 2025 to 2035.

Need help to buy this report?