United States Industrial Ethanol Market Size, Share, and COVID-19 Impact Analysis, By Source (Agriculture and Synthetic), By Application (Food & Beverage, Cosmetics & Personal Care, Electronic, Pharmaceuticals, Chemicals, and Others), and United States Industrial Ethanol Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited States Industrial Ethanol Market Insights Forecasts to 2035

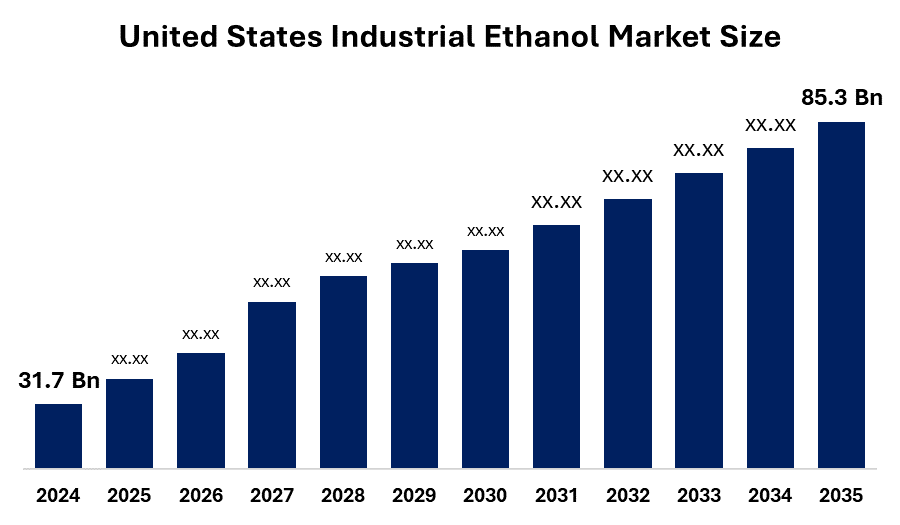

- The United States Industrial Ethanol Market Size Was Estimated at USD 31.7 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 9.42% from 2025 to 2035

- The United States Industrial Ethanol Market Size is Expected to Reach USD 85.3 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States industrial ethanol Market is anticipated to reach USD 85.3 billion by 2035, growing at a CAGR of 9.42% from 2025 to 2035. The increasing demand from various application industries such as food and beverage, electronics, cosmetics, pharmaceutical, and chemical. In addition, the growing alcoholic and non-alcoholic beverage industry in the country is expected to further boost the growth of U.S. industrial ethanol market.

Market Overview

Industrial ethanol is referred to as an industrial-grade ethyl alcohol, which is a multipurpose chemical substance used as a fuel additive, solvent, and raw material in most industrial processes. Industrial ethanol is often decomposing-which is mixed with additives, which disqualify it for human consumption-unlike the ethanol, enabling its safe and affordable use in the construction and processing fields. Clear, colorless, and volatile, ethanol is a great solvent due to its high solubility in both water and organic molecules. Industrial ethanol is usually made by fermentation, such as ethylene such as petrochemical derivatives, or biomass feedstocks, including corn, sugarcane, and wheat. Rules regulate its construction and use to guarantee quality, safety, and environmental needs. It is an essential feedstock in the chemical industry for the production of acetic acid, ethyl acetate, and other derivatives used in adhesives, paints, coatings, and plastics. It is used as a disinfectant, antiseptic and preservative with a solvent in drugs in the pharmaceutical and medical industries. Considering the international stability goals, ethanol also plays an important role in biofuels, especially when combustion is added to gasoline to increase the combustion efficiency and low emissions.

Report Coverage

This research report categorizes the market for United States industrial ethanol market based on various segments and regions, forecasts revenue growth, and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the U.S. industrial ethanol market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment US industrial ethanol market.

United States Industrial Ethanol Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 31.7 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 9.42% |

| 2035 Value Projection: | USD 85.3 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 120 |

| Tables, Charts & Figures: | 150 |

| Segments covered: | By Source, By Application. |

| Companies covered:: | Cargill, Inc., MGP Ingredients Inc., Grain Millers Inc., Cristalco SAS, Green Plains Inc., Greenfield Global, The Andersons Inc., Grain Processing Corporation, Birla Sugar Ltd., Chippewa Valley Ethanol Co.LLP and Others. |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The United States industrial ethanol market is driven by increased use in chemicals, cosmetics, and drugs, extension of biofuel requirements for low carbon emissions, and an increase in sanitizer and disinfectant consumption. Increasing government support for advances and renewable energy in the manufacture of bioethanol from sustainable feedstocks promoted the expansion of the industry and adoption of various types of industries.

Restraining Factors

The United States industrial alcohol market faces challenges with raw materials, especially sugarcane and corn, changing prices due to high production costs and complex rules. Large-scale industrial ethanol adoptions are more disrupted by optional renewable fuel from competition and land use for biofuels feedstocks.

Market Segmentation

The United States industrial ethanol market share is classified into source and application.

The agriculture segment held the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States industrial ethanol market is segmented by source into agricultural and synthetic. Among these, the agriculture segment held the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Agricultural ethanol is made of sugar and starch crops such as sugarcane, beet, corn, maize, wheat, rye, and potato. In terms of customer comfort, convenience and safety, the agricultural ethanol is suitable for all industrial uses, unlike the synthetic variety. About 80% of ethanol generated in agriculture worldwide is made from feedstock based on sugar and starch.

- The food & beverage segment accounted for a significant share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The United States industrial ethanol market is segmented by application into food & beverage, cosmetics & personal care, electronics, pharmaceuticals, chemicals, and others. Among these, the food & beverage segment accounted for a significant share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Grain-based and pure, ethanol is the primary component in processed food due to the increasing demand for organic items. Ethyl alcohol is employed as a processing aid in the food business. A natural substance, ethanol is widely used to remove taste and odor, and flavor, which are later used by food and beverages.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the United States industrial ethanol market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cargill, Inc.

- MGP Ingredients Inc.

- Grain Millers Inc.

- Cristalco SAS

- Green Plains Inc.

- Greenfield Global

- The Andersons Inc.

- Grain Processing Corporation

- Birla Sugar Ltd.

- Chippewa Valley Ethanol Co.LLP

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States Industrial Ethanol market based on the below-mentioned segments:

United States Industrial Ethanol Market, By Source

- Agriculture

- Synthetic

United States Industrial Ethanol Market, By Application

- food & beverage

- cosmetics & personal care

- electronics

- pharmaceuticals

- chemicals

- others

Frequently Asked Questions (FAQ)

-

Q: What was the market size of the U.S. industrial ethanol market in 2024?A: The U.S. industrial ethanol market size was valued at USD 31.7 billion in 2024.

-

Q: What is the projected size of the U.S. industrial ethanol market by 2035?A: The market is expected to reach USD 85.3 billion by 2035.

-

Q: What is the forecasted CAGR for the U.S. industrial ethanol market?A: The market is projected to grow at a CAGR of 9.42% during 2025–2035.

-

Q: Which application segment held the largest market share in 2024?A: The food & beverage segment accounted for a significant share in 2024 due to the rising use of ethanol in processed foods, flavor extraction, and organic product demand.

-

Q: What factors are driving the U.S. industrial ethanol market?A: Key drivers include rising demand for biofuels, growing use in pharmaceuticals, sanitizers, and cosmetics, government support for renewable energy, and increased applications in chemicals and food & beverage industries.

-

Q: What factors are restraining the U.S. industrial ethanol market growth?A: Restraints include fluctuating raw material costs (corn, sugarcane), high production expenses, regulatory complexities, land-use challenges for biofuel feedstocks, and competition from alternative renewable fuels.

-

Q: Who are the key players in the U.S. industrial ethanol market?A: Major companies include Cargill, Inc., MGP Ingredients Inc., Green Plains Inc., Greenfield Global, Cristalco SAS, The Andersons Inc., and Grain Millers Inc., Others.

Need help to buy this report?