United States Incontinence and Ostomy Care Products Market Size, Share, and COVID-19 Impact Analysis, By Type (Incontinence Care Products and Ostomy Care Products), By Application (Protection and Cleaning, Security and Leakage Control, Odor Control, and Others), and United States Incontinence and Ostomy Care Products Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited States Incontinence and Ostomy Care Products Market Insights Forecasts to 2035

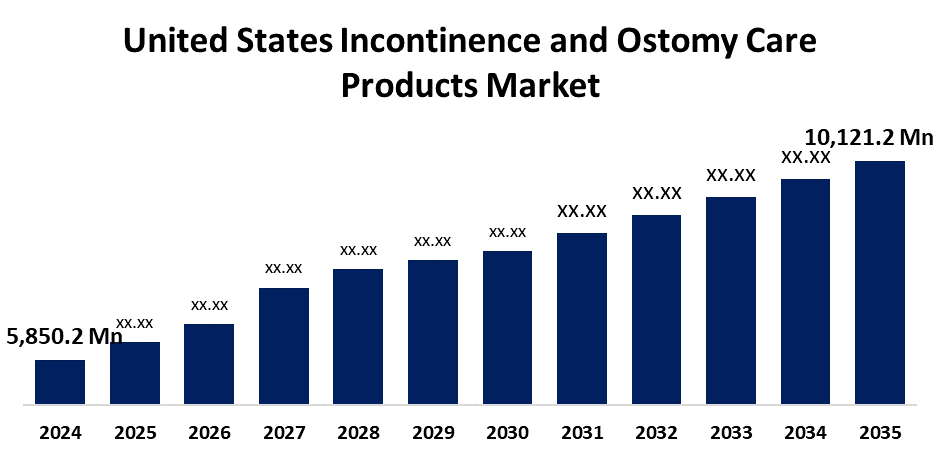

- The United States Incontinence and Ostomy Care Products Market Size Was Estimated at USD 5,850.2 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.11% from 2025 to 2035

- The United States Incontinence and Ostomy Care Products Market Size is Expected to Reach USD 10,121.2 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States incontinence and ostomy care products market size is anticipated to reach USD 10,121.2 million by 2035, growing at a CAGR of 5.11% from 2025 to 2035. The incontinence and ostomy care products market in the United States is driven by the rising prevalence of incontinence among the aging population and patients with chronic health conditions, along with increasing awareness of personal hygiene and growing adoption of advanced incontinence and ostomy care products.

Market Overview

The United States incontinence and ostomy care products market refers to the commercial market for medical and personal care products specifically designed to manage urinary or fecal incontinence and to support individuals living with an ostomy, within the United States. The market is applied for managing urinary and fecal incontinence as well as caring for patients with colostomy, ileostomy, or urostomy. The market is growing due to the rising prevalence of incontinence among the aging population and patients with chronic health conditions, along with increasing awareness of personal hygiene and growing adoption of advanced incontinence and ostomy care products.

Key opportunities in the United States incontinence and ostomy care products market stem from the increasing elderly population, which boosts demand for effective and comfortable solutions, the rise of awareness campaigns that promote early diagnosis and care, the growth of home healthcare services, and ongoing innovations in product design that improve comfort, discretion, and ease of use. In June 2025, the Centers for Medicare & Medicaid Services proposed redefining ostomy and urological supplies as medical equipment under its DMEPOS rule (CMS-1828-P), enabling Competitive Bidding expansion. United Ostomy Associations of America strongly opposed the move, warning that it threatens patient access, individualized care, and safety.

Report Coverage

This research report categorizes the market for the United States incontinence and ostomy care products market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States incontinence and ostomy care products market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States incontinence and ostomy care products market.

United States Incontinence and Ostomy Care Products Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 5,850.2 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 5.11% |

| 2035 Value Projection: | USD 10,121.2 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 112 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Coloplast, Kimberly-Clark Corporation, Salts Healthcare, Total Home Care Supplies, Unicharm Corporation, Urological Supplies Inc, B. Braun Melsungen AG, ConvaTec, Teleflex Incorporated, Svenska Cellulose Aktiebolaget (SCA), Others |

| Pitfalls & Challenges: | COVID-19 Impact Analysis and Forecast 2023 - 2033 |

Get more details on this report -

Driving Factors

The United States incontinence and ostomy care products market driven by the rising prevalence of incontinence among the aging population and patients with chronic health conditions, along with growing awareness of personal hygiene, increasing adoption of advanced incontinence and ostomy care products, expanding home healthcare and long-term care services, rising disposable income, supportive healthcare reimbursement policies, a growing focus on improving patient quality of life and comfort, and ongoing innovations in product design and technology that enhance comfort, discretion, and ease of use.

Restraining Factors

The United States incontinence and ostomy care products market is restrained by high product costs, out-of-pocket expenses, social stigma, strict regulations, competition from low-cost alternatives, limited awareness in some populations, and challenges in product distribution and adoption among technologically inexperienced users.

Market Segmentation

The United States incontinence and ostomy care products market share is classified into type and application.

- The incontinence care products segment accounted for the largest revenue market in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States incontinence and ostomy care products market is segmented by type into incontinence care products and ostomy care products. Among these, the incontinence care products segment accounted for the largest revenue market in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to high and consistent demand from the rapidly growing elderly population and patients with chronic conditions. Its dominance is supported by widespread adoption across home healthcare, long-term care facilities, and hospitals, combined with continuous product innovations that enhance comfort, discretion, and usability. Additionally, strong reimbursement policies and awareness campaigns boosted adoption rates, making this segment the top revenue contributor in 2024.

- The protection and cleaning segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The United States incontinence and ostomy care products market is segmented by application into protection and cleaning, security and leakage control, odor control, and others. Among these, the protection and cleaning segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This segment growth is due to consistent daily demand, increasing focus on hygiene and skin protection, broad applicability across patient populations, and continuous innovations enhancing convenience, comfort, and overall user experience.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States incontinence and ostomy care products market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Coloplast

- Kimberly-Clark Corporation

- Salts Healthcare

- Total Home Care Supplies

- Unicharm Corporation

- Urological Supplies Inc

- B. Braun Melsungen AG

- ConvaTec

- Teleflex Incorporated

- Svenska Cellulose Aktiebolaget (SCA)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In May 2025, Coloplast announced a voluntary recall in the international urology segment (bladder health and surgery), which impacted product availability and sales performance during Q2.

- In April 2024, Conva Tec launched esteem body with leak defence in the U.S describing it as a new soft convexity ostomy system with features such as a water repellent material and enhanced sealing technology designed for increased security and discretion.

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States incontinence and ostomy care products market based on the below-mentioned segments:

The United States Incontinence and Ostomy Care Products Market, By Type

- Incontinence Care Products

- Ostomy Care Products

The United States Incontinence and Ostomy Care Products Market, By Application

- Protection and Cleaning

- Security and Leakage Control

- Odor Control

- Others

Frequently Asked Questions (FAQ)

-

What is the growth outlook of the United States incontinence and ostomy care products market from 2025 to 2035?The United States incontinence and ostomy care products market was valued at USD 5,850.2 million in 2024 and is projected to reach USD 10,121.2 million by 2035. The market is expected to grow at a CAGR of 5.11% during the forecast period.

-

What factors are driving the growth of the United States incontinence and ostomy care products market?The market is driven by the aging population, rising chronic diseases, increased hygiene awareness, improved quality of life, supportive reimbursement policies, and continuous product innovations enhancing comfort, discretion, and usability, boosting adoption.

-

What are the key restraining factors affecting the United States incontinence and ostomy care products market?Market growth is limited by high costs, out-of-pocket expenses, social stigma, strict regulations, competition, and distribution challenges restricting adoption.

-

How do government policies support the United States incontinence and ostomy care products market?The Centers for Medicare & Medicaid Services proposed redefining ostomy and urological supplies as medical equipment under its DMEPOS rule (CMS-1828-P), enabling Competitive Bidding expansion. United Ostomy Associations of America strongly opposed the move, warning that it threatens patient access, individualized care, and safety.

-

What opportunities exist in the United States incontinence and ostomy care products market?The market offers strong opportunities from the growing U.S. elderly population, awareness campaigns promoting early diagnosis, expanding home healthcare services, and ongoing product innovations enhancing comfort, discretion, and ease of use.

Need help to buy this report?