United States Hydrogenated Vegetable Oil Market Size, Share, and COVID-19 Impact Analysis, By Grade (Unfractionated, Fractionated), By End Use (Food & Beverage, Personal Care & Cosmetics, Industrial, and Others), and United States Hydrogenated Vegetable Oil Market Insights, Industry Trend, Forecasts To 2035

Industry: Food & BeveragesUnited States Hydrogenated Vegetable Oil Market Insights Forecasts to 2035

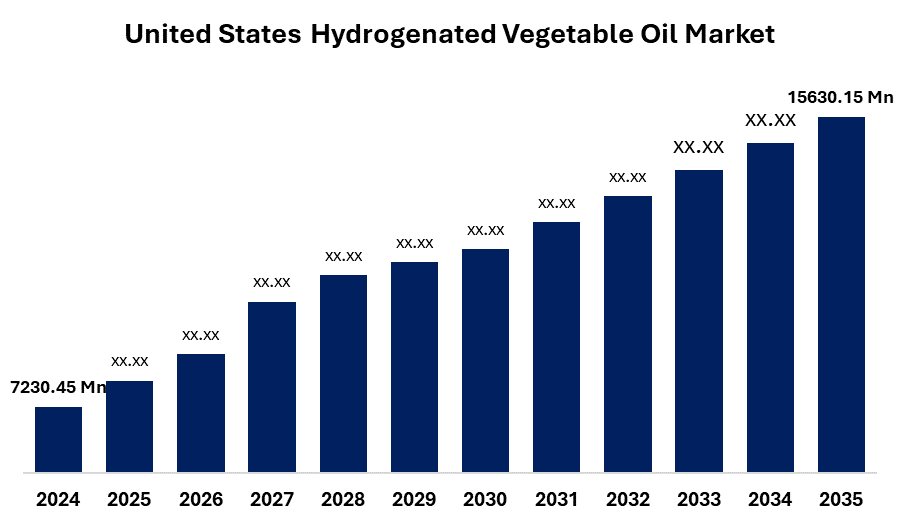

- The United States Hydrogenated Vegetable Oil Market Size Was Estimated at USD 7230.45 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.26% from 2025 to 2035

- The United States Hydrogenated Vegetable Oil Market Size is Expected to Reach USD 15630.15 Million by 2035

Get more details on this report -

The United States Hydrogenated Vegetable Market Size is anticipated to reach USD 15630.15 Billion by 2035,Growing at a CAGR of 7.26% from 2025 to 2035

Market Overview

Hydrogenated vegetable oil is a vegetable oil processed through hydrogenation, a chemical reaction in which hydrogen is added to unsaturated fatty acids with the help of a catalyst. Under room temperature, this process converts liquid vegetable oils such as soybean, palm, and canola oil to semi-fat or solid fat. The main purpose of hydrogenation is to increase the oxidative stability of oil, prolong its shelf life, and change the texture so that it is suitable for various types of industrial and business uses. Hydrogen vegetable oil is an important product in the food and beverage industry. It usually occurs in margarine, bread shortening, confection coatings, coffee creams, and packaged snack foods, where its effect contributes to beneficial product texture, taste stability, and additional protection. Hydrogenated vegetable oils are also used in creams, lotions, and ointments in the form of emulsifiers, moisturizing agents, and stabilizers in cosmetology and drug use. Its continuous relevance is based on compatibility with innovation, regulatory goals, and the needs of stability, especially with the increasing demand of customers for the offerings of healthy and greenery products.

Report Coverage

This research report categorizes the United States hydrogenated vegetable oil market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States hydrogenated vegetable oil market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States hydrogenated vegetable oil market.

United States Hydrogenated Vegetable Oil Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 7230.45 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.26% |

| 2035 Value Projection: | USD 15630.15 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 111 |

| Segments covered: | By Grade, By End Use |

| Companies covered:: | Adm (Archer Daniels Midland), Bunge, Abitec, Aak Ab, Basf, Croda International Plc, Louis Dreyfus Company, Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factor

The United States hydrogenated vegetable oil market is driven by its widespread use in food processing, cosmetics, and pharmaceuticals due to its stability, texture-growing, and shelf-life-expanding properties. Extending applications in individual care and industrial areas further strengthens the increasing demand for cheap processed foods, bakery products, and the growth of confectionery fuel, its business relevance, and long-term market opportunities.

Restraining Factor

The United States hydrogenated vegetable oil market faces restraints due to consumer preference for health concerns on trans fats, hard regulatory guidelines limiting their use, and healthy, non-hydrogenated options. Instability in the prices of raw materials and environmental stability issues also obstruct mass adoption.

Market Segmentation

The United States hydrogenated vegetable oil market share is classified into grade and end-use.

- The unfractionated segment accounted for the largest revenue share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The United States hydrogenated vegetable oil market is segmented by grade into unfractionated and fractionated. Among these, the unfractionated segment accounted for the largest revenue share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. This is due to Extensive use in food and personal care, where natural triglyceride structure provides better oxidative stability and shelf life. The ability to use these oils without additional processing makes them ideal for wholesale fat systems. The increasing demand for stable, cost-effective trans-free oils in processed foods and cosmetic bases is a major contributor to the dominance of this section.

- The food & beverage segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The United States hydrogenated vegetable oil market is segmented by end-use into food & beverage, personal care & cosmetics, industrial, and others. Among these, the food & beverage segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. Hydrogenated vegetable oils are widely used due to their shelf stability and stability in bakery shortening, frying fats, and confectionery coatings. The trend of improvement away from trans fats has further increased the dependence on hydrogenated vegetable oils. Regulatory improvements in trans-fossa eradication, joined with increasing demand for shelf-siege, neutral-swollen oils, are driving the expansion of the section.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the United States hydrogenated vegetable oil market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Adm (Archer Daniels Midland)

- Bunge

- Abitec

- Aak Ab

- Basf

- Croda International Plc

- Louis Dreyfus Company

- Others

Recent Development

- In April 2025, Bunge collaborated with Repsol to create renewable fuels from hydrogenated vegetable oils. The collaboration focuses on processing camelina and safflower into low-carbon intensity oils, which will serve as feedstock for hydrotreated vegetable oil manufacturing, thus promoting sustainable energy options.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States hydrogenated vegetable oil market based on the following segments:

United States Hydrogenated Vegetable Oil Market, By Grade

- Unfractionated

- Fractionated

United States Hydrogenated Vegetable Oil Market, By End-Use

- Food & Beverage

- Personal Care & Cosmetics

- Industrial

- Others

Frequently Asked Questions (FAQ)

-

1. What is the base year considered for the United States hydrogenated vegetable oil market report?The base year considered for this United States hydrogenated vegetable oil market report is 2024.

-

2. What is the historical data coverage for the United States hydrogenated vegetable oil market?The report covers historical data from 2020 to 2023.

-

3. What is the estimated market size of the United States hydrogenated vegetable oil market in 2024?The United States hydrogenated vegetable oil market size was estimated at USD 7,230.45 million in 2024.

-

4. What is the current size of the United States hydrogenated vegetable oil market?The United States hydrogenated vegetable oil market was valued at USD 7,230.45 million in 2024.

-

5. What is the projected market size by 2035?The market is expected to reach USD 15,630.15 million by 2035, growing at a CAGR of 7.26% from 2025 to 2035.

-

6. What are the key factors driving the U.S. hydrogenated vegetable oil market?Growth is driven by increasing demand for processed foods, bakery products, cosmetics, and renewable energy, along with the oil’s stability, texture-enhancing, and shelf-life-extending properties.

-

7. What are the major restraining factors?The market faces restraints from health concerns over trans fats, strict regulatory policies, raw material price volatility, and environmental sustainability issues.

-

8. Which grade segment holds the largest market share?The unfractionated segment accounted for the largest share in 2024 due to its extensive use in food and personal care products.

-

9. Which end-use industry dominated the market in 2024?The food & beverage segment dominated in 2024, driven by strong demand in bakery shortenings, frying fats, and confectionery coatings.

-

10. Who are the leading players in the market?Key companies include ADM, Bunge, Abitec, AAK AB, BASF, Croda International Plc, and Louis Dreyfus Company.

-

11. Who are the key stakeholders targeted in this market?Stakeholders include market players, investors, end-users, government authorities, consulting firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?