United States Humate Market Size, Share, And COVID-19 Impact Analysis, By Application (Ecological Bioremediation, Horticulture, and Agriculture), By Distribution Channel (Store, Online Retail, Company Owned Dealership, and Others), and United States Humate Market Insights, Industry Trend, Forecasts To 2035

Industry: AgricultureUnited States Humate Market Insights Forecasts to 2035

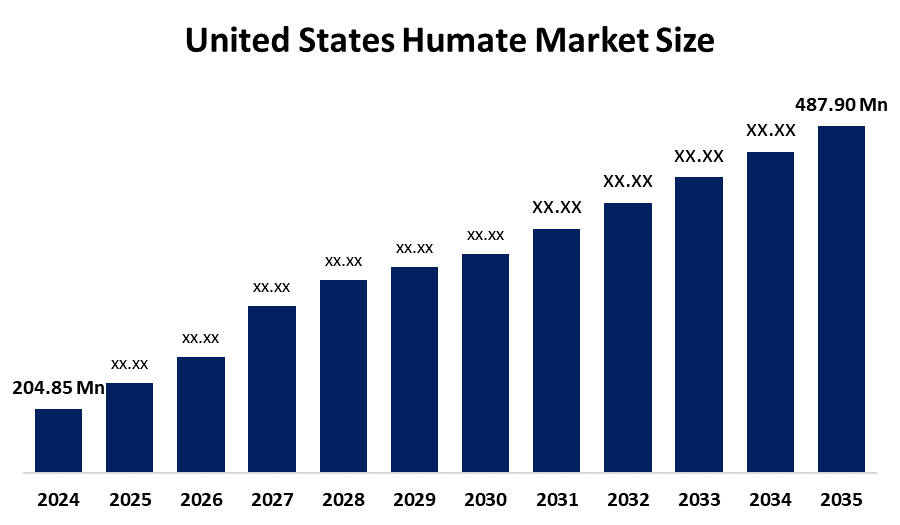

- The United States Humate Market Size Was Estimated at USD 204.85 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.21% from 2025 to 2035

- The United States Humate Market Size is Expected to Reach USD 487.90 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United States Humate Market Size is anticipated to reach USD 487.90 Million by 2035, growing at a CAGR of 8.21% from 2025 to 2035. The United States humate market is being driven by a rise in the development of the organic food industry, an increase in concerns regarding environmental hazards and soil contamination, and an increase in the application as a chelation and pollution detoxifying agent.

Market Overview

Humate is are natural organic material derived from the decomposition of plants and animals, primarily from lignite, leonardite, and peat deposits. Humic acid, popular acid, and salts are all high in humor. These chemicals are generally recognized for improving soil fertility, increasing nutritional absorption, encouraging plant development, and promoting environmental stability. Vets are mostly employed in agriculture as soil conditioners and fertilizers since they dramatically improve soil structure, water retention, and nutrient bioavailability, particularly nitrogen, phosphorus, and potassium. Their chelating characteristics allow crops to absorb minerals more effectively, increase yields, and improve resilience to stressors including drought, salt, and disease. With the increasing demand for organic farming and durable crop management practices, the vets are receiving traction as an environmentally friendly alternative to synthetic fertilizers. Beyond agriculture, Hamates also find applications in the form of natural additives in animal feed, improve digestion, increase immunity, and bind harmful toxins. In the industrial area, they are used for water treatment, oil drilling fluid, and environmental treatment due to their bonding and stabilization properties. Increased awareness about soil health management, jointly adopted, has driven the market, combined with government initiatives promoting sustainable farming.

Report Coverage

This research report categorizes the United States humate market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States humate market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States humate market.

United States Humate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 204.85 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.21% |

| 2035 Value Projection: | USD 487.90 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Application and By Distribution Channel |

| Companies covered:: | The Andersons Inc., Humintech GmbH, HGS BioScience, Inc., Black Earth Humic LP, Faust Bio-Agricultural Services, Inc, Actagro LLC, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factor

The United States humate market is inspired by organic farming, increasing awareness about soil health management, and increasing demand for change towards permanent agricultural practices. With government support for environmentally friendly inputs to improve the attacks to improve crop yield, nutrient absorption, and to improve drought resistance, market development in agricultural and industrial applications, and fuel.

Restraining Factor

The United States humate market faces restraints due to availability of raw materials, high production costs and lack of standardized quality in suppliers face the Humate Market of the United States. Limited awareness and competition from synthetic fertilizers among farmers on a small scale.

Market Segmentation

The United States humate market share is classified into application and distribution channel.

- The agriculture segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States humate market is segmented by application into ecological bioremediation, horticulture, and agriculture. Among these, the agriculture segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to increasing motivation for organic agriculture, and the use of naturally derived products is promoting the demand for Hamat in the agriculture sector. In addition, there is a possibility of bending well for development to increase the cultivation of cannabis and cannabis across the country.

- The online retail segment accounted for the biggest share in 2024 and is anticipated to grow at the highest CAGR during the forecast period.

The United States Humate market is segmented by distribution channel into store, online retail, company-owned dealership, and others. Among these, the online retail segment accounted for the biggest share in 2024 and is anticipated to grow at the highest CAGR during the forecast period. The advent of online retail helps manufacturers formulate products according to different soil types and nutrient requirements. The absence of customization in the store distribution channel is compensated for by online retail.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the United States humate market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- The Andersons Inc.

- Humintech GmbH

- HGS BioScience, Inc.

- Black Earth Humic LP

- Faust Bio-Agricultural Services, Inc

- Actagro LLC

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States humate market based on the below-mentioned segments:

United States Humate Market, By Application

- Ecological

- Bioremediation

- Horticulture

- Agriculture

United States Humate Market, By Distribution Channel

- Store

- Online Retail

- Company-Owned Dealership

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the United States humate Market size in 2024?A: The United States Humate Market size was estimated at USD 204.85 billion in 2024.

-

Q: What is the expected growth rate of the United States humate Market?A: The market is projected to grow at a CAGR of 8.21% from 2025 to 2035.

-

Q: What will be the United States humate Market size by 2035?A: The market size is expected to reach USD 487.90 billion by 2035.

-

Q: Which factors are driving the growth of the U.S. humate Market?A: Key drivers include the rising demand for organic farming, improved soil health management practices, government support for sustainable agriculture, and wider use in industrial and environmental applications.

-

Q: Which application segment holds the largest market share?A: The agriculture segment dominated in 2024 and is expected to maintain its lead, driven by demand for organic crop production and sustainable farming practices.

-

Q: Which distribution channel is growing the fastest?A: The online retail segment accounted for the largest share in 2024 and is projected to grow at the highest CAGR due to customization and wider product accessibility.

-

Q: What are the key restraints in the U.S. humate Market?A: Challenges include fluctuating raw material availability, high production costs, lack of quality standardization, and competition from synthetic fertilizers.

-

Q: Which companies are major players in the U.S. humate Market?A: Key companies include The Andersons Inc., Humintech GmbH, HGS BioScience, Black Earth Humic LP, Faust Bio-Agricultural Services, and Actagro LLC.

-

Q: How does government support influence the humate market?A: Government initiatives promoting eco-friendly farming practices and sustainable inputs are encouraging farmers to adopt humates as alternatives to synthetic fertilizers.

-

Q: What is the forecast period for the U.S. humate Market study?A: The market is analyzed for historical data from 2020–2023, with 2024 as the base year, and forecasts provided from 2025 to 2035.

Need help to buy this report?