United States Hospital and Nursing Home Probiotics Market Size, Share, and COVID-19 Impact Analysis, By Channel (Hospital and Nursing Home), By Function (Gut Health, Immunity, Wellness, and Others), and United States Hospital and Nursing Home Probiotics Market Insights, Industry Trend, Forecasts To 2035

Industry: HealthcareUnited States Hospital and Nursing Home Probiotics Market Insights Forecasts to 2035

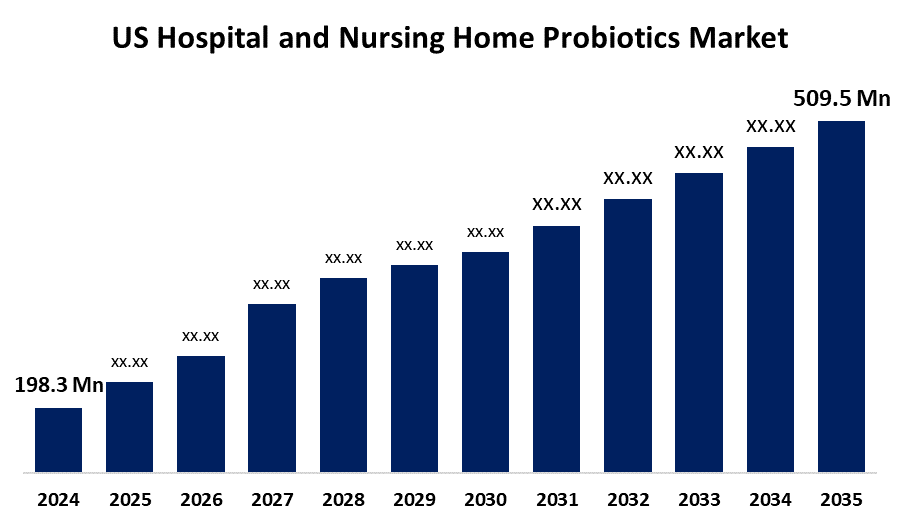

- The United States Hospital and Nursing Home Probiotics Market Size Was Estimated at USD 198.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.96% from 2025 to 2035

- The United States Hospital and Nursing Home Probiotics Market Size is Expected to Reach USD 509.5 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United States Hospital and Nursing Home Probiotics Market Size is anticipated to reach USD 509.5 Million by 2035, growing at a CAGR of 8.96% from 2025 to 2035. The U.S. hospital and nursing home probiotics market is being driven by a quick shift in consumer preferences toward healthier lifestyles and the resulting increase in demand for such services.

Market Overview

Hospital and nursing home probiotics refer to improving intestinal health, restoring beneficial microorganisms, to restore or treat infections, and to prevent or treat infections - most often, lactobacillus, bifidobacterium are given to patients and inhabitants in healthcare facilities. These strains are chosen scientifically and administered under medical supervision, unlike typical diet probiotics. They are often involved in dietary supplements, or medical nutrition products designed for susceptible groups. Patients in hospitals and senior citizens, and survival facilities often deal with weaker immune systems, the use of chronic drugs, and pathogen exposure, which can all change the intestinal microbiota. In particular, antibiotics often result in an imbalance that contributes to nutritional absorption, diarrhea, and reduction of Clostridium difficile infections. By increasing immunity, preventing colonization of pathogenic microbes, and restoring beneficial intestinal flora, probiotics help reduce these risks. Probiotics are being included in regular treatment in nursing homes to help the elderly, who are more vulnerable to chronic diseases, weak immune systems, and digestive issues. Additionally, probiotic administration is often associated with enhanced flexibility against general infections, low dependence on drugs, and a better quality of life.

Report Coverage

This research report categorizes the USA hospital and nursing home probiotics market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the U.S. hospital and nursing home probiotics market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States hospital and nursing home probiotics market.

United States Hospital and Nursing Home Probiotics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 198.3 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.96% |

| 2035 Value Projection: | USD 509.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 213 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Channel and By Function |

| Companies covered:: | Bio-K+, a Kerry company, American Lifeline Inc., Rising Pharmaceuticals, Biocodex, Probiotical S.p.A., Protexin, Dietary Pros, Inc., Dr.Joseph Mercola, and Others |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Driving Factor

The United States hospital and nursing home probiotics market is driven by reducing hospital-mediated infections, increasing knowledge of microbiome health, and an increase in antibiotic-diarrhea episodes. Clinical verification of some strains, using probiotics in elder care, and all health facilities involved in preventive healthcare procedures contribute to the acceleration of demand.

Restraining Factor

The United States hospital and nursing home probiotics market has to face restrictions due to Restricted regulatory worries about clarity, high price of clinical-grade probiotics, and protecting strains in susceptible individuals. Additionally, there is an inconsistent efficacy in hospital and nursing home settings and inconsistency in the disgrace of the study and healthcare providers.

The United States hospital and nursing home probiotics market share is classified into channel and function.

- The hospital segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the projected timeframe.

The United States hospital and nursing home probiotics market is segmented by channel into hospital and nursing home. Among these, the hospital segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the projected timeframe. This is due to an increase in patient entry rate for the progress-related conditions in hospital services and infrastructure. Probiotics are used in various types of settings in these features, mainly in relation to immunological functions, infectious diseases, and gastrointestinal (GI) health.

- The immunity segment is anticipated to grow at the fastest CAGR during the forecast period.

The United States hospital and nursing home probiotics market is segmented by function into gut health, immunity, wellness, and others. Among these, the immunity segment is anticipated to grow at the fastest CAGR during the forecast period. Probiotics ability to promote immune function is attracting more attention across the country, especially in health facilities such as hospitals and assisted living facilities. Due to compromised immune systems, long-term conditions, or intensive medical treatment, these settings are often susceptible to infection for residents and patients.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the United States hospital and nursing home probiotics market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bio-K+, a Kerry company

- American Lifeline Inc.

- Rising Pharmaceuticals

- Biocodex

- Probiotical S.p.A.

- Protexin

- Dietary Pros, Inc.

- Dr.Joseph Mercola

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States hospital and nursing home probiotics market based on the below-mentioned segments:

United States Hospital and Nursing Home Probiotics Market, By Channel

- Hospital

- Nursing Home

United States Hospital and Nursing Home Probiotics Market, By Function

- Gut Health

- Immunity

- Wellness

- Others

Frequently Asked Questions (FAQ)

-

Q: What was the size of the United States hospital and nursing home probiotics market in 2024?A: The U.S. hospital and nursing home probiotics market was valued at USD 198.3 million in 2024.

-

Q: What is the projected market size by 2035?A: The market is expected to reach USD 509.5 million by 2035.

-

Q: What is the forecasted CAGR for the U.S. hospital and nursing home probiotics market from 2025 to 2035?A: The market is projected to grow at a CAGR of 8.96% during 2025–2035.

-

Q: What are the main factors driving market growth?A: Key drivers include reducing hospital-acquired infections, rising cases of antibiotic-associated diarrhea, growing awareness of microbiome health, and increasing use of probiotics in elder care facilities.

-

Q: What are the major restraining factors for this market?A: Challenges include regulatory uncertainty, high cost of clinical-grade probiotics, safety concerns in vulnerable populations, and inconsistent efficacy in clinical settings.

-

Q: Which channel segment held the largest market share in 2024?A: The hospital segment held the largest market share in 2024 due to higher patient inflow and broad applications in GI health, immunity, and infection control.

-

Q: Which function segment is expected to grow the fastest during the forecast period?A: The immunity segment is anticipated to grow at the fastest CAGR, driven by rising focus on infection prevention in hospitals and nursing homes.

-

Q: Who are the key players in the United States hospital and nursing home probiotics market?A: Major companies include Bio-K+ (Kerry), American Lifeline Inc., Rising Pharmaceuticals, Biocodex, Probiotical S.p.A., Protexin, Dietary Pros Inc., Dr. Joseph Mercola, and others.

-

Q: What is the time frame covered in the market report?A: The report covers historical data from 2020–2023, the base year 2024, and forecasts from 2025 to 2035.

Need help to buy this report?