United States Healthy Vegetable Chips Market Size, Share, And COVID-19 Impact Analysis, By Product (Root Vegetable Chips, Leafy Green Chips, and Others), By Processing (Plain & Salted, Spiced & Seasoned, Cheese-Flavored, and Others), By Distribution Channel, (Online and Offline), and United States Healthy Vegetable Chips Market Insights, Industry Trend, Forecasts To 2035

Industry: Food & Beverages

United States Healthy Vegetable Chips Market Insights Forecasts to 2035

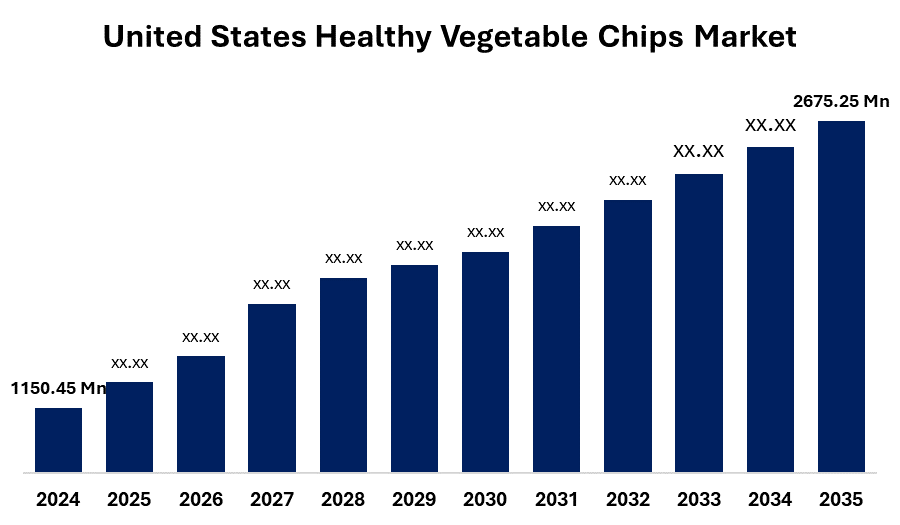

- The United States Healthy Vegetable Chips Market Size Was Estimated at USD 1150.45 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.97% from 2025 to 2035

- The United States Healthy Vegetable Chips Market Size is Expected to Reach USD 2675.25 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United States Healthy Vegetable Chips Market Size is anticipated to reach USD 2675.25 Million by 2035, Growing at a CAGR of 7.97% from 2025 to 2035.

Market Overview

Healthy vegetable chips are snack substitutes because they are produced from nutritious vegetables such as kale, beetroot, carrot, and sweet potato, which are typically baked or air-fried rather than fried. The healthy vegetable chips contain lower fat, fewer calories, higher fiber, and more micronutrients than ordinary chips, allowing for munching in a healthy way to maintain a balanced diet. They are validly ripened, dried in the air, or minimized to preserve more nutrients and use very little for oil in low-calorie foods. Since vegetarian and vegetarian lifestyles have become more popular, the use of plant-based snacks, such as vegetable chips, will see healthy vegetable chips as they are more nutritious than regular potato chips. The products are marketed as being lower fat, lower calories, gluten-free, high in vitamins and minerals, to match the growing request for healthy snacks, and offer options for health-based food consumption.

Report Coverage

This research report categorizes the United States healthy vegetable chips market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States healthy vegetable chips market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the United States healthy vegetable chips market.

United States Healthy Vegetable Chips Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1150.45 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.97% |

| 2035 Value Projection: | USD 2675.25 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 122 |

| Segments covered: | By Product, By Processing, By Distribution Channel |

| Companies covered:: | TERRA (Hain-Celestial), Kibo Foods, GoPure, Lantev Industries, Hunter Foods Private Ltd, Rivera Foods, Troovy, Rare Fare Foods, LLC, PepsiCo, Garden Veggie Snacks, Others |

| Pitfalls & Challenges: | Covid 19 Impact Challenges, Future, Growth and Analysis |

Get more details on this report -

Driving Factor

Healthy vegetable chips are not only lower in calories and fat than traditional chips, but they are also higher in fiber and micronutrients, making them healthier snacks and choices overall. Manufacturers are now offering value-added chips manufactured from veggies to suit this demand.

Restraining Factor

The U.S. healthy vegetable chips market faces high raw materials and production costs, low shelf life, a complex supply chain, limited consumer awareness in some fields, and strong competition from traditional snack products, widely adopted.

Market Segmentation

The United States healthy vegetable chips market share is classified into product, processing, and distribution channel.

- The root vegetable chips accounted for the largest revenue share in 2024 and are anticipated to grow at a remarkable CAGR during the forecast period.

The United States healthy vegetable chips market is segmented by product into root vegetable chips, leafy green chips, and others. Among these, the root vegetable chips accounted for the largest revenue share in 2024 and are anticipated to grow at a remarkable CAGR during the forecast period. The root vegetable chips are produced with nutrient-dense materials such as sweet potato, beets, and carrots. Route vegetable chips are a low-calorie, high-fiber snacks that provide significant vitamins and antioxidants. With increased health consciousness and clean, organic products, consumers are attracted to natural taste and crunch.

- The fried chips accounted for a significant share in 2024 and are anticipated to grow at a significant CAGR during the forecast period.

The United States healthy vegetable chips market is segmented by processing into plain & salted, spiced & seasoned, cheese-flavored, and others. Among these, the fried chips accounted for a significant share in 2024 and are anticipated to grow at a significant CAGR during the forecast period. Fried chips provide the correct combination of crispy texture and rich taste that is considered a healthy option for traditional potato chips. Progress in frying techniques, such as vacuum frying, has also helped limit oil absorption, giving them more attractive options for health-conscious people

- The offline segment accounted for the largest revenue share of the United States healthy vegetable chips market in 2024.

The United States healthy vegetable chips market is segmented by distribution channel into online and offline. Among these, the offline segment accounted for the largest revenue share of the United States healthy vegetable chips market in 2024. Offline channels are expanding because consumers prefer to buy in-store experiences that allow them to evaluate product freshness, materials, and packaging firsthand. In addition, they play an important role in generating sales by providing a diverse selection of products and package deals that appeal to health-conscious shoppers. In addition, the checkout helps to promote sales at the desk and in the snack corridors.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the United States healthy vegetable chips market, along with a comparative evaluation primarily based on their type offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes Protein development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- TERRA (Hain-Celestial)

- Kibo Foods

- GoPure

- Lantev Industries

- Hunter Foods Private Ltd

- Rivera Foods

- Troovy

- Rare Fare Foods, LLC

- PepsiCo

- Garden Veggie Snacks

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States healthy vegetable chips market based on the below-mentioned segments:

United States Healthy Vegetable Chips Market, By Product

- Tablets & Capsules

- Powders

- Drinks

- Gummies

- Others

United States Healthy Vegetable Chips Market, By Processing

- Plain & Salted

- Spiced & Seasoned

- Cheese-flavored

- Others

United States Healthy Vegetable Chips Market, By Distribution Channel

- Online

- Offline

Frequently Asked Questions (FAQ)

-

1. What is the size of the U.S. healthy vegetable chips market in 2024?The U.S. Healthy Vegetable Chips market size was estimated at USD 1,150.45 million in 2024.

-

2. What is the forecasted market size of the U.S. healthy vegetable chips market by 2035?The market is projected to reach USD 2,675.25 million by 2035, growing at a CAGR of 7.97% from 2025 to 2035.

-

3. Which product type segment dominates the U.S. healthy vegetable chips market?Root vegetable chips accounted for the largest revenue share in 2024, driven by strong consumer preference for nutrient-rich options like sweet potato, beet, and carrot.

-

4. Which processing type is most widely used in the U.S. healthy vegetable chips market?Fried chips held a significant share in 2024, supported by improved frying techniques such as vacuum frying that reduce oil absorption while retaining crispness and flavor.

-

5. Which distribution channel is the largest in the U.S. healthy vegetable chips market?The offline segment accounted for the largest revenue share in 2024, as consumers prefer in-store shopping experiences to evaluate freshness, packaging, and product quality.

-

6. What are the key driving factors of the U.S. healthy vegetable chips market?Major drivers include the rising demand for healthy snacking alternatives, growing health and wellness awareness, the popularity of plant-based diets, and product innovations in low-calorie, nutrient-rich chips.

-

7. What are the restraining factors of the U.S. healthy vegetable chips market?Growth is constrained by high raw material costs, shorter shelf life, complex supply chains, limited consumer awareness in certain regions, and strong competition from conventional snack formats.

-

8. Who are the key players in the U.S. healthy vegetable chips market?Key companies include TERRA (Hain-Celestial), Kibo Foods, GoPure, Lantev Industries, Hunter Foods, Rivera Foods, Troovy, Rare Fare Foods LLC, PepsiCo, Garden Veggie Snacks, and others.

-

9. What are the latest trends in the U.S. healthy vegetable chips market?Key trends include the rise of plant-based and vegan-friendly chips, innovative flavors, sustainable packaging, clean-label products, and growing online retail penetration.

-

10. What is the forecast period for the U.S. healthy vegetable chips market analysis?The report forecasts market growth from 2025 to 2035, using 2024 as the base year and considering historical data from 2020 to 2023.

Need help to buy this report?