United States Healthcare Staffing and Scheduling Software Market Size, Share, And COVID-19 Impact Analysis, By Deployment Mode (Web-Based, Cloud-based, On-Premises, and Mobile Installed), By Application (Time and Attendance, HR and Payroll, Scheduling, Talent Management, Reporting & Analytics, and Others), By End Use (Healthcare Facilities and Home Care Settings), and United States Healthcare Staffing and Scheduling Software Market Insights, Industry Trend, Forecasts To 2035

Industry: HealthcareUnited States Healthcare Staffing and Scheduling Software Market Insights Forecasts to 2035

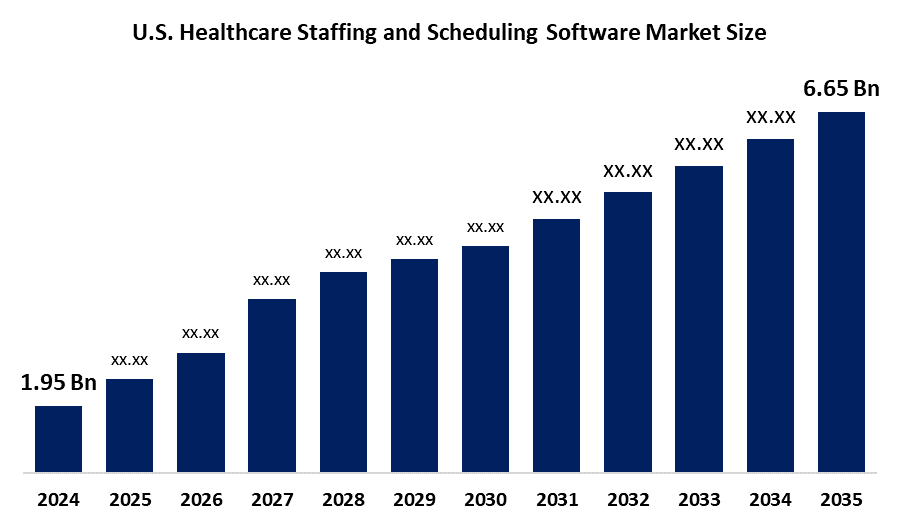

- The United States Healthcare Staffing and Scheduling Software Market Size Was Estimated at USD 1.95 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 11.8% from 2025 to 2035

- The United States Healthcare Staffing and Scheduling Software Market Size is Expected to Reach USD 6.65 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United States Healthcare Staffing And Scheduling Software Market Size is anticipated to reach USD 6.65 Billion by 2035, growing at a CAGR of 11.8% from 2025 to 2035. The United States healthcare staffing and scheduling software market is being driven by a rising need for cost reduction and operational efficiency, as well as the use of AI-driven and predictive scheduling. Other factors driving market expansion include the increased focus on compliance and credentialing, as well as integration with key health IT systems.

Market Overview

Software for healthcare staffing and scheduling is a unique digital solution designed to maximize workforce management in clinics, hospitals, long-term care facilities, and other health institutions. Patients automate the application, staff members of the staff to meet the demands, staff members automate to allocate the shift allocation and resource plan, so that the appropriate health professionals, such as nurses, doctors, and affiliated employees, are accessible when needed. These technologies promote overall operating efficiency, reduce staffing errors, and reduce administrative stress by changing manual scheduling processes. Typically, it includes software skill sets, certificates, and real-time information on employees' availability and compliance requirements. Features such as automated shift assignments, leave monitoring, overtime management, and predictive analytics are examples of advanced platforms to estimate staffing or extra. Additionally, some systems have self-service facilities that allow staff members to request shifts, switch responsibilities, and manage the schedule through web portals or mobile apps. Suitable staffing is important in the healthcare industry to guarantee the patient's safety, maintain quality of care, and meet legal obligations. Organizations can preserve the patient's happiness by increasing labor expenditure, low burnout among medical staff, and improving schedule accuracy.

Report Coverage

This research report categorizes the United States healthcare staffing and scheduling software market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States healthcare staffing and scheduling software market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States healthcare staffing and scheduling software market.

United States Healthcare Staffing and Scheduling Software Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.95 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 11.8% |

| 2035 Value Projection: | USD 6.65 Billion |

| Historical Data for: | 2020–2023 |

| No. of Pages: | 211 |

| Tables, Charts & Figures: | 122 |

| Segments covered: | By Deployment Mode, By Application and By End Use |

| Companies covered:: | UKG, BookJane, AMN Healthcare, Oracle, Aya Healthcare, ShiftMed, QGenda, LLC, RLDatix, Bullhorn Inc., and Others |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Driving Factor

The United States healthcare staffing and scheduling software market is driven by the increasing number, the desire to reduce labor costs, the desire to reduce the errors of the employees, and the effective workforce management to address the growing workforce needs of the healthcare staffing and scheduling software industry. The market is growing as a result of the use of AI and cloud-based solutions, and rules need to follow the rules, and the patient has been emphasized on increasing the quality of care of the patient.

Restraining Factor

The United States healthcare staffing and scheduling software market has to face employee protests for high implementation and maintenance costs, integration difficulties with current hospital systems, data security and privacy, and digital adoption. Inadequate technical information can also prevent smooth implementation and use.

Market Segmentation

The United States healthcare staffing and scheduling software market share is classified into deployment, application, and end-use.

- The web-based segments are expected to grow significantly over the forecast period.

The United States healthcare staffing and scheduling software market is segmented by deployment into web-based, cloud-based, on-premises, and mobile installed. Among these, the web-based segments are expected to grow significantly over the forecast period. This is due to Employees protesting for high implementation and maintenance costs, integration difficulties with current hospital systems, data security and privacy, and digital adoption. Inadequate technical information can also prevent smooth implementation and use.

- The time and attendance segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The United States healthcare staffing and scheduling software market is segmented by application into Time and Attendance, HR and Payroll, Scheduling, Talent Management, Reporting & Analytics, and Others. Among these, the time and attendance segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. Healthcare organizations accurately track working hours, shift attendance, overtime, and absence. Time and appearance software automatically automatches these functions, eliminates manual tracking, enables real-time monitoring, and provides reliable data for payroll and compliance.

- The healthcare facilities held the largest share in 2024 and is anticipated to grow substantial CAGR during the forecast period.

The United States healthcare staffing and scheduling software market is segmented by distribution channel into healthcare facilities and home care settings. Among these, the healthcare facilities held the largest share in 2024 and are anticipated to grow substantial CAGR during the forecast period. Hospitals, health systems, outpatient centers, and long-term care facilities faced continuous pressure to ensure round-the-clock staffing coverage, follow labor rules, manage workforce costs, and provide safe, high-quality patient care, which are some challenges that make strong staffing and scheduling tools unavoidable.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the United States healthcare staffing and scheduling software market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- UKG

- BookJane

- AMN Healthcare

- Oracle

- Aya Healthcare

- ShiftMed

- QGenda, LLC

- RLDatix

- Bullhorn Inc.

- Others

Recent Development

- In February 2025, MyMichigan Health integrated QGenda, LLC's credentialing solutions. This integration helped MyMichigan Health significantly enhance operational efficiency and patient access. This unified platform reduces credentialing time and increases provider deployment efficiency.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States Healthcare Staffing and Scheduling Software market based on the below-mentioned segments:

United States Healthcare Staffing and Scheduling Software Market, By Deployment

- Web-Based

- Cloud-based

- On-Premises

- Mobile Installed

United States Healthcare Staffing and Scheduling Software Market, By Application

- Time And Attendance

- HR And Payroll

- Scheduling

- Talent Management

- Reporting & Analytics

- Others

United States Healthcare Staffing and Scheduling Software Market, By End-Use

- Healthcare Facilities

- Home Care Settings

Frequently Asked Questions (FAQ)

-

Q: What is the base year considered in the United States Healthcare Staffing and Scheduling Software Market report?A: The base year considered is 2024, with historical data from 2020 to 2023 and forecasts up to 2035.

-

Q: What is the market size of the U.S. healthcare staffing and scheduling software market in 2024?A: The market size was estimated at USD 1.95 billion in 2024.

-

Q: What is the expected U.S. healthcare staffing and scheduling software market size by 2035?A: The United States healthcare staffing and scheduling software market is expected to reach USD 6.65 billion by 2035.

-

Q: What is the forecasted CAGR for the U.S. healthcare staffing and scheduling software market from 2025 to 2035?A: The market is projected to grow at a CAGR of around 11.8% during the forecast period.

-

Q What factors are driving the growth of U.S. healthcare staffing and scheduling software market?A: Key drivers include increasing patient volumes, demand for cost reduction, need for workforce optimization, rising adoption of AI-driven and cloud-based solutions, and emphasis on compliance and patient care quality.

-

Q: What challenges are restraining U.S. healthcare staffing and scheduling software market growth?A: High implementation and maintenance costs, data security risks, integration issues with existing systems, and resistance to digital adoption are major challenges.

-

Q: Which deployment mode is expected to see strong growth?A: The web-based and mobile-installed segments are expected to grow significantly due to flexibility and ease of use.

-

Q: Which application segment dominated the U.S. healthcare staffing and scheduling software market in 2024?A: The Time and Attendance segment dominated in 2024 and is expected to grow at a substantial CAGR during the forecast period.

-

Q: Which end-use segment held the largest market share in 2024?A: Healthcare facilities (hospitals, clinics, long-term care centers) held the largest share in 2024 and will continue dominating due to higher demand for efficient workforce management.

-

Q: Who are the major players in the U.S. healthcare staffing and scheduling software market?A: Key players include UKG, BookJane, AMN Healthcare, Oracle, Aya Healthcare, ShiftMed, QGenda, LLC, RLDatix, Bullhorn Inc., and others.

-

Q: What recent developments are shaping the U.S. healthcare staffing and scheduling software market?A: In February 2025, MyMichigan Health integrated QGenda’s credentialing solutions, improving operational efficiency and provider deployment.

-

Q: Which stakeholders benefit from the U.S. healthcare staffing and scheduling software market analysis?A: The report is valuable for market players, investors, end-users, government authorities, consulting firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?