United States Healthcare BPO Market Size, Share, By Pharmaceutical Service (Manufacturing Services, Research & Development, And Non-Clinical Services), By Payer Service (Human Resource Management, Claims Management, Customer Relationship Management, Care Management, Provider Management, And Others), And United States Healthcare BPO Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited States Healthcare BPO Market Insights Forecasts to 2035

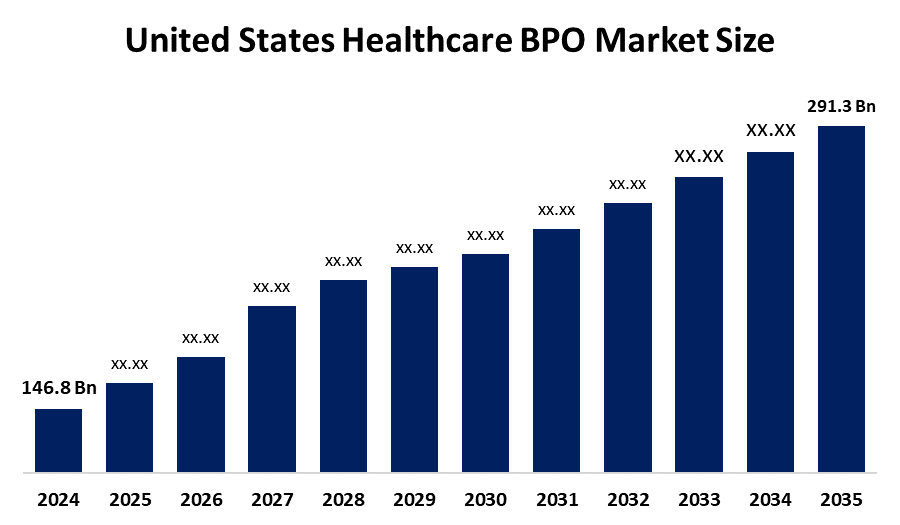

- United States Healthcare BPO Market Size 2024: USD 146.8 Bn

- United States Healthcare BPO Market Size 2035: USD 291.3 Bn

- United States Healthcare BPO Market CAGR 2024: 6.43%

- United States Healthcare BPO Market Segments: Pharmaceutical Service and Payer Service

Get more details on this report -

The US healthcare BPO market represents the practice of transferring non-core business activities and administration through outsourcing by partnering with third-party providers. These outsourced tasks primarily include medical billing, claims processing, coding, revenue cycle management, patient enrollment and appointment scheduling, compliance documentation and employee recruitment, among other necessary but non-clinical functions. As technology and the volume of health care digital data increase, the demand for scalable, technology-driven BPO services continues to rise similarly to how health care providers are converting operations and functions to a more analytics-driven, data-driven method of managing health care.

The healthcare BPO in US are backed by government support, including the Administrative Simplification provisions under HIPAA, implemented and enforced by the Centers for Medicare & Medicaid Services (CMS). U.S. healthcare spending reached over $5.3 trillion in 2024, with administrative costs including federal and private payer administration rising significantly and accounting for a large share of overall expenditure.

As technology continues to advance, U.S. healthcare providers are increasingly adopting automation, analytics, and intelligent data-processing methods to manage large volumes of information. Artificial intelligence–based automation, machine learning, and advanced analytics are being used to streamline repetitive tasks that were traditionally handled by employees within the organization.Cloud computing and digital platforms further enable healthcare providers to securely share data with outsourcing partners. As a result of these technological advancements, BPO vendors are now delivering significantly higher operational efficiency while also offering a broader range of value-added services.

United States Healthcare BPO Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 146.8 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 6.43% |

| 2035 Value Projection: | USD 291.3 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 140 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Payer Service ,By Pharmaceutical Service |

| Companies covered:: | Accenture, Cognizant, Optum, McKesson, IQVIA, Genpact, R1 RCM, IBM, Conduent, Wipro, HCL Technologies, Tata Consultancy Services, Firstsource Solutions, EXL Service, Sutherland Healthcare Solutions,and Other Key Player |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the United States Healthcare BPO Market:

The United States Healthcare BPO Market Size is driven by the rising administrative burden, increasingly complex coding standards, demand for frequent regulatory updates, reimbursement challenges, global growth in healthcare utilization, outsourcing administrative functions helps improve payment cycles, and manage compliance, technological advancements, and strong government supports for healthcare BPO market in US.

The United States Healthcare BPO Market Size is restrained by the slow pace of outsourcing adoption, data security and regulatory compliance, stringent adherence to HIPAA and other privacy standards essential, and cybersecurity and regulatory risk mitigation challenges.

The future of United States Healthcare BPO Market Size is bright and promising, with versatile opportunities emerging from the expanding use of analytics and outcome-oriented outsourcing has led to more utilisation of artificial intelligence in the healthcare industry. The growth of telemedicine and other remote delivery methods of care create opportunities for outsourced support services that will mimic the delivery of care digitally. As these new opportunities continue to emerge, BPO vendors will need to develop new models in order to create unique service solutions that align with the evolving landscape of healthcare delivery in the future.

Market Segmentation

The United States Healthcare BPO Market share is classified into pharmaceutical service and payer service.

By Pharmaceutical Service:

The United States Healthcare BPO Market Size is divided by manufacturing services, research and development, and non-clinical services. Among these, the research and development segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Outsourcing complex drug development, regulatory compliance, need to accelerate time-to-market, strong focus on core competencies, and supply chain evolution all contribute to the research and development segment's largest share and higher spending on healthcare BPO when compared to other pharmaceutical service.

By Payer Service:

The United States Healthcare BPO Market Size is divided by payer service into human resource management, claims management, customer relationship management, care management, provider management, and others. Among these, the claims management segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The claims management segment dominates because of high volume, complex reimbursement rules, need for efficiency, accuracy, and cost reduction, massive workloads, rising denial rates, and sophisticated technology making outsourcing essential for payers in US.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the United States Healthcare BPO Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in United States Healthcare BPO Market:

- Accenture

- Cognizant

- Optum

- McKesson

- IQVIA

- Genpact

- R1 RCM

- IBM

- Conduent

- Wipro

- HCL Technologies

- Tata Consultancy Services

- Firstsource Solutions

- EXL Service

- Sutherland Healthcare Solutions

- Others

Recent Developments in United States Healthcare BPO Market:

In October 2025, AGS Health launched agentic digital-workforce solutions utilizing AI and intelligent automation to tackle increased claim denial rates and staffing challenges.

In July 2025, Omega Healthcare partnered with Microsoft to introduce over 20 GenAI and agentic AI solutions aimed at improving revenue cycle speed and accuracy, particularly in managing denials, appeals, and correspondence.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the United States Healthcare BPO Market Size based on the below-mentioned segments:

United States Healthcare BPO Market, By Pharmaceutical Service

- Manufacturing Services

- Research & Development Services

- Non-Clinical Services

United States Healthcare BPO Market, By Payer Service

- Human Resource Management

- Claims Management

- Customer Relationship Management

- Care Management

- Provider Management

- Others

Frequently Asked Questions (FAQ)

-

What is the US healthcare BPO market size?US healthcare BPO market is expected to grow from USD 146.8 billion in 2024 to USD 291.3 billion by 2035, growing at a CAGR of 6.43% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by the rising administrative burden, increasingly complex coding standards, demand for frequent regulatory updates, reimbursement challenges, global growth in healthcare utilization, outsourcing administrative functions helps improve payment cycles, and manage compliance, technological advancements, and strong government supports for healthcare BPO market in US.

-

What factors restrain the US healthcare BPO market?Constraints include the slow pace of outsourcing adoption, data security and regulatory compliance, stringent adherence to HIPAA and other privacy standards essential, and cybersecurity and regulatory risk mitigation challenges.

-

How is the market segmented by pharmaceutical service?The market is segmented into manufacturing services, research & development services, and non-clinical services.

-

Who are the key players in the US healthcare BPO market?Key companies include Accenture, Cognizant, Optum, McKesson, IQVIA, Genpact, R1 RCM, IBM, Conduent, Wipro, HCL Technologies, Tata Consultancy Services, Firstsource Solutions, EXL Service, Sutherland Healthcare Solutions, and Others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?