United States Gluten-Free Food and Beverages Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Bakery Products, Snacks and RTE Products, Beverages, and Others), By Distribution Channel (Supermarket/Hypermarkets, Convenience Stores, Specialist Retailers, and Others), and United States Gluten-Free Food and Beverages Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesUnited States Gluten-Free Food and Beverages Market Insights Forecasts to 2035

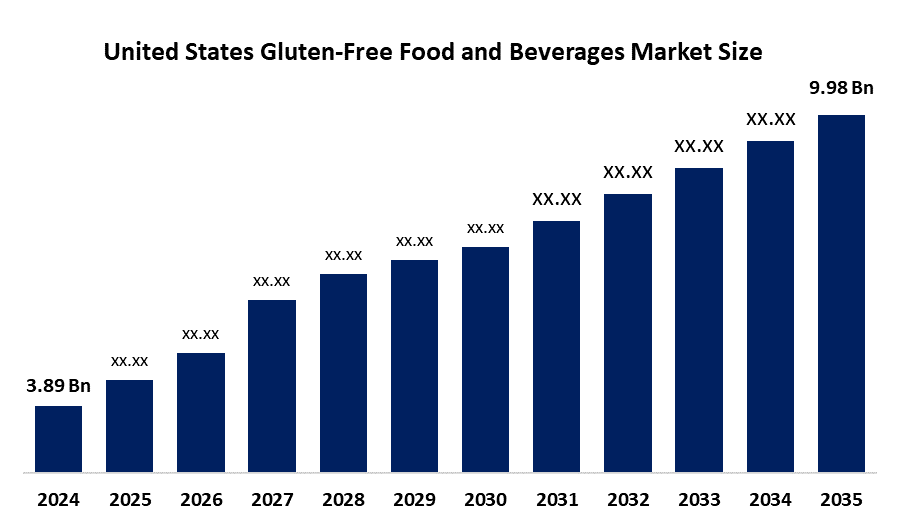

- The United States Gluten-Free Food and Beverages Market Size Was Estimated at USD 3.89 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 8.94% from 2025 to 2035

- The United States Gluten-Free Food and Beverages Market Size is Expected to Reach USD 9.98 Billion by 2035

Get more details on this report -

According to a Research Report published by Spherical Insights & Consulting, The United States Gluten-Free Food and Beverages Market Size is Anticipated to reach USD 9.98 Billion by 2035, Growing at a CAGR of 8.94% from 2025 to 2035. The market is growing due to rising diagnosis rates of celiac disease and gluten sensitivity, government regulations supporting gluten-free labelling, increased awareness through social media influencers and wellness content, and growing focus on gut health and microbiome-friendly diets.

Market Overview

The United States gluten-free food and beverages market refers to the industry segment comprising food and drink products formulated without gluten and sold across the United States, targeting consumers with celiac disease, gluten intolerance, or lifestyle-driven dietary preferences. The United States gluten-free food and beverages market is applied across multiple categories, including bakery products, snacks, ready-to-eat meals, dairy alternatives, beverages, and nutritional products. The market is driven by rising diagnosis rates of celiac disease and gluten sensitivity, government regulations supporting gluten-free labelling, increased awareness through social media influencers and wellness content, and growing focus on gut health and microbiome-friendly diets.

Key opportunities in the United States gluten-free food and beverages market include innovation in clean-label and fortified products, expansion into ready-to-eat categories, rising demand for plant-based and functional options, stronger retail and e-commerce penetration, increasing digestive health awareness, premiumization, and private-label growth. In January 2026, the FDA issued a Request for Information (RFI) to improve gluten labelling and prevent cross-contact in packaged foods. This initiative enhances transparency, strengthens consumer confidence, and supports safer choices, likely boosting demand and expanding the United States gluten-free food and beverages market, particularly for packaged products, ready-to-eat meals, and fortified offerings.

Report Coverage

This research report categorizes the market for the United States gluten-free food and beverages market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States gluten-free food and beverages market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States gluten-free food and beverages market.

United States Gluten-Free Food and Beverages Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3.89 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 8.94% |

| 2035 Value Projection: | USD 9.98 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Application |

| Companies covered:: | General Mills Inc., Conagra Brands, Inc., The Hain Celestial Group, Inc., The Kraft Heinz Company, Bob’s Red Mill Natural Foods, Inc., Barilla G. e R. Fratelli S.p.A., Dr Schar AG/SPA, Enjoy Life Foods (Mondelez International), Amy’s Kitchen, Inc., PepsiCo, Inc., Others, and Key Players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The United States gluten-free food and beverages market is driven by rising cases of celiac disease and gluten sensitivity, which are driving demand for gluten-free products. Government regulations now support clear gluten-free labelling, helping consumers make informed choices. Manufacturers are innovating continuously to improve taste, texture, and formulation, while social media influencers and wellness content raise awareness of gluten-free diets. Additionally, gluten-free products are increasingly perceived as part of a healthier, cleaner lifestyle, aligning with growing consumer interest in gut health and microbiome-friendly eating habits.

Restraining Factors

The United States gluten-free food and beverages market is constrained by higher production and ingredient costs for gluten-free formulations, intense competition from health-positioned categories, regulatory compliance and certification requirements for gluten-free labelling, and taste and texture inconsistencies in certain gluten-free bakery and staple products.

Market Segmentation

The United States gluten-free food and beverages market share is classified into product type and distribution channel.

- The bakery products segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States gluten-free food and beverages market is segmented by product type into bakery products, snacks and RTE products, beverages, and others. Among these, the bakery products segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the fact that they are staple items with consistently high consumer demand. Strong product innovation, a wide variety, and premium pricing opportunities make them commercially attractive. Additionally, health-conscious trends and broad retail availability further drive their market share, making the bakery the most profitable and accessible segment in gluten-free foods.

- The supermarkets/hypermarkets segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The United States gluten-free food and beverages market is segmented by distribution channel into supermarkets/hypermarkets, convenience stores, specialist retailers, and others. Among these, the supermarkets/hypermarkets segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This is due to these outlets offering a wide assortment of gluten-free products, including breads, snacks, beverages, and prepared foods, making them a convenient one-stop shopping option. Supermarkets/hypermarkets often provide private-label gluten-free products at competitive prices, attracting cost-conscious buyers. Finally, the convenience of purchasing all groceries in a single trip further reinforces their dominance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States gluten-free food and beverages market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- General Mills Inc.

- Conagra Brands, Inc.

- The Hain Celestial Group, Inc.

- The Kraft Heinz Company

- Bob’s Red Mill Natural Foods, Inc.

- Barilla G. e R. Fratelli S.p.A.

- Dr Schar AG/SPA

- Enjoy Life Foods (Mondelez International)

- Amy’s Kitchen, Inc.

- PepsiCo, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In January 2026, General Mills Inc. launched a family-size certified gluten-free chicken enchilada dish in Annie’s brand, targeting health-conscious and gluten-free consumers (e.g. new gluten-free cookies and baked snacks).

- In February 2026, Amy’s Kitchen Inc. launched the Cheez-its original gluten-free crackers Cheez-its first gluten-free version and expanded the brand's 2026 snack lineup for health-conscious consumers.

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States gluten-free food and beverages market based on the below-mentioned segments:

United States Gluten-Free Food and Beverages Market, By Product Type

- Bakery Products

- Snacks and RTE Products

- Beverages

- Others

United States Gluten-Free Food and Beverages Market, By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialist Retailers

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the projected size of the United States Gluten-Free Food and Beverages Market by 2035?A: The United States Gluten-Free Food and Beverages Market is projected to reach USD 9.98 billion by 2035, growing from USD 3.89 billion in 2024 at a CAGR of 8.94% during 2025–2035.

-

Q: What factors are driving the growth of the gluten-free food and beverages market in the United States?A: Market growth is driven by rising celiac disease diagnoses, gluten sensitivity awareness, supportive labeling regulations, social media influence, clean-label trends, and increasing consumer focus on gut health and microbiome-friendly diets.

-

Q: Which product segment held the largest market share in 2024?A: The bakery products segment accounted for the largest revenue share in 2024 due to high consumer demand, strong innovation, premium pricing opportunities, and widespread retail availability across supermarkets and hypermarkets.

-

Q: What are the key opportunities in the United States gluten-free market?A: Key opportunities include innovation in clean-label and fortified products, expansion into ready-to-eat categories, rising plant-based demand, e-commerce growth, digestive health awareness, premiumization, and private-label expansion.

-

Q: What are the major restraining factors affecting the market?A: The market faces challenges such as high production costs, regulatory compliance requirements, certification complexities, competition from other health-focused categories, and taste and texture inconsistencies in some gluten-free products.

Need help to buy this report?