United States Flow Battery Market Size, Share, By Product Type (Redox and Hybrid), By Application (Industrial & Commercial, Defense, Utilities, and Others), United States Flow Battery Market Insights, Industry Trend, Forecasts to 2035.

Industry: Semiconductors & ElectronicsUnited States Flow Battery Market Insights Forecasts to 2035

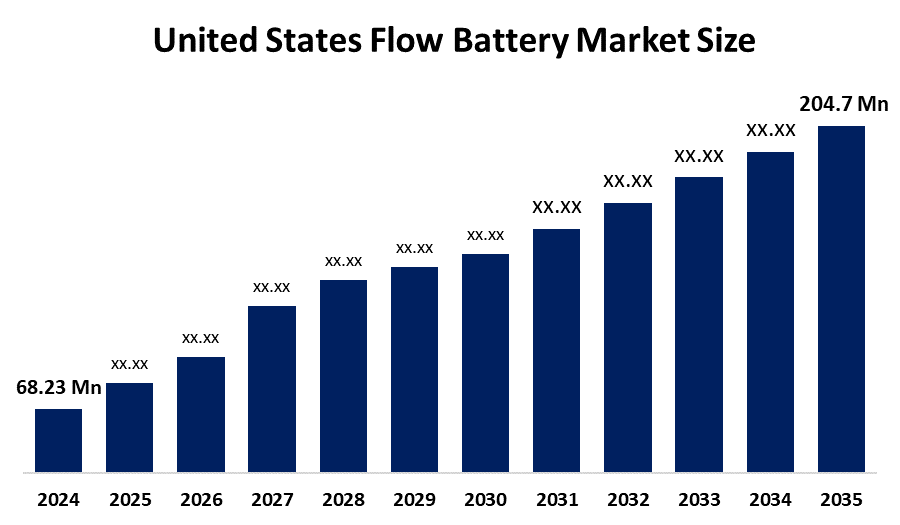

- United States Flow Battery Market Size 2024: USD 68.23 Mn

- United States Flow Battery Market Size 2035: USD 204.7 Mn

- United States Flow Battery Market CAGR 2024: 10.5%

- United States Flow Battery Market Segments: Product Type and Application

Get more details on this report -

The United States Flow Battery Market Size includes the area that deals with the creation, the power, and the application of flow batteries, which are the rechargeable electrochemical energy storage systems that are primarily utilised in power plants, the industry, and the commercial sector for large-scale, long-duration energy storage.A United States start-up (BESSt) presented a progressive zinc-polyiodide redox flow battery that offered an energy density of 320 Wh/L, which is nearly 20× higher than that of the traditional vanadium systems, a considerable step made towards the direction of more compact long-duration storage.

The United States Department of Energy (DOE) announced a 100 million funding program to help the pilot-scale, non-lithium long-duration energy storage projects, including the flow batteries having durations of 10 hours or more. This grant is intended to expedite the commercialization process, lowering costs and enhancing the performance of technologies like flow batteries, which are, at the same time, part of the larger grid storage solutions.The United States Flow Battery Market Size will be strongly backed up by future opportunities in long-duration grid storage, renewable energy integration, micro grids and industrial applications. The market expansion will be fuelled by clean energy policies and the ever-increasing need for reliable and scalable storage.

Market Dynamics of the United States Flow Battery Market:

The United States Flow Battery Market Size t is driven by the emerging need for long-duration energy storage, the rising penetration of renewables such as solar and wind, and the backing of government policies and funding initiatives. Besides, the requirements of grid reliability, peak load management, and green industrial power are pushing the market forward. Moreover, the research for high-energy-density, low-cost, and large-scale flow battery systems is generating the current market trend.

The United States Flow Battery Market Size is restrained by very high initial investment costs, complicated system designs, and a lack of experience with large-scale deployments. Besides, cheaper lithium-ion batteries are competing with flow batteries and thus slow down the adoption of flow batteries, even though the demand for long-duration energy storage is increasing.

The future of the United States Flow Battery Market Size is bright and promising, with the rising demand for long-duration energy storage, renewable integration, friendly government policies and the new technologies coming in, driving the mass use of flow batteries in the utilities, industries and commercial sectors.

Market Segmentation

The United States Flow Battery Market share is classified into types and applications.

By Type:

The United States flow battery market is divided by type into redox and hybrid. Among these, the redox segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Redox flow batteries are still the leaders as they provide a longer cycle life, proven reliability for grid scale, the capability to scale up energy capacity and commercial deployment already established. This has made them the most widely used compared to hybrid flow battery systems in the U.S.

By Applications:

The United States Flow Battery Market Size is divided by applications into industrial & commercial, defense, utilities, and others. Among these, the utilities segment accounted for the largest market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The utilities segment is the biggest reason for the dominance of flow batteries since they are able to provide long-duration and scalable storage, which is very important for the integration of renewable energies, reliability of the grid, and management of peak demand, and thus, most critical for the utilities compared to other applications.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the United States flow battery market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in United States Flow Battery Market:

- Ess Inc. (Ess Tech)

- Lockheed Martin Corporation

- Primus Power

- Vizn Energy Systems

- Stryten Energy

- Unienergy Technologies (Uet)

- Form Energy

- Quino Energy

- Xl Batteries

- Terraflow

- Zenthos

- Others

Recent Developments in United States Flow Battery Market:

In October 2025, The Salt River Project revealed its intention to set up a 5 MW/50 MWh iron flow battery system that has been developed by ESS Tech, which is indicative of one of the larger domestic utility trial projects.

In July 2025, TerraFlow Energy is promoting a 9.6 MW/48 MWh vanadium redox flow battery project in Texas, which is a significant move towards battery technology being used on the grid scale.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

United States Flow Battery Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 68.23 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR Of 10.5% |

| 2035 Value Projection: | USD 204.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 113 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Ess Inc. (Ess Tech) Lockheed Martin Corporation Primus Power Vizn Energy Systems Stryten Energy Unienergy Technologies (Uet) Form Energy Quino Energy Xl Batteries Terraflow Zenthos Others Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States Flow Battery market based on the below-mentioned segments:

United States Flow Battery Market, By Type

- Redox

- Hybrid

United States Flow Battery Market, By Application

- Industrial & Commercial

- Defense

- Utilities

- Others

Frequently Asked Questions (FAQ)

-

What is the United States Flow battery market size?United States flow battery market is expected to grow from USD 68.23 million in 2024 to USD 204.7 million by 2035, growing at a CAGR of 10.5% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by the emerging need for long-duration energy storage, the rising penetration of renewables such as solar and wind, and the backing of government policies and funding initiatives. Besides, the requirements of grid reliability, peak load management, and green industrial power are pushing the market forward. Moreover, the research for high-energy-density, low-cost, and large-scale flow battery systems is generating the current market trend

-

What factors restrain the United States flow battery market?Constraints include the very high initial investment costs, complicated system designs, and a lack of experience with large-scale deployments. Besides, cheaper lithium-ion batteries are competing with flow batteries and thus slow down the adoption of flow batteries, even though the demand for long-duration energy storage is increasing

-

How is the market segmented by type?The market is segmented into redox and hybrid.

-

Who are the key players in the United States flow battery market?Key companies include ESS Inc. (ESS Tech), Lockheed Martin Corporation, Primus Power, ViZn Energy Systems, Stryten Energy, UniEnergy Technologies (UET), Form Energy, Quino Energy, XL Batteries, TerraFlow, Zenthos, and Others

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?