United States Ethylene Propylene Diene Monomer Rubber Market Size, Share, and COVID-19 Impact Analysis, By Product (Hoses, Seals & O-Rings, Gaskets, Rubber Compounds, Weather Stripping, and Others), By End Use (Automotive, Building and Construction, Plastic Modification, Wires and Cables, Lubricant Additives, and Others), and United States Ethylene Propylene Diene Monomer Rubber Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited States Ethylene Propylene Diene Monomer Rubber Market Insights Forecasts to 2035

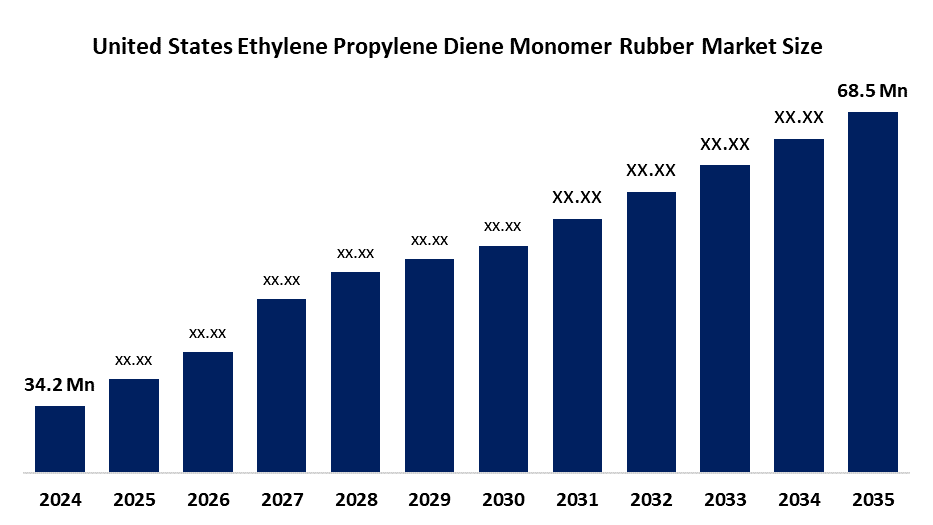

- The United States Ethylene Propylene Diene Monomer Rubber Market Size Was Estimated at USD 34.2 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.52% from 2025 to 2035

- The United States Ethylene Propylene Diene Monomer Rubber Market Size is Expected to Reach USD 68.5 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States ethylene propylene diene monomer rubber market size is anticipated to reach USD 68.5 million by 2035, growing at a CAGR of 6.52% from 2025 to 2035. The ethylene propylene diene monomer rubber market in the United States is driven by strong automotive demand, expansion in roofing and building applications, high weather resistance qualities, infrastructure investment, and growing replacement need for durable elastomer materials.

Market Overview

The United States ethylene propylene diene monomer (EPDM) rubber market refers to the production and consumption of EPDM, which is a synthetic elastomer that resists heat, weather, and ozone damage. The material has multiple applications in automotive seals and hoses, gaskets and roofing membranes, electrical insulation, wire and cable jacketing, and industrial hoses and construction applications because it provides durability and flexibility and extended service life to various end-use industries.

Government infrastructure expenditures, particularly through the USD 1 trillion Infrastructure Investment and Jobs Act, create demand for roofing materials and sealants and construction materials, which benefits the United States EPDM rubber market. The automotive and construction industries receive indirect support for EPDM adoption and innovation through energy-efficient building incentives, EPA green chemistry programs, and state public infrastructure grants.

Recent United States EPDM rubber market developments include ExxonMobil Chemical and Dow’s new EPDM formulations with enhanced UV resistance and flexibility (Oct 2025) to better serve automotive and construction sectors. ExxonMobil plans to restart additional EPDM production capacity in Louisiana (2025), while specialty products for EV sealing and sustainable materials are expanding. Future opportunities exist through bio-based EPDM development, EV component production, infrastructure expansion, and circular recycling technology implementation.

Report Coverage

This research report categorizes the market for the United States ethylene propylene diene monomer rubber market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States ethylene propylene diene monomer rubber market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States ethylene propylene diene monomer rubber market.

United States Ethylene Propylene Diene Monomer Rubber Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 34.2 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 6.52% |

| 2035 Value Projection: | USD 68.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 109 |

| Segments covered: | By Type, By Application |

| Companies covered:: | ExxonMobil Chemical Company, Dow (Dow Inc.), Lion Elastomers LLC, Johns Manville, ARLANXEO, Carlisle Companies Incorporated, West American Rubber Company, LLC, American Rubber Company, Redco Rubber Products, Others, and Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The ethylene propylene diene monomer rubber market in United States is driven by the automotive sector, which requires long-lasting seals, hoses, and weatherstrips; the construction and roofing sectors continue to expand, and infrastructure upgrades take place. The superior material properties of EPDM, which include resistance to heat, ozone, and aging, combine with the increasing demand from growing electric vehicle production and government projects to build an infrastructure base to establish EPDM as a standard material in industrial, electrical, and building construction applications.

Restraining Factors

The ethylene propylene diene monomer rubber market in United States is mostly constrained by the volatile raw material prices, dependence on petrochemical feedstocks, strict environmental regulations, high energy and compliance costs, and competition from alternative elastomers and thermoplastic materials in key applications.

Market Segmentation

The United States ethylene propylene diene monomer rubber market share is classified into product and end use.

- The seals & o-rings segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States ethylene propylene diene monomer rubber market is segmented by product into hoses, seals & o-rings, gaskets, rubber compounds, weather stripping, and others. Among these, the seals & o-rings segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Strong automotive and industrial demand, frequent replacement cycles, and EPDM's excellent resilience to heat, corrosion, and chemicals in sealing applications are the main factors driving this supremacy.

- The automotive segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The United States ethylene propylene diene monomer rubber market is segmented by end use into automotive, building and construction, plastic modification, wires and cables, lubricant additives, and others. Among these, the automotive segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This is caused by the widespread use of EPDM in weatherstrips, hoses, seals, and gaskets, as well as increased car manufacturing, EV adoption, and replacement demand brought on by performance and durability demands.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States ethylene propylene diene monomer rubber market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ExxonMobil Chemical Company

- Dow (Dow Inc.)

- Lion Elastomers LLC

- Johns Manville

- ARLANXEO

- Carlisle Companies Incorporated

- West American Rubber Company, LLC

- American Rubber Company

- Redco Rubber Products

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In December 2025, China increased anti-dumping duties on EPDM from American manufacturers (such as Dow and ExxonMobil), underscoring the continued trade dynamics that impact US EPDM exports.

- In July 2025, Dow Inc. intends to resume producing more EPDM at its facility in Plaquemine, Louisiana, to satisfy rising demand worldwide.

- In October 2024, Johns Manville introduced the JM EPDM FIT Self-Adhered roofing membrane in the United States, which enhances sustainability and installation in construction applications.

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States ethylene propylene diene monomer rubber market based on the below-mentioned segments:

United States Ethylene Propylene Diene Monomer Rubber Market, By Product

- Hoses

- Seals & O-Rings

- Gaskets

- Rubber Compounds

- Weather Stripping

- Others

United States Ethylene Propylene Diene Monomer Rubber Market, By End Use

- Automotive

- Building and Construction

- Plastic Modification

- Wires and Cables

- Lubricant Additives

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the United States ethylene propylene diene monomer rubber market size?A: United States ethylene propylene diene monomer rubber market size is expected to grow from USD 34.2 million in 2024 to USD 68.5 million by 2035, growing at a CAGR of 6.52% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the automotive sector, which requires long-lasting seals, hoses, and weatherstrips; the construction and roofing sectors continue to expand, and infrastructure upgrades take place.

-

Q: What factors restrain the United States ethylene propylene diene monomer rubber market?A: Constraints include the volatile raw material prices, dependence on petrochemical feedstocks, and strict environmental regulations.

-

Q: How is the market segmented by product?A: The market is segmented into hoses, seals & o-rings, gaskets, rubber compounds, weather stripping, and others.

-

Q: Who are the key players in the United States ethylene propylene diene monomer rubber market?A: Key companies include ExxonMobil Chemical Company, Dow (Dow Inc.), Lion Elastomers LLC, Johns Manville, ARLANXEO, Carlisle Companies Incorporated, West American Rubber Company, LLC, American Rubber Company, Redco Rubber Products, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?