United States Ethylene Oxide EO Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Ethylene Glycol, Ethanolamine, Ethoxylates, Glycol Ethers, and Others), By End Use (Automotive, Agriculture, Food & Beverages, Personal Care, Pharmaceuticals, Textile, and Others), and United States Ethylene Oxide EO Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited States Ethylene Oxide EO Market Insights Forecasts to 2035

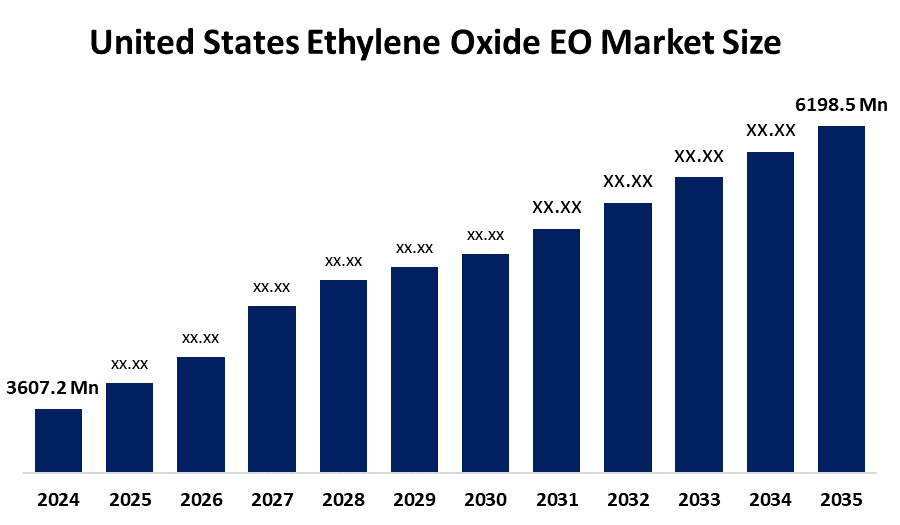

- The United States Ethylene Oxide EO Market Size Was Estimated at USD 3607.2 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.04% from 2025 to 2035

- The United States Ethylene Oxide EO Market Size is Expected to Reach USD 6198.5 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States ethylene oxide EO market size is anticipated to reach USD 6198.5 Million by 2035, growing at a CAGR of 5.04% from 2025 to 2035. The ethylene oxide EO market in United States is driven by increasing demand for ethylene glycol, surfactants, and detergents, expansion in polyester and packaging sectors, rising healthcare sterilizing needs, and expanding industrial and consumer uses.

Market Overview

The market for ethylene oxide in the United States operates through the manufacturing and usage of this essential organic intermediate chemical. The primary application of ethylene oxide involves producing ethylene glycol, various surfactants and detergents, and glycol ethers. Its essential function extends to medical device sterilization and antifreeze manufacturing, polyester fiber production and packaging material creation, and multiple industrial and consumer chemical uses that span the automotive and healthcare, textile, and construction industries.

The U.S. Environmental Protection Agency (EPA) has established strict regulations through the Clean Air Act, which require commercial sterilizers and chemical plants to reduce their ethylene oxide emissions by more than 90% to decrease cancer risk. The organization established new worker exposure limits and interim registration decisions, which would safeguard both workers and communities while working with OSHA and the FDA to develop safer methods and monitoring systems.

The U.S. ethylene oxide market has developed new advanced catalysts, automatic process systems, and emission-control systems to comply with EPA regulations. Companies are improving efficiency and safety. Future opportunities exist in bio-based ethylene oxide and sustainable derivatives, healthcare sterilization, packaging, and polyester applications.

Report Coverage

This research report categorizes the market for the United States ethylene oxide EO market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States ethylene oxide EO market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States ethylene oxide EO market.

United States Ethylene Oxide EO Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3607.2 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 5.04% |

| 2035 Value Projection: | USD 6198.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Product Type, By End Use |

| Companies covered:: | Dow Inc., Shell Chemicals, Huntsman Corporation, Formosa Plastics Corporation, LyondellBasell Industries, Indorama Ventures Oxides LLC, 3M Company, Pollution Systems, Inc., Balchem Corporation, Others, and Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The ethylene oxide EO market in United States is driven by the strong demand for ethylene glycol, which serves multiple applications, including polyester fiber production, antifreeze, and packaging. The market shows growth because increasing demand for detergents, surfactants, and personal care products leads to higher product consumption. The need for healthcare equipment sterilization and the growth of pharmaceutical manufacturing and industrial use, combined with improved EO production methods, drive consistent market expansion.

Restraining Factors

The ethylene oxide EO market in United States is mostly constrained by the environmental and health regulations, the need to spend money on compliance and emission control, and the safety risks from EO toxicity, flammability, and the unpredictable nature of ethylene feedstock costs.

Market Segmentation

The United States ethylene oxide EO market share is classified into product type and end use.

- The ethylene glycol segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States ethylene oxide EO market is segmented by product type into ethylene glycol, ethanolamine, ethoxylates, glycol ethers, and others. Among these, the ethylene glycol segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the fact that ethylene glycol makes up the majority of EO use, which is fueled by strong demand from the manufacturing of polyester fiber and resin, antifreeze, automotive coolants, and packaging materials, all of which support steady revenue growth.

- The textile segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The United States ethylene oxide EO market is segmented by end use into automotive, agriculture, food & beverages, personal care, pharmaceuticals, textile, and others. Among these, the textile segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Large-volume demand and steady market expansion are ensured by the high consumption of ethylene glycol for the production of polyester fiber, which is widely used in clothing, home furnishings, and industrial textiles.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States ethylene oxide EO market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Dow Inc.

- Shell Chemicals

- Huntsman Corporation

- Formosa Plastics Corporation

- LyondellBasell Industries

- Indorama Ventures Oxides LLC

- 3M Company

- Pollution Systems, Inc.

- Balchem Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In June 2024, the EPA reaffirmed the updated EtO emission levels in community fact sheets (such as those in Queensbury and Salinas), highlighting significant additional controls and monitoring requirements around the country.

- In March 2024, the EPA finalized increased emissions regulations for EO from commercial sterilizing facilities under the Clean Air Act, requiring >90% emission reductions and ongoing monitoring for the majority of operations.

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States ethylene oxide EO market based on the below-mentioned segments:

United States Ethylene Oxide EO Market, By Product Type

- Ethylene Glycol

- Ethanolamine

- Ethoxylates

- Glycol Ethers

- Others

United States Ethylene Oxide EO Market, By End Use

- Automotive

- Agriculture

- Food & Beverages

- Personal Care

- Pharmaceuticals

- Textile

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the United States ethylene oxide EO market size?A: United States ethylene oxide EO market size is expected to grow from USD 3607.2 million in 2024 to USD 6198.5 million by 2035, growing at a CAGR of 5.04% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by strong demand for ethylene glycol, which serves multiple applications, including polyester fiber production, antifreeze, and packaging. The market shows growth because increasing demand for detergents, surfactants, and personal care products leads to higher product consumption.

-

Q: What factors restrain the United States ethylene oxide EO market?A: Constraints include the environmental and health regulations, the need to spend money on compliance, and emission control.

-

Q: How is the market segmented by product type?A: The market is segmented into ethylene glycol, ethanolamine, ethoxylates, glycol ethers, and others.

-

Q: Who are the key players in the United States ethylene oxide EO market?A: Key companies include Dow Inc., Shell Chemicals, Huntsman Corporation, Formosa Plastics Corporation, LyondellBasell Industries, Indorama Ventures Oxides LLC, 3M Company, Pollution Systems, Inc., Balchem Corporation, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?