United States Equine Imaging Services Market Size, Share, and COVID-19 Impact Analysis, By Service Type (Computed Tomography, X-ray, Ultrasound, Endoscopy, MRI, Others), By Application (Orthopedics and Traumatology, Oncology, Cardiology, Neurology, Respiratory, Dental Application, and Other), and United States Equine Imaging Services Market Insights, Industry Trend, Forecasts To 2035.

Industry: HealthcareUnited States Equine Imaging Services Market Insights Forecasts To 2035

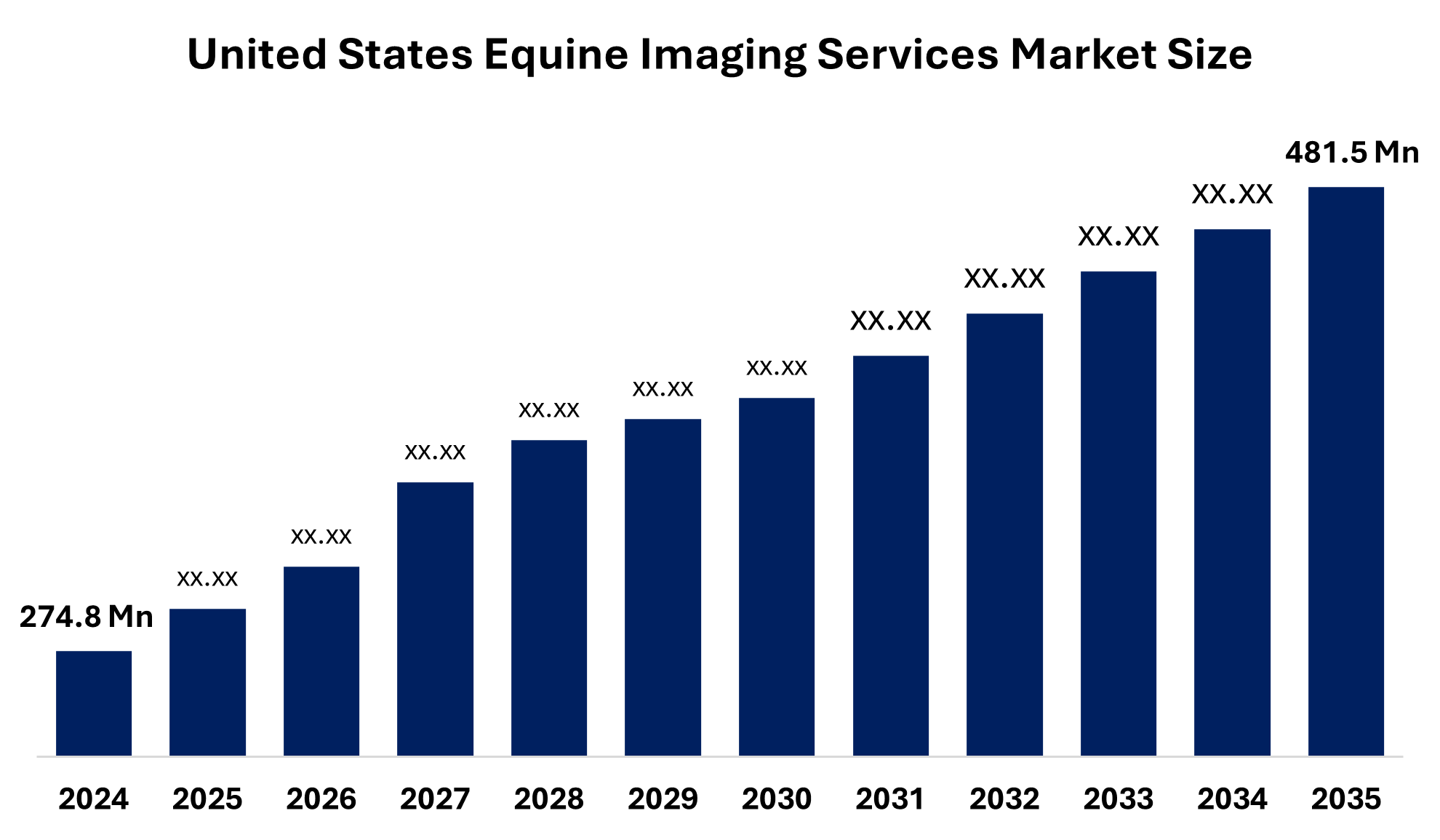

- The U.S. Equine Imaging Services Market Size Was Estimated at USD 274.8 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.23% from 2025 to 2035

- The U.S. Equine Imaging Services Market Size is Expected to Reach USD 481.5 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights Consulting, The USA Equine Imaging Services Market Size is Anticipated To Reach USD 481.5 Million by 2035, Growing at a CAGR of 5.23% from 2025 to 2035. The U.S. equine imaging services market is being driven by the growing introduction of advanced equine imaging technologies. These innovations enhance diagnostic accuracy and reduce the need for general anesthesia, attracting more veterinary practices and improving service quality, especially for equine athletes.

Market Overview

Equine imaging services specifically refer to the application of state-of-the-art clinical imaging technologies made to assess the structures of internal organs, tissues, and horses. These services provide extensive, non-invasive information about soft tissue, neurological, cardiovascular, and musculoskeletal disorders in horses. nuclear scintigraphy (bone scan), computed tomography (CT), magnetic resonance imaging (MRI), ultrasound, radiography (X-ray), and endoscopy are examples of normal imaging methods. Each device has a separate function that helps in early diagnosis, treatment plan, and recurrence tracking of horse patients. The capacity of horse imaging services is of main importance to identify the conditions that are not clear during physical examinations. while ultrasound AIDS, X-rays in evaluation of tendon, ligaments, and reproductive health, X-rays are often used to detect bone fractures, dental issues and anomalies in joints soft tissues, including the head, spine, and organs, are provided by high-resolution images of soft tissues and complex physiological areas by MRI and CT scans, which allow accurate evaluation of disrupting performance diseases. When bone inflammation or stress may be in search of a fracture that cannot appear on traditional X-rays, nuclear scintigraphy is particularly helpful.

Report Coverage

This research report categorizes the USA equine imaging services market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the USA equine imaging services market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA equine imaging services market.

United States Equine Imaging Services Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024 : | USD 274.8 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.23% |

| 2035 Value Projection: | USD 481.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Service Type, By Application |

| Companies covered:: | Hagyard Equine Medical Institute, Mid-Atlantic Equine Medical Center, Palm Beach Equine Clinic, Peterson Smith Equine Hospital, Rood Riddle, Tennessee Equine Hospital, B.W. Furlong Associates, Virginia Equine Imaging, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factor

The US equine imaging services market is driven by rising demand for advanced diagnostics in sports and racehorses, where performance and health are critical. Increasing cases of musculoskeletal injuries, reproductive monitoring, and orthopedic conditions in horses are gaining adoption. Technological advancements, including portable imaging systems and high-resolution modalities, further enhance accessibility, accuracy, and efficiency in equine healthcare management.

Restraining Factor

The US equine imaging services market has to face restrictions because of market expansion is interrupted by the high price of sophisticated imaging technology, as well as a lack of special equipment and qualified personnel. Also, widely adopting these services leads to an obstruction of the issues of insurance coverage for the owners of small scale to the owners of small scale.

The United States equine imaging services market share is classified into service type and application.

- The X-ray segment dominated the market in 2024 and is expected to grow at a substantial CAGR during the projected timeframe.

The United States equine imaging services market is segmented by service type into computed tomography, x-ray, ultrasound, endoscopy, MRI, and others. Among these, the X-ray segment dominated the market in 2024 and is expected to grow at a substantial CAGR during the projected timeframe. This is because of specific use in veterinary treatment for increasing the frequency of musculoskeletal problems, improvement in imaging technology, rapid and successful diagnosis, focus on bone health, strength, and veterinary treatment for horses. Similarly, the growing progress in digital radiology solutions supports market expansion.

- The orthopedics and traumatology segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States equine imaging services market is segmented by application into orthopedics and traumatology, oncology, cardiology, neurology, respiratory, dental applications, and other. Among these, the orthopedics and traumatology segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to their physical structure and racing, jumping, and other types of activity, horses are particularly prone to many orthopedic disorders. Osteoarthritis, tendon injuries, and the development of orthopedic diseases are common problems.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the US equine imaging services market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List Of Key Companies

- Hagyard Equine Medical Institute

- Mid-Atlantic Equine Medical Center

- Palm Beach Equine Clinic

- Peterson Smith Equine Hospital

- Rood Riddle

- Tennessee Equine Hospital

- B.W. Furlong Associates

- Virginia Equine Imaging

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segments

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the USA equine imaging services market based on the below mentioned segments:

U.S. Equine Imaging Services Market, By Service Type

- Computed Tomography

- X-Ray

- Ultrasound

- Endoscopy

- MRI

- Others

U.S. Equine Imaging Services Market, By Application

- Orthopedics And Traumatology

- Oncology

- Cardiology

- Neurology

- Respiratory

- Dental Application

- Other

Frequently Asked Questions (FAQ)

-

1. What was the size of the U.S. equine imaging services market in 2024?The market size was estimated at USD 274.8 million in 2024.

-

2. What is the projected size of the U.S. equine imaging services market by 2035?It is expected to reach USD 481.5 million by 2035.

-

3. What is the growth rate (CAGR) of the market during 2025–2035?The market is projected to grow at a CAGR of 5.23% from 2025 to 2035.

-

4. What are the main factors driving growth in the U.S. equine imaging services market?Growth is driven by the increasing prevalence of musculoskeletal injuries, growing demand for advanced diagnostics in race and sports horses, and advancements in imaging technologies such as portable and high-resolution systems.

-

5. What are the major restraints on this market?High cost of advanced imaging technologies, shortage of specialized equipment and skilled professionals, and limited insurance coverage for equine diagnostics are key restraints.

-

6. Which service type dominated the market in 2024?The X-ray segment dominated the market in 2024 due to its wide availability, affordability, and strong use in diagnosing bone fractures and joint conditions.

-

8. Which application segment held the largest share in 2024?The orthopedics and traumatology segment held the largest share in 2024 because horses are highly prone to tendon injuries, osteoarthritis, and bone fractures.

-

9. Who are the key players in the U.S. equine imaging services market?Key players include Hagyard Equine Medical Institute, Mid-Atlantic Equine Medical Center, Palm Beach Equine Clinic, Peterson Smith Equine Hospital, Rood & Riddle, Tennessee Equine Hospital, B.W. Furlong & Associates, and Virginia Equine Imaging., and Others.

-

10. What is the forecast period covered in this report?The report covers historical data from 2020 to 2023, with forecasts from 2025 to 2035.

Need help to buy this report?