United States Equine Healthcare Market Size, Share, and COVID-19 Impact Analysis, By Product (Vaccines, Pharmaceuticals, Medicinal Feed Additives, Diagnostics, Software & Services, and Others), By Activity (Sports/Racing, Recreation, and Other Activities), By Distribution Channel (Veterinary Hospitals & Clinics, E-commerce, Equestrian Facilities, and Other), and United States .

Industry: HealthcareEquine Healthcare Market Insights, Industry Trend, Forecasts To 2035

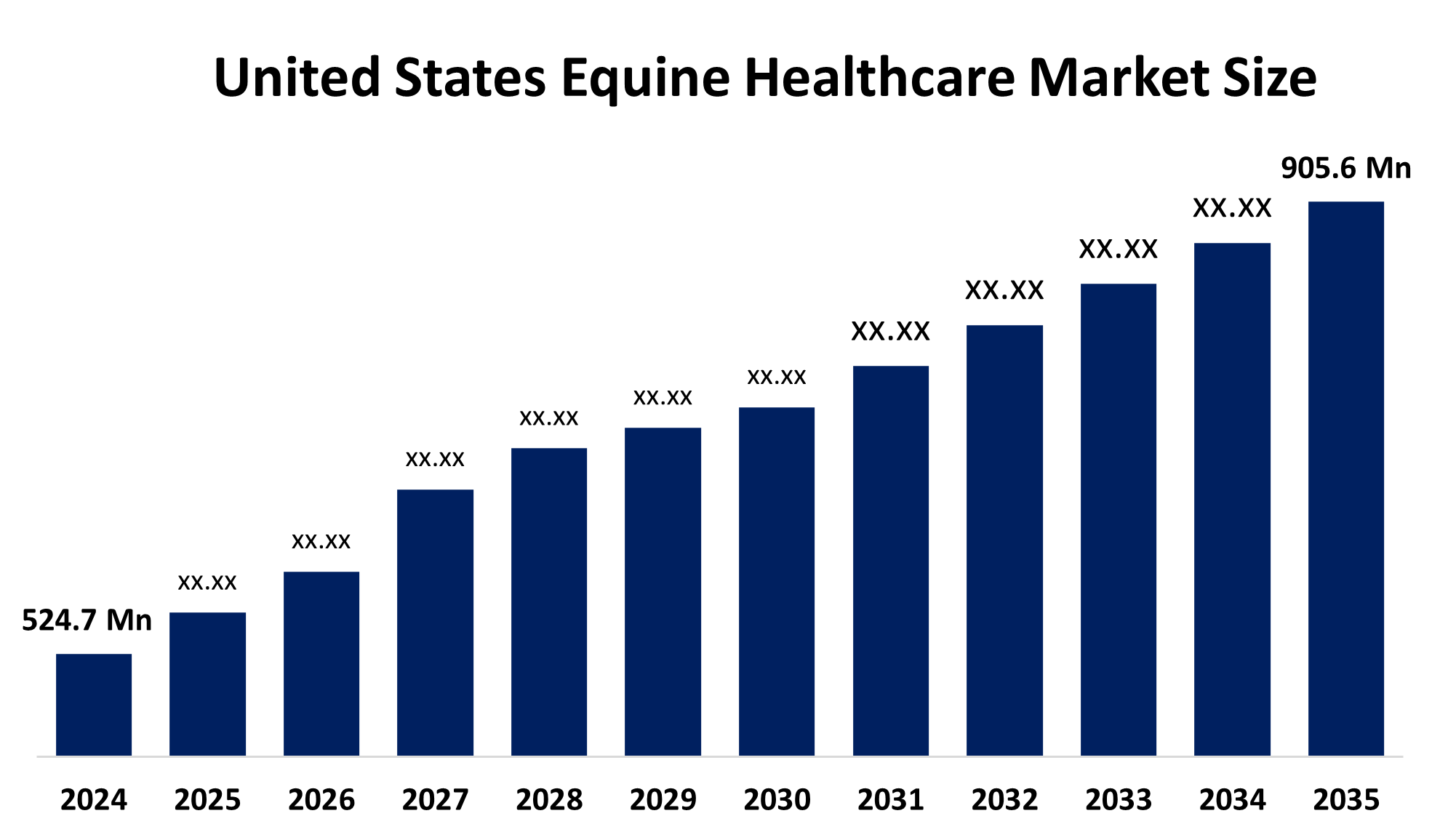

- The United States Equine Healthcare Market Size Was Estimated at USD 524.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.09% from 2025 to 2035

- The United States Equine Healthcare Market Size is Expected to Reach USD 905.6 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights Consulting, The United States Equine Healthcare Market is Anticipated To Reach USD 905.6 Million by 2035, Growing at a CAGR of 5.09% From 2025 to 2035.The U.S. equine healthcare market is being driven by expanding R&D projects, an increase in equine health issues, the growing acceptance of horse-assisted treatment, and the introduction of artificial intelligence (AI) in the field of equine health.

Market Overview

Equine healthcare is an area of veterinary and animal husbandry that focuses on preventing, diagnosing, and treating diseases and injuries, along with general health management of horses. This includes a wide range of treatment and services, such as regular checkups, vaccination, dental care, parasitic control, diet management, reproductive care, surgery, and rehabilitation. Whether a horse is used for racing, sports, employment, or companionship, the main objective of Equine Healthcare is to maintain its health, performance, and lifetime. Therapeutic intervention for acute or chronic diseases includes preventive measures, including frequent health monitoring and proper stable management. Equine diagnostic progression, including digital imaging, ultrasonography, and endoscopy, enables veterinarians to identify respiratory diseases, gastrointestinal issues, and lameness. To assist both immediate recovery and long-term performance, treatment options include anything from drugs and surgery to physical therapy and rehabilitation programs, equine healthcare is regulated by USFDA's Animal and Plant Health Inspection Service (APHIS), with initiatives promoting disease surveillance, vaccination programs, biosecurity standards, and welfare-focused veterinary practices.

Report Coverage

This research report categorizes the USA equine healthcare market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the U.S. equine healthcare market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the US equine healthcare market.

United States Equine Healthcare Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024 : | USD 524.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.09% |

| 2035 Value Projection: | USD 905.6 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Activity, By Distribution Channel |

| Companies covered:: | Hallmarq Veterinary Imaging, Vetoquinol SA, Dechra Veterinary Products, Merck Co Inc, CEVA Inc, Patterson Companies, Equus Magnificus, Others |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factor

The United States equine healthcare market is driven by increasing demand for preventive care, including vaccination and parasitic treatment, expansion of horse-riding sports and racing businesses, and more awareness about animal welfare. The industry is growing even more rapidly for development in tele-health services, regenerative medicine, and clinical imaging. Constant demand is also fueled by professional associations and government initiatives that support the pursuit of health standards

Restraining Factor

The United States equine healthcare market has to face restrictions due to the high expenses of sophisticated treatments, which limit market expansion. Horse healthcare solutions are widely adopted by many issues, including limited access to special care, regulatory obstacles, and incompatible insurance coverage in rural areas.

The United States equine healthcare market share is classified into product, activity, and distribution channel.

- The pharmaceuticals segment held the largest market revenue share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The United States equine healthcare market is segmented by product into vaccines, pharmaceuticals, medicinal feed additives, diagnostics, software & services, and others. Among these, the pharmaceuticals segment held the largest market revenue share in 2024 and is anticipated to grow at a substantial CAGR Guring the forecast period. The variety of health conditions that affect horses, such as pain management, respiratory problems, infectious diseases, and musculoskeletal disorders, requires many common drugs are required, such as anti-parasitic, anti-infective, analgesic, and anti-inflammatory treatments. Veterinarians usually prescribe these drugs as the first line of treatment, requiring more sophisticated care.

- The sports/racing segment dominated the market in 2024 and is expected to grow at a significant CAGR during the projected timeframe.

The United States equine healthcare market is segmented by activity into sports/racing, recreation, and other activities. Among these, the sports/racing segment dominated the market in 2024 and is expected to grow at a significant CAGR during the projected timeframe. The popularity of horse-riding games, is increasing in United States. The demand for section is motivated by the need to provide specific care for horses used in these activities to keep them fit enough to keep them healthy and participate.

- The veterinary hospitals & clinics segment dominated the market in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States equine healthcare market is segmented by distribution channel into veterinary hospitals & clinics, e-commerce, equestrian facilities, and other. Among these, the veterinary hospitals & clinics segment dominated the market in 2024 and is expected to grow at a remarkable CAGR during the forecast period. This is due to the increasing popularity of equestrian activities, horseback riding, and therapy horses, there is a growing need for specialized healthcare services for horses. Hospitals and veterinary clinics have a larger market share since they are better suited to providing the services.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the United States Equine Healthcare market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States equine healthcare market based on the below-mentioned segments:

United States Equine Healthcare Market, By Product

- Vaccines

- Pharmaceuticals

- Medicinal Feed Additives

- Diagnostics

- Software & Services

- Others

United States Equine Healthcare Market, By Activity

- Sports/Racing

- Recreation

- Other Activities

United States Equine Healthcare Market, By Distribution Channel

- Veterinary Hospitals & Clinics

- E-commerce

- Equestrian Facilities

- Other

Frequently Asked Questions (FAQ)

-

1. What was the size of the United States equine healthcare market in 2024?The U.S. equine healthcare market was valued at USD 524.7 million in 2024.

-

2. What is the projected market size of the U.S. equine healthcare market by 2035?The market is expected to reach USD 905.6 million by 2035.

-

3. What is the growth rate (CAGR) of the U.S. equine healthcare market during 2025–2035?The market is projected to grow at a CAGR of 5.09%.

-

4. What are the main factors driving the growth of the U.S. equine healthcare market?Key drivers include rising demand for preventive care, expansion of horse-riding sports and racing, adoption of telehealth and regenerative medicine, and growing animal welfare awareness.

-

5. What are the major restraints in the U.S. equine healthcare market?High treatment costs, limited access to specialized care in rural areas, insurance limitations, and regulatory challenges restrain market growth.

-

6. Which product segment held the largest share of the U.S. equine healthcare market in 2024?The pharmaceuticals segment held the largest share in 2024 and is projected to maintain dominance.

-

7. Why is the pharmaceuticals segment leading the U.S. equine healthcare market?Because of the widespread use of anti-parasitic, anti-infective, analgesic, and anti-inflammatory drugs for common equine health conditions like infections, respiratory, and musculoskeletal disorders.

-

8. Which distribution channel accounted for the largest the U.S. equine healthcare market share in 2024?Veterinary hospitals & clinics held the largest share, supported by advanced facilities and skilled veterinarians.

-

9. Who are the key players in the U.S. equine healthcare market?Key companies include Hallmarq Veterinary Imaging, Vetoquinol SA, Dechra Veterinary Products, Merck & Co., CEVA Inc., Patterson Companies, and Equus Magnificus., and Others.

Need help to buy this report?