United States Electrolyte Powder Market Size, Share, and COVID-19 Impact Analysis, By Type (Bulk, Bagged, and Canned), By Application (Sports and Fitness), and United States Electrolyte Powder Market Insights, Industry Trend, Forecasts To 2035

Industry: Food & BeveragesUnited States Electrolyte Powder Market Insights Forecasts to 2035

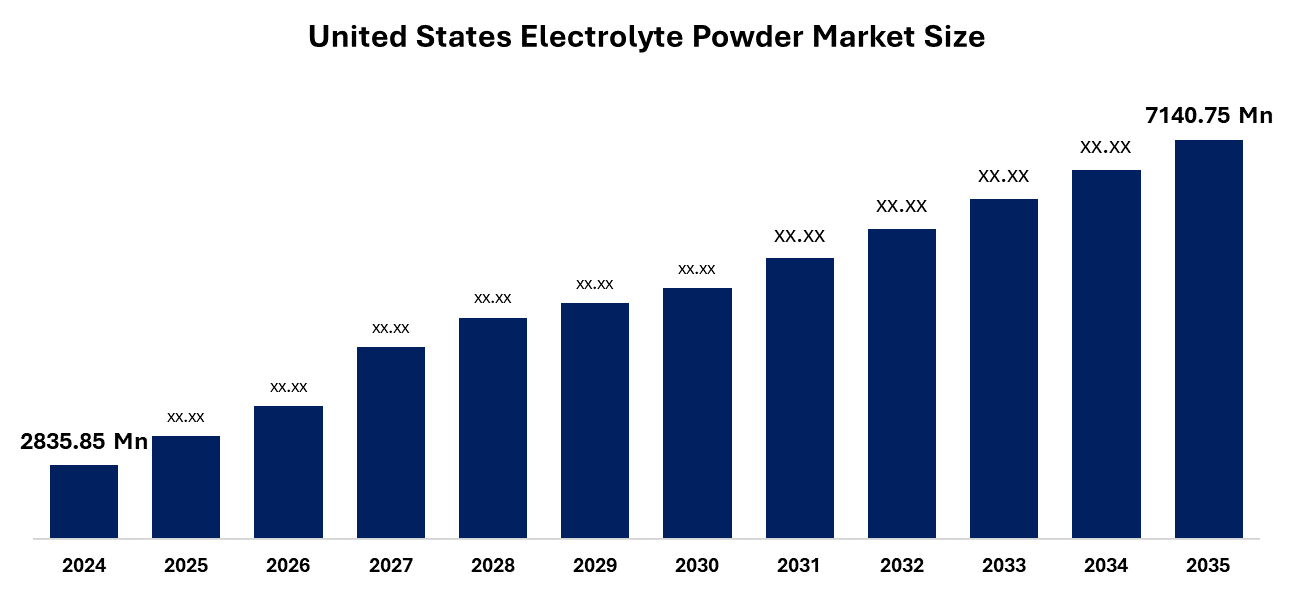

- The United States Electrolyte Powder Market Size Was Estimated at USD 2835.85 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.76% from 2025 to 2035

- The United States Electrolyte Powder Market Size is Expected to Reach USD 7140.75 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United States Electrolyte Powder Market Size is Snticipated to Reach USD 7,140.75 Million by 2035, Growing at a CAGR of 8.76% from 2025 to 2035. The United States electrolyte powder market is being driven by the rising awareness of the significance of electrolyte balance and hydration for overall health and sports performance. The demand for practical and efficient hydration solutions has increased as more individuals participate in activities such as sports, fitness training, and outdoor excursions.

Market Overview

Electrolyte powder is a dietary supplement that contains important minerals such as calcium, magnesium, potassium, sodium, and chloride. These minerals, also known as electrolytes, are used by the body to regulate muscle contraction, neuron activity, fluid balance, and level of hydration. To make drinks, the powder is usually paired with water or any other liquid. To restore mineral balance and hydration, electrolyte powder is often used, especially during illness, dehydration, heat risk, or acute activity. Those who are recovering from the loss of fluid from sports and fitness fundamentalists, along with vomiting, diarrhoea, or sweating, often swallow them. Unlike traditional sports beverages, electrolyte powder often provides a more concentrated supply with low sugar levels and individual dose sizes. Electrolyte powder is becoming more and more common in general welfare and sports nutrition. They are particularly helpful in conditions where the body loses rapid salts and fluids, which include severe exercise, heat exposure, and disease during a long-distance race. Sports and energy drinks are also popular among enthusiasts of athletes and fitness enthusiasts, who are popular to replenish and restore the levels of electrolytes lost through sweat, as they include electrolytes such as salt, potassium, and magnesium.

Report Coverage

This research report categorizes the United States electrolyte powder market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States electrolyte powder market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States electrolyte powder market.

United States Electrolyte Powder Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2835.85 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 8.76% |

| 2035 Value Projection: | USD 7140.75 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Type, By Application. |

| Companies covered:: | Danaher, GenScript, Revvity Inc., Bio-Techne, Merck KGaA, Tocris Bioscience, Bio-Rad Laboratories, New England Biolabs, Inc., OriGene Technologies, Inc., Thermo Fisher Scientific, Inc and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factor

The United States electrolyte powder market is driven by the increasing requirement for easy hydration options, increased participation in sports and fitness activities, and more health consciousness. Development is more aided due to increasing customer preference for plant-based, clean-label, and low-sugar. Its use in everyday welfare, travel, and medical repetition increases the adoption of the market among a variety of consumer groups in search of better performance and hydration.

Restraining Factor

The United States electrolyte powder market has to face restrictions due to customer concerns about unnatural chemicals, competition from ready-to-drink options, and uneven product quality. Higher-priced premium formulation may restrict the uptake, and low awareness among non-athletic or casual consumers can further enter the market.

The United States electrolyte powder market share is classified into type and application.

- The bagged electrolytes powder segment accounted for the largest revenue share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The United States electrolyte powder market is segmented by type into bulk, bagged, and canned. Among these, the bagged electrolytes powder segment accounted for the largest revenue share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. This is due to the bagged electrolyte powder supplied in single parts or pouches. Customers who want on-the-go electrolyte replacement, such as athletes, tourists, or emergency personnel, will find this facility attractive.

- The sports segment held the largest market share in 2024 and is anticipated to grow at a significant CAGR during the projected timeframe.

The United States electrolyte powder market is segmented by application into sports and fitness. Among these, the sports segment held the largest market share in 2024 and is anticipated to grow at a significant CAGR during the projected timeframe. This is due to ease of use, quick absorption, and exact dosage capabilities of the drug. Electrolyte replacement is necessary for athletes to survive hydrated, support muscle function, and avoid cramps during long exercise. The powder versions are more portable than traditional pills or liquid forms, making athletes able to consume them quickly before or later before workouts.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the United States electrolyte powder market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- NutriBiotic

- Lyteline

- Key Nutrients

- Ultima Health Products

- Stokely-Van Camp

- Skratch Labs

- Vitalyte

- Liquid I.V

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States Electrolyte Powder market based on the below-mentioned segments:

United States Electrolyte Powder Market, By Type

- Bulk

- Bagged

- Canned

United States Electrolyte Powder Market, By Application

- Sports

- Fitness

Frequently Asked Questions (FAQ)

-

Q: What is the base year for the United States electrolyte powder market report?A: The base year is 2024, with historical data spanning from 2020 to 2023.

-

Q: What was the market size of the United States electrolyte powder market in 2024?A: The market size was estimated at USD 2,835.85 million in 2024.

-

Q: What is the projected United States electrolyte powder market size by 2035?A: The market is expected to reach USD 7,140.75 million by 2035.

-

Q: What is the forecasted CAGR from 2025 to 2035?A: The market is expected to grow at a CAGR of 8.76% during 2025–2035.

-

Q: What are the main types of electrolyte powders in the United States electrolyte powder market?A: The market is segmented into bulk, bagged, and canned forms. Among these, bagged electrolyte powders held the largest revenue share in 2024.

-

Q: Which application dominates the United States electrolyte powder market?A: The sports segment dominated in 2024 and is expected to maintain significant growth due to athletes’ need for quick and effective hydration.

-

Q: What are the key drivers of the United States electrolyte powder market?A: Market growth is driven by rising health consciousness, growing sports and fitness participation, demand for convenient hydration solutions, and preference for plant-based, clean-label, and low-sugar products.

-

Q: What are the major restraints for the United States electrolyte powder market?A: Challenges include competition from ready-to-drink products, consumer concerns over artificial additives, uneven product quality, higher-priced premium formulations, and low awareness among non-athletic consumers.

-

Q: Who are the key players in the United States electrolyte powder market?A: Major companies include NutriBiotic, Lyteline, Key Nutrients, Ultima Health Products, Stokely-Van Camp, Skratch Labs, Vitalyte, Liquid I.V., and others.

-

Q: How is the United States electrolyte powder market segmented by type?A: By type, the market includes bulk, bagged, and canned electrolyte powders.

Need help to buy this report?