United States Drug Device Combination Products Market Size, Share, and COVID-19 Impact Analysis, By Product (Transdermal Patches, Infusion Pumps, Inhalers, Orthopedic Combination Products, Photodynamic Therapy Devices, and Others), By End-Use (Hospital & Clinic, Ambulatory Surgery Center, Home Care Setting, and Other), and United States Drug Device Combination Products Market Insights, Industry Trend, Forecasts to 2035.

Industry: HealthcareUnited States Drug Device Combination Products Market Insights Forecasts To 2035

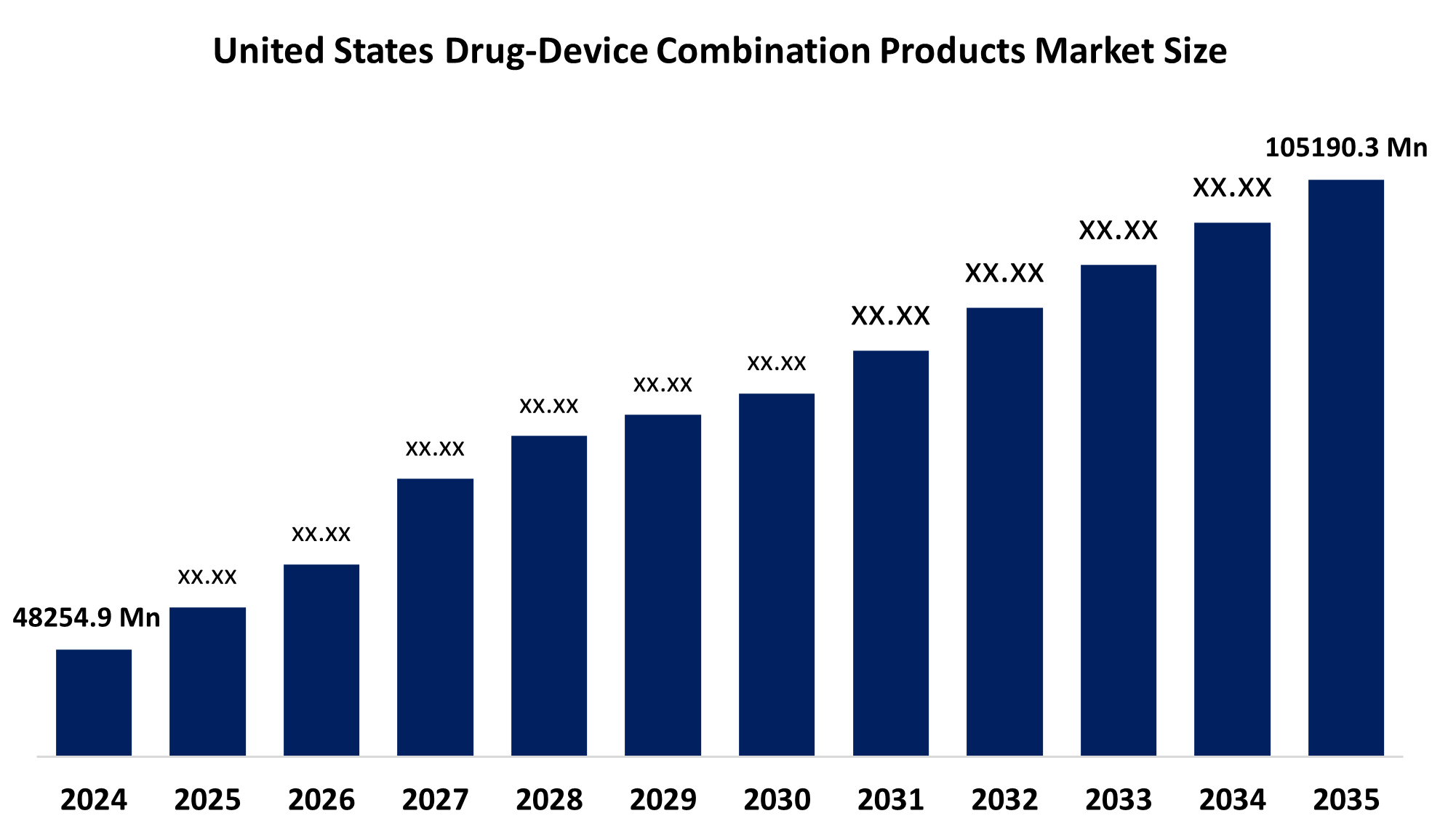

- The United States Drug Device Combination Products Market Size Was Estimated at USD 48254.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.34% from 2025 to 2035

- The United States Drug Device Combination Products Market Size is Expected to Reach USD 105190.3 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights Consulting, The U.S. Drug Device Combination Products Market Size is Anticipated To Reach USD 105190.3 Million by 2035, Growing at a CAGR of 7.34% from 2025 to 2035. Growing elderly populations, rising rates of chronic diseases like diabetes, growing need for minimally invasive drug delivery systems, and technological advancements are driving the US drug-device combination products market.

Market Overview

The drug-device combination products refer to the products that add a drug, biologic, or medical equipment to a unit to improve patient care, effectiveness, and convenience. These products can be in the form of a transplanted drug in delivery devices, a drug-coated device, or an integrated biologic in a device for a specific use. The advantages of pharmacology and state-of-the-art medical equipment technology are combined in products, which are becoming more and more important in today's healthcare system. Examples include insulin pens, drug-eluting stents, transdermal patches, bronchodilators or corticosteroid-containing inhalers, prefilled syringes, and a catheter coated with an antimicrobial. These products reduce the dangers of incorrect administration, increase patient compliance, and improve drug distribution precision. Innovation in this sector is also being intensified by technological development such as wearable technology, digital health integration and smart medicine delivery systems. For instance, wearable injectors and connected inhalers enable real-time monitoring, results, and enhancement. The relevance of drug combinations in oncology and autoimmune diseases has also increased due to the growing requirement of biology and targeted therapy.

Report Coverage

This research report categorizes the market for the U.S. drug device combination products market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US drug device combination products market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA drug device combination products market.

United States Drug Device Combination Products Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024 : | USD 48254.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.34% |

| 2035 Value Projection: | USD 105190.3 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By End-Use |

| Companies covered:: | Abbott Laboratories, Stryker Corp, Viatris Inc, Medtronic PLC, Boston Scientific Corp, Becton Dickinson & Co (BD), Teleflex Inc, Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The USA drug device combination products market is driven by increasing rates of chronic diseases, the need for self-administration equipment that is easy to use patients, and technological progress such as connected inhalers and smart injectors. Combination products contribute to the rapid expansion of the market, supporting FDA support, increasing R&D expenditure, and increasing biologics for better patient compliance and treatment results.

Restraining Factors

The USA drug device combination products market faces challenges due to expensive development expenditure, approval procedures, and strict regulatory barriers. Adoption eclipse is further interrupted by complex manufacturing, interoperability issues, and reimbursement uncertainty.

Market Segmentation

The United States drug device combination products market share is classified into product and end-use.

- The transdermal patches segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US drug device combination products market is segmented by product into transdermal patches, infusion pumps, inhalers, orthopedic combination products, photodynamic therapy devices, and others. Among these, the transdermal patches segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period. This dominance is due to the non-invasive character, which is in line with the growing need for patient-friendly and less invasive medication administration methods. Transdermal patches provide a practical substitute for continuous, regulated drug delivery, satisfying patient demands for simplicity of use and reduced discomfort.

- The hospitals & clinics segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US drug device combination products market is segmented by end-use into hospital & clinic, ambulatory surgery center, home care setting, and other. Among these, the hospitals & clinics segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The hospital and Clinic Segment should be the top priority for the drug and medical industries. This category of products aims to mix drugs and medical devices and improve the efficacy, safety, and convenience of treatments administered in hospital settings.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States drug device combination products market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List Of Companies

- Abbott Laboratories

- Stryker Corp

- Viatris Inc

- Medtronic PLC

- Boston Scientific Corp

- Becton Dickinson & Co (BD)

- Teleflex Inc

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States drug device combination products Market based on the below-mentioned segments:

United States Drug Device Combination Products Market, By Product

- Transdermal Patches

- Infusion Pumps

- Inhalers

- Orthopedic Combination Products

- Photodynamic Therapy Devices

- Others

United States Drug Device Combination Products Market, By End-Use

- Hospital & Clinic

- Ambulatory Surgery Center

- Home Care Setting

- Other

Frequently Asked Questions (FAQ)

-

1. What was the market size of the United States drug-device combination products market in 2024?The market size was estimated at USD 48,254.9 million in 2024.

-

2. What is the expected market size of the U.S. drug-device combination products market by 2035?The market is expected to reach USD 105,190.3 million by 2035.

-

3. What is the compound annual growth rate (CAGR) for this market?The market is projected to grow at a CAGR of 7.34% during the forecast period 2025–2035.

-

4. What are drug-device combination products?These are products that combine a drug, biologic, or medical device into a single unit to improve patient care, effectiveness, safety, and convenience. Examples include insulin pens, drug-eluting stents, transdermal patches, inhalers, prefilled syringes, and antimicrobial-coated catheters.

-

5. What are the main growth drivers of the U.S. drug-device combination products market?Key drivers include the rising prevalence of chronic diseases, an aging population, demand for minimally invasive drug delivery systems, and technological advancements such as smart injectors and connected inhalers.

-

6. What factors are restraining market growth?Challenges include high development costs, strict regulatory approvals, complex manufacturing, interoperability issues, and uncertainties in reimbursement policies.

-

7. Which product segment dominated the U.S. market in 2024?The transdermal patches segment dominated in 2024 due to its non-invasive nature, patient-friendly use, and ability to deliver drugs continuously and effectively.

-

8. Who are the major players in the United States drug-device combination products market?Key companies include Abbott Laboratories, Stryker Corp, Viatris Inc, Medtronic PLC, Boston Scientific Corp, Becton Dickinson & Co, and Teleflex Inc., and Others.

-

9. What is the forecast period considered in this research report?The report provides insights for the period 2020–2035, with 2024 as the base year and 2025–2035 as the forecast years.

Need help to buy this report?