United States Detergent Alcohols Market Size, Share, and COVID-19 Impact Analysis, By Source (Natural detergent alcohol and Synthetic detergent alcohol), By Application (Laundry Detergents, Dishwashing Detergents, Personal Care & Cosmetics, and Industrial Cleaners), and United States Detergent Alcohols Market Insights, Industry Trend, Forecasts To 2035

Industry: Chemicals & MaterialsUnited States Detergent Alcohols Market Insights Forecasts to 2035

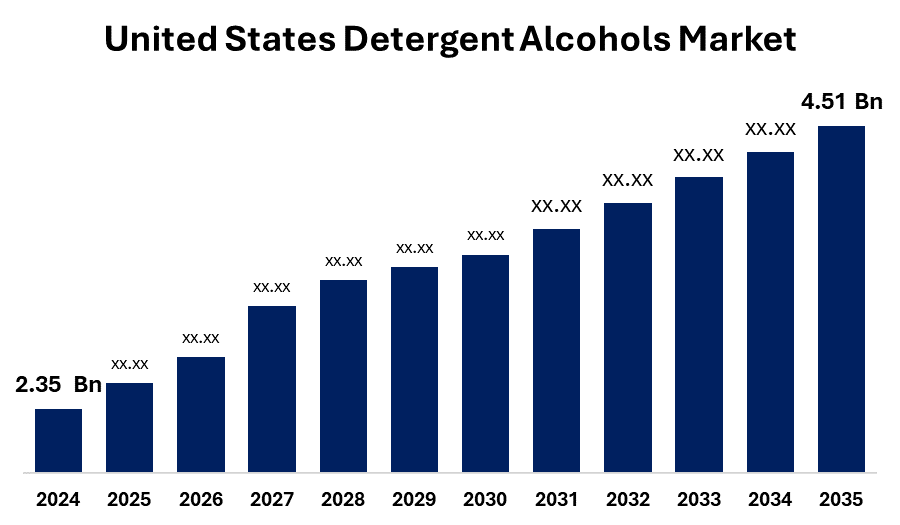

- The United States Detergent Alcohols Market Size Was Estimated at USD 2.35 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.11% from 2025 to 2035

- The United States Detergent Alcohols Market Size is Expected to Reach USD 4.51 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United States Detergent Alcohols Market Size is anticipated to reach USD 4.51 Billion by 2035, Growing at a CAGR of 6.11% from 2025 to 2035

Market Overview

Detergent alcohol is also known as fatty alcohol, is a high molecular weight, long-range alcohol that is mainly obtained from natural fat and oil or synthesized through petrochemical processes. They serve as the required raw materials in the production of surfactants, which are the major materials in detergents, cleaning agents, and personal care products. Typically, detergent alcohol ranges from C12 to C18 carbon chain length, offering excellent surface-active properties that make them highly effective in breaking oil, grease, and dirt. Detergent alcohol is commonly employed in industrial applications to produce linear alkylbenzene sulfonates (LAS) and alcohol ethoxylates, rush components. cleaner. They are also used in shampoos, soaps, creams, and cosmetics as emulsifiers, solubilizers, and foaming agents. Furthermore, the rising demand for ecologically friendly home and industrial sanitation solutions creates chances for market growth. Additionally, the rising adoption of plant-based and biodegradable ingredients is occurring across home care, personal care, and institutional cleaning applications. Increasing consumer preference for clean-label and eco-certified products is opening new avenues for manufacturers offering RSPO-certified and non-GMO natural alcohols.

Report Coverage

This research report categorizes the United States detergent alcohols market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States detergent alcohols market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States detergent alcohols market.

Driving Factor

The United States detergent alcohols market is driven by increasing demand for domestic and personal care products, rising hygiene awareness, and urbanization. Assistant enhances the growth of the market, along with government policies and stability initiatives, as well as bio-based and environmentally friendly surfactants, which increase market growth. Technological progress in halogen chemicals and expansion of applications in industrial cleaning areas also strengthen market opportunities.

Restraining Factor

The United States detergent alcohols market faces restraints due to the Price of raw materials with environmental concerns over volatility, especially palm and coconut oil, as well as deforestation associated with natural feedstocks. High production costs and stringent regulatory requirements also adopt large scale and hindering profitability.

Market Segmentation

The United States detergent alcohols market share is classified into source and application.

- The natural detergent alcohol segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The United States Detergent Alcohols market is segmented by source into natural detergent alcohol and synthetic detergent alcohol. Among these, the natural detergent alcohol segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. This is due to increasing consumer demand for environmentally friendly products, innovation in biotechnology for natural alcohol production, and increasing regulatory pressure for stability. In addition, natural alcohols are used on a large scale in home care and personal care applications, in which manufacturers emphasize certificates and traceability.

- The laundry detergents segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The United States detergent alcohols market is segmented by application into laundry detergents, dishwashing detergents, personal care & cosmetics, and industrial cleaners. Among these, the laundry detergents segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This is due to strong consumer demand for high-performance and concentrated cleaning products. Detergent alcohols are major intermediates in the production of alcohols, ethoxylates, and sulfates, widely used in both liquid and powder.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the United States detergent alcohols market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Stepan Company

- Kraton Corporation

- Procter & Gamble

- Vantage Specialty Chemicals, Inc.

- Colonial Chemical

- Pilot Chemical Company

- Oleon NV

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States detergent alcohols market based on the following segments:

United States Detergent Alcohols Market, By Source

- Natural Detergent Alcohol

- Synthetic Detergent Alcohol

United States Detergent Alcohols Market, By Application

- Laundry Detergents

- Dishwashing Detergents

- Personal Care & Cosmetics

- Industrial Cleaners

Frequently Asked Questions (FAQ)

-

What was the size of the United States detergent alcohols market in 2024?The U.S. detergent alcohols market size was estimated at USD 2.35 billion in 2024.

-

What is the forecasted size of the market by 2035?The market is expected to reach USD 4.51 billion by 2035.

-

what CAGR is the market projected to grow from 2025 to 2035?The market is anticipated to grow at a CAGR of 6.11% during the forecast period.

-

What are detergent alcohols?Detergent alcohols, also known as fatty alcohols, are long-chain alcohols derived from natural fats/oils or petrochemicals. They are primarily used in the production of surfactants for detergents, personal care, and industrial cleaning applications.

-

Which segment dominated the market by source in 2024?The natural detergent alcohol segment dominated the market in 2024 and is projected to grow significantly due to increasing demand for eco-friendly and sustainable solutions.

-

Which application held the largest share in 2024?The laundry detergents segment accounted for the largest revenue share in 2024, driven by strong consumer demand for high-performance cleaning products.

-

What are the major driving factors of the market?Key drivers include rising hygiene awareness, urbanization, increasing demand for bio-based surfactants, supportive government policies, and technological advancements in oleochemical production.

-

What are the major restraining factors of the market?Restraints include raw material price volatility (palm and coconut oil), environmental concerns such as deforestation, high production costs, and stringent regulatory compliance.

-

Which companies are key players in the U.S. detergent alcohols market?Major players include Stepan Company, Kraton Corporation, Procter & Gamble, Vantage Specialty Chemicals, Colonial Chemical, Pilot Chemical Company, and Oleon NV.

-

Who are the key target audiences for this market report?Target audiences include market players, investors, end-users, government authorities, consulting & research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?